Summary:

- Morgan Stanley’s wealth management division achieved steady growth, contributing $6.6 billion in Q2 2024, providing stability amid volatile investment banking and trading revenues.

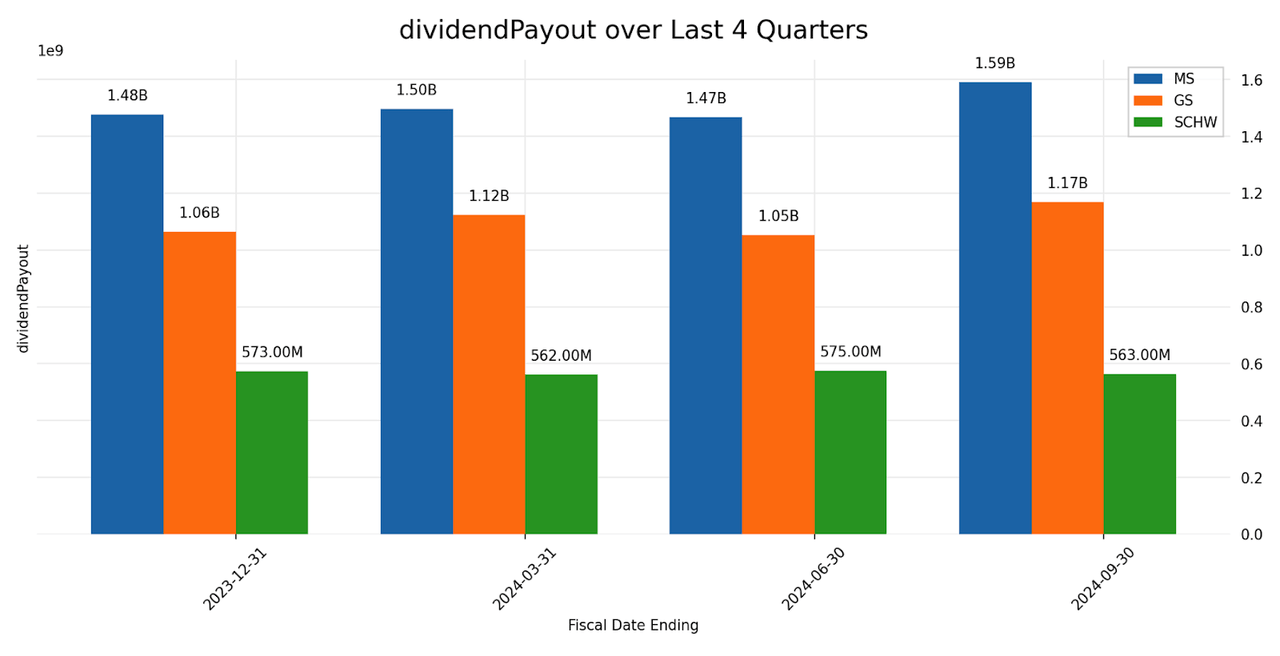

- The company returned $1.59 billion to shareholders in Q3 2024 through dividends, showcasing a strong commitment to shareholder value and confidence in long-term growth.

