Summary:

- NIO faces consistently significant quarterly losses due to challenges in handling competition.

- NIO Inc. faces challenges in the EV industry with low market share, intense competition from rivals like Tesla and BYD, and financial concerns despite revenue growth.

- Political tensions and valuation metrics further complicate NIO’s prospects, urging potential investors to closely monitor its ability to navigate challenges and sustain profitability.

Editor’s note: Seeking Alpha is proud to welcome Supporting Souls as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

hapabapa/iStock Editorial via Getty Images

Investment Thesis

The Shanghai-based electrical vehicle (EV) and battery manufacturer, most known for their revolutionary idea of battery-swapping stations as opposed to the conventional charging stations, NIO Inc. (NYSE: NYSE:NIO), operates in an electric vehicle landscape engulfed in current challenges, including escalating competition and overwhelming quarterly losses. The company’s substantial reliance on the Chinese market exposes it to economic volatility and regulatory uncertainties. Evolving government policies, particularly those related to subsidies and incentives for electric vehicles, introduce an additional layer of risk. While NIO has demonstrated growth in electric vehicle deliveries, persistent financial concerns surrounding profitability and cash flow cast a shadow on its overall stability. Investors considering entry into the dynamic electric vehicle sector are advised to conduct a thorough assessment of these challenges. I have a bearish view on NIO stock and would advise investors to hold off on this company until it shows signs of growth sometime around late 2025 to early 2026.

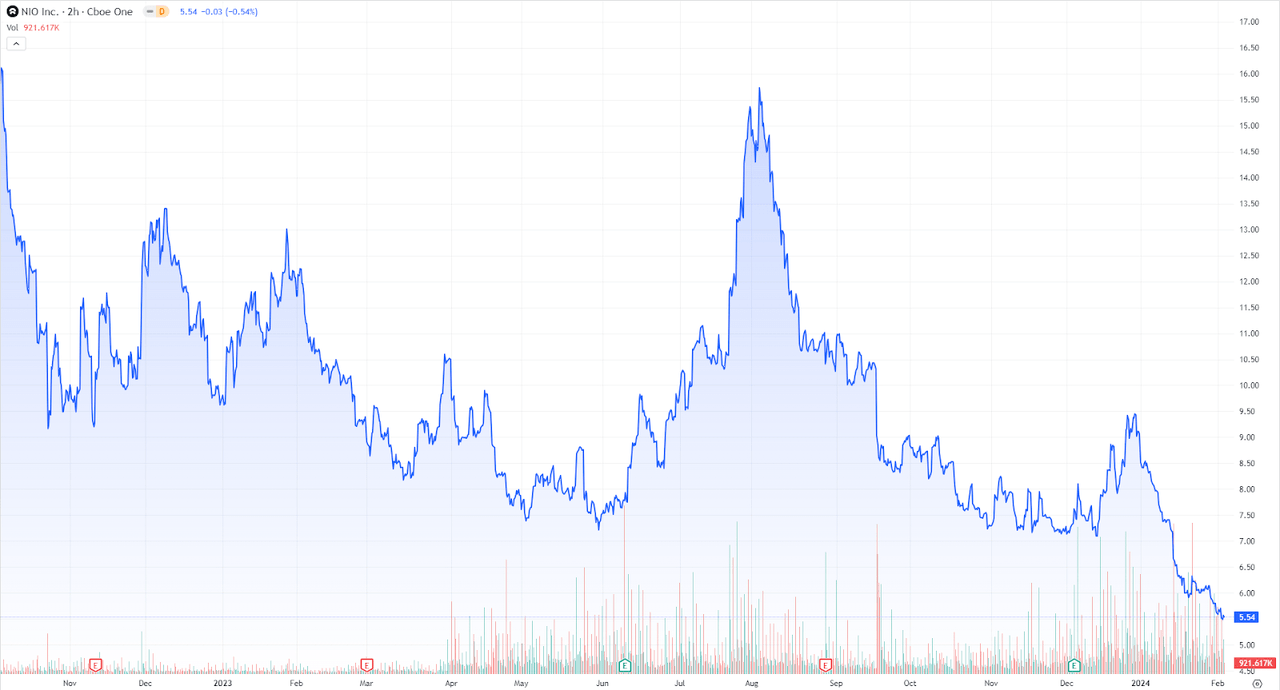

NIO Graph (Seeking Alpha)

Low Market Share in the EV Industry

NIO Inc.’s current market presence in the electric vehicle (EV) sector stands at a meager 2.1% domestically (in China) and 1.7% globally, signaling a comparatively modest position among its competitors. This lower market share raises concerns among investors, who may see it as a potential obstacle for NIO to achieve sustained profitability, particularly if challenges arise in scaling operations and optimizing distribution networks.

