Summary:

- Mastercard remains in a top position with strong net revenue growth, resilient consumer spending, and robust cross-border volume growth.

- The company’s value-added services and solutions are outperforming total growth, with strong growth in cyber intelligence, consulting, marketing, and loyalty solutions.

- Mastercard’s future looks bright with expected EPS growth of 14% this year, followed by 17% in 2024 and 18% in 2025, along with a history of consistent dividend growth and massive buybacks.

Digitalroomm

Introduction

A few days ago, I wrote an article titled Betting Big: Fed Mayhem And My Personal Picks For 2024. As the title suggests, in that article, I discussed the recent Federal Reserve press conference and my favorite picks for 2024 in light of a 2024 macro outlook I wrote with Seeking Alpha at the start of this month.

Although market valuations are a reason for me to focus on stocks that fit in the “value” category, I did mention that I am looking for growth stocks as well.

Growth Stocks: I’m cautiously investing in growth stocks as a hedge, particularly those with proven track records, strong balance sheets, and anti-cyclical demand. I avoid companies with lofty valuations and high dependence on speculative stock market sentiment.

However, when it comes to growth stocks, I avoid high-flying companies with sky-high valuation multiples or companies that are not yet profitable.

When I talk about growth stocks, I mean companies with proven track records that are still capable of elevated growth. This includes companies like Danaher (DHR), which I own, and Mastercard (NYSE:MA), the star of this article.

My most recent article on this company was published on July 1, when I used the bullish title Mastercard: In A Good Spot To Remain A Wealth Compounder.

Since then, shares are up 7.3%, beating the 6.1% return of the S&P 500 by 120 basis points.

In light of my 2024 outlook, I decided to take another close look at this company and focus on its ability to maintain high growth rates, which I believe will make it likely that it remains a total return outperformer.

So, let’s get to it!

What About The Consumer?

Although I would make the case that both Mastercard and Visa (V) are growing so fast with expansions in differentiated services that consumer sentiment does not have *that* big of an impact on its growth, we do see some good news when it comes to the consumer.

While I am far from bullish on the consumer due to my belief that rates and inflation are likely to remain higher for longer, there’s no denying that we’re dealing with some good news.

For example, consumer sentiment saw a notable surge in early December, attributed to the recent decline in gas prices and an upward trend in equity values.

According to Wells Fargo, despite a divergence between what consumers express and their actual spending habits, the latter has significantly supported overall economic growth throughout the year.

Wells Fargo

Furthermore, according to the bank, while November retail sales data is anticipated to show some weakness, sustained high expectations throughout December could lead to a year-end surge in spending.

Consumer purchasing power is expected to remain robust, supported by sustained wage growth and easing inflation, particularly in gas prices.

Wells Fargo

Based on this context, let’s take a closer look at how Mastercard is doing.

Mastercard Remains In A Top Position

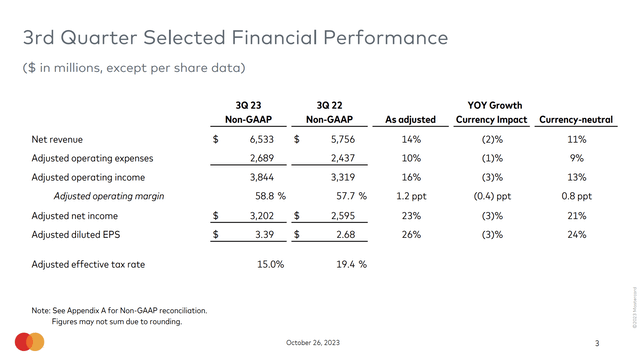

Despite high economic uncertainty, Mastercard did not show signs of weakness in its third quarter.

Net revenue increased by 11%, driven by resilient domestic consumer spending, robust cross-border volume growth, and continued expansion in value-added services and solutions.

Operating expenses rose by 9%, including a one-point increase from acquisitions.

As a result, operating income saw a 13% increase, with a minimal impact from acquisitions.

Net income and EPS grew by 21% and 24%, respectively.

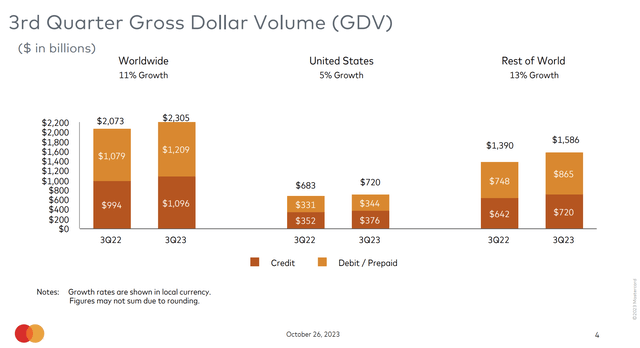

Taking a closer look under the hood, we see that worldwide gross dollar volume (“GDV”) increased by 11% year-over-year in local currency.

- In the U.S., GDV increased by 5%, with credit growth of 7% and debit growth of 4%.

- Outside the U.S., volume increased by 13%, driven by credit and debit growth.

- Cross-border volume globally increased by 21%, reflecting sustained growth in both travel and non-travel-related spending.

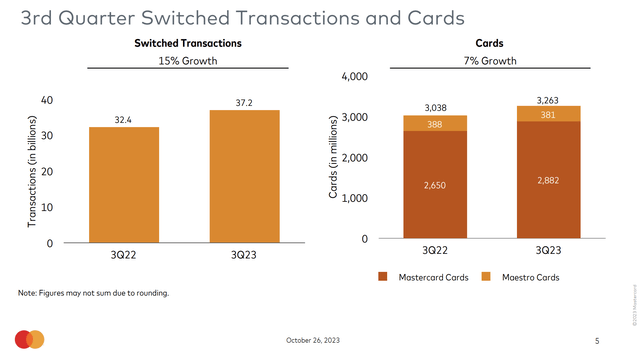

Adding to that, as we can see below, switching transactions grew 15% year-over-year in the third quarter, with strong growth rates in both card-present and card-not-present transactions.

The percentage of transactions switched increased strategically, reaching over 65% of total transactions worldwide. Card growth globally was 7%.

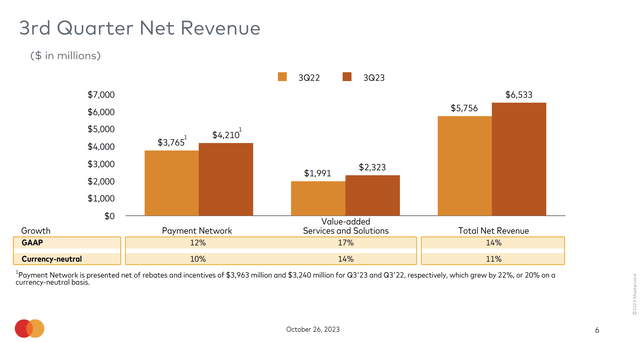

Furthermore, in light of my earliest diversification comments, a very important thing to discuss is that the company’s value-added services are strong and outperforming Payment Network growth.

In the third quarter, the Payment Network net revenue increased by 10%, driven by domestic and cross-border transaction and volume growth, including rebates and incentives.

Value-added Services and Solutions net revenue increased by 14%, with growth in Cyber Intelligence solutions, consulting and marketing services, and loyalty solutions.

Looking ahead, the company is upbeat, as it believes that consumer spending patterns are normalizing post-pandemic, with opportunities for further recovery of cross-border travel.

Hence, the base case scenario assumes resilient consumer spending, with net revenue expected to grow at the low end of a low double-digit rate on a currency-neutral basis in the fourth quarter.

Mastercard’s Future Remains Bright

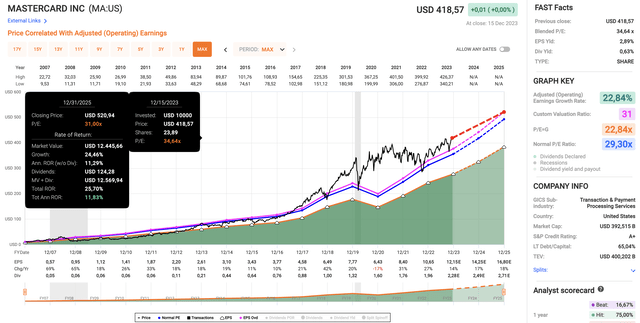

Usually, I show the chart below at the end of my articles.

However, I wanted to highlight the earnings per share growth expectations.

As we can see in the lower part of the chart (my apologies for the small numbers), the company is expected to grow EPS by 14% this year, followed by 17% expected growth in 2024 and 18% growth in 2025.

This would mean a continuation of the company’s impressive growth history and bode well for potential future returns.

Using the data in the chart below:

- MA is trading at a blended P/E ratio of 34.6x.

- This multiple is far from cheap and well above the long-term normalized valuation multiple of 29.3x. However, since the company started to diversify more aggressively, it has traded at an elevated multiple.

- If the company maintains elevated EPS growth, I believe that a “premium” valuation is justified.

- Using a 31x multiple, the company has room to return 11-12% per year.

- A return to its 29.3 multiple would imply an annual return of 9%.

- Since 2007, MA shares have returned 25% per year!

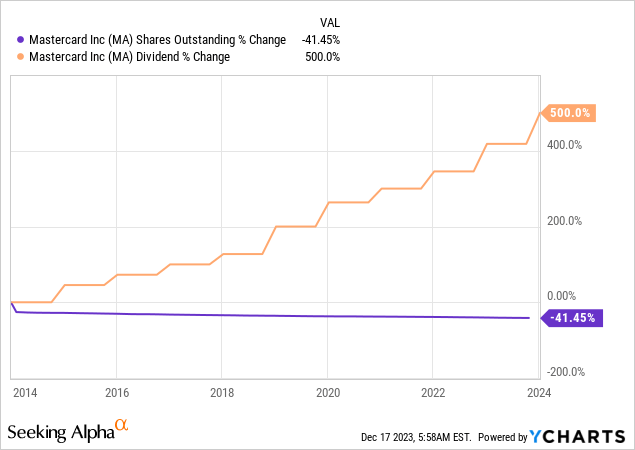

A major component of its total return is buybacks.

On December 5, the company announced a new $11 billion buyback program.

The program will be effective as soon as the prior $9 billion buyback program runs out.

As of December 1, it had $3.5 billion remaining under its prior buyback program.

Over the past ten years, Mastercard has bought back more than 42% of its shares. It has hiked its dividend by 500% during this period.

The new $11 billion buyback is roughly 3% of its market cap.

Nonetheless, despite aggressive dividend growth, MA shares yield just 0.6%.

Although MA may be a poor choice for investors dependent on income, the only reason why the current yield is so low is its history of massive capital gains (remember, 25% compounding returns since 2007).

The dividend is also protected by a 20% payout ratio, and it has a five-year CAGR of roughly 18%.

With all of this in mind, the company is working hard to diversify its business to pave the way for long-term, above-average growth.

During its third-quarter earnings call, the company mentioned that it is actively pursuing person-to-merchant payments as a sizable long-term growth opportunity.

The company’s global deal momentum, including partnerships with Webster Bank, Citi’s wealth business, and Equity Bank Group, demonstrates its commitment to expanding its presence in this space.

Meanwhile, co-branding initiatives, such as the Xbox credit card with Barclays, show the diversification of partnerships to tap into various market segments.

Adding to that, the company’s focus on contactless payments, representing 63% of in-person transactions, indicates a growing consumer preference for convenient and secure payment methods.

With over 3 billion tokenized transactions processed in one month, Mastercard makes the case that it is at the forefront of secure digital transactions.

Furthermore, the company is actively exploring untapped opportunities in commercial payments and disbursements/remittances.

Collaborations with BMO, Oracle, SAP Fioneer, Citibank, Axis Bank, and BTG Pactual support its efforts to modernize and grow B2B payment flows.

It also needs to be said that the suite of value-added services, including cybersecurity solutions and AI-powered fraud monitoring, represents a critical driver for Mastercard’s growth.

Safety Net’s success in preventing over $20 billion in fraud is one example of the company’s success in this area.

Even better, Mastercard is a major beneficiary of the “open banking” trend.

Open banking refers to the use of APIs to share financial data and services with third parties. Third parties typically provide technology, a service or an app to the bank’s customers that makes use of the shared financial data and services. – Software

With connectivity to over 95% of U.S. deposit accounts and collaborations with partners like JPMorgan (JPM) Payment, Verizon (VZ), and Worldpay, Mastercard aims to leverage its assets to enable new payment solutions.

For example, the live partnership with JPMorgan Payment’s Pay by Bank and plans to pilot with Verizon show that Mastercard has a foot in the door of what I expect to be a very attractive long-term growth opportunity.

All things considered, I continue to like the Mastercard bull case and believe that it remains in a fantastic spot to both outperform the market and deliver high total returns for many years to come.

Given my view on the economy and market, I hope to buy MA on a 10% to 15% correction. As I believe that the market has run hot in recent weeks and become too dovish, I’m positive I’ll get a buying opportunity in 2024.

Takeaway

Mastercard’s compelling future lies in its strategic positioning and dynamic growth drivers.

The company’s recent performance, marked by an 11% surge in net revenue and resilient domestic consumer spending, shows its ability to navigate economic uncertainties successfully.

Diversification is a key strength, with value-added services outperforming total growth.

Meanwhile, the company’s focus on cybersecurity solutions and AI-powered fraud monitoring aligns with the evolving landscape and its path to capture secular growth opportunities.

Despite a premium valuation justified by elevated EPS growth, Mastercard’s history of consistent dividend growth and massive buybacks signal confidence in future returns.

If I get the opportunity to buy Mastercard during a correction next year, I’ll likely use that opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.