Summary:

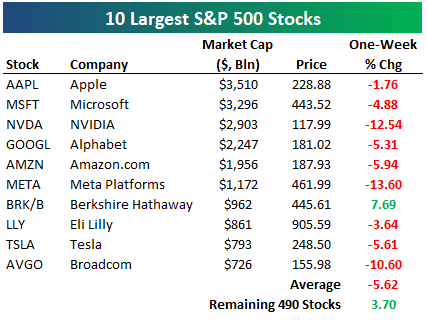

- On July 18, Bespoke data revealed a shift in the S&P 500: while the top ten stocks fell 5.6%, the remaining 490 rose 3.7%, highlighting a market-broadening trend.

- Caterpillar stands out, boasting improved profitability, steady service revenue, and strategic tech integrations. Its diverse market exposure bolsters resilience.

- Despite global challenges, CAT’s robust free cash flow, consistent dividend growth, and strong dealer network make it a solid investment. I remain bullish on its long-term prospects.

aapsky

Introduction

On July 18, I saw a very interesting table from Bespoke. According to their data, the ten largest stocks in the S&P 500 lost 5.6% on a one-week basis.

The remaining 490 stocks of the index rose by 3.7%!

X (@bespokeinvest)

Moreover, that week included a day on which the S&P 500 was down more than 1% while more than half of its holdings were up. This hasn’t happened since April 2000, more than 24 years ago.

This is part of the market-broadening trend we have discussed in countless articles over the past few months, as the risk/reward of “big tech” has gotten poor, paving the way for investments in stocks that have somewhat been left behind and “real economy”/value stocks. One of these companies is Caterpillar (NYSE:CAT) (NEOE:CATR:CA).

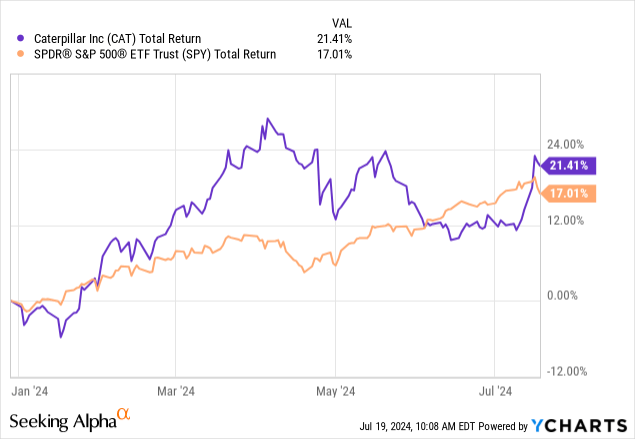

Year-to-date, the yellow machinery producer has returned 21%, beating the S&P 500 by 440 basis points.

My most recent article was written on May 17, titled “Caterpillar: The Dividend Aristocrat With A Growth Engine, A One-Stop Shop.”

While its stock price hasn’t advanced since then, a lot happened, including an in-depth call with the company’s CFO, Andrew Bonfield.

Hence, in this article, I’ll update my longer-term bull case and explain why I’m so bullish on its future despite current economic struggles.

So, as we have a lot to discuss, let’s get to it!

Caterpillar’s Future Remains Bright

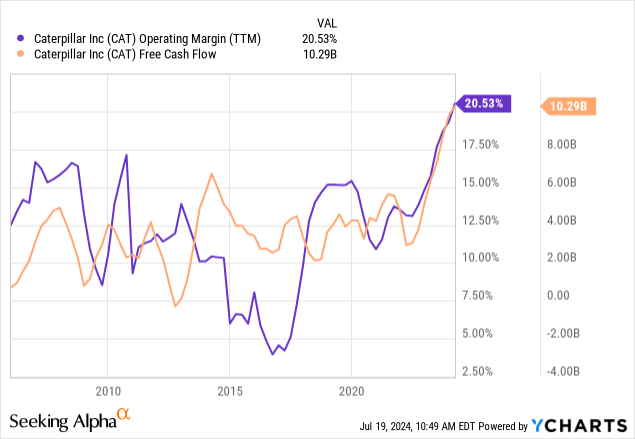

One of the most important things Mr. Bonfield noted during the call is Caterpillar’s improved profitability and cash flow. Compared to the previous cycle peak in 2012, the company’s margins and free cash flow have more than doubled.

Moreover, the company’s focus on increasing service revenues has also played an important role, as services revenue not only provides a steady income stream but also reduces the cyclicality of the company’s total revenues.

Similar strategies have been implemented by other industrial firms, such as aircraft engine manufacturers, tractor producers, and others. They all want to create more recurring revenue and make more money after they deliver their products to customers (aftermarket services).

