Why Intel Stock Deserves A ‘Strong Buy’ Rating

Summary:

- Looking at the financials, it’s no wonder that investor skepticism about Intel’s AI efforts and slow data center recovery has further impacted the stock price performance in the recent past.

- However, I think Intel’s revenue growth in key segments like CCG and DCAI shows promising signs for future profitability.

- The company has ambitious goals for its foundry services, hoping to be the second-largest external foundry company by 2030; it has already secured large orders from Microsoft and others.

- The current EPS forecasts may be too pessimistic if Q1 marked the bottom of the cycle and management’s cost-cutting initiatives helped boost Intel’s margins already in Q2.

- Intel’s valuation calculations suggest a potential 40% higher price target than the current stock price, providing a significant margin of safety.

JHVEPhoto

My Thesis

I believe that considering Intel Corporation’s (NASDAQ:INTC) future prospective market position from its current CAPEX, the stock has very strong long-term growth potential, especially given its current depressed valuations compared to most other companies in the semiconductor industry. I initiate coverage of Intel stock today, believing that it deserves a “Strong Buy” rating.

My Reasoning

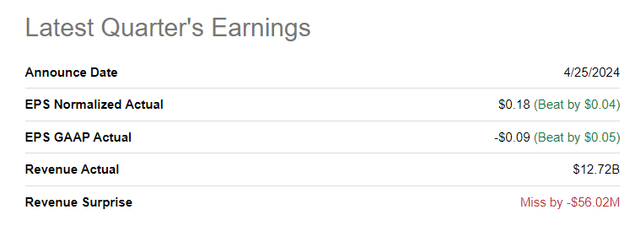

After Intel reported its Q1 2024 revenue of $12.7 billion, up 9% year-over-year but down 17% sequentially, it faced significant market pressure as the results missed the consensus estimate by 0.44%, according to Seeking Alpha. Another reason for the weakness was INTC’s losses in foundry operations, even though Intel’s non-GAAP profit was $0.18 per diluted share, compared to a loss of $0.04 the previous year (surpassing both management and consensus forecasts of ~$0.13).

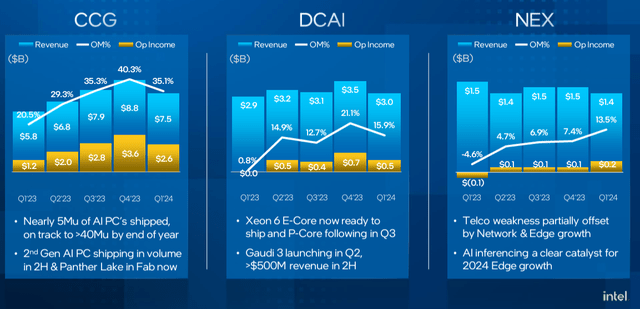

Diving deeper into the segment performance, we can see that Intel’s Client Computing Group (CCG) generated $7.5 billion in revenue, accounting for 59% of total revenue and marking a 31% YoY increase – this substantial growth is explained by the strength in desktop revenue (+31% YoY) and notebook revenue (+37% YoY). As a result, CCG’s EBIT surged by 124% year-over-year to $2.65 billion, which is a lot.

The Data Center and AI Group (DCAI), which is another important unit of the business (at ~24% of total sales), brought in sales of $3.0 billion, which is a modest 5% YoY expansion. However, it should be noted that DCAI recorded an operating profit of around $482 million, which was a big bounce back from the preceding year’s $22 million. What should be discouraging news for Intel bulls is the fact that INTC keeps losing its market share as its rivals like AMD together with ARM-based solutions gain market presence.

Intel’s Network and Edge (N&E) segment (~11% of total sales) brought in $1.36 billion in top-line, which is only 8% higher YoY. N&E’s profit was $184 million as opposed to a loss of $66 million last year; on the other hand, as I briefly mentioned above already, Intel Foundry Services (IFS) stayed in the red with deep losses, as its revenue was reduced by 10% YoY to $4.4 billion and so this led to a quarterly loss of $2.47 billion. Another chunk of bad news for Intel in Q1: in the “Other” category, which comprises Altera and Mobileye, revenues dropped by 46% YoY. The category’s profits were zero for all units, with Altera’s decreasing by 58% while those of Mobileye went down by 33%. In spite of these situations, Intel’s management noted that AI remains an important growth area for the company in the long run as it seeks future profitability and market leadership through new processor technologies and foundry services.

