Summary:

- Despite the strong YTD momentum, I’ve decided to downgrade the stock again this time, as I see significantly less margin of safety in this name.

- The good: Amazon is expanding market share, while rapid innovation and interest in the AI field are still two driving forces.

- The bad: Amazon’s valuation to date already looks fair, with no upside worth the risk in my opinion.

- The consumer discretionary sector is at high risk, as 61% of consumers surveyed by AlphaWise are inclined to reduce their spending over the next 6 months.

- I’m downgrading AMZN from Buy to Hold, as the company is one of the best FANGMAN stocks, but I think most of the upside potential is already in the price.

HJBC

Updated Thesis – From Buy To Hold Again

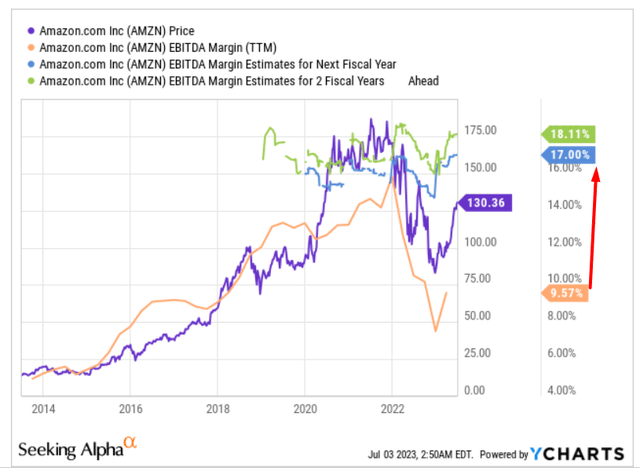

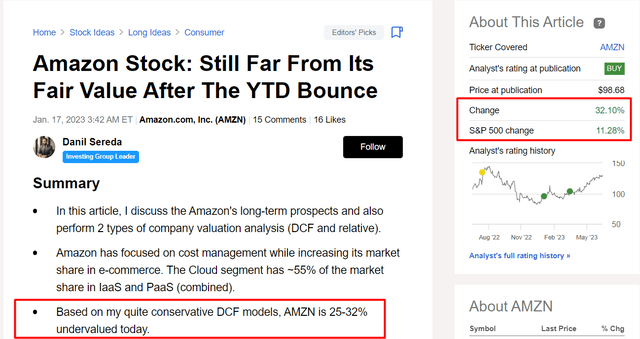

I initiated coverage of Amazon.com, Inc. (NASDAQ:AMZN) stock in early February 2021 with a Buy rating, which I changed to Hold after more than half a year. After that downgrade, the stock managed to fall sharply by ~40%. Focusing on the excessive market pessimism and the fundamental conditions for a reversal, I upgraded the stock back to Buy in January 2023, citing the company’s undervaluation as one of the main reasons for such a decision. A few months later, AMZN stock reached the upper end of the DCF range calculated at that time:

Seeking Alpha, author’s coverage of AMZN

Since the beginning of the year, AMZN stock has risen more than 51% and, as I see it, has yet to see any major setbacks. Despite this strong momentum, I have decided to downgrade the stock again this time, as I see significantly less margin of safety in this name.

Why Do I Think So?

Right at the outset, I want to make an important statement: I am not saying that investors should get rid of AMZN stock. On the contrary, there are many arguments in favor of continuing to hold the stock and buying it on the principle of dollar-cost averaging. Why?

Firstly, the company continues to expand its market share, as Credit Suisse analysts found out in their latest study [June 16, 2023 – proprietary source]:

Credit Suisse [June 16, 2023 – proprietary source]![Credit Suisse [June 16, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/3/49513514-16883635210692112.png)

Amazon has entered a phase of accelerated share gains in the United States, attributed to increased capacity investments in the e-commerce business. The trend of accelerated share gains began in 3Q22, with Prime Day returning to its usual slot, and continued in 4Q22 and 1Q23. The firm added approximately $11 billion of GMV in 1Q23, $13 billion in 4Q22, and $43 billion in 2022. The higher service level, particularly one-day and same-day Prime delivery, has contributed to these gains. Amazon’s increased capacity has eliminated constraints and supports potential upside to US GMV estimates – Credit Suisse sees a positive trajectory for GMV forward growth compared to the currently published estimate of $35 billion.

