Summary:

- Mastercard could rightly become the next stock in my portfolio.

- In fact, Mastercard is entrenched in the economy and holds a role similar to key infrastructure everyone has to use.

- In this article, we go over the recently released Q2 earnings report and see why Mastercard’s strength makes me eye the stock with increasing attention.

jbk_photography

Why I am interested in Mastercard

Railroads and infrastructure plays fascinate me and this is why, besides my coverage of Class 1 railroads, I am now adding another company to this basket: Mastercard (NYSE:MA). Yes, I consider Mastercard a rail and the company explains its business with words that seem to support my thought:

“Mastercard is a technology company in the global payments industry. […] We operate a multi-rail payments network […] we offer payment products and services and capture new payment flows”.

Considering Mastercard as an infrastructure player helps us understand why it has not been disrupted by fintech companies such as PayPal (PYPL) or big tech companies (Apple Pay, Google Wallet). These are not true rivals, but partners that use Mastercard’s infrastructure and prosper on it.

One of the reasons Mastercard – and Visa (V) – interest me is similar to why I research railroads and – to some extent – HR services companies: they are a proxy of the economic activity around the world.

Mastercard: The company

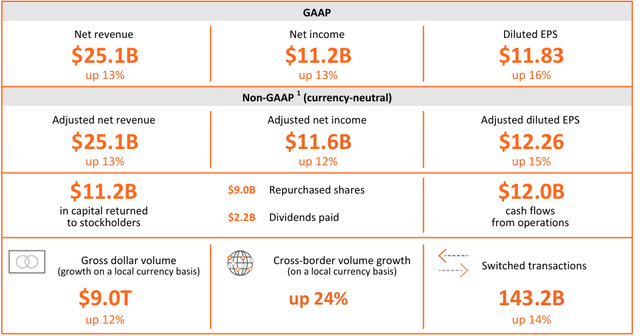

Regarding Mastercard, many know the brand, but not everyone is familiar with the company and its results. Here are a few financial and operational highlights from the 2023 Annual Report.

We see that the company earned $25.1 billion in net revenue, which turns into a $11.2 billion net income. The company was able to generate $12 billion in operating cash and returned to its shareholders over $11 billion.

Mastercard classifies its net revenues into two categories: payment network, and value-added services and solutions.

As Mastercard’s CEO Michael Miebach explained during the last J.P. Morgan Annual Global Technology, Media and Communications Conference,

Value-added services and solutions are comprised of the following. It comprises our fraud and security solutions, it comprises of our data insights and analytics, our marketing and our consulting capabilities, our loyalty assets, and our payment gateway, right? And then in addition to that, it also includes our open banking capabilities, our digital ID capabilities, and our real-time assets which are there.

As the economic environment develops and becomes more sophisticated, this business becomes more and more necessary and entrenched in the infrastructure itself. The nice part of it is that it is the higher margin segment for the company. But this doesn’t mean payment is not a growing category. It is “a secular trend”, as Mr. Miebach explained.

A nice example of what this means was given by Mastercard’s CFO during the Bernstein Strategic Decision Conference,

An example I would give you from that new business model and new consumer behavior standpoint is historically when we subscribe to cable services, you do a cable package with your cable provider and you would pay your monthly charge on your credit card, debit card, or direct from your bank account.

More and more people are moving away from that cable model and going into subscription services and saying, I’ll do a subscription with Netflix. I’ll do a Paramount+. I’ll do the discrete services which they’re signing up for. As a result, you’re getting more spend and more transactions, which come onto the system.

Perhaps we have not yet grasped what our normal lifestyle means for a business such as Mastercard. With the growth of apps and subscription services, the number of transactions expands exponentially. From one payment to the cable provider, we now pay for three or four different platforms. But think about other sectors: Airbnb, for example. The guest pays Airbnb then pays the host. But Airbnb also pays the taxes, when due. And all of this is done digitally. These are digital transactions. And the more there are, the higher the likelihood they will also need some services.

Mastercard Q2 earnings review

Now, Mastercard just reported earnings. To read them from the right perspective, let’s keep in mind what Mastercard disclosed at the end of Q1 and what its main peer Visa reported for the quarter that just ended (for Visa, it is its financial Q3).

