Summary:

- Palantir’s revenue growth and profitability are improving, with potential inclusion in the S&P 500 Index on the horizon.

- The company’s unique AI solutions and boot camp sales model are driving customer growth and revenue expansion.

- Despite improving fundamentals, the company’s rapid rise after its second quarter earnings makes valuation a significant concern.

JHVEPhoto

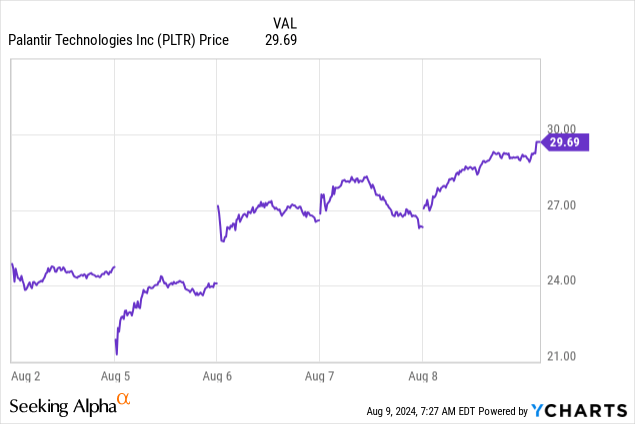

My last article on Palantir Technologies (PLTR) discussed its rebounding revenue growth, improving GAAP net income profitability, opportunities in AI, a new commercial sales model, and potential inclusion into the S&P 500 Index (SPX). After the company reported its second quarter 2024 earnings on August 5, 2024, all those talking points remain reasons to buy the stock.

The S&P 500 left the company out of the index when it rebalanced in June. Still, it’s only a matter of time before it includes Palantir, which should boost the stock price. The company’s second-quarter 2024 report showed revenue growth continuing its trek upwards and expanding margins. The company beat analysts’ revenue and earnings estimates. It also raised guidance for the third quarter and full year 2024 guidance on the back of its new bootcamp sales model for its Artificial Intelligence (“AI”) platform. Investors, pleased with the company’s progress, bid the stock up 10% on August 6, the day after earnings. As I write this on August 8, the stock is up to $29.28.

However, the market has become well aware of all of the company’s positives and pushed the company’s valuation to levels that may be unsustainable. By almost all valuation methods, Palantir will look overvalued. When I first started writing this article the day after earnings, I intended on rating the stock a buy for aggressive growth investors only. However, the stock has moved much higher in the days after earnings into valuations that I believe are stretched.

This article will discuss the AI problem that Palantir solves, the history and importance of its commercial business, and the company’s fundamentals. It will also review a few risks, the valuation, and reasons I now recommend a hold.

The problem that Palantir solves

Palantir’s Chief Revenue Officer (“CRO”) Ryan Taylor said the following on the company’s second quarter 2024 earnings call:

As noted by Sequoia, the revenue expectations from the AI ecosystem’s infrastructure build-out have grown from $200 billion to $600 billion per year in just nine months. The world is struggling with this huge problem. There’s a great bottleneck between prototype and production. The world has also come to understand what we’ve been saying all along. The standard playbook does not and will not work. It cannot solve this problem. While many companies can build prototypes, the leap from prototype to production is substantial. Palantir has made that leap. Our focus is on deploying enterprise AI in production, solving meaningful problems for our customers.

When Taylor mentions Sequoia, he is referring to a blog by David Cahn on that company’s website that discusses the growing gap between investments in AI infrastructure, such as GPUs, and the revenue generated by AI applications and services. In other words, David Cahn believes an AI infrastructure bubble has formed. Palantir’s management thinks the growing gap stems from many companies’ development teams building AI use cases in research labs that cannot perform tasks, make decisions, or provide insights good enough in a real-world setting to create value for customers.

