Summary:

- Visa Inc. has had a stellar year in 2023 and continues to perform well despite economic headwinds.

- The company’s focus on new partnerships, global expansion, and innovative services positions it for sustained growth.

- Regulatory risks are a concern, but investors remain unfazed due to Visa’s innovative strength and potential for long-term returns.

_laurent

Introduction

It’s time to talk about a company I haven’t been able to add to my portfolio this year for two reasons.

- It did not offer a good buying opportunity recently, as it had a stellar performance in 2023.

- I haven’t figured out which stocks on my watchlist will become long-term members of my dividend growth portfolio. This includes the fact that I haven’t figured out how much money I owe the tax man this year, which has a major impact on my cash balance.

As you already saw in the title of this article, the company I’m talking about is Visa Inc. (NYSE:V), the world’s largest credit service company with a market cap exceeding half a trillion dollars.

My most recent article on this stock was written on September 9, when I used the title Visa: Top-Tier Dividend Growth And $10 Trillion Market Opportunities.

In this article, I’ll go a step further as we assess recent developments, its new all-time high, potential regulatory headwinds, and the likelihood of Visa shares returning more than 12% per year on a consistent basis.

So, let’s get to it!

Visa Seems To Be Totally Unstoppable

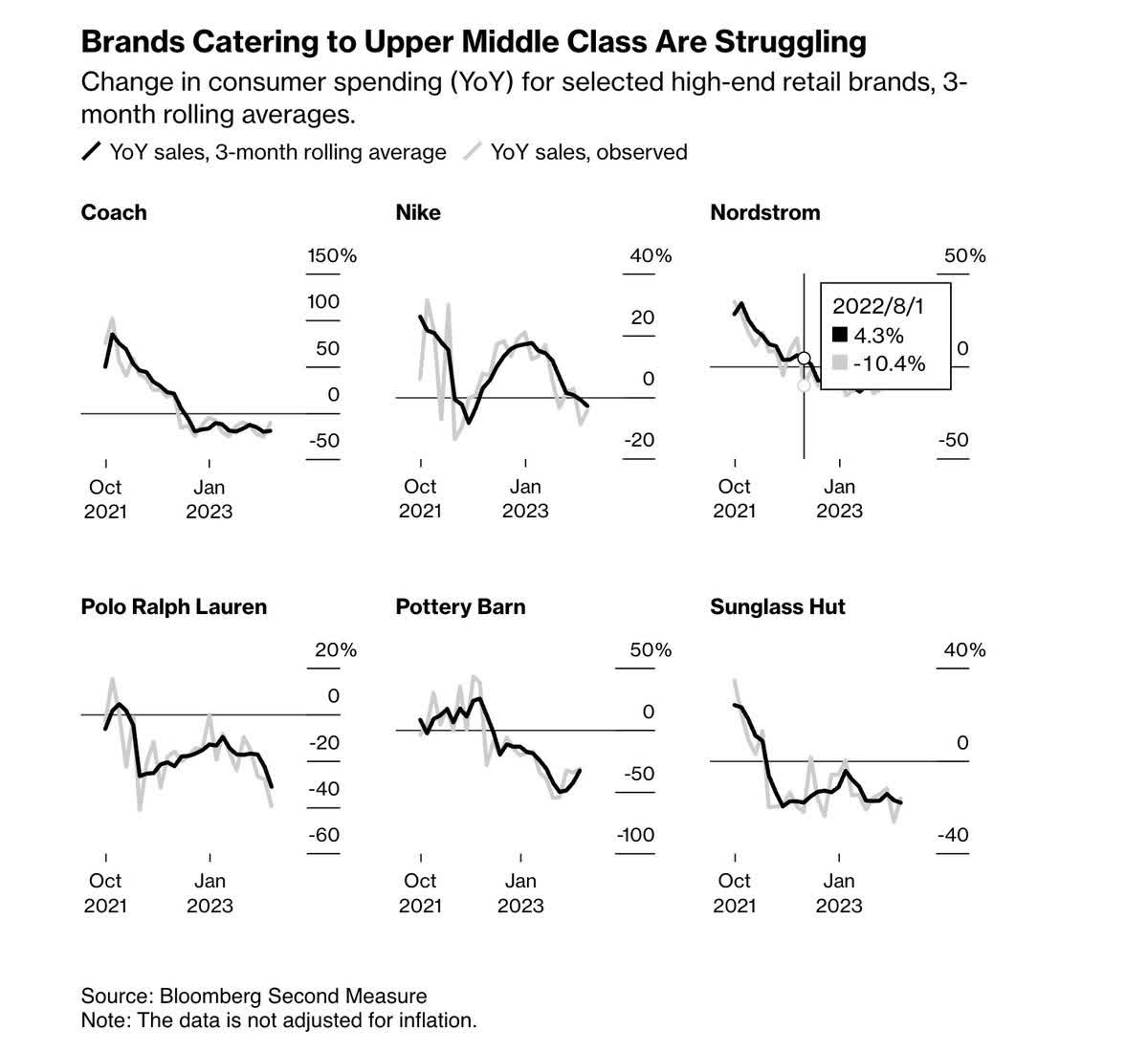

In general, the consumer is not doing so well.