As we can see in the chart above, the company’s margins and free cash flow have become a lot less volatile.

This includes programs like the one mentioned below. In 2022, the company sold more than $10 million worth of parts per day via its online channels.

Back then, the company was already working to innovate its aftermarket sales.

“We’re upgrading our Service Information System, now we call it SIS 2.0, with new remote troubleshooting capabilities, again, using connectivity, with easier-to-use service and repair instructions, and with the ability to order parts right at the fingertips of a dealer service technician working remotely in the field, to optimize their efficiency,” De Lange said. – Digital Commerce 360

In order to further improve these operations – for both the company and its customers – the company is consistently integrating advantaged technologies into its products, including sensors and digital tools for condition monitoring and predictive maintenance.

By doing this, the company achieves two goals:

- It increases the total cost of ownership (it makes money for a long time after the initial sale of the machine).

- It remains competitive.

Interestingly enough, during the special call, the company mentioned it was brought up that it should acquire AGCO (AGCO), one of the largest tractor companies in the world, which owns brands like Fendt and competes with Deere & Company (DE). However, it said it’s unlikely to make such a move, as it would require substantial capital and require the company to take on much larger peers (I’m assuming it means Deere).

Hence, its main focus remains on service-focused companies, which I think is a great decision.

It also enjoys pricing power, as it aims to keep price hikes higher than manufacturing cost inflation to protect its margins.

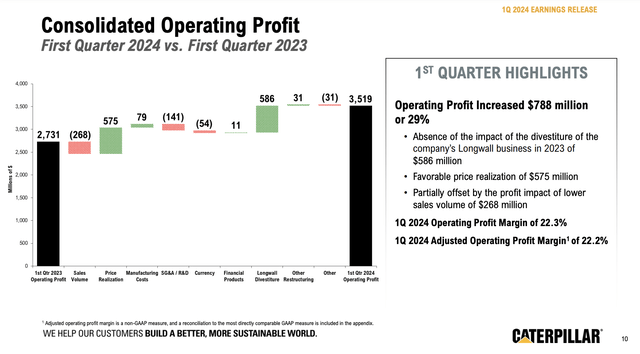

In 1Q24, this worked well, as pricing added $575 million to operating profits, more than offsetting a $141 million headwind in selling, general, and administrative costs. Interestingly, manufacturing costs were a tailwind as well, mainly caused by lower freight costs.

Another benefit is the company’s increasing diversification, as it services construction, resources, and energy/transportation industries. Although all of these are cyclical, they each come with different demand profiles and customers.

According to the company, while the construction market in the U.S. remains strong, its Energy & Transportation segment is also seeing significant growth, driven by increased demand in data centers and other energy sectors.

Data center demand is a major pillar of the company’s secular growth. I added emphasis to the quote below.

There’s a number of factors within what’s driving data center growth, as we’ve talked about. One, which is AI proliferation. That means, obviously, there’s a lot more significance relating to that. Secondly, also the size of a data center is growing much, much larger. So now I think you put out a note today referencing 15 to 40 gen sets for a data center, that’s for a relatively modest data center today. There are bigger data centers today, and that is probably only going to get bigger as we see AI come on. So that is, again, a large upside. – CAT June Special Call

Additionally, the energy transition, which includes the shift to renewable energy sources and the need for infrastructure to support electric vehicles, further supports the demand for the company’s construction and power generation equipment.

This includes power lines as well as solar and wind farms.

What matters here as well is that Caterpillar has a huge dealer network, which comes with the competitive advantage of offering on-the-ground support and services, making sure that CAT is in the right place at the right time.

Even in 1996 – almost 30 years ago – the company’s dealer network was a major reason why it did not get “crushed” by the emerging competition from Japan, as the Harvard Business Review wrote back then.

But the biggest reason for Caterpillar’s success has been our system of distribution and product support and the close customer relationships it fosters. – Harvard Business Review (1996)

