Summary:

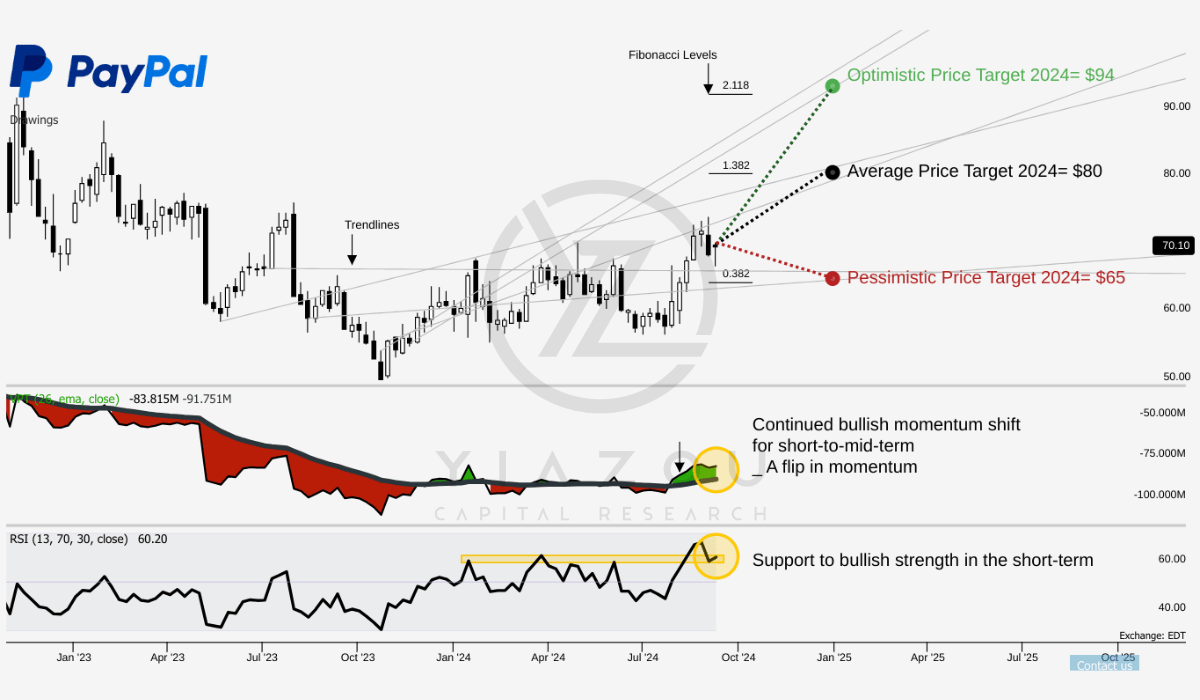

- PYPL is projected to reach $80 in 2024, with a potential upside to $94 if momentum sustains.

- PayPal’s TPV grew by 11%, reaching $417 billion, reflecting strong growth across domestic and international markets.

- Transaction margin dollars rose 8% year-over-year, marking the best performance since 2021 due to product improvements.

- RSI at 60.55 suggests a neutral-to-bullish outlook, improving momentum and easing selling pressure.

- PayPal’s partnership with Shopify enhances growth prospects by tapping into a vast merchant network in U.S. e-commerce.

da-kuk/E+ via Getty Images

Investment Thesis

Our medium-term target price of $90 per share for PayPal Holdings, Inc. (NASDAQ:PYPL), based on our earlier DCF valuation, remains intact. Last month, we demonstrated how the technicals aligned with the fundamentals, and we now see this trend continuing and strengthening our thesis. The improving momentum, reduced selling pressure, and increasing buying activity reinforce a positive outlook.

Further supporting our thesis, PayPal’s recent growth in Total Payment Volume (TPV) highlights its expanding market share across domestic and international markets. Transaction margins have also improved, driven by key products like Braintree and Branded Checkout. Finally, the strategic partnership with Shopify Inc. (SHOP) offers significant potential for further growth through increased transaction volumes across a large merchant base.

