Summary:

- Consumer sentiment towards Consumer Defensive stocks is souring due to fears of GLP-1 anti-obesity therapies, but the impact has been negligible, so far.

- Coca-Cola has been growing and beating estimates for revenue and earnings.

- Coca-Cola’s debt has decreased under the current CEO, and revenue and earnings per share are increasing. The dividend yield is attractive. The company is a Buy.

Justin Sullivan

Consumer Defensive stock prices face headwinds because of souring consumer sentiment about the sector. The opposing argument is that GLP-1 anti-obesity therapies are reducing demand and affecting results for the sector. But Coke’s main competitor, PepsiCo (PEP), reported excellent results, and in the third quarter earnings call transcript, the CEO stated the impact has been negligible. Although this may change in the long term, it has not yet caused a headwind for now.

Still, investor fears of GLP-1 drugs and inflation are causing them to sell Coca-Cola. It’s down slightly more than 14% year-to-date. However, the company has been growing the top and bottom lines, beating estimates in the second quarter on strong organic growth and greater market share. I expect the momentum to continue in the near term. Moreover, the yield is attractive, and dividend safety is acceptable. I view Coca-Cola as a long-term buy.

Coca-Cola’s Moat Still Exists

One of the attractive characteristics of Coca-Cola is its wide moat. I initially identified the competitive advantages resulting from the moat in 2020 during the COVID-19 pandemic. Despite the severe pressure of bar, restaurant, arena, theater, etc., closures, the company was still profitable. Also, importantly, it did not cut or suspend the dividend. The moat comes from its brand leadership, spending to maintain it, and an effective duopoly with PepsiCo. Even the addition of a third large competitor, Keurig Dr Pepper (KDP), did not significantly affect the moat. Today, Coca-Cola’s scale, global distribution, and other strengths still make it attractive for dividend growth investors.

GLP-1 Drug Fears Are Overblown for Now

Ozempic and Wegovy are GLP-1 class drugs from Novo Nordisk (NVO). Studies show they help suppress appetite, stabilize blood sugar levels, slow digestion, and thus promote weight loss in people with Type 2 diabetes or obesity. The success of the drugs has resulted in excellent results for Novo Nordisk and, in turn, raised the market capitalization to nearly $500 billion.

However, the drugs need a prescription and must be injected weekly. Also, studies have reported side effects like gastrointestinal disorders, gallbladder-related disorders, and, in rare instances, pancreatitis. They also now include an FDA warning about intestinal blockage. Further, they are expensive at about $935 per pen, meaning one year’s cost will run into thousands to tens of thousands of dollars. These factors may limit use over time.

That said, investors still fear the success of the GLP-1 therapies may lower demand for snacking products and carbonated soft drinks [CSDs]. However, earnings results do not show a substantial change in the results of Consumer Defense stocks. Ozempic was approved by the FDA in 2017 and Wegovy four years later, sufficient time to see an impact on the stocks.

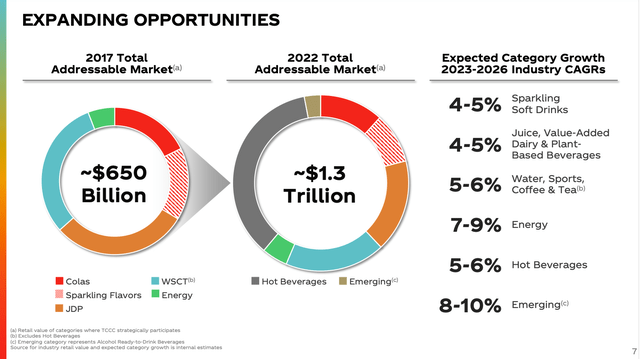

Although GLP-1 drugs may influence results in the long term, Coca-Cola sells more than drinks with sugar. It is a market leader in energy drinks, water, coffee, juices, and other categories. It has 26 brands with at least a billion dollars in sales and the number one share position globally. Consumers may reduce drinking some brands but will switch to another produced by Coca-Cola. Hence, my view is that fears about GLP-1 therapies are overblown for now.

Debt and Leverage Are Lower

In the past, one concern we discussed about Coca-Cola has been the net debt and leverage. The company used it to buy back shares and grow its dividend. Consequently, net debt ballooned, and the leverage ratio reached nearly 3X. At the end of 2020, total and net debt were $44,420 million and $33,506 million, respectively. Simultaneously, the leverage ratio was 2.82X, and interest coverage was too low at roughly 7X.

However, under the current CEO, net debt has come down because of higher cash balances and pay down of borrowings. For instance, at the end of 2020, total cash, equivalents, and marketable securities were $10,914 million, and net debt was $33,506 million. However, now, total cash, cash equivalents, and marketable securities are currently $15,694 million, and net debt is $27,501 million.

As a result, the leverage ratio is now 1.94X in the last twelve months [LTM], and interest coverage has reached 10.1X. Furthermore, operational cash flow is $11.1 billion in LTM, enough to continue deleveraging.

The firm is generating about $9.5 billion in free cash flow, sufficient to pay for the dividend, stock repurchases, and still pay down debt. We expect debt to trend lower each year.

