Summary:

- Meta’s core business of social networking and advertising is performing excellently, with consistent revenue and cash flow growth.

- Meta’s main risk may not be competition but new regulations.

- Meta has the potential for growth and diversification through features like WhatsApp Pay, augmented reality/virtual reality, and artificial intelligence integration.

Flashpop/DigitalVision via Getty Images

A few days ago, on Seeking Alpha, I read a comment where it was highlighted the static nature of the Menlo Park company compared to other giants such as Alphabet and Amazon. After all, Meta (NASDAQ:META) has always remained in the social networking sphere, while Amazon has gone from selling books to being a diversified behemoth; Alphabet, from a simple search engine, then invested in the Cloud and YouTube.

Such considerations may seem objective and indisputable at first glance, but in my opinion, they are too superficial and hide quite a different reality.

From this simple comment, I got the idea for this article, whose goal is to refute the thesis that Meta is a static company. Through objective data, personal insights, and comparisons with other big tech, I will show you why I believe Meta is second to none.

A competitive advantage that no other big tech has

As already anticipated, most of the major U.S. big tech companies have preferred to diversify their revenues over the years, and have invested heavily in other sectors where demand is thriving. Microsoft, Alphabet, and Amazon share the Cloud market; Amazon has revolutionized e-commerce, although competition is fierce today; Google remains the top search engine, although Bing is slowly growing in popularity.

These three giants have achieved incredible performance over the past decade, although they operate in competition with each other in some market segments. To some extent, they can coexist and continue to be money-making machines, given the breadth of the markets in which they operate. But in all of this, where does Meta fit in?

Meta has always been about the same thing, developing its social networks (family of apps) to the best of its ability. Contrary to what many people may think, the billions invested in artificial intelligence have been mainly devolved into the family of apps in order to make it possible to increase the efficiency of ads. If advertisers find more hits (thus have a higher ROI) by placing ads on Facebook/Instagram, they are more likely to continue to do so in the future. To see if Meta is doing a good job, simply take a look at its financial results over the past 10 years.

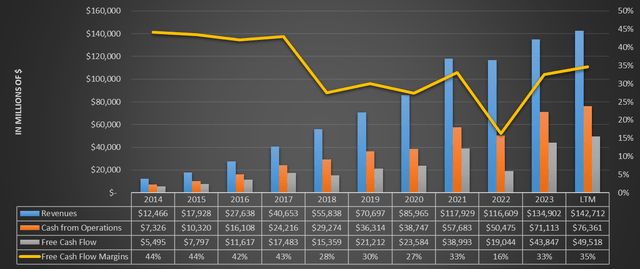

Chart made by the author, based on financial reports data

Except in 2022 (when there were problems with iOS privacy settings), revenues and cash from operations have always increased, and not at a slow pace. The free cash flow margin is currently 35%, but it could be far higher if Meta reduces CapEx, which it is likely to do in the coming years. Overall, we are talking about a company growing in double digits and with a free cash flow margin that can potentially exceed 40%. In short, I would say that Meta’s ads are satisfying advertisers, otherwise we would not be looking at such results.

How long will this growth continue? Probably much longer, since digital advertising is gradually suppressing traditional methods. According to Precedence Research, the global market size of digital advertising spending has been estimated at $550 billion in 2023 and is expected to exceed $1.36 trillion by 2033 with a CAGR of 9.58% from 2024 to 2033.

In light of these considerations, it is evident that Meta’s core business is performing excellently and has made the company the behemoth it is today. On the other hand, the less optimistic might criticize the little diversification of revenues, which are totally dependent on social network advertising. What if people stopped using Facebook? What if Instagram is a passing fad? These are all legitimate doubts, but let me show you why I believe these apps are meant to last.

The use of social networks is now ingrained in our culture and is becoming increasingly important. Just think that in 2012 the average time spent on social media was 90 minutes, in 2023 it was 2 hours and 30 minutes: we’re talking about an insane amount of time. Just like a drug, social networks are known to be addictive, and prolonged use can generate negative consequences. In some cases, there are even people who spend 4–5 hours a day between Instagram and Facebook, which is why it is absurd to think that this ingrained habit can be considered a mere passing fad. But there is more.

