Summary:

- Meta Platforms and Booking Holdings are dominant in their industries, offering strong growth, profitability, and shareholder returns, making them attractive buys during market downturns.

- Earnings season often leads to market overreactions, presenting opportunities to buy high-quality stocks like Meta and Booking at discounted valuations.

- Despite short-term market fears, both Meta and Booking have strong fundamentals, making them excellent long-term investments with potential for double-digit returns.

- Buying best-in-breed stocks at discounts and holding them long-term is a simple, reliable investment strategy that I consistently follow.

Jupiterimages/Stockbyte via Getty Images

Terms like “blue chip” and “best-in-breed” are often thrown around willy-nilly in the stock analysis world. I’m sure I’ve been guilty of overusing these words myself. But when it comes to two of the companies that I bought during the market’s recent downturn, it’s clear that they dominate their respective industries.

I’m talking about:

Meta Platforms (NASDAQ:META) which hosts nearly 3.3 billion people as daily active users on its social media sites (approximately 40% of the estimated 8.2 billion people on planet Earth).

And…

Booking Holdings (BKNG) which has a market cap that is more than $100b larger than its nearest competitor (Booking’s current market cap is $124.1b whereas Expedia’s (EXPE) is $17.4b).

Both of these companies made my recent Top 20 Highest Companies In The World list that I published recently.

They both recently established dividends which caused them to soar up my personal watch list (I covered that bullish outlook in this article, published back in March of this year).

And they both recently took a hit during Q2 earnings season, creating wonderful opportunities to buy more shares at a discount.

Meta shares dipped in late July alongside its big-tech brethren. It appears that fears surrounding disappointing YouTube ad revenues from Alphabet soured sentiment surrounding Meta. In early July, META was trading in the $530 area. On July 25, I was able to add to my position at $455.62. That bargain was too good for me to pass up. And a similar situation played out with Booking.com.

On July 16th, BKNG shares were trading north of $4,100. This company traded lower, alongside tech, based on sentiment that the consumer was hurting and that the US is headed towards recession. Amazon’s earnings came out on 8/1 and its disappointing retail segment results seemed to support this thesis. BKNG also posted earnings on 8/1 and while I thought they were solid, the market disagreed. Short-term fear took over, causing those shares to plummet to the $3,300 range. On 8/2 I added to my position at $3,368.30. Once again, the value here was too enticing to pass up.

Today, Meta shares trade for $518.22. Booking shares trade for $3980.81. It’s been about a month since I bought both of these companies and the trades have been very successful in the short term.

Obviously, I had no idea that shares would bounce back so quickly when I bought them. I thought they might. I thought both stocks offered strong upside potential and attractive risk/reward prospects when they sold off. So today, I want to highlight the effective strategy of buying best-in-breed companies into weakness because this continues to be one of my favorite ways to make money in the stock market.

You Gotta Love Overreactions During Earnings Season

Earnings season is my favorite time of the year. It’s like Christmas to me…and it happens four times a year.

I like it so much because it’s when the market overreacts. Those overreactions provide opportunities to buy companies at irrationally cheap valuations. And given that buying opportunities on best-in-breed stocks are so rare, I look forward to each earnings season, hoping that fear moves the market in my direction.

It’s crazy to me that the stock prices of wonderful companies move so much because they slightly miss Wall Street’s expectations…

Or when they beat expectations overall, but a small segment of the company misses…

Or when they do absolutely nothing at all, but one of their peers disappoints.

Or when some random data point from a report from a totally different sector or industry leads investors to fearfully speculate that their upcoming results must be bad.

You get the point. I could spend all day writing a litany of silly reasons that stocks sell off. But here’s the deal…if those reasons don’t change my long-term outlook for a given company, then I know I should ignore them.

Scratch that.

I know I should capitalize on them.

And that’s exactly what happened this quarter with Meta and Booking.

Meta sold off because of digital advertising weakness from Alphabet. When META eventually reported its own data, the stock beat on the top and bottom lines, showed strong growth throughout its operations, and gave capex guidance which appeased the market.

Booking beat expectations on both the top and bottom lines, but sold off double digits because of macro uncertainty and relatively slow guidance for the current quarter which spooked investors.