Revenue and Earnings Are Increasing

Coca-Cola’s revenue and earnings per share are increasing. In fact, since the first quarter of 2021, the company has consistently beaten estimates. Important metrics are growing at a mid-single digit to low teens rate. On average, in the past five years, organic revenue growth has risen 7% annually, EPS has climbed 6% each year, and free cash flow has increased 14% annually.

A key component has been price increases when volumes are flat. The firm has also expanded by acquiring new brands like Body Armor to grow in the energy drink category, Costa to add a coffee brand, alcoholic beverages, and fairlife for value-added dairy. In addition, the strategic partnership with Monster has grown. Moreover, diversification and emphasis on other categories besides sparkling sodas let Coca-Cola overcome concerns about limited growth and health trends we previously discussed.

I expect the top and bottom lines to climb further. Despite inflation and, thus, higher pricing, the consumer continues to spend at restaurants, sporting events, concerts, etc., where Coca-Cola has an entrenched presence.

The Dividend Metrics Are Attractive

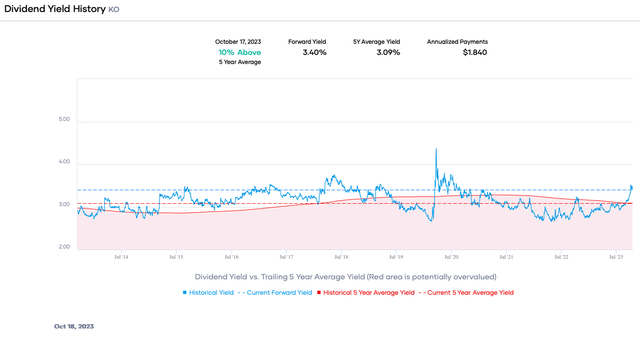

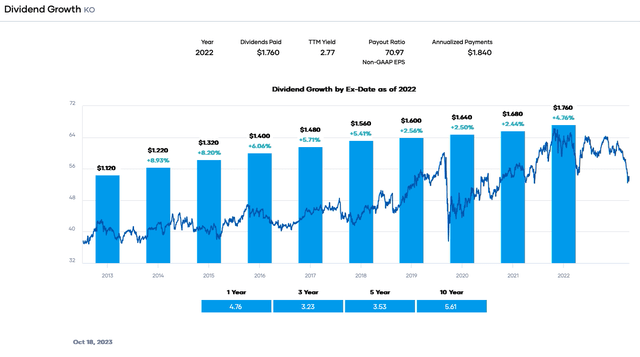

The falling share price has pushed dividend yield to around 3.5%, a value that usually signifies a good buying point. In fact, the stock rarely yields more than this value and has only once been over 4% during the COVID-19 pandemic bear market in the past decade. At that time, I wrote about Coca-Cola and its competitive advantages, permitting it to pay a growing dividend. Today, the firm’s advantages still exist, and the dividend is still increasing. The forward dividend yield exceeds the 5-year average of ~3.1%. It is also more than double the S&P 500 Index’s average dividend yield.

Coca-Cola is also a famous dividend growth stock with 61 consecutive years of increases, making it one of the 42 Dividend Kings. The growth rate is typically in the low-to-mid single digits.

The dividend is supported by a 69% earnings payout ratio, which is a little high. However, the dividend-to-FCF ratio is better at 62% in the trailing twelve months. Portfolio Insight’s dividend quality grade, a measure of earnings performance, revenue performance, dividend performance, profitability, and financial strength is a B+. This value means it is in the 80th percentile. The credit rating is also an A+/A1 upper medium investment grade credit rating.

The yield, expected future growth, and safety make Coca-Cola attractive.

Valuation

The share price has declined about 14% year-to-date and almost 4% in the past year. Simultaneously, the price-to-earnings (P/E) ratio has fallen to 20.5X, below the five- and ten-year ranges. The lower valuation is primarily because of fears about GLP-1 drugs and inflation affecting consumers.

The consensus estimate for earnings per share is $2.63 in fiscal 2023. We will use 24X as the fair value multiple near the mid-point of the 10-year range and account for near-term difficulties, like higher interest rates. Thus, our fair value estimate is $63.12. The present share price is ~$54.35, implying Coca-Cola is undervalued.

Applying a sensitivity calculation using P/E ratios between 23X and 25X, we obtain a fair value range from $60.49 to $65.75. Hence, the stock price is approximately 83% to 89% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

23 |

24 |

25 |

|

|

Estimated Value |

$60.49 |

$63.12 |

$65.75 |

|

% of Estimated Value at Current Stock Price |

89% |

88% |

83% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value estimate of $62.50 per share. The Gordon Growth Model [GGM] provides a fair value of $61.33, assuming a discount rate of 9% and a conservative annual dividend growth rate of 6%.

The three-model average is ~$62.32, indicating that Coca-Cola is undervalued at the current price.

Final Thoughts

It’s tough to go wrong with Coca-Cola. At the proper valuation, the equity will probably generate consistent total returns for investors. People have previously argued negatively about the company, but it continues to grow and return cash to shareholders despite challenges related to COVID-19, more competition, and health trends. The company was last a buy more than three years ago during the pandemic bear market. Today, the company is undervalued, and the dividend metrics are solid. I view the stock as a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO, PEP, KDP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.