PayPal Stock’s Price Path To $80 In 2024

PYPL hovers around $70, while the consensus price target 2024 is $80, matching the 1.382 Fibonacci level. That would represent a moderate growth outlook whereby the stock can rebound with support from the short-term price projections. The optimistic target of $94 corresponds to a more aggressive 2.118 Fibonacci extension level, hence indicating that there may be substantial gains if the market conditions remain bullish. This contrasts the pessimistic target at $65, representing a bearish development pegged at 0.382 in the Fibonacci level.

Also, the RSI of 60.55 shows a neutral to moderately bullish position. Neither bullish nor bearish divergence occurs, but an upward slope of the RSI indicates improving momentum, which can continue and support positive price action. It is also supported by the trend line of VPT, which reversed upward from its low of -83.78 million to its moving average of -91.75 million. This upward shift reflects the possibility of letting off the selling pressure while the buying is gathering strength.

Yiazou (All-in-One Market Research & Trading Software)

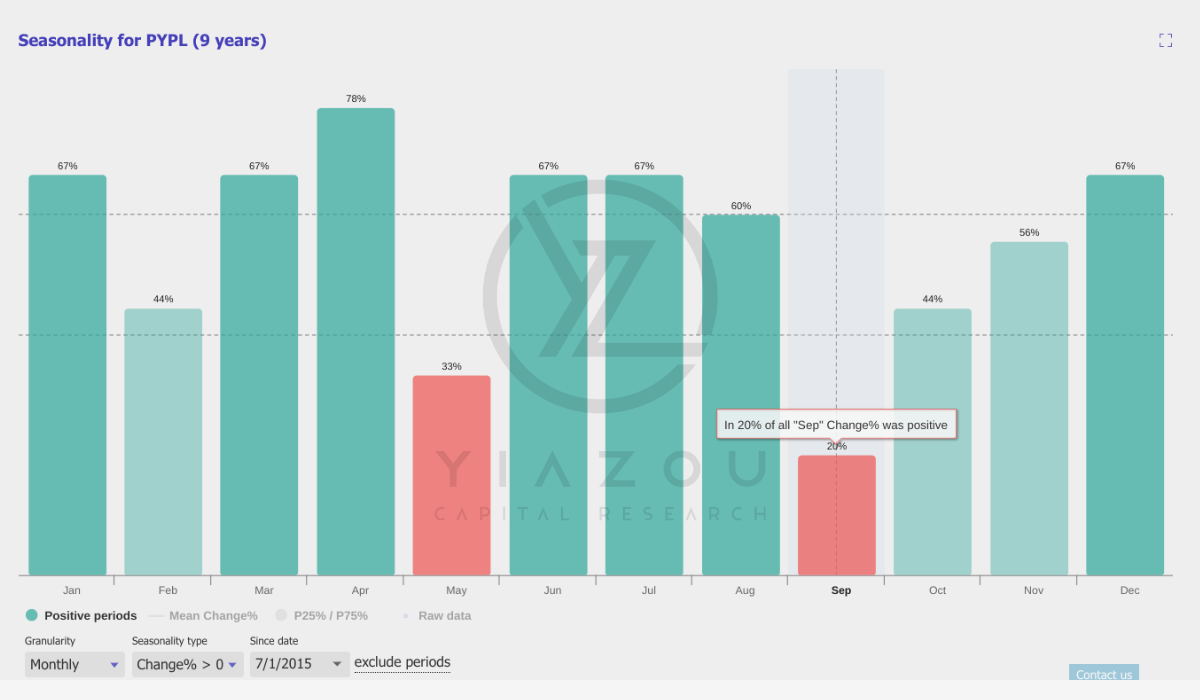

Finally, PYPL showed a historically weak performance in September, with only a 20% chance of achieving positive returns based on a 9-year historical trend. This September data indicates a relatively low probability for investment gains, making it a more cautious period for potential investors in PayPal, signaling an accumulation period.