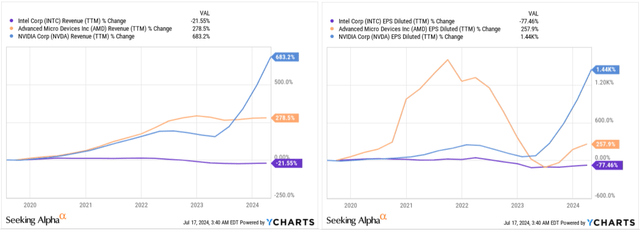

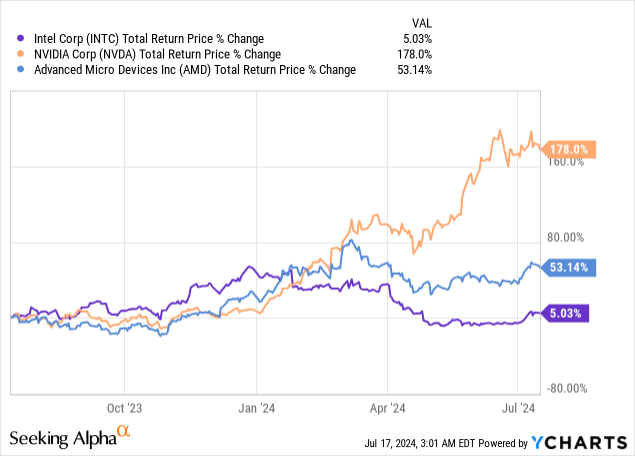

Looking at the financials, it’s no wonder that investor skepticism about Intel’s AI efforts and slow data center recovery further impacted the stock price performance in the recent past, widening the existing spread between the closest peers – Nvidia (NVDA) and Advanced Micro Devices (AMD):

Fundamentally speaking, with no great exposure in GPU, Intel stayed far behind in this race. Over the past five years, the company’s revenue has decreased by more than 1/5 and EPS has dropped by almost 77.5%. In contrast, the peers have managed to increase their EPS by hundreds or even thousands of percentage points:

But what changes do I expect, so that I’m giving Intel a “Strong Buy” rating today despite its underperformance?

First and foremost, I find the way in which data centers commenced to higher margins in recent quarters to be appealing. Amid better cost control, Intel’s DCAI’s top line is going to have a massive boost from its 5th-generation Xeon processors that include AI acceleration on every core, resulting in significant performance gains and cost savings over previous generations. We know that the Gaudi 3 AI Accelerator will be launched soon (assumingly Q3 2024), and it will seek to secure a bigger market share in AI and compete with known brands such as Nvidia and AMD. Based on that, Intel projects accelerated product sales of more than $500 million during H2 2024, with continued strength into 2025.

I’ve previously written in my article on Nvidia and other technology companies, that new technologies like AI and chips for it are subject to various investment cycles. The company that succeeds is the one that can maintain its market leadership and get a proper IRR from its current investments, as advancements in AI, chip development, and related fields are very capital-intensive. Therefore, access to cheap capital plays a significant role here, and as far as I can see today, this hasn’t been a challenge for Intel. The firm is making substantial investments in developing its $100 billion complex in Ohio and securing federal funding for that (at least for $25 billion). It’s clear that Intel receives strong support from the U.S. government like almost no other semiconductor industry players, as the U.S. is concerned about the West’s heavy reliance on the small South Asian region – Taiwan. Thus, the difficulty in obtaining capital, specifically for Intel, is not a significant obstacle to its development in the semiconductor market. So I believe that as the chips market becomes saturated, Intel is going to have more chances to emerge in areas that it hasn’t previously covered and also in areas where it’s currently lagging behind the “green” and “red” teams.

Northland Capital Markets analysts seem to agree with me. Yes, they decreased their EPS estimates for INTC due to the impact of export restrictions on Huawei, loss of competitiveness in server CPU market share to AMD as well as anticipated deceleration of PC demand by 2H 2024. Yet, they consider Intel as potentially a leading-edge logic foundry alternative to TSMC (TSM). Their price target is $68, which implies nearly double the closing price on July 16th, 2024.

The company has ambitious goals for its foundry services, hoping to be the second largest external foundry company by 2030; most importantly, it has already secured large orders from its key clients such as Microsoft (MSFT) for its 18A process node, which says a lot about the potential quality of Intel’s offering, in my opinion.

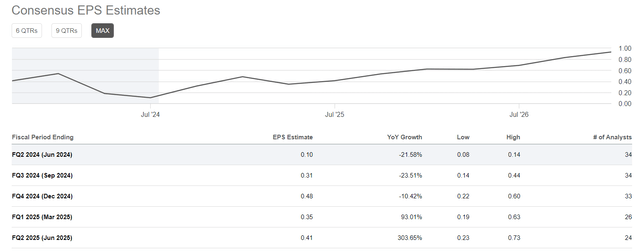

According to the earnings call, we can deduce that the management hopes for sequential sales improvement will be more robust over 2024 and into 2025, with Q1 2024 being the cyclical trough. The growth is going to be propelled by an enterprise refresh cycle, a growing pace of AI PCs, and data center market recovery. Despite the relatively positive outlook, the company’s forecast for Q2 2024, which will be announced on August 1, assumes that sales will reach $13 billion (mid-range), reflecting a lack of growth compared to the previous year. However, the gross margin is expected to be 43.5%, almost 4% higher YoY. Unfortunately, INTC’s EPS is expected to be $0.03 lower than in the previous year:

Even given past earnings misses, Wall Street is evaluating management’s statements as the most likely scenario. The consensus is that Intel’s revenue will be a bit lower than $13 billion, with EPS at 10 cents – this aligns with management’s forecast, indicating that expectations are realistic and not overly optimistic, in my opinion.