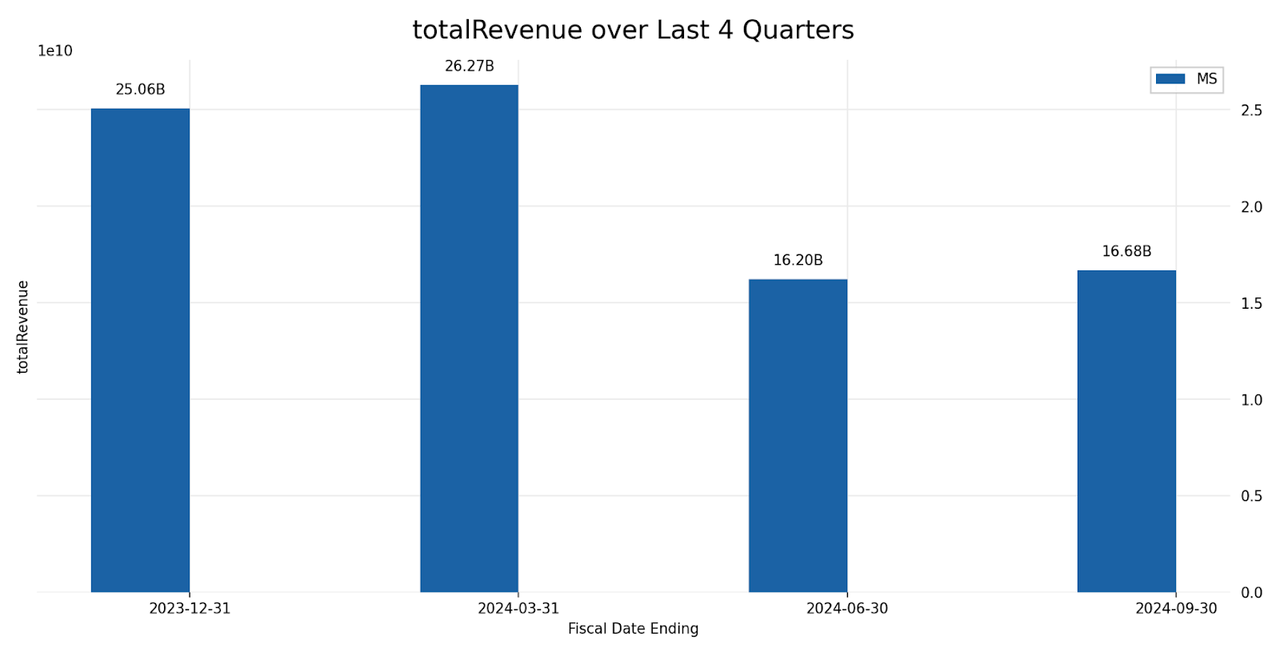

- Revenue fluctuated over the last year, peaking at $26.3 billion in Q1 2024, driven by a 15% surge in fixed-income trading activity.

- Morgan Stanley maintains a solid balance sheet, with total assets reaching $1.26 trillion and shareholder equity rising to $103.6 billion in Q3 2024.

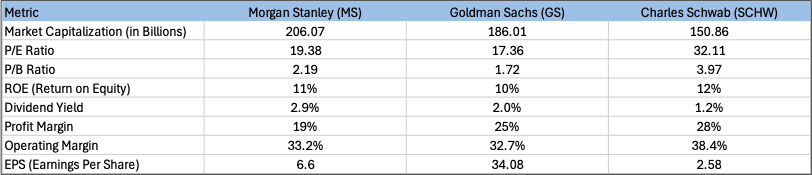

- Trading at a P/E of 19.38x and offering a 2.9% dividend yield, Morgan Stanley is fairly valued compared to peers Goldman Sachs and Charles Schwab.

Editor’s note: Seeking Alpha is proud to welcome Motti Sapir as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

RiverNorthPhotography

Why Morgan Stanley Stands Out Right Now

I think Morgan Stanley (NYSE:MS) is in a really solid position right now. Over the past year, the company has managed to hold its ground, balancing the ups and downs of the market while its wealth management business quietly steals the spotlight. Unlike some of its peers that ride heavily on the volatile waves of trading and investment banking, Morgan Stanley’s diversified approach gives it an edge. For instance, just last quarter (Q3 2024), they handed back $1.59 billion to shareholders in dividends. That’s not pocket change-it’s a real commitment to keeping investors happy and confident in the company’s long-term potential.

That said, Morgan Stanley isn’t working in a vacuum. They’re up against powerhouses like Goldman Sachs (GS) which dominates investment banking and Charles Schwab (SCHW) whose retail focus has been remarkably resilient. With interest rates climbing and economic uncertainty hanging overhead, I’d call my stance on Morgan Stanley cautiously bullish. There’s a lot to like but a few hurdles too.

Dividend Payout (Alpha Vantage API)

Morgan Stanley’s Business Playbook: A Focus on Balance

Morgan Stanley doesn’t need much introduction-it’s one of the biggest names in finance. The company operates across several key areas: investment banking, wealth management and institutional trading. They’ve done a great job positioning themselves as a diversified player, splitting their revenue between these segments so they aren’t overly reliant on one thing. Right now, they’re worth about $206 billion in market cap. Not bad for a company that’s managed to adapt so well to market changes.