Secondly, the rapid pace of innovation and remaining interest in the AI field are 2 solid growth drivers, Morgan Stanley’s analysts wrote in their recent research report [June 21, 2023 – proprietary source]. AWS is well-positioned to drive and benefit from AI trends, despite some leaders, including AWS, still being viewed as structurally challenged. Large, unique datasets, distribution of data, and the ability/willingness to invest in data/distribution are key to building long-term competitive moats through AI. The MS report also suggests that AI-related cloud adoption could potentially add 500 basis points to public cloud growth from 2022 to 2025.

MS [June 21, 2023 – proprietary source]![MS [June 21, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/3/49513514-1688364088027125.png)

These two reasons alone are enough to ensure that AMZN will likely continue to flourish in the coming years.

But then why did I switch to Hold?

Everything is quite simple. In my opinion, Amazon stock has absorbed most of the AI talk, and the remaining upside potential is not enough to remain bullish as it has been.

First, Amazon is part of the Consumer Discretionary sector of the S&P 500. This sector includes various industries such as retail, media, consumer durables, apparel, leisure, and automotive, to name a few. Online stores, physical stores, and third-party sellers brought in over 67% of the company’s revenue last quarter [combined] – Amazon continues to be more dependent on these segments than on AWS. Recent surveys by Morgan Stanley’s AlphaWise [June 26, 2023 – proprietary source] indicate that the consumer discretionary sector is at high risk, as 61% of consumers surveyed are inclined to reduce their spending over the next 6 months.

AlphaWise, MS [June 26, 2023 – proprietary source]![AlphaWise, MS [June 26, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/3/49513514-16883658934362853.png)

Second, AWS is a huge growth driver for Amazon – its prospects are an essential part of any bullish report on the stock. It is thanks to this segment that the share price has risen so quickly since the beginning of the year, outperforming the sector to which the company belongs:

AWS’s affiliation with the tech sector makes Amazon’s valuation vulnerable to the risk of multiple contraction, a reverse process that has seen techs’ share of the S&P 500’s structure rise almost back to its peak:

Goldman Sachs [June 30, 2023 – proprietary source]![Goldman Sachs [June 30, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/3/49513514-16883662354895413.png)

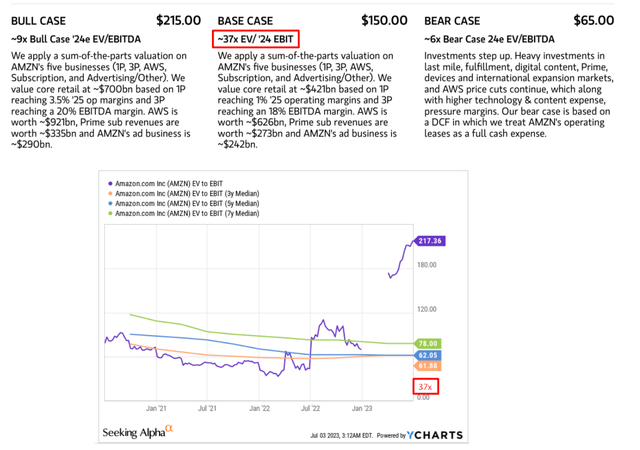

Third, Amazon’s valuation to date already looks fair, with no upside worth the risk. I am not going to write about what the company’s P/E ratio is right now – that’s a completely wrong approach to valuing the company, in my opinion. I am just going to look at the price targets AMZN stock has received recently from investment banks, and the assumptions underlying their forecasts.

Here’s what Morgan Stanley’s analysts wrote in their note:

We apply a sum-of-the-parts valuation on AMZN’s five businesses (1P, 3P, AWS, Subscription, and Advertising/Other). We value core retail at approximately $421bn based on 1P reaching 25% operating margins and 3P reaching an 18% EBITDA margin [FY25]. AWS is valued at approximately $627bn, Prime subscription revenues are valued at approximately $273bn, and AMZN’s ad business is valued at approximately $242bn.

