Summary:

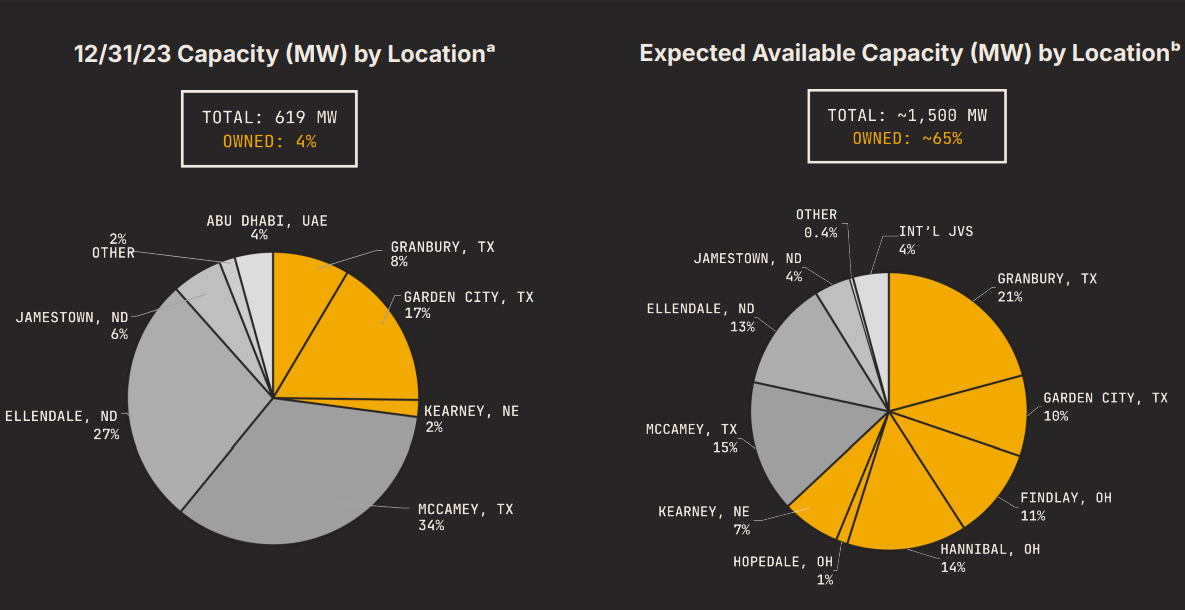

- MARA Holdings’ 1.5 GW capacity, with 65% owned, ensures unmatched cost control and scalability.

- Ohio data centers acquired at $500/operating KW, significantly below peers’ $900-$1500 range, boosting ROI.

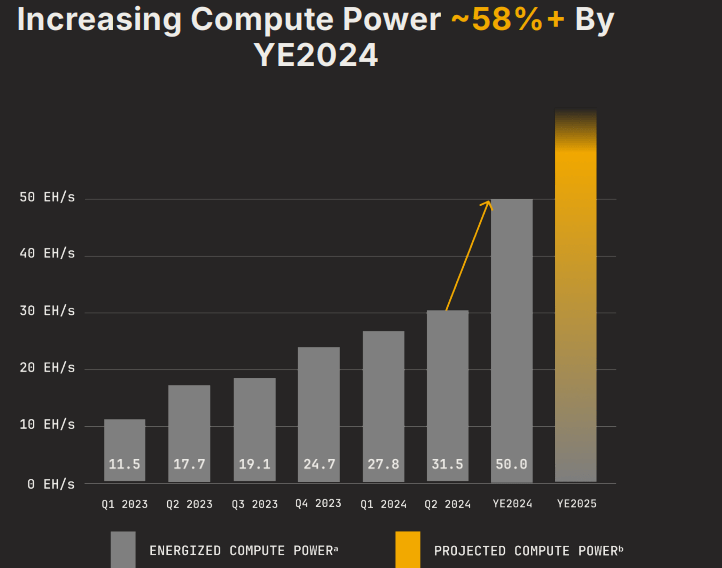

- 102% annual increase expected by 2024, reaching 50 EH/s, solidifying MARA’s digital asset dominance.