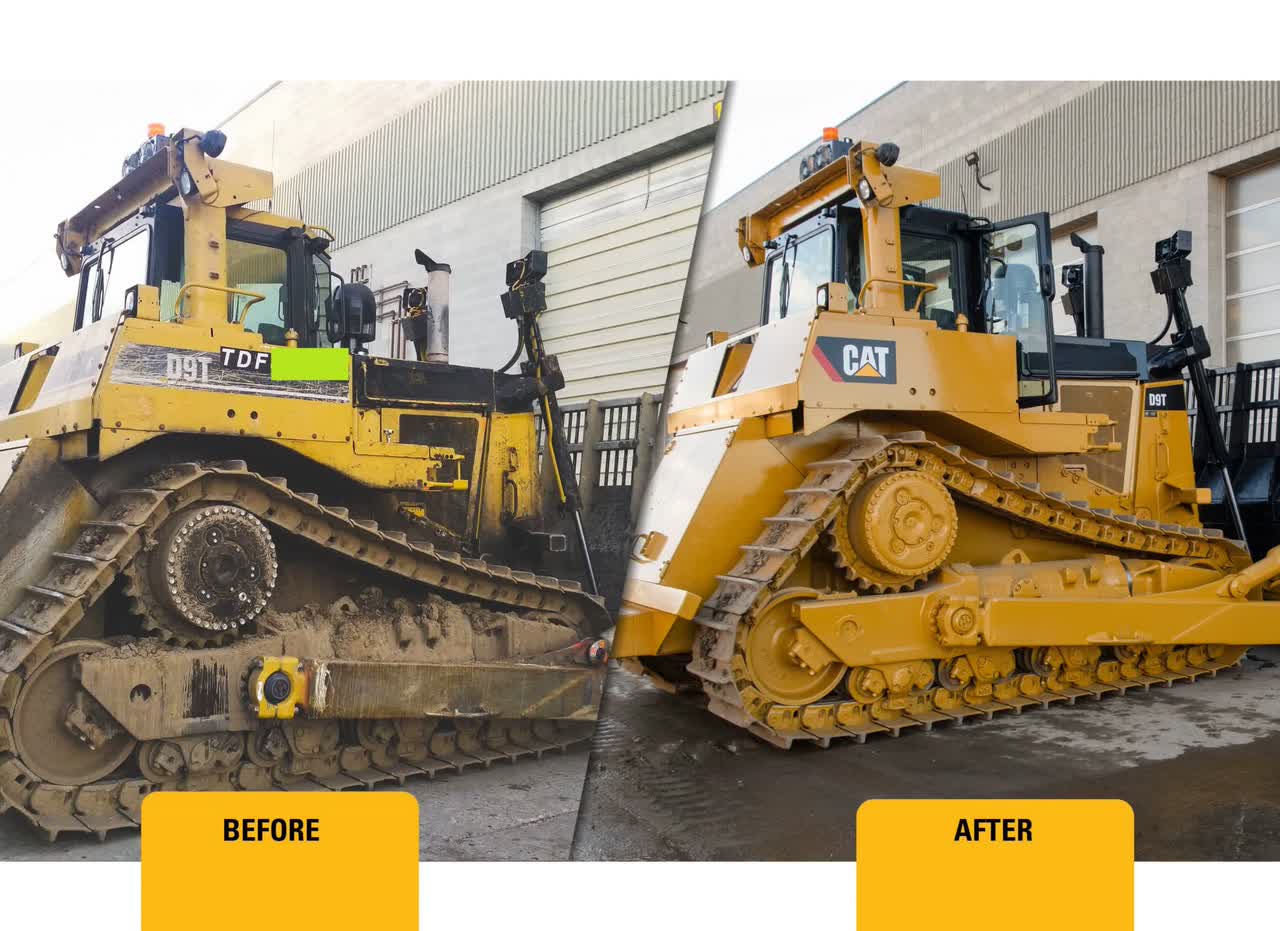

The company also benefits from mining demand, as long-term demand for commodities like copper, also driven by the energy transition, is rising. This is further supported by CAT’s rebuilding services.

Essentially, the company takes old equipment and completely refurbishes it. This often makes new investments attractive for (price-sensitive) customers.

All of this bodes well for shareholders.

Outlook & Shareholder Distributions

Despite global economic challenges (Europe’s manufacturing recession, China’s weak housing market, and poor manufacturing growth in the U.S.), the company raised its free cash flow targets.

[…] our previous targets were $4 billion to $8 billion, which is based on being between $1 billion and $2 billion higher than they had been historically. Obviously, last year, we went to generate $10 billion of free cash flow, so we moved the targets from $5 billion to $10 billion. – CAT June Special Call

To put things in perspective, $10 billion is roughly 6% of its $171 billion market cap, which is great news for shareholders. Even during the pandemic in 2020, the company generated $3 billion in free cash flow without cutting back on capital expenditures.