The other day, Bloomberg showed a chart highlighting declining sales at some of America’s largest retailers.

Bloomberg

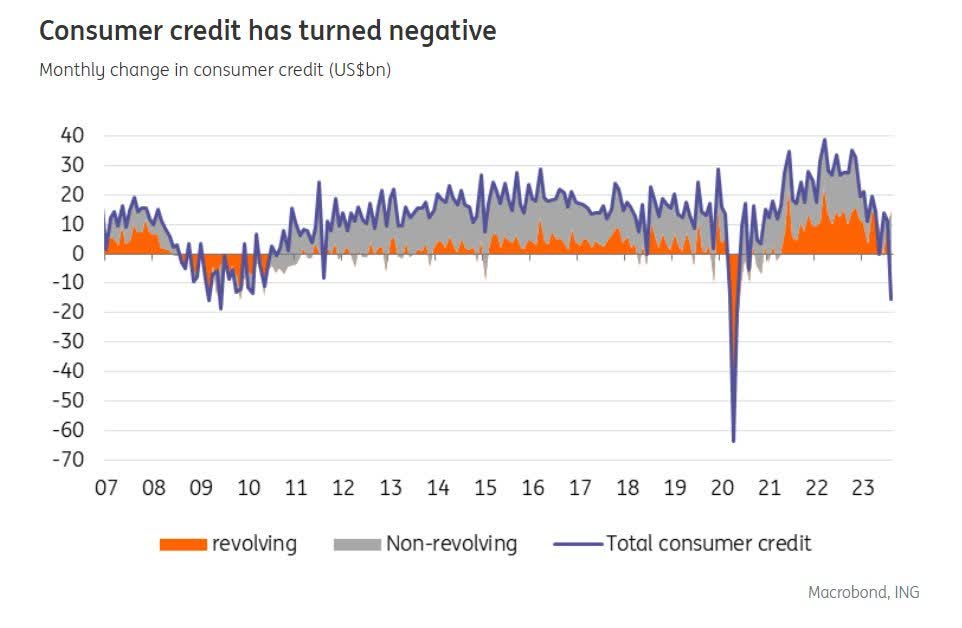

ING showed a chart that consumer credit has turned negative, which rarely happens outside of recessions – it happened only during recessions in the chart below.