In contrast, NIO’s competitors show promising growth as the US-based Tesla (NASDAQ: TSLA), exhibits significant growth in the Chinese market with Tesla expanding its market share from 11% to 12% in the first 11 months of 2023, prompting plans for the establishment of a Gigafactory in Shanghai, which could lead to stunted growth for NIO within their own base of operations. Back at home, one of NIO’s most threatening rivals, BYD, with its 11% Chinese market share and 17% in the global market, makes an appearance on the world stage, investing nearly $1.3 billion in EV factories across Indonesia and other East Asian countries in addition to future expansion plans in North America, primarily in Mexico and the United States. However, one of the concerning facts for NIO is that these developments appear to be part of a larger plan; a recent article published by InvestorPlace attributes NIO’s recent poor performance to Tesla’s strategic move of reducing prices for the Model 3 and Model Y in China in a move known as penetration pricing, subsequently lowering NIO’s sales while boosting Tesla’s. Further consideration on the fact that more established EV manufacturers like Tesla and BYD, with their predatory pricing strategies and global brand recognition can exert pressure on NIO’s market share, and in a competitive atmosphere where the utilization of economies of scale often plays a crucial role, and lower market share can impact NIO’s cost structure, leading to potential limiting of their ability to benefit from economies of scale and other operational efficiencies, subsequently reducing their competitive edge. With a key selling point of the EV being sustainability and environmental-friendliness, the market demands substantial investments in research and development, manufacturing capabilities, and charging infrastructure, but a smaller market share may limit NIO’s ability to fund further research.

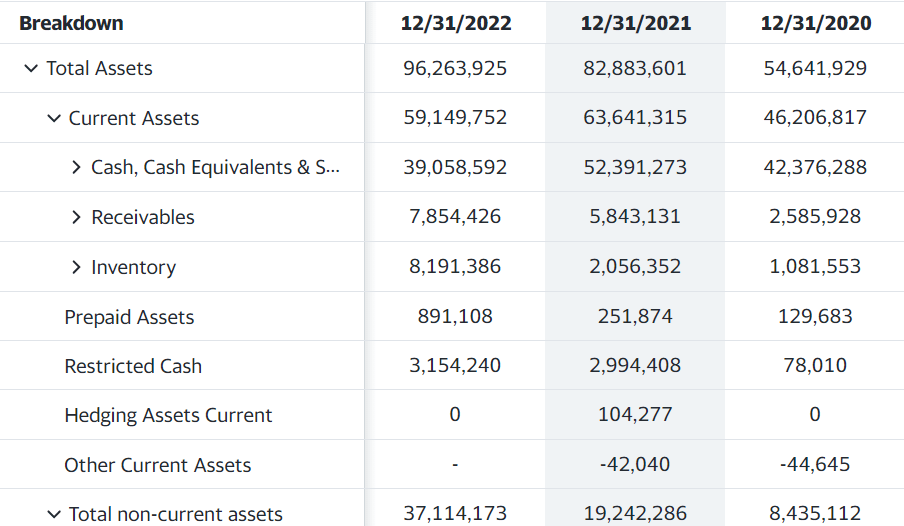

Financials

Quarterly Performance

NIO’s performance in Q3, as per London Stock Exchange Group(LSEG) consensus estimates, showed a revenue of 19.1 billion Chinese yuan ($2.7 billion), slightly below the expected 19.4 billion yuan. Despite the marginal miss on revenue expectations, the company was able to achieve positive trends. Their loss per share stood at 2.67 yuan, beating the anticipated 2.91 yuan loss and reflecting an improvement from the 3.7 yuan per share loss recorded in Q2. Additionally, the company’s revenue demonstrated a robust growth with a 26.61 percent year-on-year increase, compared to the sector median of 4.96 percent, and their 5-year average of 963.41 percent stood at over double the sector median of 436.36% indicating substantial growth within Q2. Despite this growth, they have not yet exhibited signs of profitability, as indicated by a shocking $35,000 cost per car produced in October 2023 in addition to a net loss of 4.6 billion yuan in the third quarter, marking a 24.8% reduction from the second quarter of 2023. However, it is important to highlight that, in spite of these major losses, the net loss remained higher than the corresponding period in 2022, meaning signs of possible profitability in the future. In response to these challenging market dynamics, NIO saw the need to make strategic adjustments, being forced to undertake drastic workforce restructuring by large-scale lay-offs of roughly 10% of its employees in the preceding months, with the reason cited being the “fierce competition.” Following the release of these results, NIO shares initially experienced losses but were later able to rebound and even began trading around 4% higher in pre-market sessions in the U.S. The market’s response suggests a positive sentiment, possibly driven by the company’s revenue growth and the lower-than-expected loss per share, indicating investor confidence in NIO’s ability to withstand competitive pressures and deliver positive financial outcomes.

