Summary:

- Netflix’s fourth-quarter results exceeded expectations, with revenue growth in line with consensus and EPS beating estimates.

- The company added 8.76 million net subscribers, surpassing consensus estimates of 5.5 million.

- Operating margins continued to expand, contributing to the company’s strong performance.

simpson33

Netflix (NASDAQ:NFLX) announced fourth-quarter results that exceeded expectations. Revenue grew 12.5% a YoY to $8.83 billion, beating expectations by $120.38 million, and EPS came in at $2.11, missing $0.11, as the streamer added 13.1 million subscribers, well above consensus estimates of 9 million New subscribers.

The password-sharing crackdown is a huge success, as revenue is higher than pre-launch.

Management provides guidance for the first-quarter 24′, which will generate revenue growth of 13%, and expects to add net subscribers at a pace similar to Q3-23, and the operating margin will meet the 24%.

Netflix’s management has announced that it anticipates a significant boost in revenue growth, with a double-digit pace expected, through a combination of both increased subscribers and price hikes. The company is also looking to achieve a bit of operating leverage, according to management guidance. This follows Netflix’s considerable success in outpacing its competitors in the streaming services industry.

Let’s dig deeper and figure out why I reiterate a Buy rating.

Background

In October, I authored an article titled Netflix Q3 2023 Earnings Preview: What To Watch For In A Critical Quarter. The article included an in-depth analysis of the company’s performance, highlighting its unique position in the streaming industry and exploring the potential impact of the Hollywood Strike on Netflix. Additionally, the article showcased the company’s impressive margin expansion.

Let’s see how the growth acceleration, margin expansion, ARPU, and FCFs have trended, beginning with growth acceleration.

Growth Acceleration

Netflix reported revenues of $8.7B in Q4-23, representing a 12.5% YoY, beating the expectations and its management guide. The growth in the paid net subscribers was phenomenal, beating 52% of the 8.8 million new subscribers expectation, reaching 13.1 million new subscribers.

For Q1-24, the management said it expects to add a similar amount of subscribers to Q3-23, which means 1.8 million new subscribers.

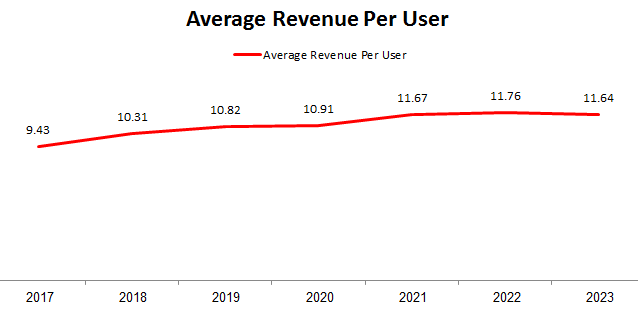

Netflix ARPU (Based on Netflix financial data)

The data indicates that Netflix’s average monthly revenue per paying membership (ARPU) has remained stagnant since 2021, when the company began cracking down on password-sharing. This suggests that Netflix may not experience the same level of subscriber growth it has seen in recent quarters. In anticipation of this, Netflix is planning a price increase for 2024. We’ll likely see an increase in ARPU during this period.

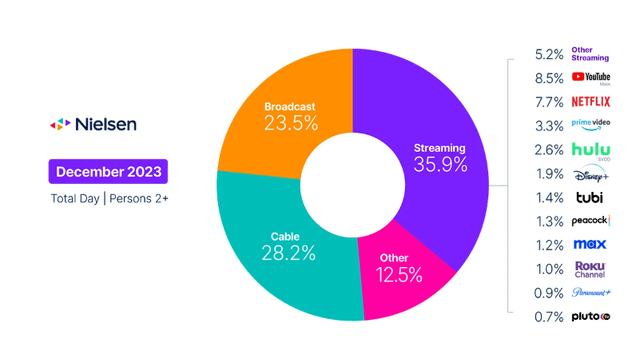

Streaming Market Share (Based on Nielsen Data)

Looking at streaming share, it’s slowed down a bit, taking 35.9% of U.S. TV screen time on December 23′ compared to 37.5% on September 23′. In addition, Netflix continues to take market share in streaming, representing 21.4% in December 2023, compared to 20.8% in Q3-23.

Netflix Q4-23 Letter To Shareholders (Netflix’s Letter)

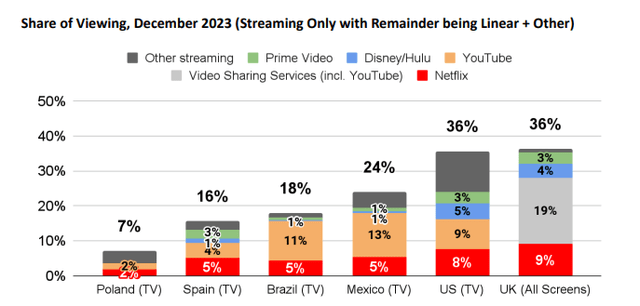

In the graph above we can see the viewing share (TV) in December 2023, in Poland Netflix has the largest market share at 18.2%, Spain is the second at 17.2%, the third place goes to Brazil with 14.3%, the USA is the fourth place with 13.1 %, the fifth place is the United Kingdom with 12.7%, but the United Kingdom should be in the lowest place because it represents in all screens, and the last place is Mexico with 11.4%.

This is possible thanks to the company’s unparalleled content offering. Netflix has the top original TV series 48 out of 52 weeks, and the top original movie 41 out of 52 weeks.

