Summary:

- American Airlines Group stock is down 9% and 20% overall due to a downward revision for Q2 and the departure of a key executive.

- The airline’s inability to pass on costs to consumers is impacting its ability to maintain profitability.

- American Airlines’ focus on smaller cities and the Sun Belt region is not providing a competitive advantage in terms of unit revenues.

Laser1987/iStock Editorial via Getty Images

At the time of writing, American Airlines Group Inc. (NASDAQ:AAL) stock is trading down 15% and the stock is now down nearly 20% since I reiterated my buy rating for American Airlines last week. Normally, I do not revisit a stock this quickly, but for American Airlines, there have been two key developments that are worth discussing. The company issued a downward revision for the second quarter and one of its key executives will be leaving the company.

American Airlines Sees Unit Revenues Weaken In Q2

One thing that I have been pointing out throughout the recovery phase for airlines is that, while initially airlines were committed to rebuilding their business in a lean way, they reverted to adding costs left and right to execute flight schedules and simply pass on the costs to the consumer. However, the ability to pass on costs is not infinite, and I have been pointing out for several quarters that we are seeing a decreasing stretch in that ability to price fares against the elevated cost environment that airlines in part have created themselves.

We now see that it is biting back American Airlines. In Q1 we already saw that the airline was barely able to hold on to an operating profit while its margins were 3.5% a year earlier. Now, the first quarter is the softest quarter and not necessarily an indicator for the remainder of the year, but I think every airline executive will agree with me that coming out of the first quarter with an operating profit will make airlines more confident about its margin expansion in the balance of the year. While I don’t see Q1 results as something to be projected forward, they are not completely meaningless either.

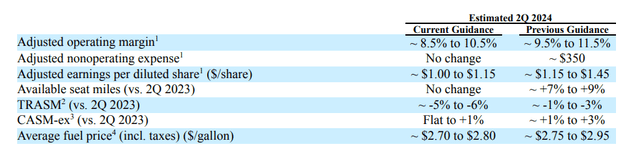

We see that unit cost growth is expected to be better than initially guided. However, unit revenues are expected to be significantly worse, with a 5 to 6 percent reduction compared to the 1 to 3 percent expected earlier. Even with a lower average economic fuel price, we see that adjusted operating margins will be 1 percentage point lower than initially anticipated. With that, it appears that American Airlines has maneuvered itself in the position where costs are not coming down fast enough and capacity additions continue to erode unit revenues, resulting in adjusted margin pressure.

American Airlines’ Chief Commercial Officer Vasu Raja To Leave

I have been impressed with American Airlines cleaning up its balance sheet. However, by now we have been seeing on too many occasions that American Airlines either made a small mistake that cost them or keeps kicking the can on some growth items down the road. It appears that it has now cost Vasu Raja his position as American Airlines’ Chief Commercial Officer.

American Airlines Failed Modern Distribution Channel

Airlines constantly have to find new ways and channels to efficiently fill their seats. Simply speaking, it means that revenue needs to be managed and the cost of revenue management systems or sales mechanisms should not be too high. About everything in an airline is complex, and their digital backbone in operations and sales and revenue management is no exception. We see more airlines using modern distribution channels, and American Airlines has been no exception. Using more modern solutions allows airlines to provide more personalized experiences and offers to optimize ancillary revenues, but also to optimize prices.

American Airlines, under the lead of Vasu Raja, has been taking a vastly different approach toward its transition to a modern distribution channel. Instead of really using it as a tool to optimize fare prices, they have used the modern distribution channel as a way to cut distribution costs. While that is also a possibility with the implementation of a modern distribution channel, it does mean that American Airlines is leaving money on the table, focusing on pennies while losing out on dollars.

In some way, the unit revenues reduction and the expected as well as the reported margins show that American Airlines has a problem. Last quarter it was the deployment of too much capacity in off-peak hours, but the real overarching problem has been the lack of revenue management. American Airlines rushed the implementation of the NDC (New Distribution Capability) and subsequently failed to leverage its true power.

American Airlines CEO Robert Isom admitted that changes to their distribution system actually filled the seats in airplanes of the competition:

As we take a look at the first quarter, there’s quite likely some benefit that our competitors received because of some of the things that we’ve — the changes that we’ve made. That said, this is the opportunity for us to go and to make sure that as I said, the goal is cost savings and especially revenue production.

So, what we are seeing is actually nothing short of a failed implementation of NDC, and for American Airlines I do not see an easy way to undo the damage they did to the distribution channels.

American Airlines Focuses On Sun Belt Cities

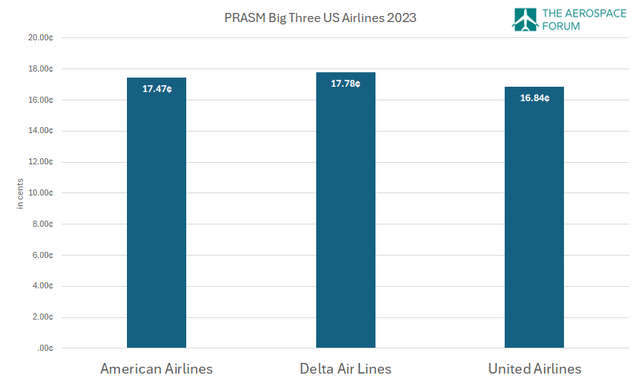

Another strategy shift that can be attributed to Raja is the focus on Sun Belt cities as well as smaller cities. American Airlines is heavily focusing on expansion in those areas, whereas we see most airlines focusing on the coastal regions, with an important role for long haul operations. American Airlines believes smaller city residents and Sun Belt cities will see significant growth in the years ahead and are prepared to pay a premium compared to the average. This would, of course, be a genius move by Raja and American Airlines. However, if we look at the reported PRASM which is the passenger revenue per available seat mile, we see that American Airlines is not harvesting any premium when viewed over the entire network. Delta Air Lines has a PRASM that is 1.8% higher and indeed United Airlines has a PRASM that is 3.6% lower, but we do not see a material differential here, and the unit revenue projections for the second quarter do not also point at any favorable movement in unit revenues stemming from American Airlines’ strategy.

So, my conclusion would be that American Airlines’ small city and Sun Belt city strategy is currently not providing the airline with competitive advantages over capacity deployment in the coastal areas.

Conclusion: American Airlines Is In A Tough Spot

For now, I am maintaining my buy rating, but there is no question about American Airlines having made mistakes that are costing them. Not properly leveraging the power of modern distribution channels to optimize revenue is probably the biggest mistake. American Airlines put too much emphasis on the NDC to cut costs, but with that system now not providing any strong revenue and sales optimization, the company actually finds itself with a subpar and dismantled system while the capacity deployment is also not providing key differentiators. Hopefully, with Vasu Raja out, American Airlines will take prompt actions to streamline its network and its distribution channels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.