Summary:

- Tesla, Inc.’s stock is rated as “Hold” due to excessive optimism and lack of margin of safety amidst an EV price war and weakened demand.

- Despite record-high revenues, Tesla’s profit margins are contracting due to aggressive pricing and fierce competition, from Chinese and domestic manufacturers.

- The upcoming “Robotaxi” event is considered a potential catalyst, but caution is advised as the stock’s valuation remains high with optimism baked in.

- I would only consider buying Tesla’s stock at around $80/share, given the high degree of uncertainty and the need for a significant margin of safety.

Sven Piper

The last time I covered Tesla, Inc. (NASDAQ:TSLA) stock was back in February this year. That was following the slump in the stock price as the company navigated weaker-than-expected EV demand. This followed significant price cuts to its flagship Model 3 and Model Y with the competition heating up in the electric vehicle (“EV”) space.

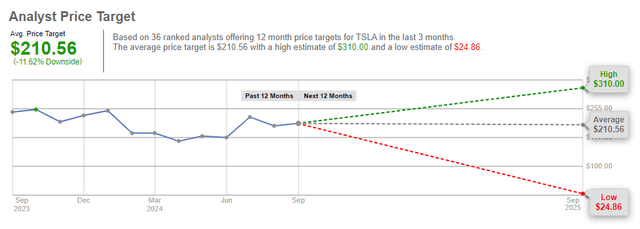

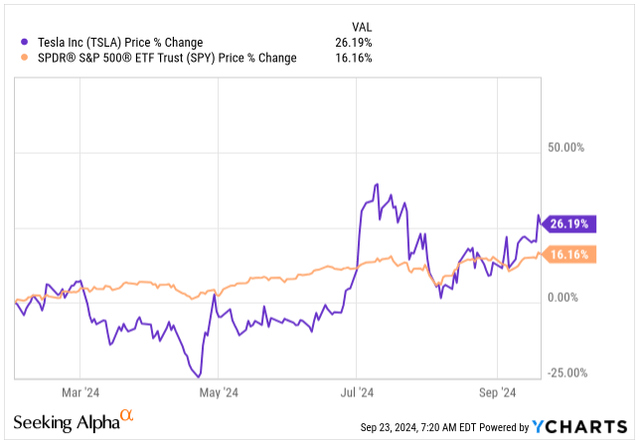

Since my last coverage, when I rated the stock as a “Hold,” the company has outperformed the S&P 500 (SP500) by a margin of 10%. Excessive optimism about its “Robotaxi” event, expected to take place in October, is driving the stock once again to dizzy valuation highs.

Price Development (Seeking Alpha)

With the event largely expected to be a “break or make” catalyst, I am advising caution as the stock does not offer any margin of safety despite the difficult car sales environment, where volumes are falling and profitability remains under pressure.

Let me show you why I am very cautious moving forward.

What’s Next For Tesla?

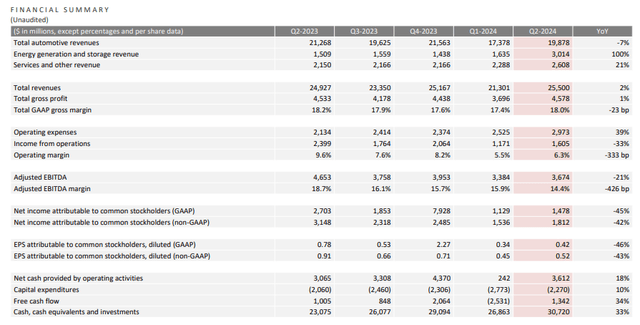

While digging too much into Q2 earnings at this point does not make too much sense, as the company is set to release Q3 earnings in mid-October, let’s take a look at a few key figures.

When Tesla reported its Q2 earnings in July, the company reported quarterly revenue totaling $25.5B, up 2% YoY, with EPS falling as much as 43%. This was driven by the slow demand for EVs and continuous weakness in pricing amidst the price war with Chinese EV manufacturers.

