Summary:

- On the last trading day of 2022, I made two buys for my portfolio.

- This is the first article of a two-article mini-series to explain thoroughly my two bull cases.

- In this article, I look at Apple and show the main aspects I looked at to increase my stake by 25% in the company.

Shahid Jamil

Introduction

At year’s end, some investors are used to selling their bigger losers for tax advantage purposes. In 2021 I did so myself, even though it had to do with small positions. This time, I decided to do another thing: on the last trading day of the year, I bought two stocks. I decided to write about this because I would like to start from informing right away my followers and any other reader of my last moves. A side note on my style of portfolio management: I tend to make as little adjustments (buys/sells) as possible. This is why some months can go by without me buying or selling anything. On the other hand, it is very rare that I make more than 5 movements in a single month. The fact that I bought two stocks on one day is for me something unusual.

Now, I picked two stocks: one is a major holding of mine and I decided to increase my stake in it; the other is a new holding I have actually changed my mind on as I happened to be bearish just six months ago. In this article I would like to deal with the first pick: Apple. I will write another one to talk about my second purchase.

Here is what I did. On Friday, December 31st, 2022, I increased my stake in Apple (NASDAQ:AAPL) by 25% buying at $129 a share. This has brought Apple to be my third largest holding with a 9% weight on my whole portfolio. In this article I would like to explain what I looked at in order to decide to proceed with this new buy.

Why I increased my stake in Apple

Two words on how I research Apple

There is almost no need to explain what Apple does. However, Apple doesn’t stand out only for its hardware products such as iPhones, MacBooks, AirPods, iPads. In fact, the more I consider it the more I see that it is a top-class company also by the way it is managed and because it is turning its hardware devices in a way to earn a huge extra revenue from subscriptions that are quickly growing.

Now, there are plenty of articles published on Seeking Alpha every week on this company, as it draws a lot of attention from SA members. This is why I have only written three articles on the company, trying to deal with some particular news or financial data that wasn’t covered as well by the amount of research the platform already offered. With mega-cap stocks that have many people writing about them and that have such operations that are very wide to cover thoroughly, I try to go in depth in some particular aspect of the company with the idea that a single part has some statistical character as the whole business has. This is in fact a way of researching that is inspired by fractal analysis because fractals are geometrical figures in which similar patterns recur at smaller scales, as we can see in a snowflake, where a triangle recurs over and over.

xaktly.com

My bull case

So far, I have shared three such articles on Apple to show why I think this company is very well-managed and is set to offer good returns over the long-term.

My first step was an article (The Reason Why Apple Didn’t Increase iPhone Prices) that I wrote after Apple announced it would not hike its iPhone 14 prices, despite a lot of fuss about hikes as big as $100. I believe that Apple didn’t need to increase its device prices because it is using its devices more and more as a way to generate subscription income that has a gross margin of 72.5% compared to the 34.4% of the products category. In my view, the fact that Apple is turning into a subscription company while producing hardware devices make it an incredible company with a terrific moat. In fact, it enables the company to meet two kinds of demand: hardware and services. In addition, the more its subscription revenue grows, the more the company’s multiples need to be re-rated accordingly as the market is now pricing at a premium those companies that have a recurrent and stable revenue. This is likely why Microsoft (MSFT) trades at higher multiples than Apple.

Secondly, I also think that Apple didn’t increase its iPhone prices as a marketing expense to make customers perceive they had very good value buying an iPhone 14 during high-inflation times. A reader also rightly pointed out that Apple is using the old chip and that Apple is actually making more money this time because it kept the same price instead of lowering its price by $100.

Through some simple calculations it is easy to show that the annual revenue per subscription Apple earns is now $89 ($76.8 billion services revenue divided by the 860 million paid subscriptions reported). The services segment is growing at double-digits and this is one of the aspects that make me like the company even more because I know that this segment is going to push up the already very good margins the company has.

There are two other aspects I carefully consider about my investment in Apple:

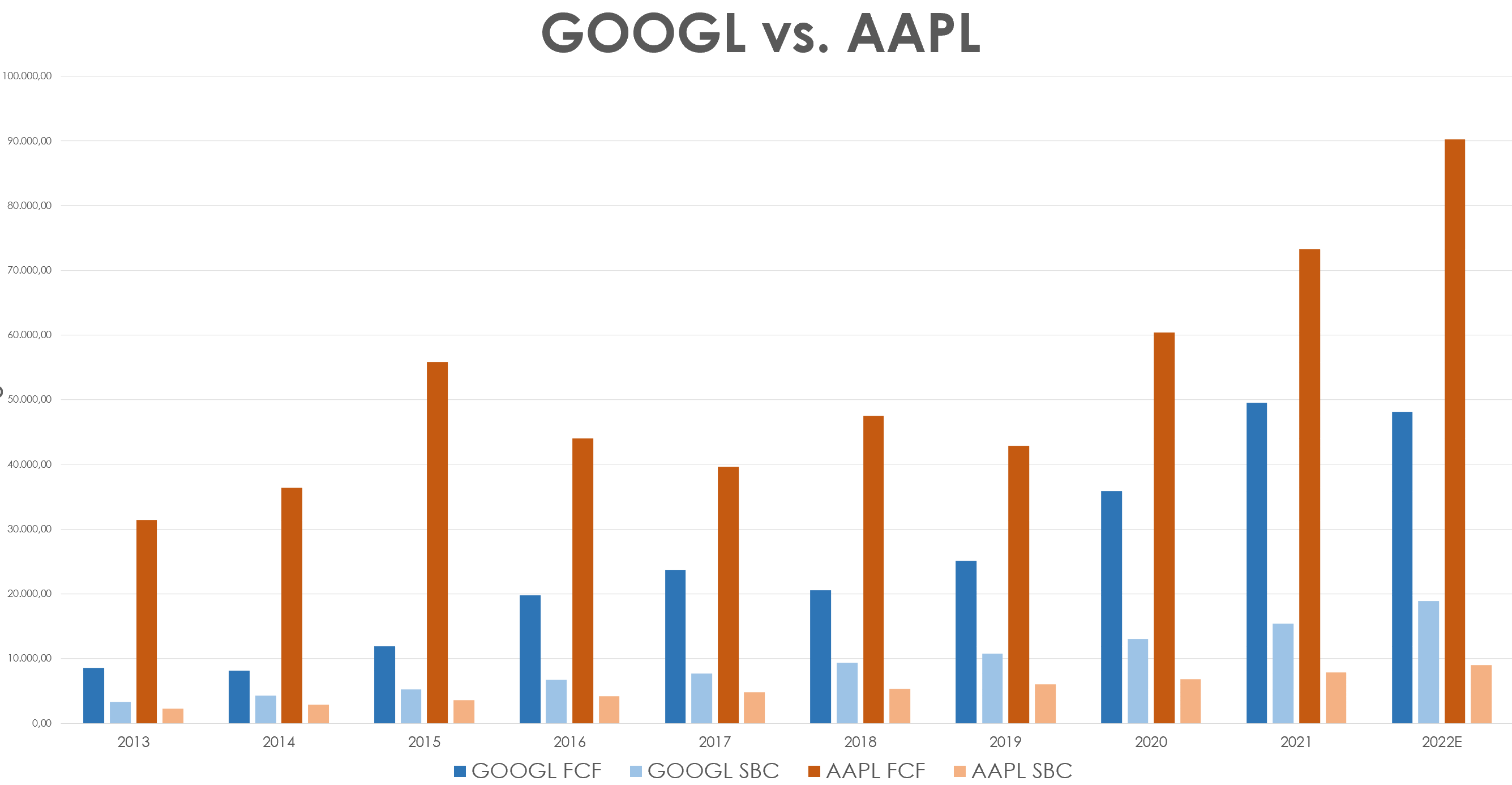

First of all, Apple is being managed more conservatively compared to other big-tech companies, such as Google (GOOGL) (GOOG). Let’s look at this graph that compares the two companies free cash flow and stock-based compensation:

Author, with data from SA

If we consider stock-based compensation (SBC) and its impact on free cash flow, we see that Google generates almost $50 billion in FCF, but every year SBC eats away a chunk that is in the range between 31% and 59% of FCF. On the other hand, Apple protects its free cash flow a lot more than Google and thus it dilutes a lot less its shareholders, while preserving a lot more free cash flow for shareholder returns. In fact, while in 2022 Apple generated $90 billion in FCF, its SBC was less than $10 billion. This leaves Apple with a lot of FCF and this leads us to the second step of this research.