Visionaries like Palantir Chief Executive Officer (“CEO”) Alex Karp thinks his company’s history of solving complex problems for the U.S. government gives it a leg up on creating AI applications that provide measurable value to its enterprise customers. Suppose Palantir’s applications deliver significant value to customers; it may be the best positioned to capitalize on the $600 billion and growing gap between money invested in the AI infrastructure build-out and putting value-creating custom AI applications into production for enterprises.

The importance of its commercial business

The company has come a long way in just one year. When the company reported second-quarter 2023 earnings, total revenue had dropped to 13% year-over-year. Even more worrying, in the second quarter of 2023, U.S. commercial revenue dropped to 20% year-over-year, down from the second quarter of 2022’s revenue growth of 120%. The company was out of favor with the market in 2023 as investors worried about its sales model not bringing in enough commercial customers. A big part of Palantir’s investing thesis is that the company is reducing its reliance on government contracts by diversifying into commercial space. Although government contracts have been a significant revenue driver for the company since its inception, they are a more unstable source of income than commercial due to the timing of government budgetary decisions and politics heavily influencing when and what company wins a contract, so investors tend to award government contractors lower valuations.

The market’s reasons to worry in 2023 were valid. Palantir started as a government contractor in 2003 and began operating commercially in 2009 when it controversially engaged its first client, JPMorgan Chase (JPM). Its commercial business rapidly became its fastest-growing and largest segment until around 2019, when the government segment retook the lead as the fastest and largest-growing portion of the business. The company has been trying since 2019 to reestablish the commercial business as the largest portion of the business. One of the first difficulties was that Palantir only had 34 commercial customers in the second quarter of 2021. Part of the problem may have been CEO Alex Karp’s belief in the earlier part of the company’s history that its software was so good that it sold itself and the company didn’t need a sales force. Bloomberg published an article in 2019 that stated:

For Karp, it was a point of pride that the tech was good enough to sell itself. Karp once said publicly the only way he’d hire a sales team was if investors forced him to, or if he was “hit by a bus.” As recently as 2017 he told CNBC, “Almost everyone here is an engineer. I’m a PhD in philosophy,” and “We have no salespeople.”

Although the philosophy of no salespeople may have worked well when selling to the government, it caused a situation where the company only had 34 customers after over ten years of operating commercially. The company started aggressively growing its sales team around 2019, and by the second quarter of 2022, it had 119 customers. Still, when commercial revenue growth declined in 2023, investors became concerned with its sales model that allowed customers to test its products for a free 30-day trial period. This sales strategy took significant time and resources to acquire customers.

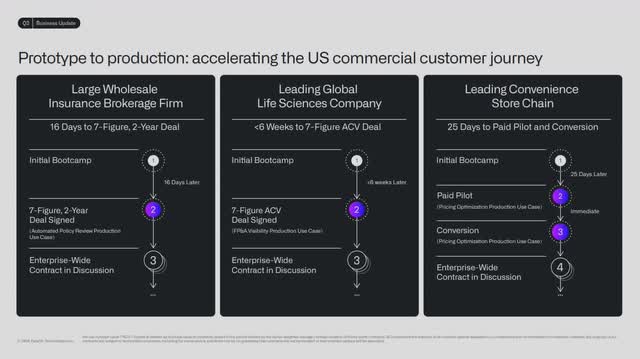

Palantir would likely still have sales issues for its solutions without the rising popularity of generative AI and if it had not developed a unique way to sell its AI solutions through its AIP (Artificial Intelligence Platform) boot camp. I discussed the AIP boot camp in my February 9, 2024 article on Palantir. Deals that used to take several months or even a year for its sales team to close are now only taking weeks.

Palantir Second Quarter 2024 Earnings Presentation.