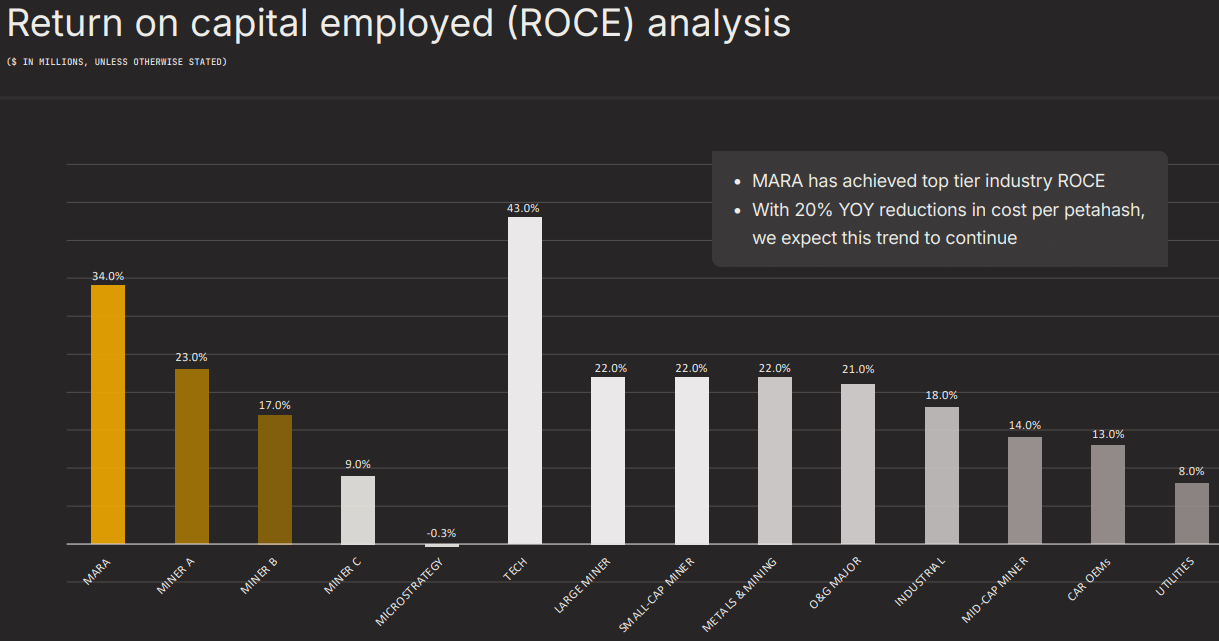

- Secures electricity at $0.01/kWh, reducing costs and supporting a 34% return on capital employed (ROCE).

- $2.5B Bitcoin holding (~28% of market cap) positions MARA for gains but exposes it to volatility.

BlackJack3D

Investment Thesis

MARA Holdings, Inc. (NASDAQ:MARA) is poised for exponential growth, underpinned by its aggressive expansion of compute capacity and strategic acquisitions at industry-leading low multiples. With 1.5 GW of nameplate capacity, 65% of which is owned and operated, MARA achieves unmatched cost control and operational efficiency.

The company’s acquisition of Ohio data centers at ~$500/Operating KW, far below peers’ ~$900-$1500, positions it for superior ROI. A 102% annual increase in compute power by 2024 fortifies its digital asset dominance. Coupled with energy partnerships yielding $0.01/kWh electricity and a 34% ROCE, MARA exemplifies scalability, cost leadership, and capital efficiency in a surging compute market.

Expansion of Compute Capacity and Low Acquisition Multiples

MARA stock holds valuation support from the company’s expansion of compute capacity. Here, the company added 372 megawatts (MW) of interconnect-approved capacity across three sites in Ohio in Q3 2024. Additionally, acquiring two operational data centers in Hannibal and Hopedale brings in 222 MW, whereas 122 MW is already operational. These centers will generate 100 MW of remaining approved capacity in 2025. Further, MARA is assembling a new 150 MW facility in Findlay, Ohio (30 MW already operational). These ongoing developments may be online by 2025 and may increase the company’s compute capacity and get optimized over time. For 2024, there will be a 102% annual increase in compute capacity to 50 EH per second.

MARA Investor Presentation

Moreover, MARA’s strategy is moving beyond expanding capacity with geographic and operational diversification. The data centers are now across multiple jurisdictions so no single independent system operator (ISO) has control >50% of MARA’s owned and operated capacity. This strategy minimizes risks from regulatory shifts, system failures, and operational issues within a single ISO. It pushes MARA to leverage multiple energy markets and maximize the potential for business returns. MARA’s return on capital employed (ROCE) is now at 34% just behind the tech sector’s 43%. Meanwhile, the closest peer yielded 23%.