ING Think, Macrobond

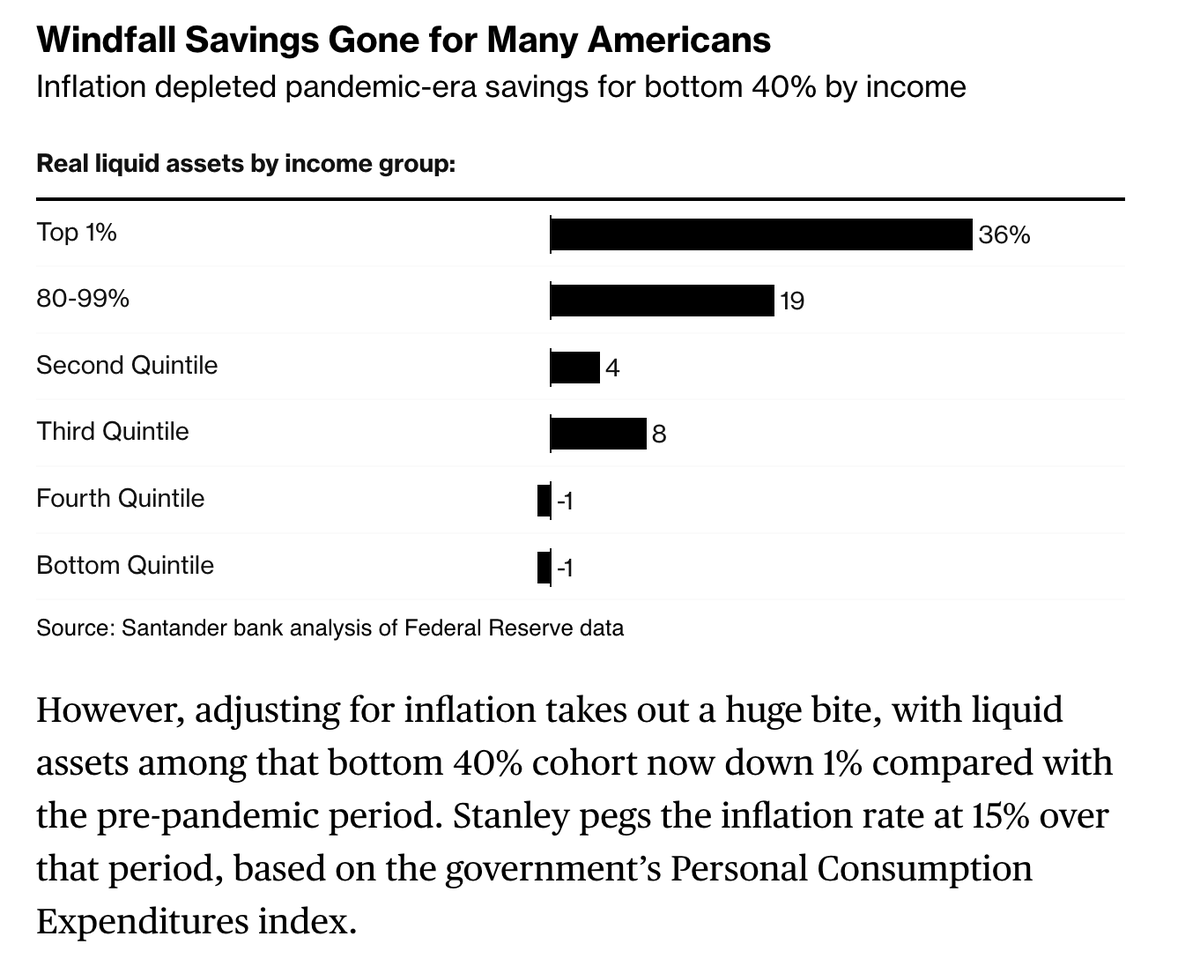

Even worse, inflation has depleted pandemic-era savings for the bottom 40% by income, which makes weaker consumers even more fragile to sticky inflation and economic weakness (no buffer).

Bloomberg

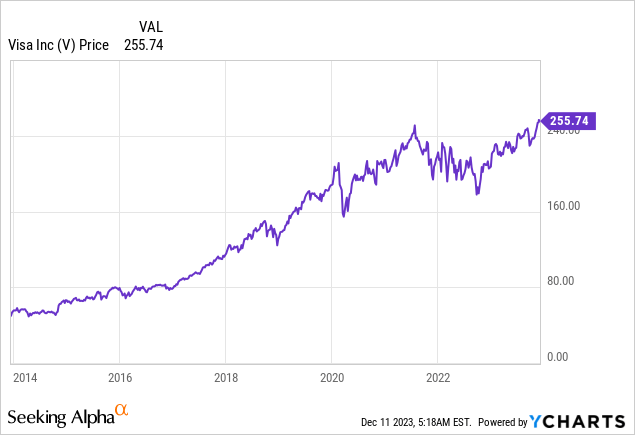

While this may have hurt the stock price of certain cyclical consumer stocks, it did not hurt the stock price of Visa, as we saw at the start of this article.

That’s because Visa is different.

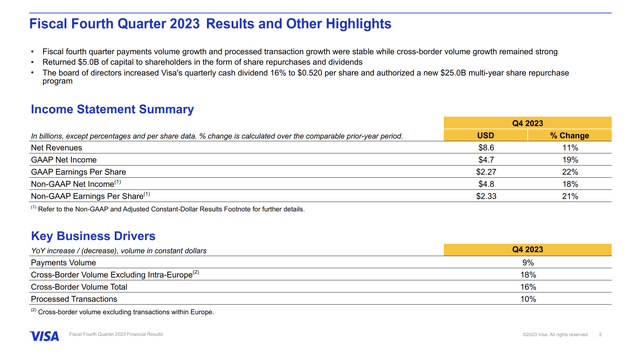

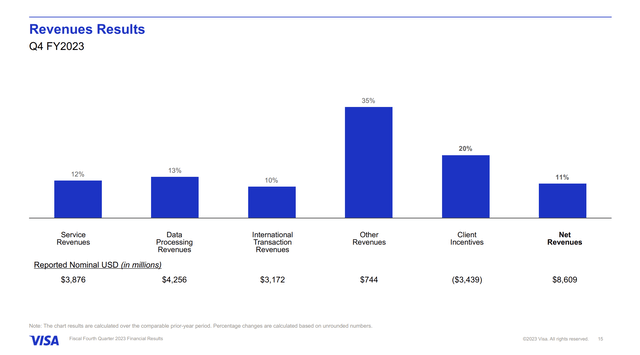

For example, in the fourth quarter of the fiscal year 2023, net revenues grew by 11%, with GAAP EPS up 22% and non-GAAP EPS up 21% in both nominal and constant dollars.