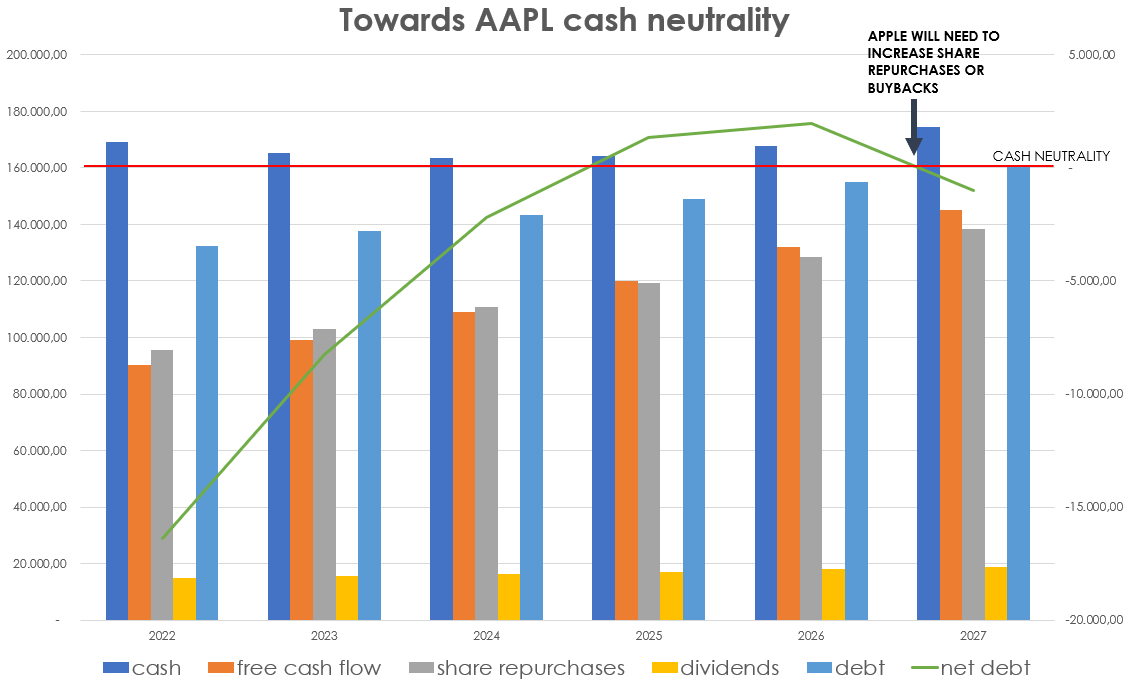

Once we realize how much FCF Apple generates, it is almost inevitable to come across the concept of cash neutrality, which in 2018 Apple declared it is targeting to reach. Just to be clear, cash neutral doesn’t mean that Apple won’t have any cash on its balance sheet. On the contrary, it means it will have a balance sheet where cash and debt balance each other to zero. In order to reach this goal, Apple can do two things: increase its debt or decrease its cash by spending it. While Apple did increase its debt a bit, it doesn’t really need to borrow money, since it has plenty of it. Thus, Apple is deploying its cash and most of it, apart from funding its operations and its R&D, is going to dividends and, most importantly, to share buybacks. Some investors are worrying that once Apple will become cash neutral it will stop its buybacks, thus creating downward pressure on the stock. However, I forecast that Apple will grow its free cash flow by 10% per year (versus the actual 20%) and that it will increase its share repurchases by 7.7% annually. In the meantime, it will increase its dividend growth by 5% and will increase its debt by 4%. Based on these assumptions, Apple should reach a positive net debt position between 2025 and 2026. However, if we continue to project this growth, take a look at what happens by 2027:

Author, with 2022 data from SA

Apple will need to increase once again its massive share repurchases in order to keep its cash neutral position. I have not seen, so far, many forecasts about what will happen once Apple become cash neutral and, actually, I have read a few concerns that buybacks will decrease. As far as I can see, I don’t think this is a real problem because of the huge power Apple has to generate free cash flow that needs to be deployed.

Risks

What about the recent estimate cuts that made many research firms to lower their expectations for the company as production facilities in China face labor shortages and supply chain disruption?

I honestly think this may be a temporary headwind as China may actually exit its zero-Covid policy. But I also think that if iPhone 14 production is hampered, investors may see a surprise after this issue as I expect that this situation will cause some pent-up demand that will benefit Apple in the second half of the year. In addition, if production is lower than demand, Apple will have massive pricing power (which the company already has).

Valuation

Now, my experience with Apple is that there are very few opportunities to pick up the stock at a low valuation. Currently, the stock trades at a forward P/E of 20, which is the lowest I have ever seen during my investing journey. Secondly, the free cash flow yield is now at 5%, which I think is extremely attractive for a company that knows how to generate more and more free cash flow, while growing it at 11% per year over the past decade. The more the company transitions towards a subscription-based revenue, the more its multiples should reflect this. This is why I wouldn’t be surprised to find once again the company at a 25 PE, which would mean a price, based on current earnings, of $153.75. But if we look at the free cash flow yield, the stock could easily trade a 4% yield that, based on the current free cash flow per share, would give a target price of $171.75. To tell the truth, I am not buying Apple with a real target price in mind as I am willing to hold it as long as its business doesn’t show true signs of deterioration. For me, this is a stock that I could actually hold for my whole life and that I could actually hand on to my children and grand-children. In any case, I think Apple is currently undervalued as it should trade at least between $155 and $170 per share.

Last, but not least, I consider Apple not only a tech company, but also as a company that sells a product that is both part of the luxury industry (Apple devices all belong to the premium category in their segment), with similar margins. I may also be considered a bit of a contrarian when I think that Apple is also somewhat of a consumer defensive stock. In fact, it provided stable and consistent dividends and it has proven that in every economic environment there is still demand for its products. This is why, starting from below $130, I am willing to make new buys for every $10 drop in the stock price.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.