Further, MARA acquired the two data centers in Ohio at a cost of ~$270K per MW of interconnect-approved capacity. This acquisition cost is lower than its publicly traded peers. MARA’s turnkey purchase multiple is at ~$500/Operating KW whereas the closest peers are in ~$900-$1500/Operating KW range. The relatively low cost of acquisition indicates MARA is securing valuable assets at attractive prices. With that, MARA may continue to yield high investment once the compute data centers become online and fully operational.

By acquiring assets at a low multiple, MARA can have massive operational savings. At the Hopedale data center, MARA projects that ownership may reduce operating costs by up to ~50%. This heavy cut in OpEx will boost the company’s bottom line and operational edge obviously. In a capital-intensive industry like data centers, OpEx can burn a major portion of revenue. By reducing its operational footprint and boosting control over its assets, MARA may derive economies of scale to optimize its bottom line.

MARA Investor Presentation

Additionally, MARA persists in its digital asset compute market lead due to its high scale. In 2024, the company secured ~1 gigawatt (GW) of nameplate capacity through acquisitions and greenfield developments, bringing its consolidated nameplate capacity to ~1.5 GW. 65% of this capacity may be owned and operated by MARA. As a result, this direct control scales up MARA’s lead in the digital asset compute and data center sector.

How? By owning and operating a majority of its assets, MARA gains a cost edge against the market. Relying on leasing and third-party arrangements brings in additional costs and less operational control. The ownership of such a large portion of its capacity provides MARA with a higher potency of long-term improvement in its cost structure. Market-wise, the demand for data storage and compute capacity continues to grow, now owning and operating data centers may allow MARA to have a larger market opportunity. Overall, the company is now best-capitalized and can edge by pursuing M&A opportunities to accelerate its operational growth and compute expansion.

MARA Investor Presentation

Energy Dependency, Bitcoin Price Volatility, and HODL Strategy

As observed, MARA Holdings targets to reduce OpEx (mostly energy costs), but it requires sharp scaling of energy generation and managing power prices against the macro challenges. While MARA hit a high reduction in energy costs (through its partnership with NGON) the ability to continue to derive electricity at ~$0.01 per kilowatt-hour (kWh) against the market price of $0.04 per kWh makes the long-term scalability of this cost-saving strategy uncertain.

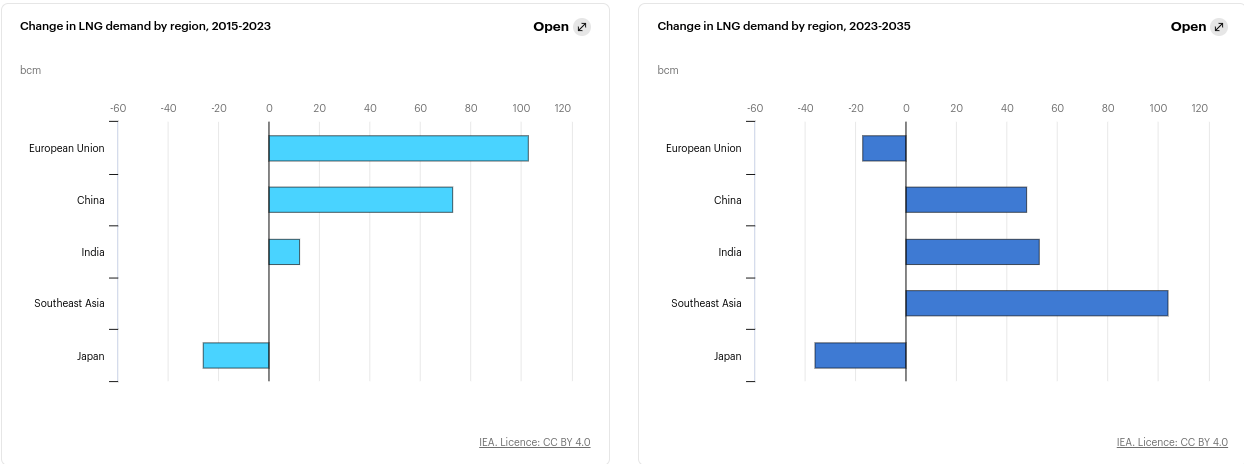

Although this reduction can be sustained with the use of stranded gas, the availability of this energy resource on a large scale (for MARA’s needs) may be limited based on the outlook for demand from Asia giants. On the earnings call, MARA mentioned over 1 million gigawatt-hours of available stranded gas. However, this is an estimate based on the entire market availability, not what can be reliably captured and utilized by MARA alone.