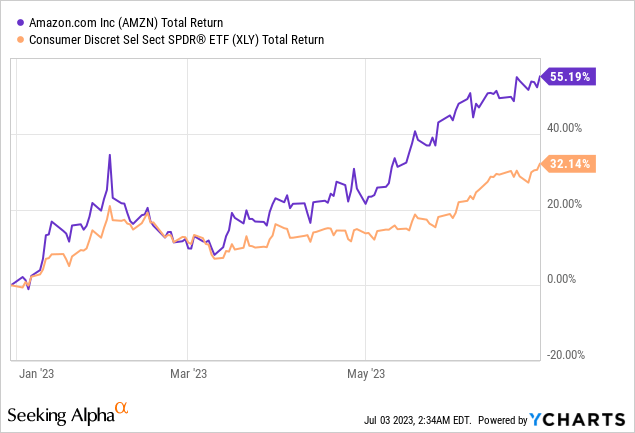

That is, analysts expect the company to reach EBITDA margins >200 basis points above its peak in just 2 years. That looks like too fast of a margin expansion, in my opinion, given the sector’s headwinds I pointed out above:

Credit Suisse’s calculations seem more reasonable to me – in any case, they are based on DCF modeling, where we can see all the financial items and their impact on FCF:

Credit Suisse [June 16, 2023 – proprietary source]![Credit Suisse [June 16, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/3/49513514-16883672340241.png)

As you can see for yourself, CS is projecting an EBITDA expansion of ~20% annually [2023-28] in absolute terms, with FCFF reaching nearly $200 billion by FY2028. That’s a lot even for a $1.3 trillion market-cap company. With a WACC of 10.5% and Gordon’s g of just 3%, the stock is 9.2% undervalued today based on this model. In my opinion, this is a fair valuation output, but it implies rather low growth potential for AMZN stock shortly.

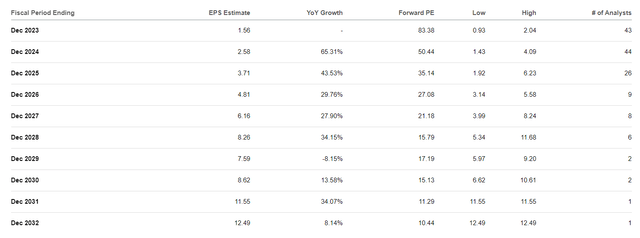

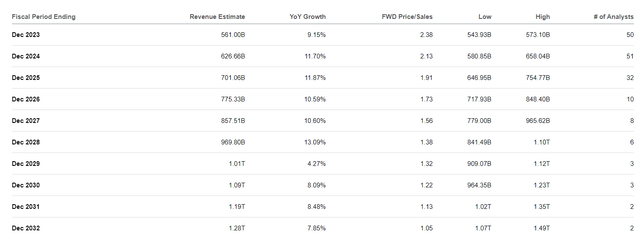

If we look at the current consensus forecasts for AMZN, we will see a strong positive both in terms of EPS and sales up to FY2032:

Seeking Alpha, AMZN’s projected EPS Seeking Alpha, AMZN’s projected revenues

The headwinds seem to be ignored, as in 81% of the cases analysts have raised their EPS forecasts in the last 3 months. How will their conclusions be affected by a possible weakening of demand in consumer discretionary categories in 2H 2023 and 1H 2024? The question remains.

Concluding Thoughts

Perhaps I am being too harsh about the impact of AI and automation trends on AMZN’s financials over the next few years. My skepticism has led me to the wrong conclusions quite often, and I have to admit that and bear responsibility for it as an analyst. Moreover, AMZN seems relatively undervalued even if we follow Morgan Stanley’s projections, which imply an EV/EBIT multiple of 37x with a price target of $150/share. The multiple is well below the historical means, which is good in terms of the stock’s upside potential:

However, the stock’s rapid growth today has caused it to lose its margin of safety, which I defined a few months ago. Maybe now is the time to think about selling put options or waiting for a pullback to find a better price point for cost averaging.

I am downgrading AMZN from Buy to “Strong” Hold, as the company is one of the best FANGMAN stocks, but most of the upside potential is already in the price in my opinion.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!