Altogether, the earnings report was rather lackluster for an auto manufacturer priced at a significant premium over other carmakers. Yet, the Q2 Revenue beat analysts’ estimates of $24.5B but fell short of the $0.61 EPS expected.

Tesla acknowledged the difficult quarter in its earnings call, describing the “operating environment difficult” even as revenues were the highest on record.

TSLA Financial Summary (TSLA IR)

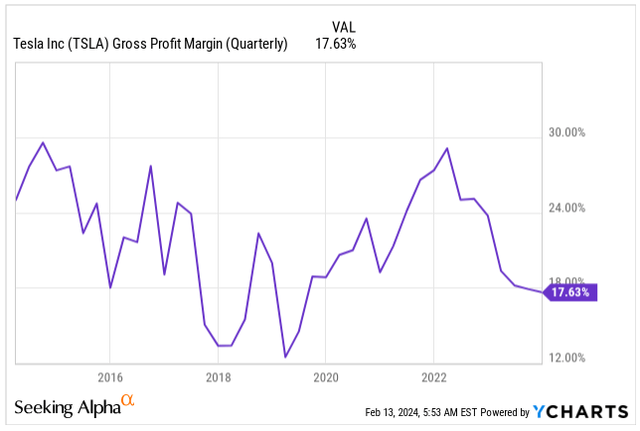

Despite the record-high revenues, what’s more troubling is the continuously contracting profit margins without any relief in sight.

The increased competition in the EV market forces Tesla and other manufacturers to implement aggressive pricing without significant success in volume improvement, ultimately hurting the bottom line. This negative loop directly impacts its Gross Margin, which fell by another 23 basis points, continuously sitting below 18%.

TSLA Gross Margin (Seeking Alpha)

To put the price drops into perspective, let me show you a few key figures, as reported by Bloomberg.

Tesla’s top-selling EVs, such as Model 3 and Model Y, have starting prices now lower than the US’s average transaction price for combustion-engine cars.

For instance, the Model 3 rear-wheel-drive variant has a starting selling price of $38,990 before taxes and fees. That’s $8,700 lower than the national average for new gasoline-powered cars and trucks. To take it a step further, even compared to other EVs, with an average transaction price of $52,000, Tesla’s pricing is very aggressive.

How did we get here?

Historically, EVs were priced at a significant premium compared to conventional cars, partially due to their new technology and partially thanks to more expensive materials such as lithium:

- Model 3 witnessed a significant price reduction from $66,000 back in 2018 to $42,490 in 2024.

- Model Y was introduced in 2019 at $55,550. Since then, its price has gradually increased to its peak of $68,490 before decreasing to $48,490 in 2024.

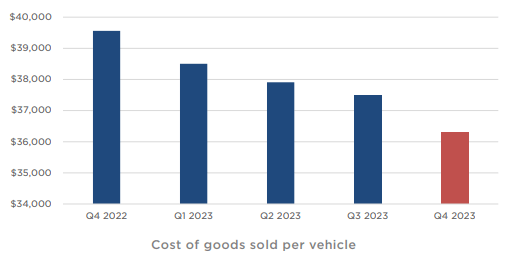

One explanation for the 15-30% car price decreases is overcoming the early manufacturing challenges and significantly reducing the cost of goods sold per vehicle. Between Q4 2022 and Q4 2023, the average production costs per vehicle fell by roughly 10% to just over $36,000.

Cost Per Vehicle (TSLA IR)

Yet, economies of scale and cost improvement per vehicle is only part of the story.

Tesla has continuously lost its market dominance despite the significant price reduction in the US, seeing its market share drop to 49.7% in Q2 2024 compared to 60% in Q1 2023 and 79% in 2020. This has been driven by the increased competition from other carmakers such as Ford (F), General Motors (GM) and BYD Company (OTCPK:BYDDF), playing catch-up.

As the EV market matures, it’s natural that Tesla is seeing its dominant market share eroded by new entrants; nevertheless, the battle is fierce, and other carmakers are cutting the prices of their EV models, which resembles the race to the bottom, without end in sight.

To prevent the influx of cheaper, Chinese-made vehicles, the US has increased its import duties on Chinese-made EVs from 25% to 100%, effectively quadrupling the rate to defend its car-making industry and save domestic jobs.

Tesla’s recent price cuts may cost the company $1.2B annually. That’s an investment to defend its market share and aim for long-term, sustainable price parity with traditional gas-powered cars. Yet, this move hinders short-term profits, souring investors, but has the opportunity to drive superior demand for Tesla’s vehicles in the long term.

The immediate effect is visible in the deteriorating profitability, with the gross margin contraction. Nevertheless, that’s a trade-off CEO Elon Musk has to take, in my view.

Certainly, I am not expecting any near-term relief in the EV price war. However, as manufacturing costs per vehicle improve by the end of the decade, I expect Tesla to be able to achieve gross margins in the low-20% range, above the current 18% but below its all-time high of 29% achieved back in 2022.

Back in 2023, Tesla delivered 1.81M vehicles globally. For 2024, I forecast the company will deliver slightly fewer vehicles, pressured by slower-than-expected demand for EVs, elevated interest rates pressuring the general auto industry, and fierce competition, particularly in China, with domestic carmakers.

In Q1 2024, Tesla delivered 386,810 vehicles, 444,000 in Q2, and analysts are expecting Q3 vehicle deliveries to total 458,000, up 5% from Q3 2023, bringing the first three quarters of the year to 1.29M vehicles. For Q4 2024 expecting vehicles delivered in the range of 460,000 to 500,000 is absolutely feasible.

Speaking of profitability, I remain cautious, not expecting any significant turnaround, with the gross margin remaining under pressure, most likely landing around 18% by the end of the year.

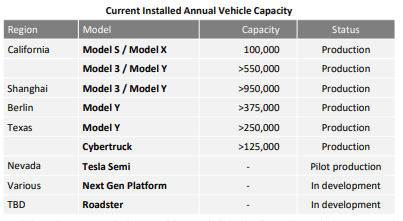

To gauge this against Tesla’s production capacity, which currently sits at around 2.35B per annum, we clearly see some overcapacity with potential idleness in the factories. This should last as long as the demand does not improve in the near term, pressuring the conversion cost and ultimately the cost per vehicle.

Installed Capacity (TSLA IR)

Naturally, at the current sales run rate, the business is far from the management’s aspiration of selling 20 million vehicles by 2030.

At this stage, I expect Tesla to be capable of selling around 5M vehicles by the end of the decade. This would still represent an attractive 18.45% CAGR between today and 2030. It would be driven by the expected release of an affordable hatchback EV and a potential release of a lower-priced SUV as early as 2025, with a production ramp-up in 2026 at a comparable pace to Model 3.

While the release of an affordable SUV may be particularly attractive for the US customer base, the compact EV might particularly well cater to European customers.

Beyond the conventional vehicles, Tesla has been stepping up its rhetoric around its Full Self-Driving (“FSD”) Capability and AI. It is investing as much as $10B in 2024 in AI training and inference, with the message on full display during the Q2 earnings call and the “Robotaxi” unveiling event around the corner, now expected on 10th October.

Tesla, like other Mag7 businesses, is expected to deploy significant CAPEX to build AI infrastructure in 2024 and beyond as it works on its ride-hailing functionalities, which are expected to be released in the future. This could pressure the businesses of other ride-sharing companies such as Uber (UBER).

Some investors argue that Tesla’s business should no longer be viewed as a conventional EV carmaker. Instead, investors should be forward-looking, with the robotaxi acting as a catalyst. Each Tesla out there today automatically has the opportunity to become part of a fleet as long as it is activated by its owners. This would earn money for both Tesla and its owners without a need to ramp up the product release.

As an investor, I remain cautious about excessive optimism as Tesla has historically often delayed its product releases, and it’s not clear what the size of financial opportunity ahead.