- Service revenues grew by 12%, driven by business mix, pricing, and card benefits.

- Data processing revenues increased by 13%, outpacing process transaction growth.

- International transaction revenues were up 10%, slightly lagging behind the 18% increase in constant dollar cross-border volumes.

U.S. payments volume increased by 6% year-over-year, with credit volume growing by 6% and debit volume by 7%.

Furthermore, cross-border volume, excluding intra-Europe transactions, increased by 18%, reaching 152% compared to 2019.

Cross-border card-not-present volume, excluding travel, grew by 9% year-over-year and 173% versus 2019. Travel-related spending grew by 26% year-over-year.

Looking forward, despite macro uncertainty, Visa remains confident in managing through it.

For FY2024, the company expects low double-digit adjusted net revenue growth, with FX having a 1-point drag.

Incentives are projected to grow slightly less than in FY2023, and new flows and value-added services are expected to outpace consumer payments growth.

With a focus on propelling growth in consumer payments, new flows, and value-added services, it announced a $25 billion multiyear share repurchase program, which translates to roughly 5% of its market cap.

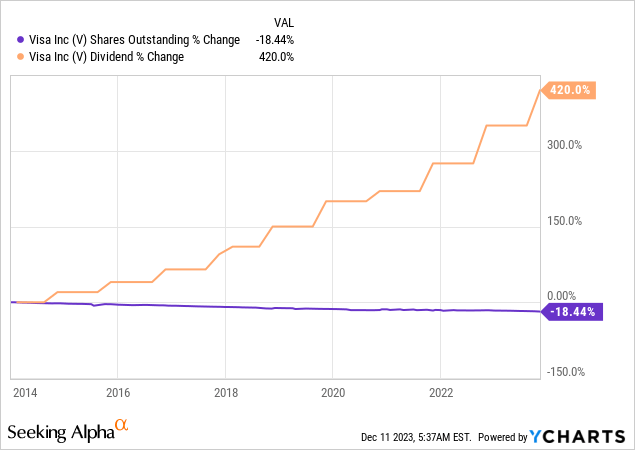

Over the past ten years, Visa has bought back close to a fifth of its shares and hiked its dividend by 420%.

Although Visa yields just 0.8%, it has a very low dividend payout ratio of 21% and a five-year CAGR of 16.3%.

It also has one of the best balance sheets in the S&P 500 with an AA- rating.

In other words, the only reason why the Visa yield is so low is because capital gains have offset dividend growth.

Sure, a 0.8% yield may be too low for income-oriented investors, but the total return picture has made up for it for almost everyone who bought in the past few years (and before that).

Since 2008, Visa has returned 21% per year!

So, what does that mean going forward?

Visa’s Path To Sustained, Elevated Growth

A big part of its success in (4Q) 2023 was based on efforts to grow the business instead of relying on existing business trends.

For example, Visa signed more than 500 commercial partnerships with fintechs globally, achieved 7% growth in credentials, and expanded merchant locations by 17%.

Visa B2B Connect added 70% more banks, while Visa Direct processed 7.5 billion transactions. Cross-border P2P transactions grew by 65%. On average, Visa’s top 265 clients used 22 products.

Furthermore, Acceptance Solutions, including CyberSource, gained traction with 2,600 new services sold globally. Notable partnerships with Costco (COST), Alaska Airlines (ALK), China Merchants Bank, and expansion in Latin America, notably in Colombia.

Additionally, during the UBS Global Technology Conference in late November, the company elaborated on its plans to grow its business.

One major takeaway is that Visa is excited about its three growth pillars: consumer payments, new flows, and value-added services.

- The company’s market-leading position in consumer payments remains a stronghold, with a focus on growing credentials and driving engagement globally.

- Meanwhile, the expansion into new flows, including money movement beyond core consumer transactions, presents a substantial market opportunity.

- Moreover, Visa’s commitment to value-added services involves expanding geographically, deepening client relationships, and launching innovative products.

The company also highlighted one major concern: a potential recession.

According to Visa, it is very resilient, thanks to a diverse spending set, encompassing credit and debit, discretionary and nondiscretionary, and domestic and cross-border transactions, which provides natural diversification.