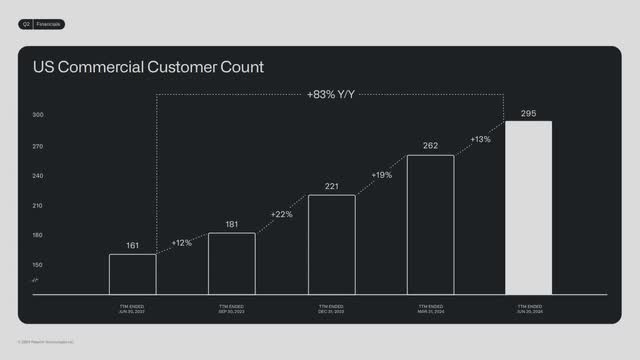

The market no longer worries about Palantir’s sales model. Its second-quarter 2024 U.S. commercial customer count rose 83% over the previous year’s comparable quarter and 13% sequentially to 295 customers. Its second-quarter global commercial customer count grew 55% over the previous year’s comparable quarter to 467.

Palantir Second Quarter 2024 Earnings Presentation.

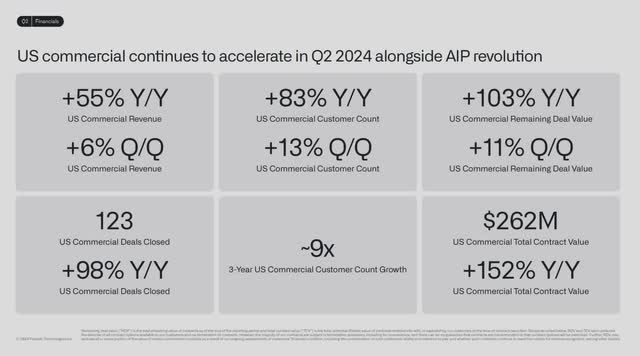

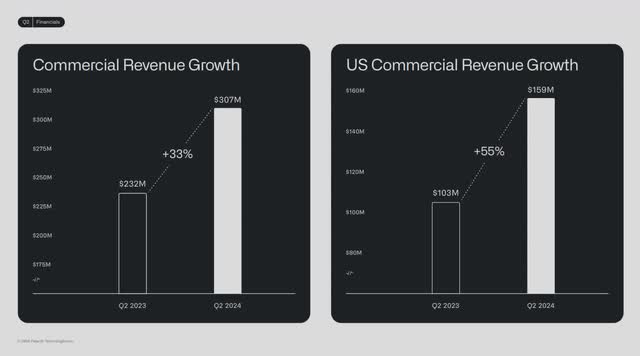

Is that customer growth translating into increased revenue? The market went into the second quarter 2024 earnings report wanting to see the company’s U.S. commercial revenue grow by at least 45%, and investors got what they hoped for.

Palantir Second Quarter 2024 Earnings Presentation.

The following chart shows the company produced second-quarter 2024 U.S. commercial revenue of $159 million. Commercial Revenue (which includes international) grew 33% year-over-year to $307 million.

Palantir Second Quarter 2024 Earnings Presentation.

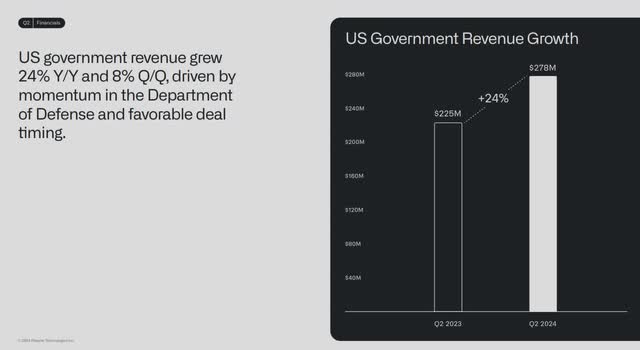

The following chart shows that in the second quarter of 2024, U.S. government revenue grew 24% year over year to $278 million. Note that the company is now growing commercial revenue faster than government revenue—exactly what the market wants to see.

Palantir Second Quarter 2024 Earnings Presentation.

Let’s look at the second quarter 2024 consolidated results.

