Summary:

- Nike stock plummeted over 30% after Q4 earnings, marking the worst single day drop in company history.

- Sales were up only 1% for the fiscal year, the worst growth in over two decades, leading to concerns about long-term prospects.

- Analysts downgraded Nike stock after earnings, citing poor performance and an uncertain growth trajectory.

sportpoint/iStock via Getty Images

I last reported on Nike (NYSE:NKE) at the end of March. In that article, I rated the stock as a Hold. The basis for my rating was largely related to the share valuation, but I voiced additional concerns regarding the company’s long-term prospects. While there are many pros to consider when one evaluates Nike as a prospective investment, I questioned whether the company could continue its historic 10% sales growth, and I also contended that Nike’s moat is more vulnerable than others claim.

On Thursday, Nike (NKE) provided Q4 earnings, and the stock plummeted 20% after earnings debuted. That marked the worst single day drop in the company’s history.

Sales were up an anemic 1% for the fiscal year. Excluding the years marked by COVID and the 2008 financial crisis, fiscal year 2024 marked the worst sales growth for Nike in over two decades.

At first glance, it might seem a bit puzzling that the stock took such a swoon following earnings. After all, Nike beat the Wall Street EPS estimate by a wide margin and came close to matching consensus for revenue. However, management’s commentary coupled with guidance for the coming fiscal year spoke volumes.

What Earnings Tell Us

Nike’s non-GAAP EPS of $1.01 was well above analysts’ $0.83 estimate. However,

$12.6 billion in reported revenue missed consensus by $250 million.

For the full fiscal year, Nike reported revenue of $51.4 billion. Although this was short of the $51.6 consensus, non-GAAP EPS of $3.95 beat analysts’ $3.70 estimate.

Reviewing results by category, NIKE Brand sales fell 1% to $12.1 billion, and NIKE Direct sales slumped by 8% to $5.1 billion from lower sales in NIKE owned stores as well as a drop in digital sales.

Wholesale revenues increased by 5% to $7.1 billion for the quarter.

Wholesale sales dropped by 5%, and sales of the Converse line fell a whopping 18% .

By region, North America footwear sales fell 6%, but apparel climbed 4%, and equipment sales increased by 47%.

In toto, North American sales were down 1% to $5.28 billion.

Sales of footwear in China increased 2% while apparel sales were up 5%. As in North America, equipment sales surged, jumping 28%.

Adjusted for currency, Nike recorded a 3% sales increase in China.

Although NIKE Direct sales fell 8%, total revenue in EMEA increased 1%. Sales in NIKE stores grew 1% but NIKE Digital declined 14%. Wholesale sales were up 7%.

Worldwide, sales of footwear declined by 4%, apparel sales were up 3%, and equipment sales increased by 34%. Across all categories, total sales were down by 1%.

It should be noted that while less than 5% of total sales are generated by equipment, footwear generates just over two thirds of Nike’s revenue.

On a positive note, management touted lower logistics costs that resulted in a 110-basis point increase in gross margin to 44.7%.

Since analysts were not forecasting a big surge in revenue, the 1% drop in sales and the modest revenue miss can’t explain the dramatic drop in the share price since earnings debuted.

I’ll opine that management’s guidance for a 10% decline in revenue in Q1 and a mid-single-digit percentage sales decline for FY 2025 is the primary cause of the stock’s drop.

The Pros And Cons Of An Investment In Nike

A year’s results do not an investment make, let alone those of a single quarter. One can easily argue that the firm is simply going through a rough spot, and in time it will provide investors with market-beating returns.

The company absolutely dominates the competition. As I reported in my most recent Nike article, Interbrand estimates Nike’s brand is worth $53.77 billion, and a study by Piper Sandler revealed that over a third of US teens rank Nike as their top apparel brand, and almost two-thirds of those rank Nike as their favorite footwear.

Furthermore, one should not underestimate the ubiquity of Nike’s brand when assessing the threat posed by smaller competitors. Nike has over 1,000 company stores plus another 6,000 locations operated by franchisees.

Bear with me as I insert some hopefully useful anecdotal information. A once avid runner, after a multiyear pause, I’ve worked myself back into racing condition. As I have several old injuries that can resurface, I researched the best training and racing shoes to fit my needs.

I then bought a pair of Hoka Mach 5s over the internet. Good shoe, but to my chagrin, a size 13 in this brand doesn’t quite fit me.

I then searched high and low for a retailer that carries ASIC Novablasts (the closest store carrying ASIC is about 35 miles away). I bought a pair, and I find Novablast to be a great shoe. I record faster times with the ASIC, and my old injuries don’t flare up. Furthermore, they are extraordinarily comfortable for everyday wear.

However, there is a downside to this story. That distant store only carries a couple of size thirteens, and that means I must settle for whatever color and/or style is available (uhm, one color, one style). Unfortunately, the shoes draw quite a bit of unwanted attention and comments. Let’s just say, “they have flare?”

My point being that many of Nike’s competitors have a steep hurdle to conquer to simply make their products available at the same scale as that of Nike’s.

Now consider that Morningstar reports that Nike’s revenue is more than double that of the second largest sportswear retailer, adidas (OTCQX:ADDDF), and that in 2023, Nike footwear sales were greater than Adidas, Under Armour (UAA) and Puma combined.