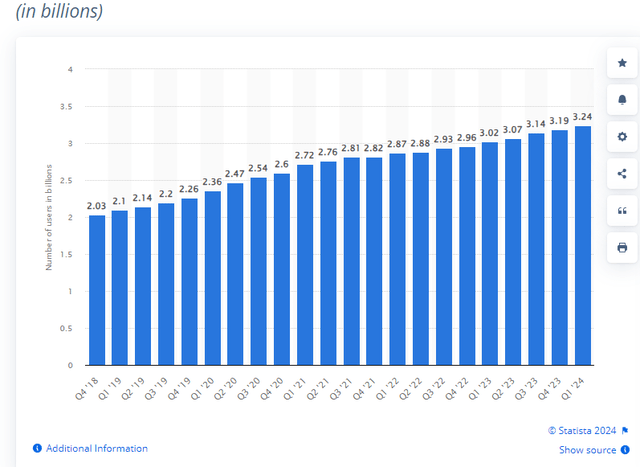

Statista

The number of daily active users on WhatsApp, Facebook, Messenger and Instagram is increasing quarter after quarter. No other company can count on 3.24 billion daily users, making Meta’s network effect one of the strongest competitive advantages around. YouTube also has lots of active users, but its use is different.

No one has been able to break Meta’s dominance, and the few that have tried have been destroyed. I remind you what happened to Snapchat when it introduced stories: shortly afterwards this feature was added to Instagram as well, and gradually people abandoned Snapchat.

So, all the major big tech companies have competitors, they often clash with each other. Meta, on the other hand, is on a totally different playing field and that makes it special. Microsoft may create its own social network, but no one will care since everyone is already subscribed to Facebook and Instagram. However, it can compete with Google by integrating new features regarding artificial intelligence to Bing. Apple can try to hinder Meta by including new privacy settings, but Meta will eventually find a way to insert personalized advertising based on the user’s interests anyway. Alphabet with the introduction of shorts may try to gain more market share, but it will never be Instagram. Merchants will continue to pay Amazon to have their product show up on top, but they will also pay for advertising on Meta’s apps, since more than three billion people connect every day. In short, the Menlo Park giant continually comes under attack, but always emerges victorious.

Meta’s only real competitor was TikTok, but we all know how much difficulty the Chinese app is having operating in the West. A ban seems to be just around the corner and in any case, despite the competition, Meta still managed to increase cash flow from operations as well as users.

As crazy as it sounds, I personally believe that Meta’s main competitor is not another company, but the government.

Meta does not sell cigarettes, but after years of research, it is clear that prolonged use of social networks is not good for our health. This is not a scientific article, so I will not elaborate on this issue, but to some extent I don’t think it is wrong to consider Meta as a sin stock. In fact, legal disputes are always around the corner because of its outsized power over so many people. Although unlikely at the moment, we cannot rule out a future where the use of social networks is restricted in some way. After all, they came into existence relatively recently, and we are still not fully aware of their consequences. With due differences, an analogy with cigarettes in the mid-1950s comes to mind: everyone knew they were harmful and addictive, but almost everyone smoked anyway.

Finally, I will conclude this paragraph with an argument regarding China risk. Almost all the major American big tech companies are dependent on China, either in terms of sales or in terms of manufacturing; for Tesla (if we want to consider it a tech company) and Apple in both cases. Others, such as Nvidia, are totally dependent on the manufacturing of Taiwan Semiconductor, a well-known Taiwanese company that is a leader in the production of cutting-edge chips. For Amazon, the argument is different, since the China risk is mainly represented by the strong competition from Chinese e-commerce companies such as Alibaba, PDD Holdings (Temu) and Shein.

Without getting too much into a political discussion, objectively the relationship between the U.S. and China is not idyllic, after all, the position of the world’s leading economic power is up for grabs. Everyone makes their own interests, of course, and we also know how complex the relationship between China and Taiwan is.

With this in mind, investing in a Western company dependent in some way on China, or competing with Chinese exporters ready for a trade war, could turn out to be a riskier choice than expected. The future is unpredictable, and our forecasting ability is worse than we may believe. In my opinion, especially in the current historical context, it is important to minimize this risk, and Meta represents one of the few tech companies with this characteristic.

Instagram and Facebook are already banned in China, so it cannot get worse than this. However, this does not mean that the company does not earn anything from China, quite the contrary. Revenues from China have increased in recent quarters, thanks mainly to the billions spent by major Chinese e-commerce companies to boost their popularity in the West. Basically, Meta can do without China, but the Chinese cannot do without Meta if they want to expand their business around the world. Here, too, Meta is in an advantageous position.