Yiazou (All-in-One Market Research & Trading Software)

TPV Soars 11% Amidst Boost in Transaction Activity And Record-Breaking Transaction Margins

Recently, PayPal’s TPV increased by 11% on both spot and currency-neutral bases to hit $417 billion (Q2 2024). This growth is evenly distributed between domestic and international markets as the US and international TPV grow simultaneously.

This growth in TPV points to PayPal’s expanding market share and the increasing adoption of its payment solutions. Over the midterm, TPV is stable compared to Q2 2023. However, the growth is still underperforming in the short term compared to the previous three quarters.

Transaction margin dollars reflect the profitability of PayPal’s payment processing activities, which have increased by 8% year over year (YoY). This is PayPal’s best transaction margin dollar performance since 2021, resulting from improved transaction margin performance and enhanced product offerings. Currently, the company focuses on optimizing transaction loss performance and reducing transaction expenses. Similarly, the success of products such as Braintree and Branded Checkout also contributed positively to transaction margin growth.

Furthermore, Branded Checkout volumes grew by 6% on a currency-neutral basis in Q2 2024, which was consistent with the performance in Q1. PayPal’s core payment processing operations are stable based on its focus on enhancing Branded Checkout for large enterprise platforms and international markets. Hence, Braintree returned to meaningful contribution to transaction margin dollar growth, a significant performance milestone.

Braintree had struggled to make a positive impact for over two years, and based on the trend, it may derive profitable growth. Similarly, Venmo processed more than $73 billion in TPV during Q2. The YoY growth in Venmo TPV has stabilized at 8% YoY for the last 4 quarters. Here, monthly active users of Venmo increased by 5% YoY to ~62 million based on the solid base of peer-to-peer users and the adoption of Venmo’s ecosystem of products.

For instance, adopting the Venmo debit card and Pay with Venmo grew 30% YoY. Moving forward, the launch of push provisioning for the Venmo debit card to Apple and Google wallets with Venmo Teen Accounts may bring growth and engagement.