Veteran investors understand that scale provides advantages on several levels, lowering costs in advertising, from suppliers, and oftentimes for logistics.

However, Nike’s success also creates a problem of sorts. Nike is huge, and that makes it difficult for the company to continue to grow at a robust pace.

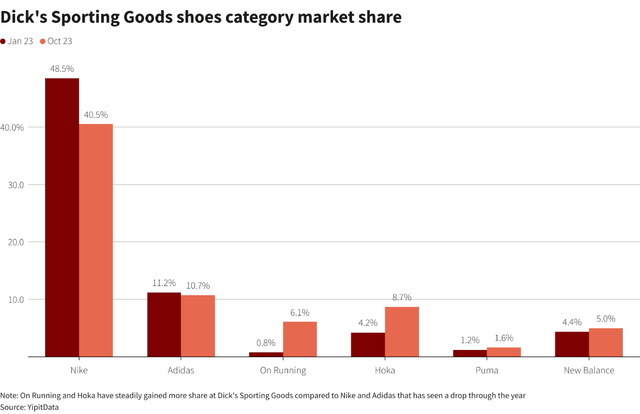

Another negative is that several brands are gaining traction. Smaller competitors are eroding Nike’s market share, and I would argue that along with the aforementioned need to grow at an ever-higher pace, these are the top problems for investors in the stock.

It’s still the undoubted leader in market share terms, but in terms of the growth profile, Nike’s performance can best be described as ‘lackluster.

Neil Saunders with GlobalData.

YipiData

In addition to the fierce competition in the space, Nike is looking to China to spur growth, and success there is far from assured.

China should remain volatile with risk of share loss to local brands, and promo posture could increase ahead, dampening margins.

Jefferies analysts

Furthermore, the footwear market is projected to grow at a moderate pace over the next few years. Statista estimates a CAGR of 3.43% for the global footwear market through 2028.

The forecast by GRAND VIEW RESEARCH is a bit more sanguine. That firm projects the global footwear market will record a CAGR of 4.3% through 2030.

Debt, Dividend, And Valuation

Investors need not worry over Nike’s financial foundation. The company’s debt is rated AA-, a high grade/investment grade rating. Cash and equivalents and short-term investments at the end of Q4 were $11.6 billion, up $0.9 billion from last year.

Nike currently yields 1.55%. With a payout ratio just below 40% and the 5-year dividend growth rate of roughly 11%, the dividend is safe and will likely grow at a robust pace for the foreseeable future.

Nike currently trades for $76.32 per share.

After the earnings report, nearly a dozen analysts lowered their price target on the stock, with J.P. Morgan downgrading Nike to a Neutral rating from Overweight and Stifel lowering the stock from a prior Buy rating to a Hold rating. Stifel also dropped its price target to $88 from $117.

Morgan Stanley dropped Nike from Overweight to Equal weight, while UBS provides a Hold rating on the stock.

Commentary from the last two rating agencies speaks volumes, with Alex Stratton of Morgan Stanley stating, “recent performance has been riddled with quarterly misses & guidance cuts” and that “NKE’s long-term growth & profitability trajectory is subsequently both unclear & lower than our prior assumption.”

Jay Sole of UBS also noted that Nike’s “…fundamental trends are much worse than we realized. Our key conclusion is there will be no quick rebound for Nike’s earnings.”.

NKE has a forward P/E of 26.15x, well below the average P/E for the stock over the last 5 years of 35.60x. The 5-year PEG ratio of 2.06x is also well below the 5-year average for that metric of 2.62x.

Is Nike A Buy, Sell, Or Hold?

There is no doubt that Nike has one of the most powerful brands in the world. The company ranks as the largest athletic footwear brand in every major category and every major market.

However, competition in this space is fierce, and sales growth for Nike is far from assured. As noted above, during the earnings call, management guided for a 10% decline in sales for the coming quarter, and a mid-single-digit percentage sales decline for this fiscal year.

I’ve made the point that one advantage Nike has over smaller competitors is the vast geographic scale in terms of the company’s brick and mortar presence. However, Nike’s share of l the digital market fell to 32.5%, versus a 34.1% share in the comparable quarter.

I’ll also use Hoka (DECK) to contrast Nike’s recent results with that of smaller competitors. While Nike’s North American footwear revenue dropped by 6% this quarter compared to Q4 of 2023, Hoka’s sales surged 34% in that same time frame.

If you take a look at Nike’s investor relations website, the first thing you’ll see, in big, bold capital letters, is “NIKE, INC. IS A GROWTH COMPANY.”

However, therein lies a problem. Arguably the greatest potential downside for investors is that Nike’s success means it takes more growth to drive the stock higher.

While I’ll readily concede that Nike is a quality company that dominates its market, I question whether it can sustain the growth rates we’ve witnessed over the past years.

I rate Nike as a HOLD.

I will add that I would not be surprised if the share price increases markedly by year’s end. However, I am largely a buy and hold investor, and I invest seeking safe, long-term results. Therefore, I don’t hold a position in NKE, and I have no intention to initiate an investment in the company for the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.