What’s interesting though is the way Morgan Stanley has leaned into wealth management. For example, in Q3 2024 they hit a record with $7.3 billion in wealth management revenue which made up more than 40% of their total income. That kind of growth is a big deal because it reflects stability. Unlike investment banking where revenues can spike or crash depending on deal activity, wealth management brings in a steady stream of fees and commissions. It’s Morgan Stanley’s safety net, and they’re doubling down on it.

Financial Industry Challenges And Morgan Stanley’s Position

The broader financial services industry has had a bumpy ride this past year, and Morgan Stanley hasn’t been immune to it. Rising interest rates have changed the game for many banks and financial firms. The Federal Reserve’s aggressive stance on monetary tightening earlier this year made financing more expensive and, as a result, deal-making slowed down. That hit the investment banking revenues of firms like Morgan Stanley and Goldman Sachs.

But here’s the silver lining-when one door closes, another opens. While IPOs and mergers took a hit in Q1 2024, Morgan Stanley’s wealth management business picked up steam. Client assets in this segment jumped to $5.5 trillion, marking a 7% increase year-over-year. People wanted solid advice on where to park their money in an uncertain economy, and Morgan Stanley delivered.

Goldman Sachs and Charles Schwab, of course, aren’t sitting idly by. Goldman’s bread and butter remains investment banking, where they pulled in $1.7 billion in commissions during Q2. Meanwhile, Charles Schwab leaned heavily into its retail banking business, reporting $3.9 billion in interest income during Q3 2024. Morgan Stanley sits somewhere between the two-balancing institutional trading with wealth management-and that balance has served it well.