Company fundamentals

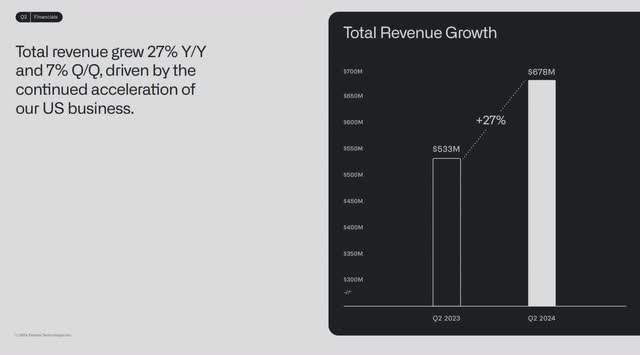

This year, the company produced revenue growth of 27% year-over-year to $678 million.

Palantir Second Quarter 2024 Earnings Presentation.

Palantir ended the second quarter of 2024 with $1.4 billion in remaining performance obligations (“RPO”), up 41% over the previous year’s comparable quarter and 5% quarter-over-quarter. In its second quarter 2024 earnings release, the company defines RPO as “the total values of contracts that have been entered into with, or awarded by, our customers, and represent non-cancelable contracted revenue that has not yet been recognized, which includes deferred revenue and, in certain instances, amounts that will be invoiced.” RPO is growing faster than total revenue, which means the company is successfully signing new contracts and expanding its customer base. Investors also tend to award a company a higher valuation when they see RPO growing faster than revenue.

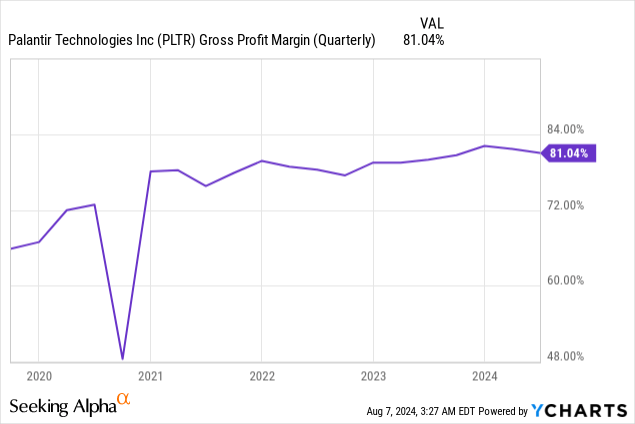

Palantir produced GAAP (Generally Accepted Accounting Principles) gross margins of 81%. Non-GAAP adjusted gross margins, which exclude stock-based compensation (“SBC”), were 83%.

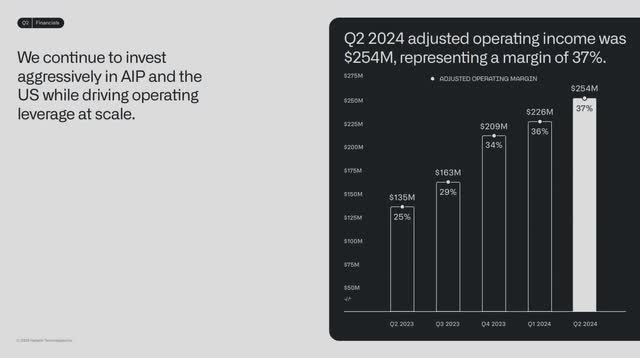

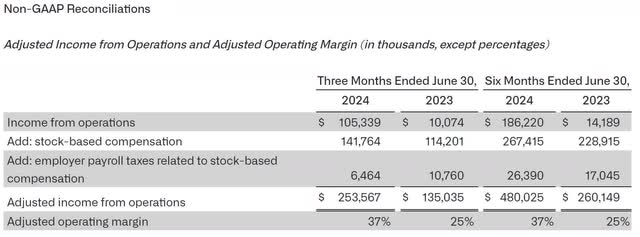

The company’s second-quarter 2024 investor presentation emphasizes non-GAAP adjusted operating income and margin of 25.4 million and 37%, respectively.

