Summary:

- Inflation appears to be waning.

- The Federal Reserve won’t likely cut just yet, but a recession appears inbound.

- I’m getting 14% while watching the economic situation unfold.

DNY59

Co-authored by Treading Softly.

So many of us have been obsessive over the impact of high levels of inflation on everyone’s wallets. When you go to the grocery store, what used to cost you $100 four years ago now costs you over $120. Inflation’s compounding effect has had a massive impact on the everyday American. But it’s not just the United States that’s experiencing widespread inflation; economies all over the globe are feeling the pinch of higher levels of inflation.

Inflation is the devaluation of the buying power of a dollar or a currency, and this compounding effect over years is caused by the increase in a currency’s availability as well as the increase in velocity of that currency. You see, if a country prints $100 million worth of new currency, but that currency never reaches circulation, its impact will be heavily muted. Likewise, if there is a higher velocity of spending in an economy, it can cause inflationary impacts because of that velocity increase. People are spending it more, so there’s increased demand, allowing higher prices to exist. The Federal Reserve, in keeping interest rates higher, is trying to discourage spending and therefore trying to reduce the velocity of money moving around the economy. A high interest rate environment discourages spending and encourages saving, thus slowing the movement of money within the economy.

The downside is that during the COVID-19 era and subsequent recovery, governments all over the world provided massive injections of currency into their economies. This meant that out of the blue, billions were injected into economies all over the globe. The sudden injection spurred spending, which spurred higher prices in the recognition that the dollars you held previously were less valuable than the dollars before. This is one reason why we consistently argue that cash is trash in a highly inflationary environment. If you held $100 and inflation was 10% that year, your $100 now is only worth $90 a year later — you’ve lost value. However, the coin is now flipped. We’re seeing greater degrees of deflationary data, meaning that the cost is decreasing comparatively instead of increasing. A long period of deflationary impact can actually hurt an economy and the stock market. It is typical to see some deflationary data before a recession occurs because people have less and spend less.

Today, I’m going to look at an investment that benefits the greatest when interest rates are cut and the economy is in a recession. It’s currently paying +14% yields and sees massive capital gains when the economy stumbles.

Let’s dive in!

Paid to wait, Big gains inbound

AGNC Investment Corp (NASDAQ:AGNC), yielding 14.6%, is a mortgage REIT that invests primarily in agency MBS (Mortgage-Backed Securities). Agency MBS is a unique asset class. When a company originates a mortgage loan, they have the option to sell a loan that meets various underwriting standards to the “agencies.”

Fannie Mae and Freddie Mac are GSEs (Government-Sponsored Enterprises) designed to improve the liquidity of the mortgage markets in the United States. They do this by purchasing qualified mortgages, guaranteeing them, and then reselling the mortgages to investors as MBS. The result for investors is an asset that has very little credit risk. If a borrower defaults, the agency will buy it back at par value. Agency MBS are rated AAA and tend to correlate strongly with US Treasuries.

One wrinkle that agency MBS has, relative to U.S. Treasuries, is that the loans are amortizing and the borrowers can prepay them at any time. As a result, the holders of agency MBS receive principal payments every month. So, while an MBS might have a maturity date that is 20+ years in the future, in reality, the life expectancy of an MBS is much shorter. How quickly agency MBS are repaid is dependent upon interest rate conditions and economic conditions. Are interest rates low enough to refinance? Are borrowers in a strong enough economic position to qualify for a refinancing?

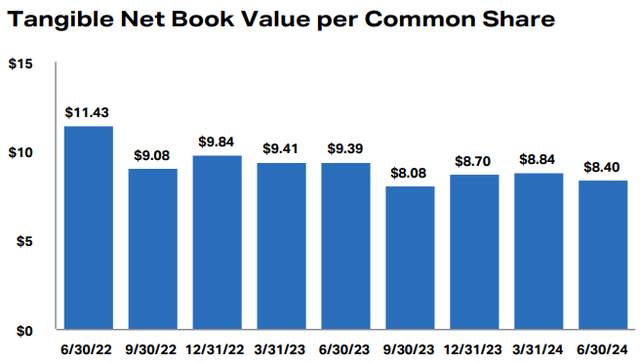

The headline numbers for AGNC show a continuation of recent trends –relatively flat book value and declining earnings. Book value was down slightly to $8.40/share, roughly in line with what AGNC has reported over the past year. Source.