Historically, debit and nondiscretionary spending have proven more resilient during economic downturns.

Additionally, changes in payment volumes are offset by variable incentives, and Visa has levers to manage costs, balancing short-term needs with long-term priorities.

On top of that, pricing, a factor determined by the value Visa provides to clients, is expected to offer benefits similar to those seen in the previous fiscal year.

It also helps that value-added services, contributing over 20% to Visa’s revenue, present a significant growth opportunity.

Fraud prevention, for example, benefits from tokenization.

Tokenization, a technology-driven security measure, has become integral to Visa’s strategy.

With 7.5 billion tokens in circulation, the technology replaces traditional account numbers, adding an extra layer of security.

According to the company, the benefits extend beyond fraud reduction to authorization rate improvement. Merchants utilizing tokens experience nearly a 5-point increase in authorization rates and a 30% reduction in fraud.

With that said, one issue is regulatory risks, which readers often (rightfully) bring up.

On October 25, Bloomberg reported that both Visa and its peer Mastercard (MA) face a new round of regulatory challenges, as the Fed is proposing lower caps on the fees banks and payment companies can charge merchants.

The cap on those fees would be cut about 28% to 14.4 cents per transaction plus 0.04% of the transaction amount under a plan that the Federal Reserve’s board of governors proposed Wednesday. The current limit is 21 cents per transaction plus 0.05%, a maximum set more than a decade ago. The fraud-prevention adjustment would increase to 1.3 cents from 1 cent under the changes, which are subject to a 90-day public comment period.

While this is certainly an unfavorable trend that goes well beyond the U.S. (we see the same in Canada, for example), it does not seem that investors are concerned, as these headlines have little to no impact on Visa.

I believe that the final results of these regulations won’t be nearly as bad as some might fear. On top of that, investments in other services will likely offset some potential fee-related headwinds.

To me, the biggest risks are disruptors. So far, Visa and Mastercard are not suffering from that. However, who knows what the global payment system will look like in a decade or two?

My bet is that Visa will still be on top, as it has innovative power like no other. However, it’s still an innovation risk that’s always present in this industry.

Valuation

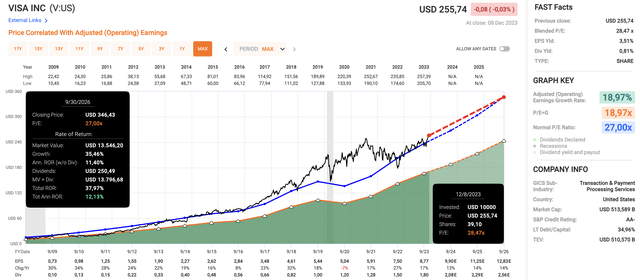

As I already briefly mentioned, Visa has returned more than 20% per year since 2008, making it one of the best S&P 500 holdings.

Going forward, I wouldn’t bet on a similar return, as the first years after the Great Recession saw massive growth. However, there’s still a lot of room left for satisfying returns.

Using the data in the chart below:

- Visa is trading at a blended P/E ratio of 28.5x.

- Its normalized valuation multiple is 27x.

- This year (FY2024), the company is expected to grow its earnings per share by 13%, followed by 14% growth in both 2025 and 2026.

- If the company’s valuation were to fall to 27x EPS and stay at that level, it could return 12% per year through FY2026.

- In other words, even if the valuation remains a bit higher, a 12% to 14% annual return should remain feasible under current circumstances.

Needless to say, this is a theoretical return. If we were to get a steep recession, we could see a sell-off and slower growth expectations.

However, in light of the company’s growth trajectory, I believe that Visa remains a great investment during corrections.

Unfortunately, for me, Visa is so strong that investors won’t let it sell-off.

Hence, my strategy remains to wait for a 10% to 15% correction opportunity.

As I am not very bullish on the economy in 2024, I wouldn’t bet against getting such an opportunity.

Needless to say, feel free to disagree with me here. Waiting for a better opportunity comes with the risk of missing more gains.

The takeaway here is that Visa continues to be in a great spot with the strong possibility of elevated longer-term total returns.

Takeaway

Despite economic headwinds, Visa stands resilient, posting robust 4Q23 results with 11% revenue growth.

The company’s strategic focus on new partnerships, global expansion, and innovative services, like tokenization for fraud prevention, positions it for sustained growth.

While regulatory risks loom, investors seem unfazed, emphasizing Visa’s innovative strength. With a low dividend payout ratio and a history of share buybacks, Visa offers the potential for long-term returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.