If the first quarter really has marked the bottom of the cycle and management’s recent cost-cutting initiatives have had even a minimal impact on the company’s margins, then I think the current forecasts may be too pessimistic. This would mean that there’s a great chance of beating the forecast if the above conditions are met.

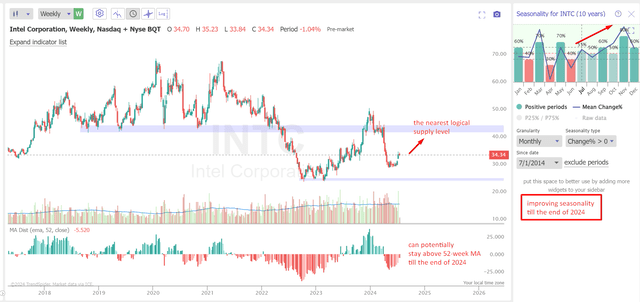

From a technical analysis point of view, I like the fact that the price reacted sharply from the $30 mark and quickly rose to around $34. If we look at the statistical data over the last 10 years, we are entering a seasonally strong period. The next strong resistance, which is the logical next target if the reversal continues, is in the $43-$44 range, representing a potential return of 24-28% in the short term. So in my opinion, the technicals are quite bullish.

TrendSpider Software, Oakoff’s notes

I believe any recovery in momentum like that should be supported by a favorable valuation, providing a margin of safety. In the case of Intel, Seeking Alpha Quant’s rating gives it a “D+” because some TTM multiples are very high indeed. However, given that the company’s EPS continues to recover, the forward-looking multiples for next year appear moderately confident. If the current consensus is correct, the company is expected to earn $1.93 per share in EPS in 2025 (a 78% year-on-year) – this would result in a price-to-earnings ratio of almost 18x.

I think it’s fair to assume that Intel’s P/E ratio in 2025 will be around 25x – both historical norms and comparisons across the industry point to this multiple. Assuming the current EPS consensus is correct, we can calculate the potential share price by the end of 2025 by multiplying 25x by $1.93. This gives us a projected share price of $38.60, which is about 40.5% higher than the current price of Intel. Thus, I can conclude that the company indeed has a margin of safety. More than that – I believe the amount of INTC’s undervaluation potential gives me a right to assign the stock a “Strong Buy” rating today.

Risks To My Thesis

I think it’s no secret that AMD is a major threat as their PC and data center segments have grown significantly. By looking at the stock price performance, it looks like INTC investors are indeed concerned, even though Intel’s plans for products and solutions span several years from 2023. I think that the risk of intense competition and the possibility that Intel may continue to lose market share for several years, despite its efforts to revive growth and explore other end markets, may sustain negative sentiment around the stock – this could lead to serious negative consequences for investors who buy the stock on the dip today.

A general economic downturn is also one of the main risks for all semiconductor companies, including Intel. Thus, should there be an economic downturn, this would lead to a decline in demand for semiconductors, followed by a build-up of inventories and a cyclical slowdown in orders.

The risk directly related to my thesis today is my assumption that the consensus appears realistic. However, this may not be the case. The assumption that Intel will trade at 25 times its earnings by the end of 2025 is uncertain – the multiple could be much lower. Everything will depend on how well the company manages to implement, or at least show progress in implementing, its current plans and strategic vision.

Your Takeaway

Based on everything I wrote above and despite some obvious risks, I think Intel stock deserves to be called a “Strong Buy” today. Due to cost controls and the introduction of 5th Gen Xeon processors with AI acceleration, improved margins in data centers are anticipated to significantly boost the top line. Intel’s upcoming Gaudi 3 AI Accelerator aims to compete strongly in AI markets against rivals like Nvidia and AMD, thus the negative sentiment around INTC could also benefit as the firm gains further market share from its closest peers.

Furthermore, Intel has strong access to capital, including federal funding for its Ohio complex, which may imply that it’s well positioned financially in this capital-intensive industry. I think Intel could be a leading-edge foundry alternative with great upside potential from current levels. My valuation calculations show a possible price target which is ~40% higher compared to the current stock price level, giving a great margin of safety.

Thus, I initiate coverage of Intel stock and give it a “Strong Buy” rating.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.