In its Q3 earnings report, Visa reported net revenue growth of 10% and a 12% EPS growth for the quarter. In particular, payments grew 7% YoY and cross-border volume increased 14%.

Visa also gave us a financial outlook for the next quarter, which is Visa’s fourth. Net revenue growth is expected in the low double digits, outpacing opex growth in the high single digits. EPS should grow around 12%-13%.

During its Q3 earnings call, Visa also talked about softening consumer spending: “In the U.S., while growth in the high-spend consumer segment remained stable compared to prior quarters, we saw a slight moderation in the lower spend consumer segment”.

Last quarter, Mastercard talked about continuing momentum, with revenues up 11% and net income up 16% YoY. These results, as Mr. Miebach explained, were “backed by healthy consumer spending” words that Visa seems to have a bit re-balanced a few days ago.

Well, even though the possibility of slower consumer spend was high and made many cautious, Mastercard proved the strength and the resilience of its growth path, overdelivering.

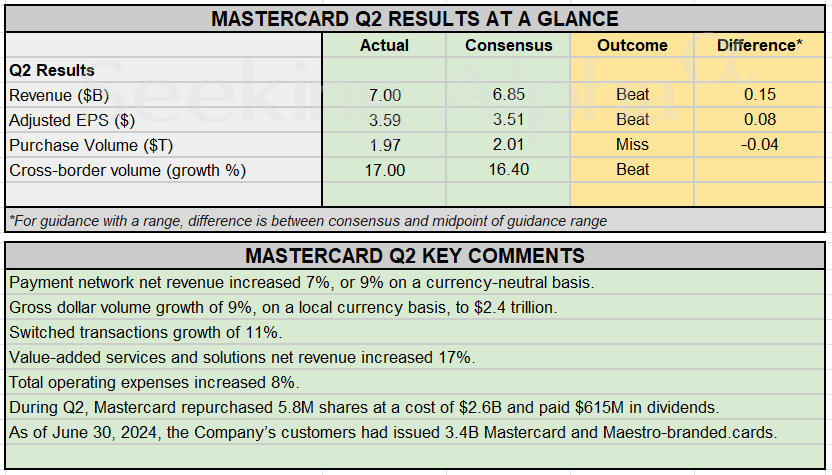

Seeking Alpha made immediately a chart showing how Mastercard beat its top and bottom line, with a slight miss only on purchase volume.

Seeking Alpha

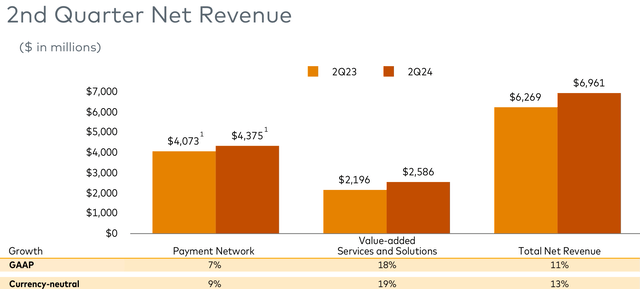

As we can see, Mastercard’s net revenue came close to $7 billion, a nice 11% increase YoY. So, what the company expected in Q1 happened. And this shows the strength of Mastercard and a certain degree of predictability that the company’s earnings have. Although there are a few more predictable businesses than this one, Mastercard is one of those companies where not only YoY comparisons make sense, but also QoQ. The reason is simple: its seasonality is low and its growth trajectory steadily moves north.

What investors now care about regarding Mastercard is the growth of its services. Mastercard pleased the market with a 17% increase from this revenue stream, which now makes up around 37% of the total net revenue.

MA Q2 2024 Earnings Presentation

All of the key business drivers – mainly gross dollar volume, cross-border volume, and switched transactions – increased significantly: 9%, 17%, and 11% respectively.

Mastercard generated $4.8 billion in operating cash and spent only $272 million on capex. This means the company churned out $4.53 billion in FCF. During Q2, Mastercard repurchased 5.8 million shares spending $2.6 billion, and paid $615 million in dividends. This means it returned over 70% of its FCF to its shareholders.