How Morgan Stanley Competes In A Crowded Field

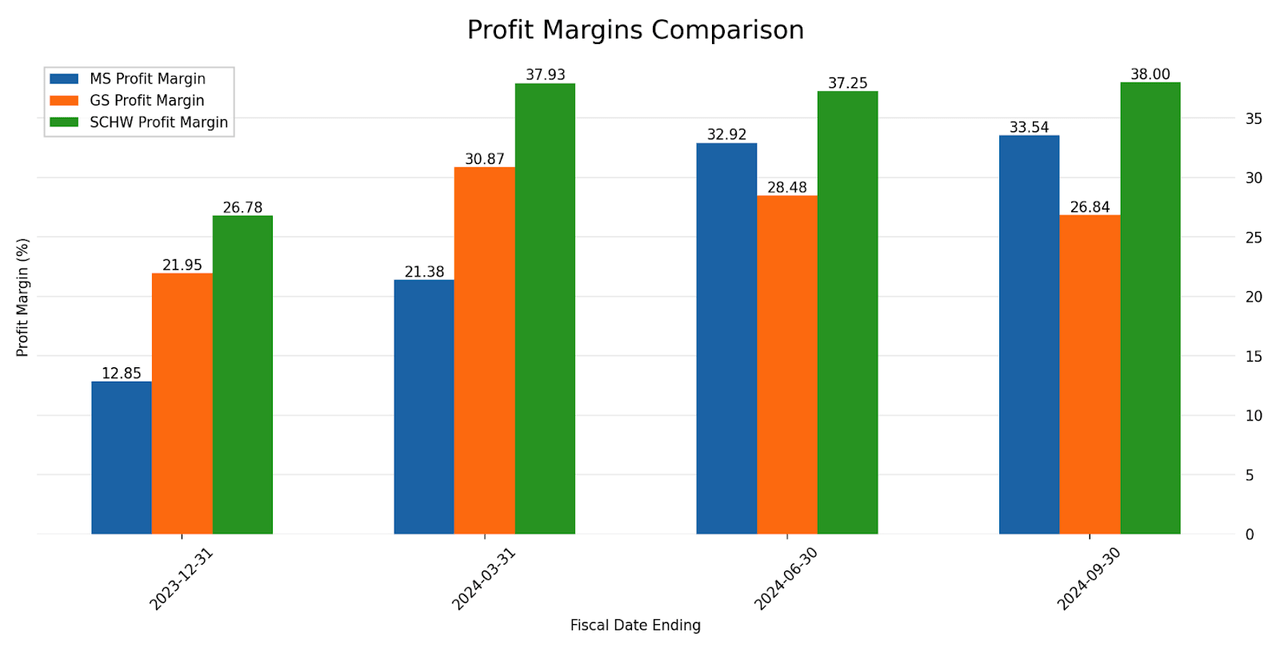

It’s impossible to talk about Morgan Stanley without mentioning Goldman Sachs. Goldman is like the older sibling who excels in investment banking and M&A deals. They managed a profit margin of 26.8% in Q3 2024 compared to Morgan Stanley’s 33.5%. Here’s where Morgan Stanley pulls ahead: their wealth management business isn’t as susceptible to market swings. In Q3 2024 Morgan Stanley reported a 13% year-over-year growth in this segment, adding a cushion to offset any weaknesses elsewhere.

Profit Margin Comparison (Alpha Vantage API)

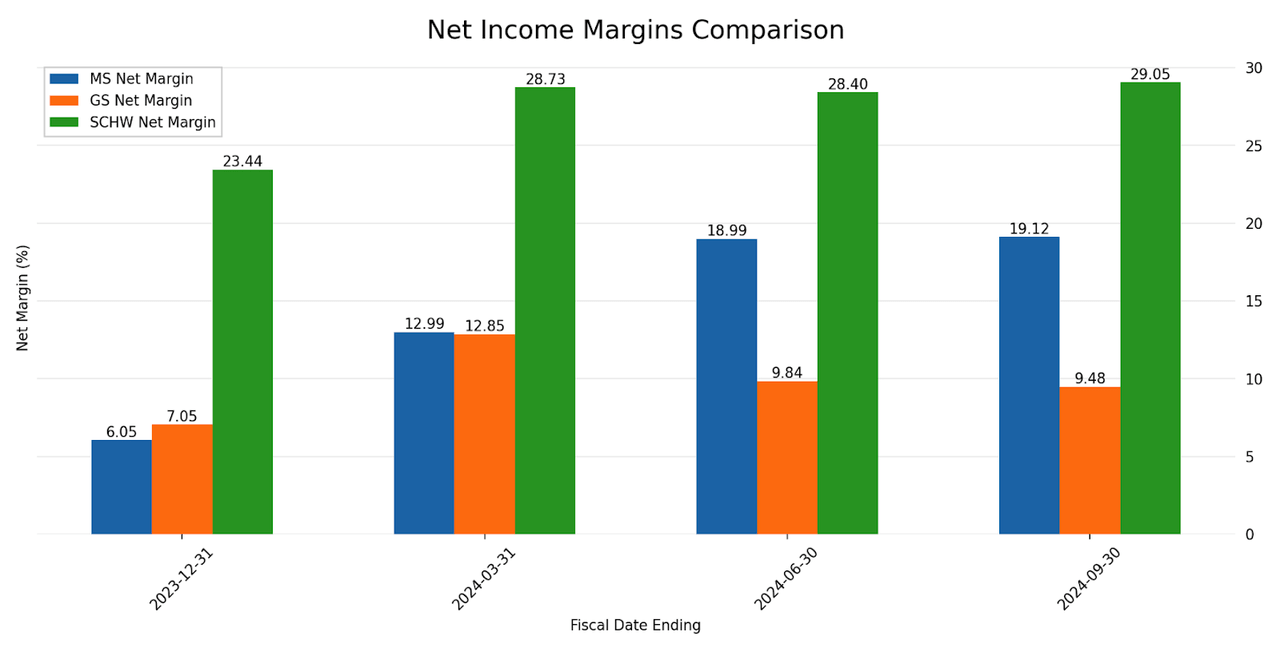

Charles Schwab, on the other hand, is a different kind of competitor. Schwab operates primarily on the retail side of finance, and they’ve been benefiting from rising interest income. They posted a hefty 29% net margin in Q3 2024, which is impressive. But Schwab lacks the diversified revenue streams that Morgan Stanley has. For example, Morgan Stanley’s net interest income hit $2.19 billion last quarter, supported by its mix of advisory trading and banking activities. That diversity makes them better prepared for whatever curveballs the economy throws next.