Neither one of these quarterly reports did anything to negatively impact my long-term outlooks on these companies. They remain highly profitable. They’re still posting strong growth. I see no evidence of meaningful market share loss. And the shareholder return prospects remain great.

So, with all of that being said, I did what anyone with a bullish perspective would do…

I ignored the macro sentiment, went against the grain, and bought shares into weakness at valuations that I felt really comfortable with.

Keep It Simple, Stupid

That’s what I tell myself when I see best-in-breed stocks sell-off.

Buying blue-chip stocks at discounts to fair value and holding those shares for years and years is the simplest, easiest, and most reliably successful investment strategy that I’m aware of.

It takes discipline and patience, but after seeing so many short-term dips turn into launching points for long-term rallies, it’s not hard for me to wear a contrarian hat when I’m staring at my brokerage screen.

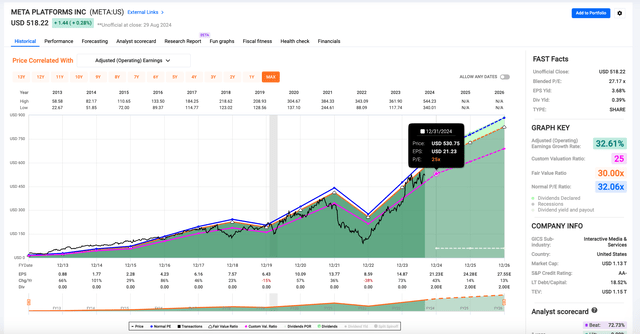

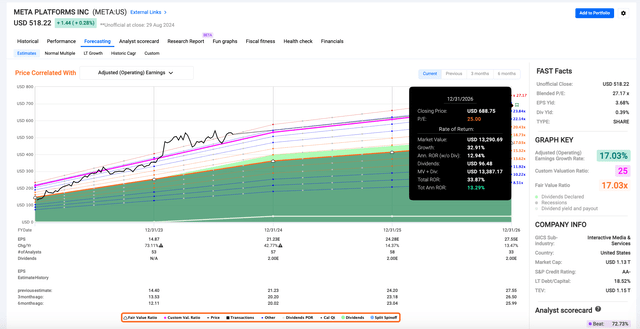

At $455/share, META was trading for roughly 21.5x this year’s EPS estimates and less than 19x next year’s earnings expectations.

META is expected to post 43% EPS growth in 2024, 14% in 2025, and 13% in 2026.

The company generated $10.9b of free cash flow last quarter. Meta has a nearly flawless balance sheet with $58.1b in cash compared to just $18.3b of long-term debt. The company has bought back more than $21b worth of shares during the first half of the year. And now that it has established a dividend, I expect to see this company morph into a dividend growth powerhouse over the coming decades.

What’s not to like about that picture?

I’ll pay 19x forward for a company with those types of metrics any day. Heck, I’ll happily pay 25x.

My fair value estimate for META is in the $530 area, meaning that even after the stock’s recent rally, I think shares are cheap.

The margin of safety isn’t as wide as it was back in late July/early August, but don’t be surprised to read about me buying more META in the near future.

Given my belief that a 25x multiple is fair for a company of this quality, I think there’s a realistic path for double-digit annual returns from here (even after the stock’s recent strength).

That upside potential, alongside my expectations for generous dividend growth, makes this one of the easiest companies for me to buy and hold in today’s market environment.

As is Booking Holdings.