Palantir Second Quarter 2024 Earnings Presentation.

The following table shows the reconciliation between operating and adjusted income, adding back SBC-related expenses. Palantir had a whopping 20.91% of SBC as a percentage of revenue in the second quarter. In comparison, Microsoft’s (MSFT) current SBC-to-revenue is 4.17% and Alphabet’s (GOOGL)(GOOG) is 6.92%.

Palantir Second Quarter 2024 Earnings Release.

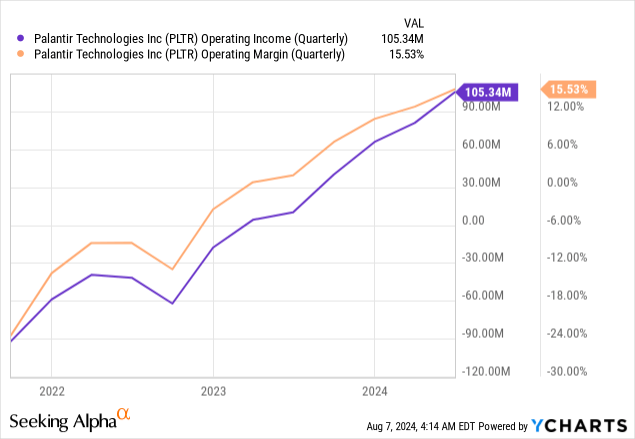

The following shows Palantir’s GAAP operating income and margin. It was the company’s sixth consecutive quarter of positive GAAP operating income and fifth straight quarter of increasing GAAP operating margin.

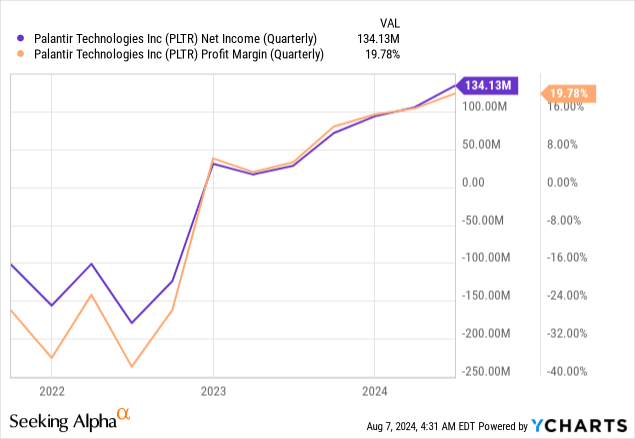

The company produced its seventh successive quarter of positive GAAP net income, reaching $134 million in the second quarter at a 19.8% profit margin.

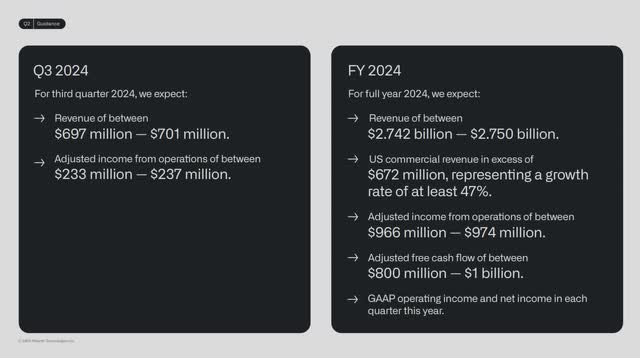

Diluted earnings-per-share (“EPS”) was $0.06, beating analysts’ expectations by $0.03. The following image shows the company’s guidance for the third quarter and the full year of 2024. The company’s third-quarter revenue guidance of $697 to $701 million was above the $679.1 million analysts had forecast before the company released its second-quarter report. Management also raised its full-year guidance from $2.677 – $2.689 billion to $2.742 – $2.750 billion. This new guidance exceeded the $2.7 billion analysts expected before the second quarter report.