Resilience Through Earnings: A Deep Dive into the Numbers

Morgan Stanley’s revenue has been a bit of a rollercoaster over the last few quarters, but the big picture shows resilience. In Q4 2023, total revenue came in at $25.1 billion, largely driven by institutional trading. Then in Q1 2024, revenue jumped 5% to $26.3 billion thanks to a surge in fixed-income trading, which grew by 15%. But like any company that leans on the markets, Morgan Stanley felt the sting in Q2 when revenues dipped to $16.2 billion. IPO activity and equity trading slowed down, but wealth management saved the day with record-breaking contributions. By Q3, revenue rebounded to $16.6 billion as investment banking fees started recovering and trading stabilized.

Total Revenue (Alpha Vantage API)

On the profitability side, Morgan Stanley has been quietly improving. Their net margin climbed from 6.1% in Q4 2023 to 19.1% in Q3 2024, which is no small feat. Operating margins stayed steady at around 33%, holding their own against Goldman Sachs (32.7%) and Charles Schwab (38.4%).

Net Income Margins Comparison (Alpha Vantage API)

Cash flow is where Morgan Stanley has seen some volatility. In Q1 2024, operating cash flow swung back into positive territory at $4.3 billion, but by Q3, it turned negative again at -$17.3 billion. Despite this, Morgan Stanley has remained committed to its shareholders. They bought back $2.54 billion in stock during Q2 2024, signaling confidence in their future.

Meanwhile, their balance sheet remains solid. Assets rose to $1.26 trillion in Q3 2024, up from $1.19 trillion a year earlier. Shareholder equity also increased to $103.6 billion, proving that Morgan Stanley’s foundations are strong.

What Morgan Stanley’s Valuation Tells Us

At current levels, Morgan Stanley’s stock looks fairly priced compared to its peers. Their P/E ratio of 19.38x sits comfortably between Charles Schwab’s elevated 32.11x and Goldman Sachs’ more modest 17.36x. Morgan Stanley’s price-to-book ratio of 2.19x reflects a slight premium over Goldman but remains far more reasonable than Schwab’s 3.97x. Throw in a dividend yield of 2.9%, and it’s clear that Morgan Stanley offers a nice balance of value and income for investors.

Valuation Comparison (Seeking Alpha)

Morgan Stanley’s Hurdles And How They Can Manage Them

Morgan Stanley isn’t without its challenges. Market volatility remains a big concern. In Q2 2024, revenues from trading dropped 15% from $4.85 billion to $4.13 billion, showing just how sensitive that segment can be. Regulatory scrutiny is also ramping up, which could push compliance costs higher over the next few quarters. Rising interest rates, while beneficial for interest income, have also made borrowing more expensive. For instance, Morgan Stanley’s interest expenses hit $11.98 billion in Q3.

Competition is another factor to watch. Goldman Sachs, for example, pulled in $7.7 billion in advisory fees by the end of Q3 while Charles Schwab continues to grow its retail base. Still, Morgan Stanley’s investments in its wealth management business and new digital tools are helping it adapt to these challenges.

Final Thoughts: Why Morgan Stanley Looks Like a Winner

Morgan Stanley has proven itself to be a solid, well-rounded player in the financial sector. The company’s steady focus on wealth management has given it a reliable revenue stream even when markets get shaky. In Q3 2024, wealth management revenue grew 13% year-over-year, helping to balance slower performance in trading and investment banking. Compared to Goldman Sachs and Charles Schwab, Morgan Stanley offers a nice blend of stability, growth and shareholder returns.

While risks like rising costs and market volatility are worth keeping an eye on, Morgan Stanley’s strong financials, robust balance sheet and shareholder-friendly policies make it a smart bet for the long run. In my view, the stock is fairly valued right now, and I’m cautiously optimistic about what the future holds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.