Analysts confirm the uncertainty. If we look at the next 12-month analysts’ price targets for Tesla, the range is broad. Some analysts forecast a price as high as $310/share, while the average is around $210. This, in fact, presents a roughly 11% downside from today’s share price of $238/share.

Valuation

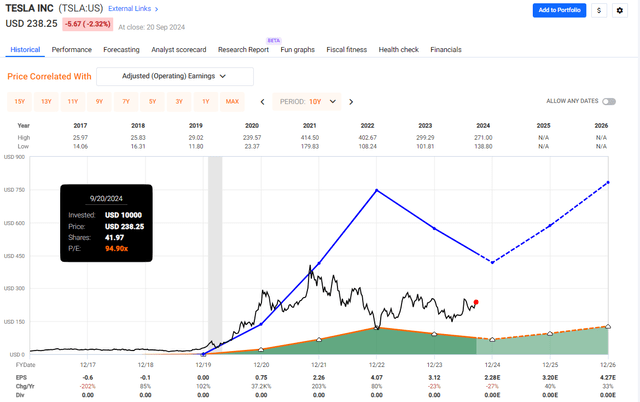

Putting a fair valuation on Tesla’s stock is a daunting task. The shares have historically been very volatile, with the valuation fluctuating from 30x its earnings to 340x in the past five years alone, as the growth prospects for the future varied massively.

Despite its market cap of $761B, Tesla is a relative newcomer when it comes to profitability. The company has achieved its first positive net income full-year in 2020 and since, experienced massive growth, which is now facing a slowdown:

- 2020: $0.75 (37.2x YoY increase)

- 2021: $2.26 (2x YoY increase)

- 2022: $4.07 (0.8x YoY increase)

- 2023: $3.12 (0.23x YoY decrease).

Unsurprisingly, such volatile earnings translate to volatile stock prices, with Tesla’s beta at 2.29.

Today, Tesla’s stock is trading at 94.9x its Blended P/E, yet the future is relatively uncertain with the EV price war, lower-than-expected EV demand and the “Robotaxi” event on tap, which can go either way.

Based on the FactSet data, analysts are forecasting a mixed EPS growth outlook:

- 2024: $2.28E, -27% YoY growth

- 2025: $3.20E, 40% YoY growth

- 2026: $4.27E, 33% YoY growth.

Perhaps for some investors, the volatility is not a problem to stomach. Still, for my liking, the earnings are far too cyclical, with too many unknowns in the car industry, which is undergoing a massive transition from combustion engine cars to EVs, with the winners unclaimed yet.

Given the degree of uncertainty, if I were to buy Tesla’s stock today, I would require a significant margin of safety. I would look to buy the shares at around 25x its projected FY25 earnings, at no higher than $80/share.

As it stands, excessive optimism is baked into Tesla’s stock price, and it is no certainty that investors won’t face a capital wipe out if the company fails to deliver on its far-reaching tech promises.

Given the uncertainty, I continuously rate Tesla’s stock as “Hold,” even though a “Sell” rating would be warranted. There is the upside catalyst if the company presents a revolutionary tech next month, which would undermine my thesis.

Investor’s Takeaway

In summary, Tesla is facing stiff competition from other carmakers, not only domestic but Chinese.

While market share erosion is expected for a pioneering company, Tesla’s massive price reductions are threatening its profitability and souring investors.

Elon Musk is now taunting Robotaxi as the company’s next major growth driver. However, I advise caution as the excessive optimism appears to be baked into the stock price, leaving investors exposed to capital destruction if the company fails to deliver on its promises.

Putting a fair valuation on such a volatile stock as Tesla’s is a daunting task. However, I would not buy Tesla, Inc. stock higher than $80/share. The high degree of uncertainty amidst the EV price war and weakened EV demand requires a high degree of margin of safety, which the stock does not offer.

As an investor, I look at the underlying data rather than future promises. Hence, I continue to rate the stock as “Hold.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.