Palantir Second Quarter 2024 Earnings Presentation.

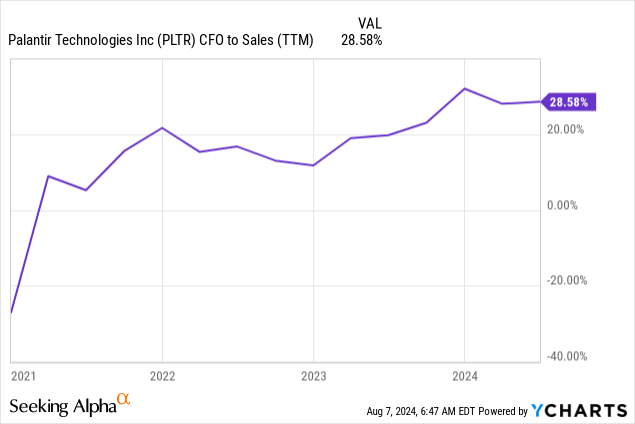

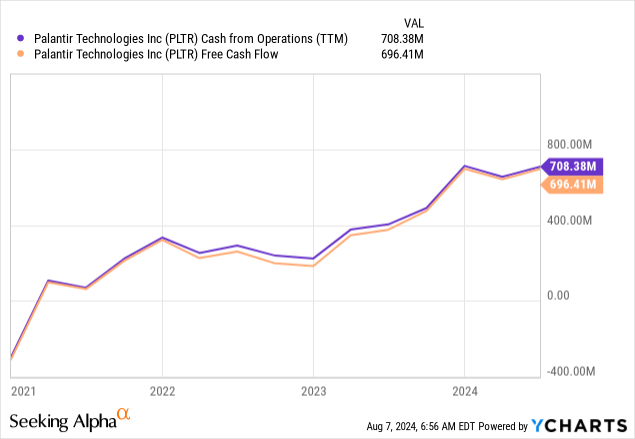

Palantir’s cash from operations (“CFO”) to sales ratio is 28.58%, meaning that it converts every dollar of sales into $0.29 of cash. This number should continue to rise as its margins increase.

In the second quarter, the company generated $708 million in trailing 12-month (“TTM”) CFO and $694 million in TTM FCF.

The company ended the second quarter with approximately $4 billion in cash and short-term investments. It had no long-term debt. Palantir has a quick ratio of 5.92, meaning it has plenty of available cash to pay its short-term obligations.

Risks

One significant risk with this company is its controversial past and close ties to the U.S. intelligence community. Some companies may be reluctant to use the company’s solutions because of some of its history. For instance, when I mentioned in this article that JPMorgan was Palantir’s first commercial customer, I left out how JPMorgan allegedly used Palantir’s software to monitor the digital activities of its employees. It became a scandal when the JPMorgan security chief used Palantir’s products to allegedly spy on his company’s highest executives.

This company may also offend some people’s sensibilities. CEO Alex Karp has supported some countries with operations that some may disagree with, which has caused some employees to become upset and leave the company in the past. A massive risk with this company is that it could get caught up in an operation where some government or private company commits some publicly condemned action, and Palantir’s software enabled the event. The bad publicity may have negative repercussions for the business and stock price.

An investment in this company also involves a belief that CEO Alex Karp is correct that his company can produce AI production software better than competitors. Although he is a brilliant man, Karp’s assessments have not always been correct in the long term. His view that Palantir didn’t need a sales team was incorrect and his ill-advised $400 million investment in SPACs (Special Purpose Acquisition Companies) in 2021 ended in losses.

An additional risk is the price of its products. One potential reason that Palantir has had trouble attracting commercial customers in the past is that its products are costly. Some companies in the market may do similar things to Palantir but with lower pricing. Management must continue to innovate and provide superior solutions, or it could lose its ability to charge customers premium prices.