Free Cash Flow

One of the metrics that Netflix looks for is free cash flow and content investments. One of the most asked questions was: Can Netflix generate free cash flow, and can Netflix benefit from free cash flow leverage? Well, that question seems to belong in the past.

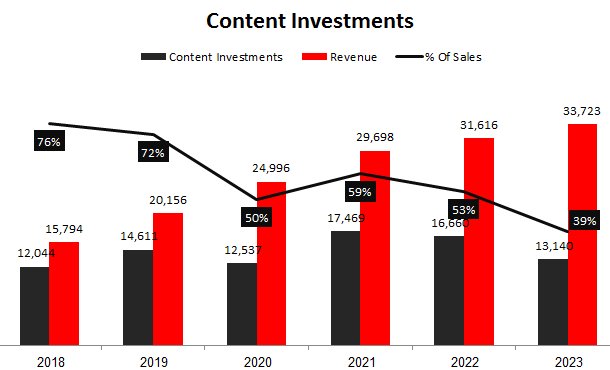

This analysis is based on data sourced from official Netflix financial documents (coupled with the author’s informed estimations and the company’s forward-looking guidance)

Content investments are the biggest expenses Netflix has, as we can see above as a percentage of revenue over the past 7 years, we can see a downward trend which is a good sign for Netflix investors. In 2023 Netflix had 13,140 million content investments, the guideline was 13,000, this allows Netflix to stand at the lowest level it has ever had, what contributed to this was the writers’ and actors’ strikes, which came to an end, and we will see a little increase in content investments in 2024.

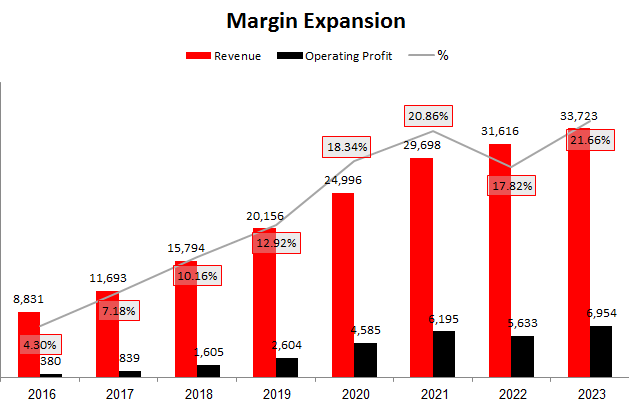

Margin Expansion

As revenues continue to rise at an extreme rate, one of the crucial things in Netflix’s long-term thesis is expanding margins.

This analysis is based on data sourced from official Netflix financial documents (coupled with the author’s informed estimations and the company’s forward-looking guidance.)

In 2023, the operating profit margin was 21.66%, an increase of 3.84% per year, and marketing and R&D expenses as a percentage of sales continued to decline, demonstrating Netflix’s clear operating leverage.

Valuation

In financial modeling, I have valued Netflix using the Discounted Cash Flow (DCF) method and set the target year as 2028. Currently, Netflix has a $6.6B FCF Adjusted for Stock-Based Compensation, but I anticipate that the company will generate $14.84B FCF in 2028. This is due to the anticipated Free Cash Flow leverage and increased operating margin efficiency.

I estimated Netflix’s target year fair value at $832 per share. This valuation is underpinned by the assumption that the company will achieve a compound annual growth rate ((CAGR)) of 11.2% in revenue between 2023-2028. Additionally, the FCF yield for the 2025 exit is 5.5%.

Netflix has a favorable market environment with many tailwinds working in its favor. These factors, combined with the potential for FCF leverage and unlimited operating leverage opportunities, make it a highly attractive investment option. Based on my analysis, I predict that Netflix will deliver a 10% annual return over the next five years.

At present, Netflix’s Fwd PEG ratio is 0.86x, which is the lowest valuation in the company’s history. Despite a 16% post-earnings upside jump, I still believe that Netflix is a buy and one of the best opportunities for 2024 and the next five years.

Risks

While I reiterate my Buy rating on Netflix, acknowledging the potential upside, it’s crucial to examine the inherent risks that could impact the company’s trajectory. Here’s a breakdown of key concerns:

1. Competition: The streaming wars are far from over. Disney+, HBO Max, Amazon Prime Video, and Apple TV+ are formidable competitors, each vying for subscriber share and content supremacy. Increased competition could limit Netflix’s subscriber growth and pricing power.

2. Content Saturation and Cost: Producing high-quality, diverse content is vital for subscriber retention and acquisition. However, content fatigue and rising production costs could strain margins and require strategic shifts in content strategy.

4. Market Saturation: Netflix has penetrated many key markets, raising concerns about reaching saturation in developed regions. Future growth might hinge on successfully navigating emerging markets with different cultural preferences and regulations.

Conclusion

Netflix defied expectations once again, exceeding Q4 revenue and subscriber growth estimates while laying the groundwork for a double-digit revenue acceleration in 2024. The password-sharing crackdown proved successful, margins are expanding, and free cash flow generation is improving. With a content library unparalleled in its reach and impact, Netflix is poised to capture even more market share and drive shareholder value.

While the stock has seen a post-earnings jump, I believe the current valuation still presents a compelling opportunity. Trading at its lowest forward PEG ratio in history, Netflix offers the potential for high double-digit returns over the next five years. Considering the company’s strong execution, robust content pipeline, and expanding operating leverage, I reiterate my Buy rating on Netflix. This is not just a good investment for 2024, but a long-term play on the future of entertainment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.