When we look at book value, we have to remember that what is reported is a single day in one quarter. Book value is slightly higher today than it was on June 30th. It changes every day that the bond markets are open. So, while we see $8.08 as the low based on what was reported, AGNC’s book value was well into the low $7s at one point in October 2023. The primary drivers of AGNC’s book value will be MBS prices and Treasury prices, since AGNC’s portfolio consists primarily of being long agency MBS and being short US Treasuries.

We can see that since January, agency MBS prices have been relatively stable. Here is the 5-year price chart for the 30-year 6% coupon agency MBS: Source.

We can see that prices were falling rapidly over the past three years, but have recently found some stability. This is reflected in MBS prices and AGNC’s book value — after all, AGNC owns tens of billions of agency MBS.

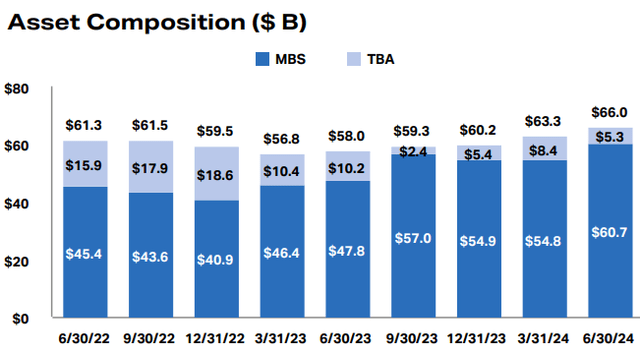

As MBS prices were falling, AGNC gradually shifted its portfolio from TBA to MBS. Note the dark blue representing MBS bottomed out at $40.9 billion in December 2022, and as of June 2024, is up to $60.7 billion.

TBA stands for “To Be Announced”, which are future contracts for Agency MBS. AGNC pursues what is known as a “dollar roll” strategy, where they simultaneously enter into contracts to both buy and sell agency MBS with different strike dates. Essentially, they’re using the proceeds from the sale to fund temporary long exposure to agency MBS. It was a way for AGNC to continue generating earnings, without committing to buying long-term MBS.

Over the past year, we’ve seen AGNC more willing to commit, and it has materially increased its MBS holdings. In Q2, AGNC raised $434 million in equity by issuing shares above book value. This is a strong positive for shareholders, as $434 million in raised capital translated into $2.7 billion in additional assets after leverage — that will lead to greater upside for shareholders if MBS prices go up. Since agency MBS is strongly correlated with Treasury prices, we believe it is very likely that AGNC is buying low. That is a great thing for investors.

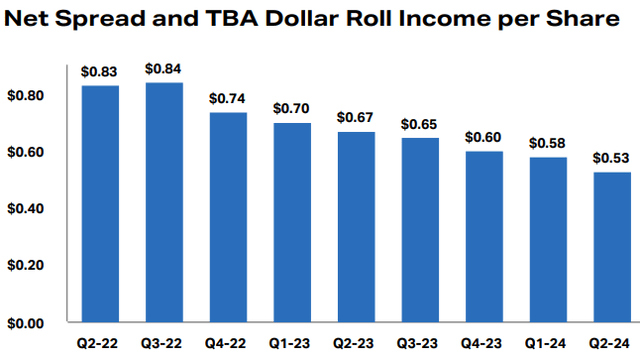

Turning to cash flow, net spread and TBA dollar roll income have been trending down:

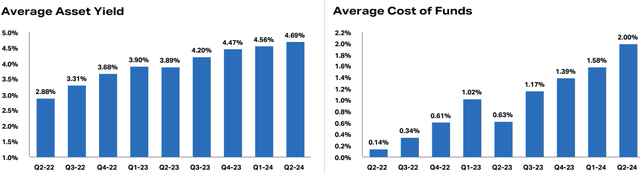

This is expected, and we warned that we expected this to continue drifting down last earnings. We noted that we expected AGNC’s cost of funds to rise relatively quickly for the next two quarters, and it did. We can see the average asset yield and cost of funds side by side:

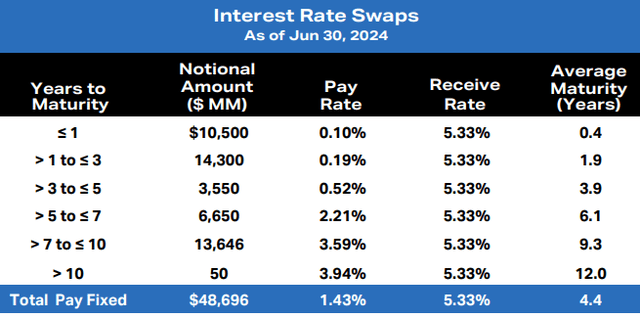

AGNC’s earnings are primarily a function of average asset yield minus the cost of funds. Last quarter, the cost of funds leaped from 1.58% to 2.00% and that drove the larger decline in net spread and dollar roll income. 2% is still an insanely low interest rate to be paying on their $48+ billion in debt. AGNC’s cost of borrowing is so low because they were smart enough to snap up interest rate swaps when they were at insanely low rates. The market rate for AGNC’s debt is currently 5.5%; on their swaps, they are paying an average of 1.43% with an average maturity of 4.4 years.

Even if interest rates remain high, it will be a very long time before AGNC is paying market rates for their debt. However, some of their lowest swaps are three years old and are maturing. The benefit of these swaps will continue to diminish as they roll off.

AGNC didn’t increase its dividend to match its cash flow. So, even as these swaps roll off, we expect that forward earnings will continue to be more than enough to cover the current $0.36/quarter dividend.

AGNC is making wise decisions and setting itself up for a strong recovery when agency MBS recovers. Management switched over to a short-term strategy focused on TBAs when MBS were expensive, and now that MBS is cheap, AGNC has become a buyer. The sector has faced stress with declining MBS prices combined with an inverted yield curve that reduces the effectiveness of a strategy that relies on borrowing short-term money and lending long-term. This has turned into the longest yield-curve inversion of all time, with short-term Treasuries having a higher yield than 10-year Treasuries. AGNC will benefit when these unusual conditions come to an end.

While we wait, management of AGNC has done an excellent job making sure the dividend remained stable through the difficult times.

Conclusion

AGNC has a proven history of great success during prior recessionary periods. Agency MBS and the mREITs that invested in them are designed to benefit the most when the economy is stumbling and interest rates are falling. Throughout AGNC’s history, its greatest periods of performance have been when the market itself is struggling because of interest rates and a recession.

Most mREITS are not designed to outperform the overall market consistently. They’re designed to perform equally or greater than the MBS market as a whole. This is why they’re able to take a high level of leverage and buy what’s considered to be exceptionally low-risk investments because of the government guarantee tied to them. I wish they would become variable dividend payers, so there would be less concern about whether they cut or raise. This is not the reality we live in, but it is something I wish more mREITs would do to avoid all the unnecessary confusion around them.

When it comes to your retirement, you should have a portfolio that is filled with players who can play the income game well in different environments. No single income portfolio should rely on a singular hero to carry them through every environment. If you think about a military squad, every squad member has an important role to play, and they’re not always able to fill in for each other. The designated marksman has a very different role compared to someone carrying a machine gun for suppressive fire, which is distinct from those who handle mortar rounds or serve as medics. The whole team works best when everyone works together. When it comes to your income portfolio, you need to have members who do their best when everyone else around them is falling. Likewise, you can expect that the member who does best when everyone else is failing to be a laggard when everyone else is succeeding.

At the end of the day, the goal of our Income Method is to see steadily growing income, regardless of the economic environment around you. If you’re receiving more income than you spend, your portfolio will grow. It’s as simple as that.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +8000 members. We are looking for more members to join our lively group! Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our Model Portfolio targeting 9-10% yield, our preferred stock and Bond portfolio. Don’t miss out on the Power of Dividends!

We’re offering a limited-time 17% discount on our annual price of $599.99 via this link only: