Summary:

- Lumen Technologies’ Q3 results showed a revenue decline but a significant increase in free cash flow, driven by strong private connectivity fabric (PCF) sales.

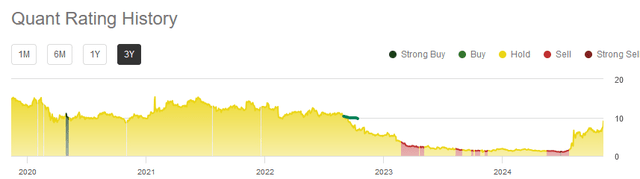

- The stock rallied 18% post-earnings, with a “Hold” quant rating, despite previous “Strong Buy” recommendations, due to positive cash flow and AI infrastructure opportunities.

- Lumen’s business model transformation is validated by increased FCF projections and substantial PCF deals, positioning it well for future growth and debt reduction.

- Discussion of short-term buying risks and long-term gains from AI-related infrastructure investments discussed.

Erik Isakson

After Lumen Technologies (NYSE:LUMN) posted its quarterly earnings report in the summer, the stock returned nearly 25%. On November 5, after Lumen posted a revenue decline in its third-quarter results, the stock gained around 18% at the time of writing.

Why is LUMN stock rallying? The stock currently has a “Hold” quant rating, compared to my most recent rating of “Strong Buy.” Should investors continue to buy shares?

Third-Quarter Results

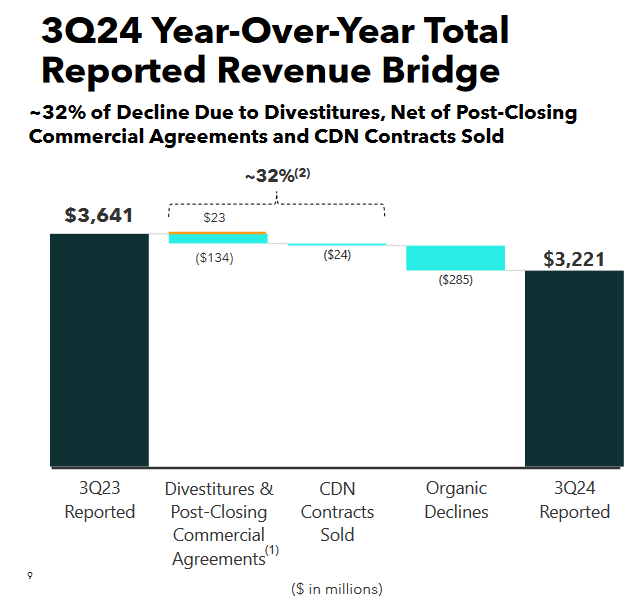

In Q3, Lumen reported non-GAAP earnings per share of -$0.13. Revenue fell by 11.5% Y/Y to $3.22 billion. Although its adjusted EBITDA of $899 million is down from $1.049 billion last year, the firm reported healthy net cash generation from operating activities of $2.0 billion. The firm expects EBITDA to continue falling Y/Y in 2025. Legacy declines will continue to drag down results. In addition, Lumen has startup costs for private connectivity fabric-related contracts, along with incremental transformation costs. Those costs will benefit the firm in the long term, improving its broader cost structure.

Free cash flow soared to $1.2 billion, up from $43 million last year.

Lumen explained what accounted for the 32% decline in the reported revenue bridge detailed below.

Lumen

In its breakdown of non-GAAP metrics, Lumen incurred $306 million in cash interest payments, $14 million in severance, and $850 million in capital expenditures. Its free cash flow figure included a $170 million voluntary pension contribution in the third quarter of 2024. As a result, the firm’s pensions are nearly 90% funded.

FCF growth will accelerate from here. As CEO Kate Johnson highlighted the company has achieved over $8 billion in new private connectivity fabric (“PCF”) sales since June 2024. Lumen’s customers validated its unique offerings in building the backbone of the AI economy. This suggests that Lumen has a strong moat that should lead to operating margin expansion in the quarters ahead.

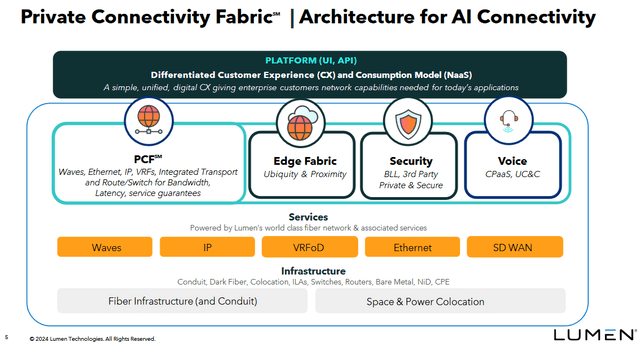

Lumen Technologies

Above is a slide explaining Lumen’s architecture for AI connectivity (slide #5). This will add over $3 billion in incremental PCF sales in partnership with big names in the industry. Expect Lumen to continue educating the investor community and the industry about this platform. This will further drive its sales growth.

Lumen said on the conference call that it estimates receiving the first $5 billion in PCF sales to provide the FCF that fuels its business. When it reaches positive FCF growth, LUMN stock should continue to rise.

Outlook

Lumen reaffirmed its previous outlook for full-year 2024. It increased the FCF projection by $200 million. This validates Lumen’s business model transformation is in the right direction.

|

Metric |

Current Outlook |

Previous Outlook |

|

Adjusted EBITDA |

$3.9 to $4.0 billion |

$3.9 to $4.0 billion |

|

Free Cash Flow |

$1.2 to $1.4 billion |

$1.0 to $1.2 billion |

|

Net Cash Interest |

$1.15 to $1.25 billion |

$1.15 to $1.25 billion |

|

Capital Expenditures |

$3.1 to $3.3 billion |

$3.1 to $3.3 billion |

|

Cash Income Taxes/(Refund) |

($200) to ($300) million |

($200) to ($300) million |

In the medium term, shareholders should expect weakness in various segments. For example, in Q3, revenue from large enterprises fell by 8.2%. As the firm reaches business stabilization, expect continued variability in trends. Revenue from the public sector is also uneven from quarter to quarter. Fortunately, Lumen is seeing large booking trends. It will realize revenue slowly as a result.

Expect Lumen to announce more PCF deals. It already signed more than 15 customers in the last quarter. Since new and existing customers are building AI models, their infrastructure investments will benefit Lumen Technologies. CFO Chris Stansbury said that this is a $12 billion opportunity. It already acknowledged $8.5 billion in secured deals to date.

When Lumen issues guidance for next year, it will provide investors with more details on the related capital expenditure associated with those deals.

Lumen’s Stock Score

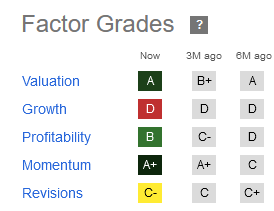

Lumen’s stock valuation returned to an A, up from a B+ three months ago.

Seeking Alpha

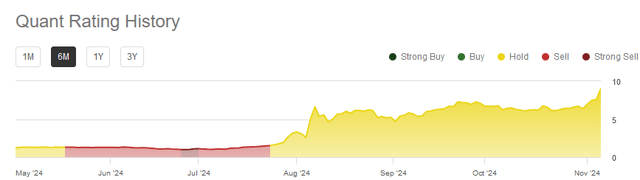

The growth and momentum score did not change, while the profitability rose slightly to a B. Seeking Alpha’s Quant rating rose from a bearish “sell” in the summer to a “hold.”

Seeking Alpha

Readers may zoom out to the three-year chart to consider buying and holding LUMN stock after the earnings report. The stock could return to the $10.00 level if the buying momentum continues.

Seeking Alpha

Your Takeaway

Investors may not want to get caught up in the stock’s buying momentum after the earnings report. Short sellers who have a 6.51% short interest are likely to cover their bearish bet to avoid more losses.

Lumen is on the way to achieving positive free cash flow growth. This will give the firm the flexibility to pay down its debt while still investing in capital expenditure requirements. Expect customer satisfaction to increase, leading to more deals. In addition, an increase in AI-related infrastructure spending is a tailwind for Lumen shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Newly Launched: DIY Value Investing Basic. Get a top stock pick weekly. Readers who want to get daily commentary may join here.