Business potential and diversification

So far, we have seen how dominant Meta is in the digital advertising market and why its competitive advantage is almost insurmountable. However, going back to what was discussed in the intro, there are those who believe that Meta is technologically behind, having never diversified its business. In other words, beyond Facebook and Instagram ads, this company is not worth much.

Microsoft has invested $13 billion in OpenAI, and millions of users already use Chat-GPT and Copilot; Alphabet has long been engaged in the development of new features based on artificial intelligence, the latest of which is represented by Gemini. Apple, on the other hand, is intent on integrating Gemini into its iPhones to make them more cutting-edge; Nvidia is fueling the AI revolution with its terrific GPUs. Amazon has invested $2.75 billion in artificial intelligence startup Anthropic; Tesla will invest $10 billion this year in developing artificial intelligence programs essential for autonomous driving. In short, all the major big tech companies are moving toward new futuristic solutions that can exploit new market segments, but among them, I think Meta is the one with the greatest potential.

First of all, none among them can count on three billion daily users, which implies countless ways to monetize this following. Second, Meta is not just Facebook and Instagram, there are other businesses in which the company is operating and will expand.

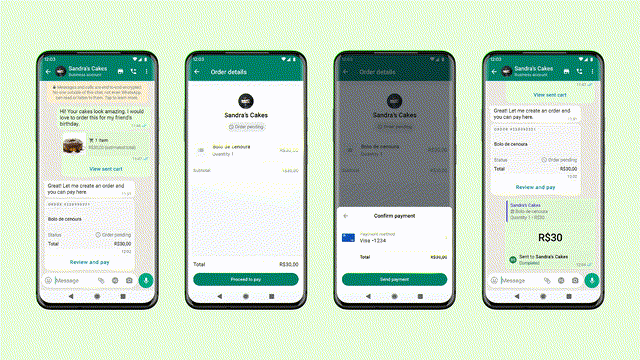

The first involves WhatsApp, the most popular instant messaging app in the West: about 2.78 billion monthly users. Although it is not very popular in the U.S., in the rest of the world it is; in fact, users cannot do without it, whether for a simple conversation with a friend or for work-related matters. The reason I included WhatsApp among Meta’s new features (albeit a dated acquisition) concerns the potential to monetize this billion-user app, something that has not been the priority until now.

Beyond the click-to-message ads that will be featured on major social networks, the real revolution will involve payments via WhatsApp Pay. Merchants and small businesses will be able to sell their products within the app without relying on external sites or other apps; therefore, Meta will have control over the entire purchasing process, from advertising to final payment.

Meta

Regarding this topic, there would be much more to say, but I don’t want to go into too much detail since I wrote a whole article about it a few months ago.

Meta’s second growth driver that differs from advertising concerns the Augmented reality (AR) and Virtual reality (VR) market. The former involves adding digital elements into everyday life, mainly through a camera or smartphone; the latter represents a totally immersive experience.

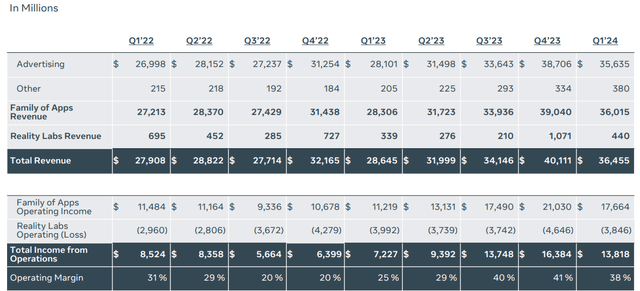

Meta Q1 2024

Everything related to these technologies is included in the Reality Labs segment, which is clearly loss-making year after year. At first glance, the results obtained may seem disastrous, but there is nothing strange about that. These are long-term investments, and Mark Zuckerberg himself has stated that Reality Labs will not be profitable until 2030.

While the new Ray-Ban Meta glasses are an interesting first approach toward augmented reality, we cannot expect them to generate positive cash flows right away. At the same time, Meta has sold 20 million Quest headsets so far, yet there is still no improvement in profitability.

The Metaverse remains a project in its infancy despite the billions of dollars spent, and it will take years for consumer habits to change. We are talking about technologies that are extremely innovative and would once again change the way we experience everyday life, just as happened before the advent of social networks. In my opinion, criticizing the Reality Labs segment three years after its inception makes very little sense, partly because none of us know exactly what technologies the company is investing in.