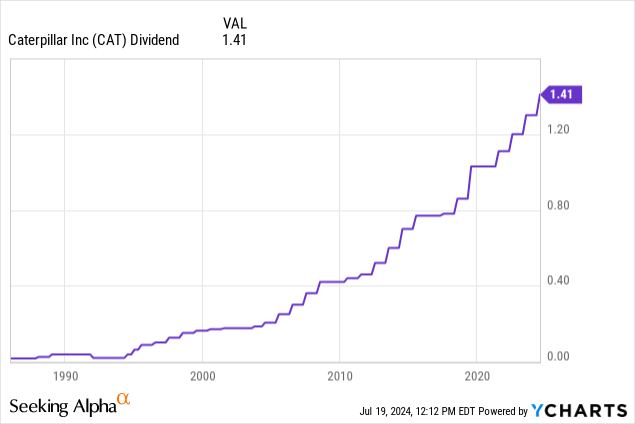

Currently yielding 1.6%, CAT aims to grow its dividend by high-single-digits each year after hiking the dividend by 20% in 2019.

The five-year dividend CAGR is 8.6%. It has a payout ratio of just 24% and a track record of 30 consecutive annual dividend hikes.

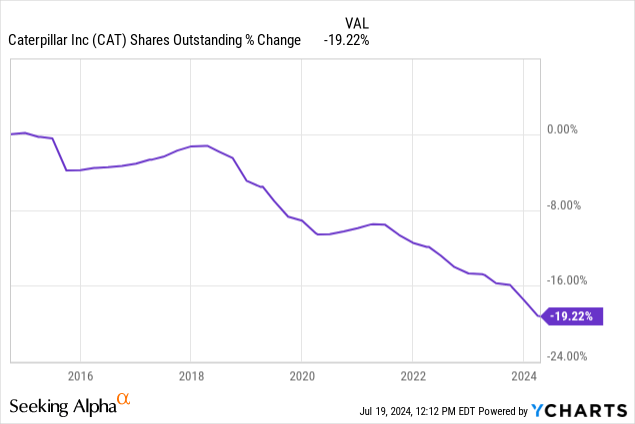

It has also bought back roughly a fifth of its shares over the past ten years, which meaningfully contributed to its stock price outperformance.

The company also enjoys an A-rated balance sheet and a valuation with room for growth.

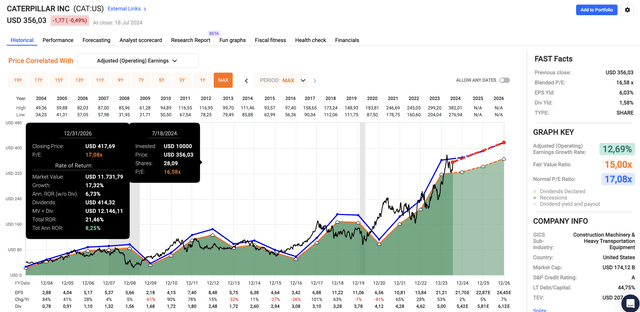

Using the FactSet data in the chart below, even under current economic conditions, analysts expect a growth acceleration from 2% EPS growth in 2024 to 7% growth in 2026.

If we apply the company’s normalized P/E ratio of 17.1x, we get a fair stock price of $418, 17% above the current price.

As such, I remain bullish on CAT and use stock price corrections to expand my position, as I believe the company is in a great spot to keep outperforming the market in the years ahead, supported by secular growth, a potential global manufacturing recovery, and its ability to enhance margins and create shareholder value.

Takeaway

I believe that despite economic headwinds, Caterpillar’s improved profitability, focus on service revenues, and strategic technological integrations position it well for future growth.

With its strong free cash flow, consistent dividend growth, and effective dealer network, CAT remains a compelling investment.

I remain bullish and see market corrections as opportunities to grow my position, as I’m very confident in the company’s ability to outperform over the long term.

Pros & Cons

Pros:

- Strong Profitability and Cash Flow: Caterpillar’s margins and free cash flow have more than doubled since 2012.

- More Predictable Revenue: The increased focus on services provides a stable income and reduces revenue cyclicality.

- Technological Integration: Advanced tech in products boosts efficiency and competitiveness.

- Resilient Dividend Growth: The company has 30 consecutive annual dividend hikes with a five-year CAGR of 8.6%.

- Robust Dealer Network: An extensive network provides great support and customer relationships.

- Diverse Market Exposure: CAT serves a wide variety of industries, which mitigates cyclical risks.

- Positive Growth Outlook: Analysts expect an EPS growth acceleration, which gives the company a fair stock price target 17% above current levels.

Cons:

- Economic Headwinds: Global challenges like Europe’s manufacturing recession and China’s weak housing market could impact CAT’s performance.

- Cyclical Nature: Despite diversification, its core industries are still cyclical, exposing CAT to economic downturns.

- Valuation Risks: The current stock price might already reflect much of its shorter-term potential, potentially limiting the upside if we do not get a rebound in cyclical growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT, DE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.