Valuation

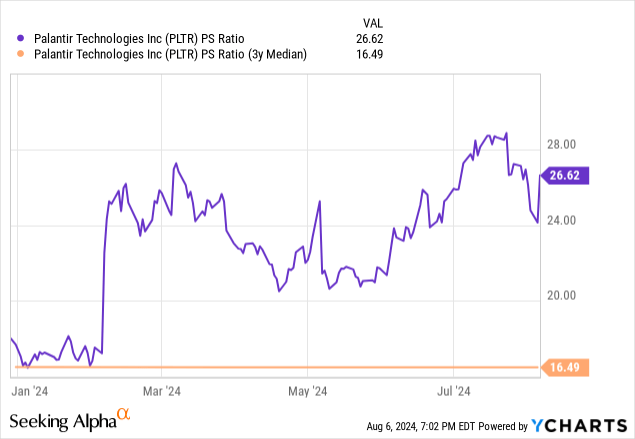

Most valuation metrics suggest the market overvalues Palantir. Seeking Alpha Quant rates the stock’s valuation as an F. Its price-to-sales (P/S) ratio is 26.62, well above its three-year median of 16.49, suggesting overvaluation. If the stock traded at its three-year median, the stock price would be $17.31, around 41% below the August 8 closing price.

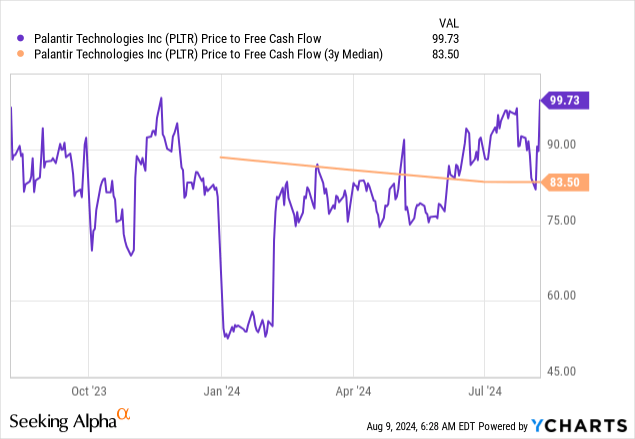

The company has a price-to-FCF of 99.73, well above its three-year median of 83.50. If the stock traded at its median, the price would be $25.05, down around 14% from the August 8 closing price. According to the chart below, the best time to buy Palantir was at the beginning of 2024.

Another way to determine a company’s valuation is by comparing its forward price-to-earnings and analysts’ EPS estimates in a given fiscal year. A company’s forward P/E exceeding its EPS estimate signals overvaluation. Alternatively, if a company’s forward P/E is lower than its EPS estimate, it possibly signals undervaluation. According to these rules, the market overvalues Palantir’s EPS estimates for the next five fiscal years. Suppose the company forward P/E trades at its 2025 EPS growth rate of 20.29%, the stock price would be $8.52.

Let’s examine Palantir’s reverse discounted cash flow analysis.

Reverse DCF

|

FCF (Trailing 12 months) margin |

28% |

|

The second quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$696 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 30% |

| Current Stock Price (August 9, 2024) | $29.28 |

| Terminal FCF value | $9.787 billion |

| Discounted Terminal Value | $47.166 billion |

One analyst expects revenue to grow at a compound annual growth rate of 22.62% over the next five years to $6.1 billion. If Palantir’s FCF margin remains at 28%, the company’s projected revenue growth rate is not enough to achieve an FCF growth rate of 27% over the next ten years. However, the company reached an FCF margin of 31% last year. How much higher can the FCF margin go? Let’s compare Palantir to several mature companies. Two of the companies below are mature, primarily software companies. The other is Broadcom (AVGO), which is a fabless chip manufacturer that has a huge software component. Since fabless chip manufacturers rely on intellectual property as a prime asset, have high margins and low capital expenditures (“CapEx”) similar to a software company, I have included it in the following comparison. First, let’s compare these companies’ FCF margins.