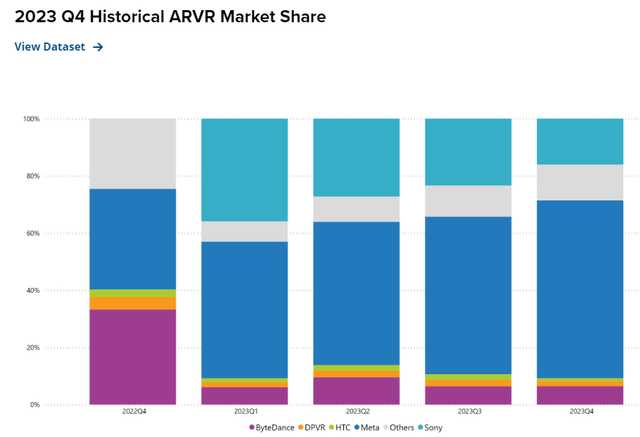

IDC

What we do know is that Meta is currently the undisputed leader in the AR/VR market, and there is unlikely to be another company willing to invest so much in this project. Months ago, Apple tried to enter with its $3,500 visor, but it did not generate the buzz they expected.

Personally, I strongly believe in Mark Zuckerberg’s vision, since he will be able to leverage on the huge following already experienced on the family of apps. Connecting people around the world through AR/VR, I think, is a feasible goal only for Meta.

While the basics are there, I realize how difficult it is to accomplish this futuristic project, and I understand the skepticism of those who believe that Meta is just throwing money around. However, I wonder why this negativity affects Meta in particular, when there are other companies with equally complex projects to implement. For example, Robotaxi and Optimus are still in their infancy and with profitability impossible to estimate, yet they are generating a lot of enthusiasm.

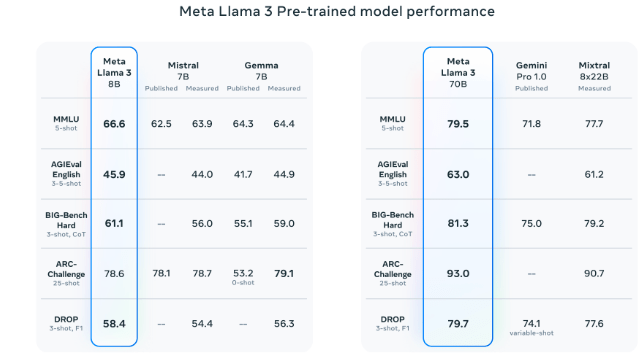

Finally, as a last growth driver, we have the much-discussed artificial intelligence. As you know, Meta also invests several billion in artificial intelligence every year and has its own language model, Llama 3. In my opinion, it is talked about too little, especially considering its power. In fact, the performance of Meta Llama 3 has been better than Gemini Pro 1.0 and Mistral.

ai.meta.com

Obviously, for all these language models there are continuous innovations and updates, and improved versions will be released soon for both Meta and Alphabet. Making a comparison on every single detail I find superfluous given the dynamic nature of this market. In my opinion, it is not important who has the better chatbot (we probably don’t even notice the differences), but who exploits it better.

Following this thread of logic, there is no doubt that Microsoft and Alphabet can best integrate Chat-GPT and Gemini, respectively, into their operations. Nevertheless, I believe that Meta’s potential is greater.

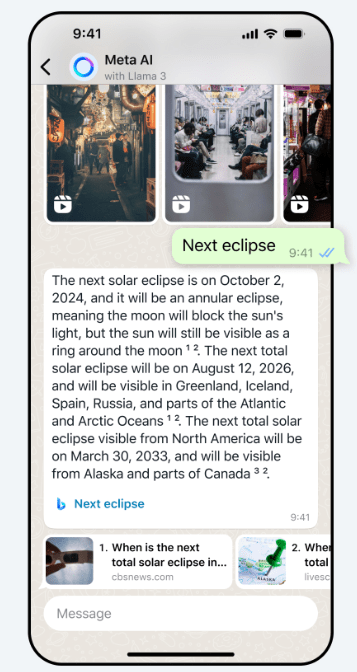

Meta

Soon, all over the world it will be possible to converse with a virtual assistant directly from Meta apps. In this image, you can observe a simple conversation on WhatsApp, where in a few seconds you will have the answer to any question and also attached links where you can get more information about it. With such an integration, I believe Chat-GPT and Gemini have no hope of competing (even if better), as the average user will find it much easier to consult Meta AI. After all, that is the benefit of having 3 billion daily users spending hours on your apps.