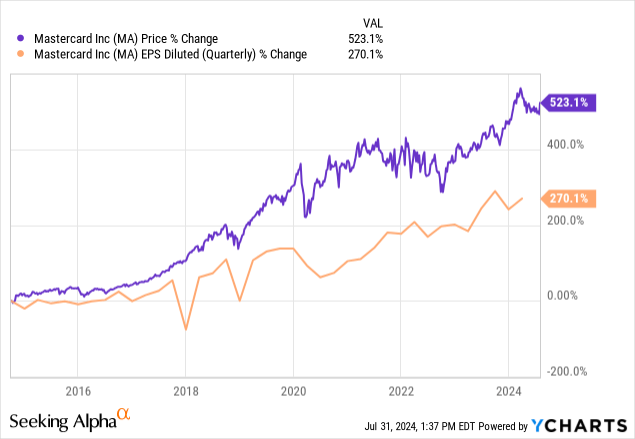

So, let’s understand one thing: the revenue mix was favorable to the company’s margins; free cash flow generation was strong, and share repurchases were significant. The consequence is easily seen: Mastercard’s EPS grew 23% YoY. As we can see, the more Mastercard’s earnings have become predictable, the more two things have happened. The stock moves more or less according to its EPS trajectory, but it slowly started trading at a premium and compounding faster than its EPS. Reliability brings with it multiple expansion.

So, why has Mastercard performed a bit better than Visa? I think the answer is its faster growth, in particular internationally.

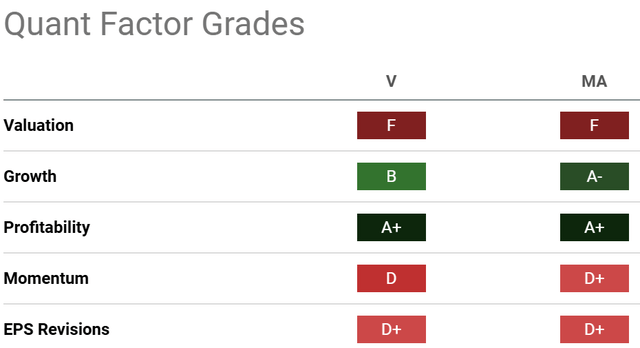

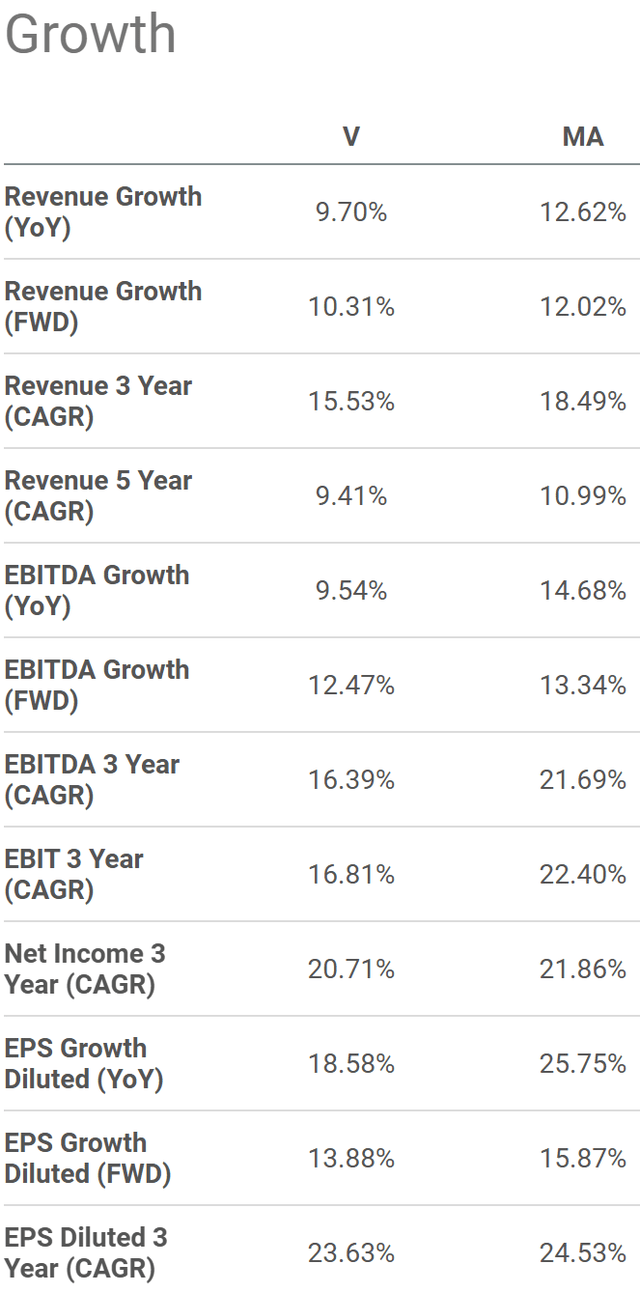

Take a look at the different growth metrics of the two companies:

No doubt both companies sport strong numbers, but we see that no matter what the metric, Mastercard is always a bit ahead. This is why Mastercard trades at a higher PE (31 vs. 26) and other higher multiples. But this difference makes sense, as reliable growth has a price.

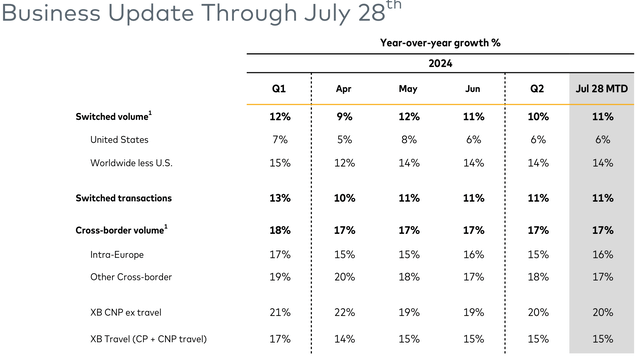

Part of this was confirmed as Mastercard even gave us a snapshot of what happened so far in Q3. Any idea of what the numbers may look like?

Well, here they are: volume is up 11%, cross-border volume is up 17%, and switched transactions are increasing 11%. This bodes well for the next quarter’s results, but, most of all, confirms that, once we get to understand Mastercard, we are rarely surprised.

MA Q2 2024 Earnings Presentation

The antitrust settlement

Visa and Mastercard recently saw their $30 billion swipe-fee settlement with U.S. merchants rejected by a federal judge in Brooklyn, NY. It seems the judge doesn’t consider this agreement enough of a relief, although it would have made the two companies reduce their swipe fees for three years and cap them for five years afterward. This lawsuit is one of the reasons why Mastercard and Visa have underperformed the market this year. Investors are a bit wary because it might lead the two payment giants to even higher fines. As much as the two have a strong balance sheet and generate several billions in FCF a year, no investor is happy to see a “splurge” of money.

So, it is unclear how this matter will end. Surely, the fine will be big. But negotiations may go on for longer than anticipated. The consequence is that, yes, surely a solution will be found and it will be costly. But we don’t know when this will happen. However, this piece of news has kept the stock from beating the market this year, and it might be an ally, rather than an obstacle, to those looking for an opportunity to invest in Mastercard.

MA stock valuation

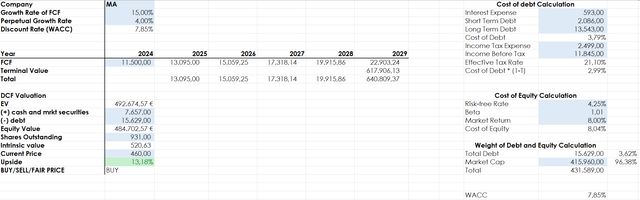

Mastercard is expensive, as we have seen. However, if we look at its compounding strength, I still find it a company offering very decent value, if not a true opportunity. I assume Mastercard can grow its FCF by 15% for the next 5 years and then use a 4% perpetual growth rate (I doubt that in 5 years Mastercard will grow its FCF at 4% annually). The market expected return is 8% and Mastercard’s WACC is calculated to be 7.85%, which I also use as my discount rate. Considering this year Mastercard is expected to report $11.5 billion in FCF (I actually expect $12 billion, but I wanted to be a bit conservative), I found out that Mastercard’s fair value is $520.

Author, with data from Seeking Alpha

However, keep in mind that I have used the TTM financials, that have not yet been updated for the quarterly report just released. As we have seen, this report improves the TTM data, so Mastercard’s fair value will be higher. Moreover, I started from a low assumption of the 2024 FCF.

All of this makes me consider Mastercard a buy that I might actually add to my portfolio in the next few days.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.