| Company name | Current FCF margin | Median FCF margin over past ten years |

| Broadcom | 43% | 40% |

| Palo Alto Networks (PANW) | 38.5% | 33.5% |

| Microsoft | 30% | 30% |

| Palantir | 28% | —————————— |

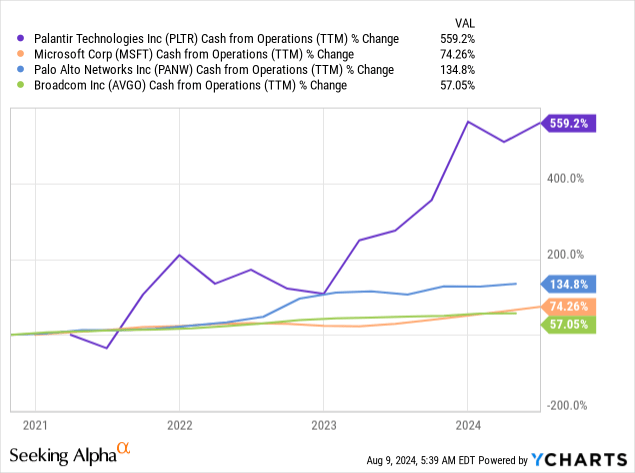

Let’s compare each company’s CFO. Palantir is growing its CFO at a much higher rate than the other companies.

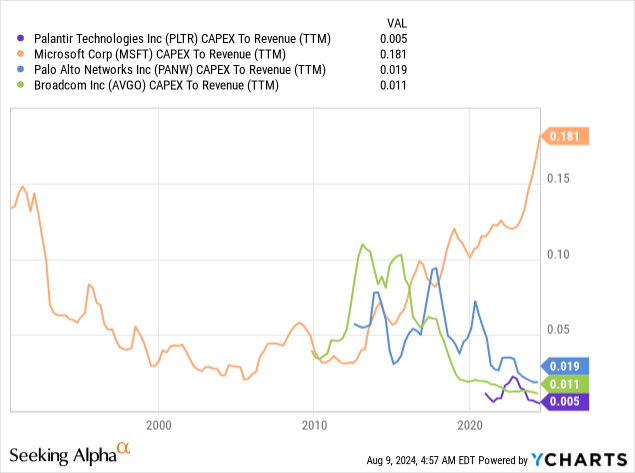

Next, let’s compare each company’s CapEx-to-revenue. According to the following chart, Palantir has the lowest CapEx-to-revenue, meaning that it converts a higher percentage of its CFO into FCF.

If Palantir’s AI business continues to grow at the same trajectory and management can maintain a strong spending discipline, the company is due to grow FCF rapidly over the next several years. Although each of these comparison companies are in different businesses, they are ideal for getting a ballpark figure of the average FCF margin that Palantir might average over the next ten years. It can probably average an FCF margin at least as high as Broadcom’s median FCF margin over the last ten years.

Suppose Palantir’s FCF margin averages 40% over the next ten years; Palantir would need to grow revenue annually at 24.7% over the next ten years to justify the stock’s price on August 8, 2024. I believe the company will have challenges achieving those revenue growth rates and maintaining a 40% FCF margin, considering that it’s likely that other companies like Google and Microsoft will catch up to Palantir over the next ten years and compete on price.

Reasons Palantir is a Hold

Investors should avoid buying Palantir at the current stock price because it’s an aggressive and risky bet that the company will benefit so much from the proliferation of AI that it can grow revenue around 25% annually at an FCF margin of 40% over the next ten years. Although positive sentiment may drive the stock price higher in the short term, the downside risk is growing. If the company’s revenue, FCF, or EPS growth rates miss analyst estimates in the slightest or sentiment turns against it, the stock will likely drop substantially. I change my recommendation a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.