Since SMS is still popular in the United States, I realize that WhatsApp does not generate much enthusiasm, but I assure you that in Europe and the rest of the world it does. Although never publicly stated, Mark Zuckerberg’s goal I believe is to develop an “everything app” just as Tencent did in China with WeChat. We may get to the point where on WhatsApp you will be able to shop for groceries, buy things, have a conversation and video calls with anyone, and quickly get an answer to any question you have. In all this, we still don’t know how the new AR/VR technologies will be integrated.

What other big tech has such potential?

Valuation

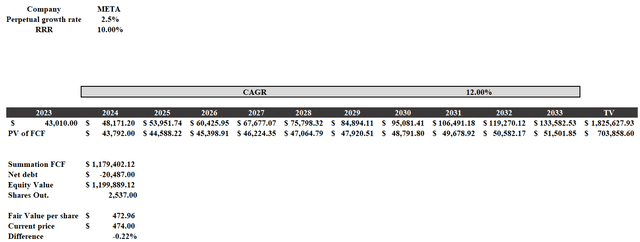

After a rather qualitative analysis, it is time to do some math. Even if Meta was the best of the big tech, that does not necessarily mean it is a buy, so we need to look at the discounted cash flow to understand its fair value.

By creating a simple model with a free cash flow growth rate of 12% through 2033 (starting with that of 2023), and entering a required rate of return of 10%, the fair value amounts to $472.96 per share. I could have entered a higher growth rate, but since Meta is already a huge company, I preferred to be more conservative. As a reminder, the 10-year free cash flow CAGR was 31.10%.

Discounted cash flow

Of course, this is only a rough estimate, and by changing the inputs the result can be totally different. For example, for those who want an RRR of 11%, the fair value amounts to $409 per share.

In addition, this model does not take into account the buyback, a factor of some significance given that Meta is spending tens of billions to buy back its own shares. Surely, this will positively impact the fair value per share given the lower denominator. Since the model omits it, we can somewhat consider it our margin of safety.

As far as I am concerned, it really makes little difference to me whether Meta is worth $400 per share or $450, since my goal is to keep this company in my portfolio for decades. If the free cash flow continues to increase in double digits (which I expect) and the outstanding shares decline year after year, it will change little for me 10 years from now to know how much I bought Meta for, unless I did so at an absolutely unreasonable price.

As of today, I don’t think Meta is cheap but nevertheless my rating remains a buy since I consider it an outstanding company, not too expensive and with a bright future ahead.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Warren Buffett

Conclusion

Meta is an exceptional company and has come out stronger than before from the difficulties it encountered in 2022. While my impression is that public opinion tends to consider Microsoft and Alphabet ahead in terms of new technologies concerning artificial intelligence, Meta with Llama 3 is proving that it is not far behind. The most important aspect, however, is the use that will be made of the language models, and no company in the world has the same possibilities as Meta.

Basically, the business model will always remain that of a company that makes money primarily through advertising, but the way in which it does it will be the real revolutionary aspect. Moreover, I consider Mark Zuckerberg to be one of the best CEOs in history, and that is a huge strength. Beyond his innovative ideas, everything he does is for the good of the company and not for his own personal interests, which is by no means a given.

Being able to undertake very long-term projects, not being swayed by market hysteria, is not for everyone. Remember when they called him crazy for buying an unprofitable texting app for $19 billion? Or when he spent $1 billion on an app where people shared personal (often uninteresting) experiences? Some things that seem normal to us were not normal at all 15 years ago, since the world and our habits are constantly evolving: in 10 years you could be working simply by wearing a visor.

Meta is not a company that aims to remunerate shareholders in the short term; otherwise it would have used the money invested in Reality Labs to issue dividends and make buybacks. The goal is to lay the groundwork for a new 10-year growth cycle by starting to evaluate other business opportunities beyond just simple advertising on Instagram and Facebook.

There will be ups and downs along this path, but once the right synergy is found between the various projects, integrating them with the needs of 3 billion people, I believe Meta will be second to none.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, BABA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.