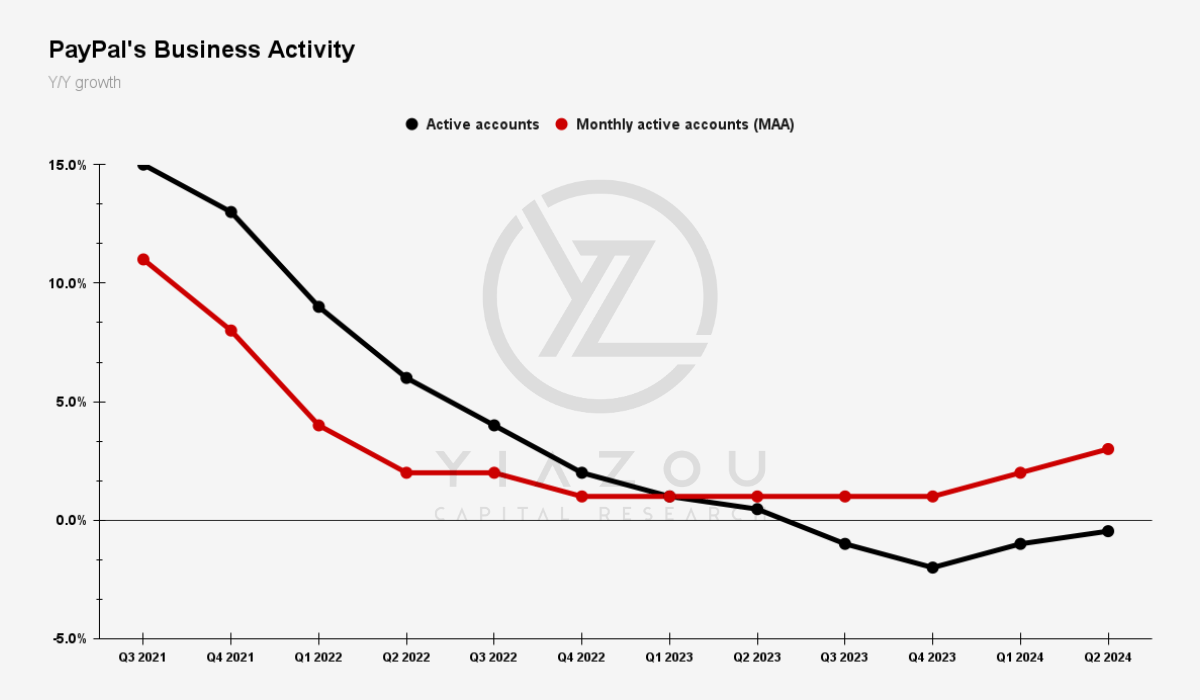

Moreover, PayPal ended Q2 2024 with 429 million total active accounts and 222 million monthly active accounts. The increase of nearly 2 million total active accounts from the first quarter points to the company’s progressive customer acquisition efforts and growing market presence.

Lastly, monthly active accounts (MAA) grew by 3% YoY, driven by both PayPal consumer accounts and Venmo. The number of transactions per active account also showed a positive trend, with a trailing 12-month number of 60.9, representing an 11% increase. Excluding PSP processing, transactions per active account grew by 6%, pointing to the growing engagement of PayPal’s user base and the effectiveness of its efforts to drive frequent usage of its platform.

Over the long term, the growth in Active accounts and MAA was not strong compared to Q3 and Q4 2021 (over 10%), but in the short term, it has been accelerating since Q4 2023 (a positive forward trend).

yiazou.com

PayPal to Power a Portion of Shopify Payments in the US

PayPal’s expansion of its strategic partnership with Shopify (SHOP) in the US e-commerce is vital for top-line and volume growth. PayPal may continue to leverage its robust payment infrastructure to service Shopify’s vast network of merchants.

PayPal can achieve this by being an additional provider for processing online credit and debit card transactions through Shopify Payments. Integrating PayPal wallet transactions within Shopify Payments may provide merchants with a unified platform for managing orders, payouts, reporting, and chargeback flows.