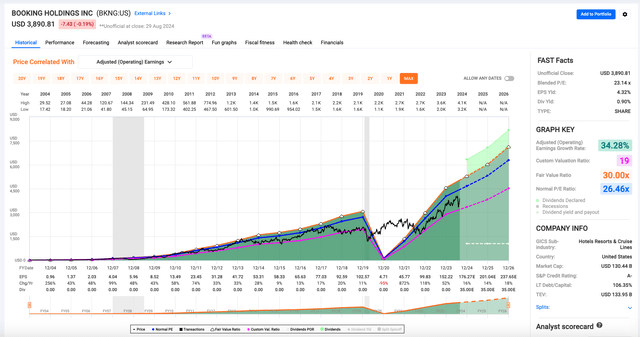

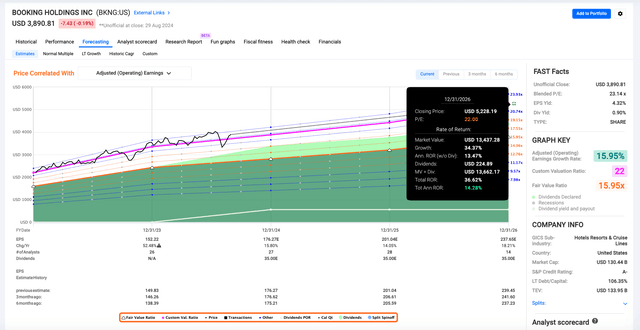

At ~$3370, BKNG shares were trading for roughly 19x this year’s EPS estimates and less than 17x next year’s earnings expectations.

This is a company that has posted positive EPS growth during 19 out of the last 20 years. BKNG has posted double-digit EPS growth during 18 out of the last 20 years. As I pointed out in my Top 20 Highest Quality Companies report, you’re going to have a hard time finding a company that has produced stronger fundamental growth than Booking during the past couple of decades. This company has been a model of consistency and analysts think that trend is going to remain intact moving forward.

This year, the Wall Street consensus is calling for 16% EPS growth. Next year, Wall Street expects to see 14%. And in 2026, BKNG’s consensus EPS growth estimate is 18%.

Here’s the way I look at it…why wouldn’t the company meet these estimates? Producing double-digit annual growth has become second nature for this company over the years.

So, when I had an opportunity to buy BKNG at the 19x level, which has served as incredibly strong support for shares for over a decade now, doing so was an easy decision.

BKNG’s long-term average P/E ratio is 26.5x; however, I feel comfortable paying up to 22x earnings here. With that being said, my fair value estimate for shares is $3,900.

With consensus estimates in mind, alongside this 22x fair value threshold, I believe that Booking Holdings also has a realistic chance to provide double digit returns (even after the stock’s recent rally).

At this point in time, Booking’s margin of safety has all but dried up; however, there are far worse things that investors can do than buying wonderful companies at a fair price.

And with that being said, BKNG remains on my watch list as a place for extra cash to land if I can’t find better opportunities moving forward.

Risks

Obviously, there are no sure things in the market. Every stock is a risk asset. They can go up and down. And since I cannot be certain of the future, there’s no way for me to know that either of these companies will continue along their reliable growth trajectories.

I expect them to; however, Meta could theoretically lose market share to an unknown disruptive competitor. So could Booking.

Both companies face anti-competitive scrutiny from regulators because of their enormous market share positions, so that could hamper growth moving forward.

The talented management teams of either company could decide to up and leave in an instant.

And there’s always the risk of accounting fraud, which, as we’ve seen in recent weeks, can cause stocks to plummet.

All investments carry risk, but when I look at historical performance, present day performance, near-term guidance, and longer-term consensus estimates from Wall Street analysts, I feel comfortable with the cash flow outlook from both companies.

Remember, as Benjamin Graham said, in the short term, the market is a voting machine. It’s irrational and easily moved by an emotional herd. But, over the long term, it reverts to a weighing machine and eventually, fundamental growth will matter.

Conclusion

Truly best-in-breed companies rarely go on sale. But, during the past month or so, I’ve seen several experiences of irrational weakness.

The Yen carry trade debacle had a lot to do with this, but that’s what being nimble in the markets is all about.

There’s always going to be bumps in the road like that one.

They’re all going to seem scary at the moment.

But if they’re unlikely to impact the cash flows of my favorite companies, then they’re little more than noise that I should ignore.

One-time events like that often create strong buying opportunities for people who’re able to overcome short-term fear and maintain a long-term perspective on the market (and more importantly, their highest conviction investment ideas).

I think the recent rallies that both Meta and Booking have experienced speak to this and over the longer-term, I suspect that I’ll be even happier than I already am that I recently added to both of these positions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, AWK, BAH, BIL, BLK, BKNG, BR, CME, CNI, CP, CPT, CRM, CSL, DE,, ECL, ELV, EMR, ENB, SPAXX, GOOGL, HON, ICE, JNJ, KO, LIN, LMT, MA, MAIN, MCD, MCO, META, MSCI, MSFT, NNN, NOC, NVDA, O, OBDC, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TD, TXN, USFR, UNH, V, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.