Although MARA is focusing on securing more control over its energy generation by investing in its own sites, its energy strategy is still subject to partnerships and the state of the market. MARA is currently operating in competitive energy regions like PJM that do not offer exclusive control over pricing and supply. If the cost of energy and access to cheap stranded gas increases or at least becomes more volatile, MARA can be hit by high operational/bottom-line issues and related drops in valuations.

iea.org

Moreover, MARA’s move to expand its energy generation and cut costs by increasingly relying on its owned and operated data centers (scaling energy infrastructure with new technologies like micro data centers) is capital intensive. MARA’s expansion efforts may continue to require massive financial outlay to build/acquire assets. Now, given the size of MARA’s operations and its target to scale up capacity with large sites (100-megawatt and larger), any delays or failures in scaling energy resources could hurt its growth potential and street confidence (analysts’ estimates).

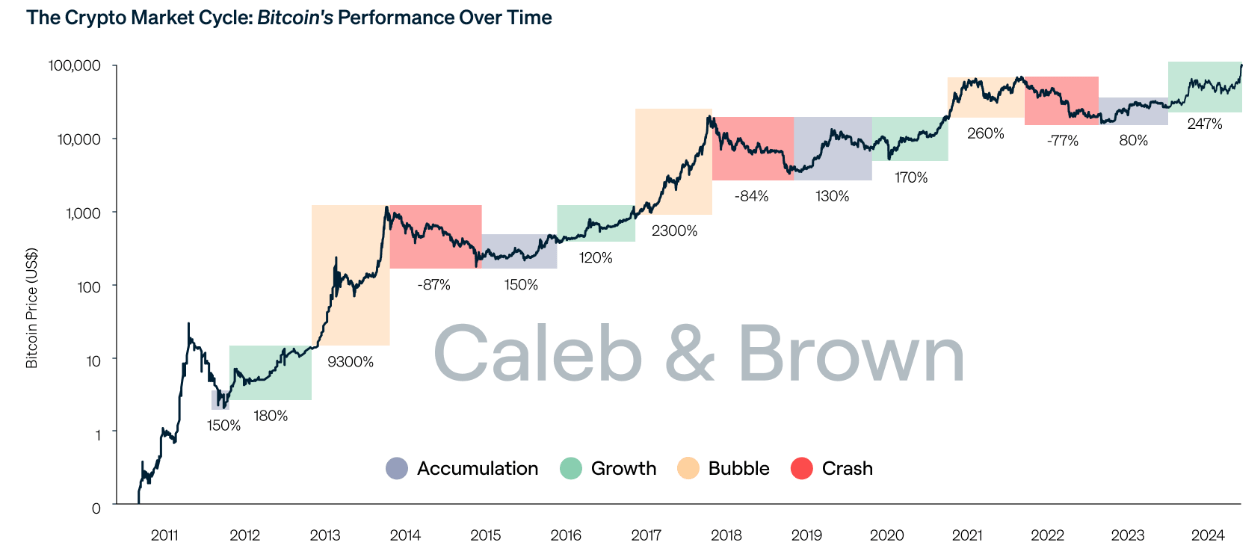

Further, MARA’s balance sheet holds ~$2.5 billion worth of Bitcoin (BTC-USD) with an average purchase cost of under $50K per Bitcoin. This holding is a major fraction of its market value (28% at the time of writing), and the price fluctuations of Bitcoin directly hit MARA’s stock price. MARA has a solid return on its Bitcoin investments due to the recent surge in Bitcoin prices, but the same volatility could also lead to massive losses if prices drop sharply below $50K (under Bitcoin Market Cycle).

MARA’s strategy on Bitcoin (Full “HODLˮ approach) introduces huge risk by getting highly exposed to fluctuations in cryptocurrency prices. While the company preferred the flexibility in managing its Bitcoin through yield generation, collateralized loans, or asset purchases, all-in-all these solutions still carry risk. Lastly, the value of collateralized Bitcoin may diminish with a drop in Bitcoin prices reducing MARA’s capability to derive cash from this source.

calebandbrown.com

Takeaway

MARA’s aggressive expansion of compute capacity, driven by industry-leading low acquisition multiples and cost-efficient operations, positions it as a dominant player in the digital asset and data center space. With 1.5 GW of capacity and unparalleled cost control, MARA is set for robust growth, offering superior ROI and scalability in a rapidly expanding market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.