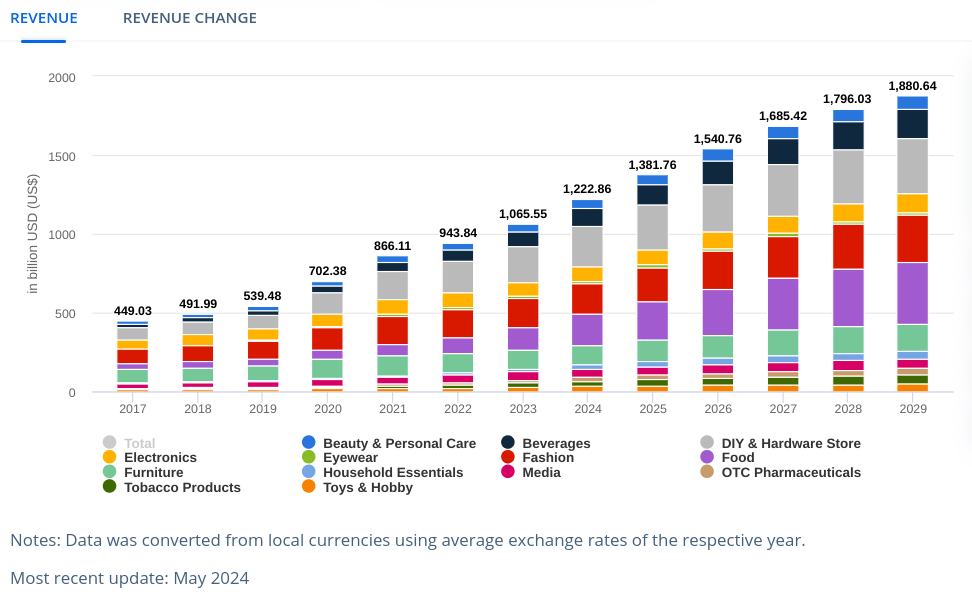

With a similar initiative in France, PayPal, and Shopify already did this in 2022. The growth trajectory from a national collaboration to a multi-regional partnership points to the increasing integration within PayPal’s infrastructure, scaling its services across geographies. For instance, Shopify has ~10% of all US e-commerce on the platform. At the macro level, US e-commerce sales hit $1.2 trillion in 2024 and may grow by 9% annually in the long term (2024-2029).

The Statistics Portal (US eCommerce) (statista.com)

Fundamentally, the strategic partnership offers two benefits: operational efficiency for Shopify merchants and a broader customer base for PayPal. The US digital payments processing market may hit over $4.5 trillion by 2028, with an annual growth rate of 11%. This means that PayPal’s integration within Shopify’s ecosystem could lead to billions of dollars in processed transactions annually.

In August 2024, around ~45% of US online shoppers used PayPal for at least one transaction. This integration may expand PayPal’s lead in the payment processing tech marketplace. By leveraging Shopify’s vast merchant base, PayPal may boost its top line and volumes through transaction fees and related services. Additionally, the partnership will provide PayPal an edge to cross-sell its other services (like working capital loans and business tools) to a growing number of merchants.

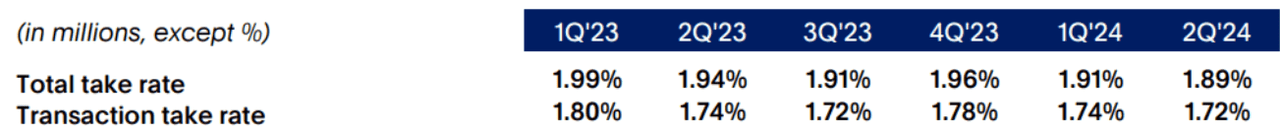

Downsides: Transaction Take Rate and Pricing Pressure

PayPal’s transaction take rate represents a declined percentage of transaction volume retained as revenue (-0.03% to 1.72% in Q2 2024). This decline follows a 0.05% drop in the previous quarter, indicating a consistent downward trend. A declining take rate indicates increased pressure on the company’s pricing strategy and overall revenue. The decline in the transaction take rate is based on the intensifying competitive environment in the payments industry.

PayPal’s competitors, like Wise, offer lower fees or more attractive terms to attract merchants and consumers, forcing it to adjust its pricing to remain competitive. Second, PayPal’s focus on large enterprise customers and lower-margin transactions contributes to the decrease in the take rate.

Additionally, PayPal’s business model shift towards higher volumes of lower-margin transactions, such as those processed through its branded checkout and Braintree services, is impacting the take rate. These segments contribute to overall transaction volume growth but yield lower fees than premium services. The result is a reduced average take rate across PayPal’s transaction portfolio.

PYPL 2Q-24 Earnings Presentation

Moreover, PayPal’s strategic emphasis on “price to value” and profitable growth might exacerbate pricing pressure. The company has made efforts to drive high-quality growth by attracting large enterprise clients, and expanding into new markets could inadvertently lead to lower average transaction fees.

As PayPal continues prioritizing profitable growth over volume expansion, it may face trade-offs between maintaining a high take rate, securing large clients, or entering new markets. The impact of these pricing strategies is reflected in the declining transaction margins and take rate. These bottom-line elements continue to impact the stock’s market valuations in the upcoming quarters.

Takeaway

PayPal’s recent performance highlights its expanding market share and increasing adoption of its payment solutions across domestic and international markets. Transaction margins are improving and are driven by key offerings like Braintree and Branded Checkout. Furthermore, its strategic partnership with Shopify opens up new growth opportunities, allowing PayPal to leverage a large merchant network to boost transaction volumes and enhance its top-line performance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.