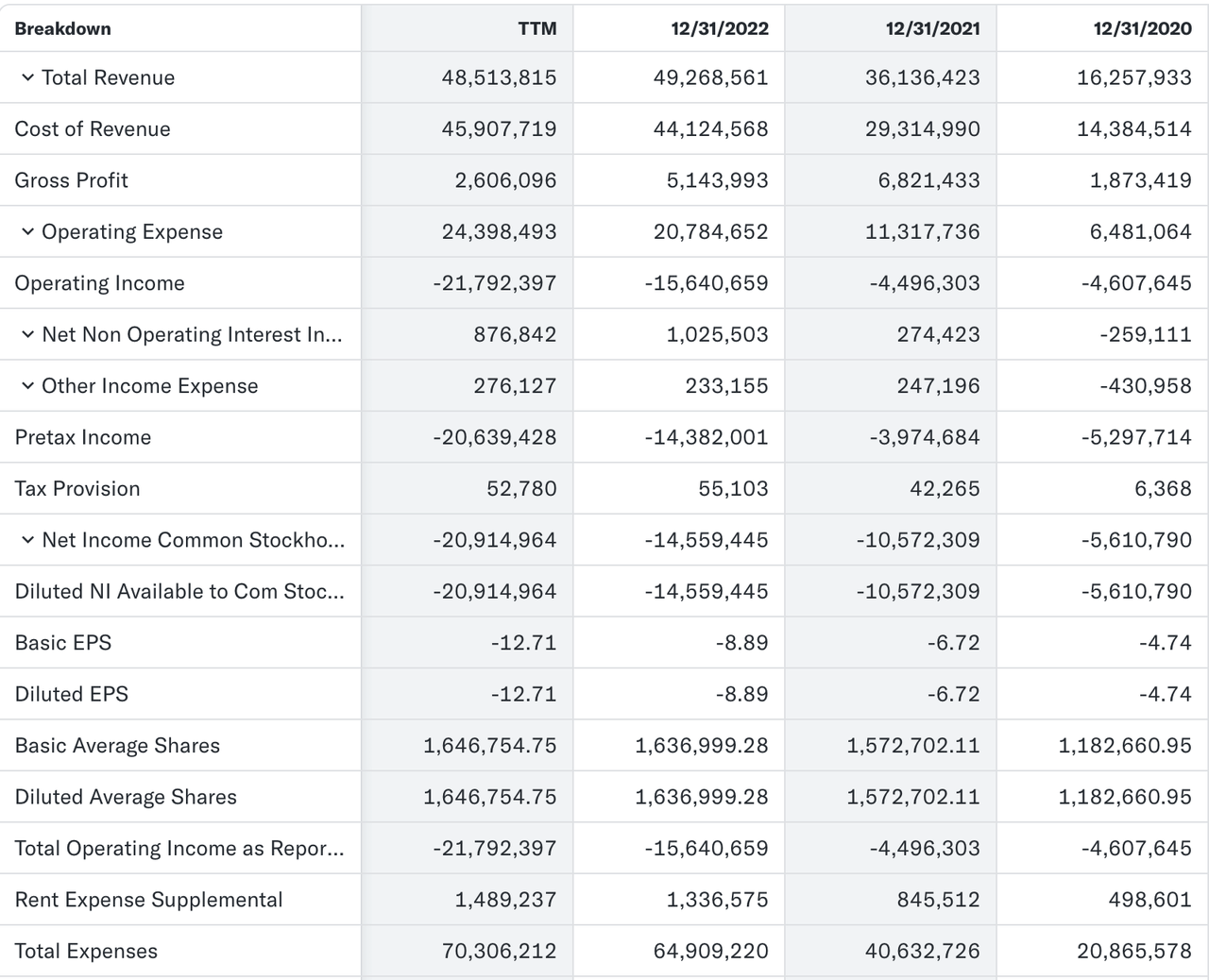

Earnings Report (Yahoo Finance)

NIO’s Performance vs. Competition

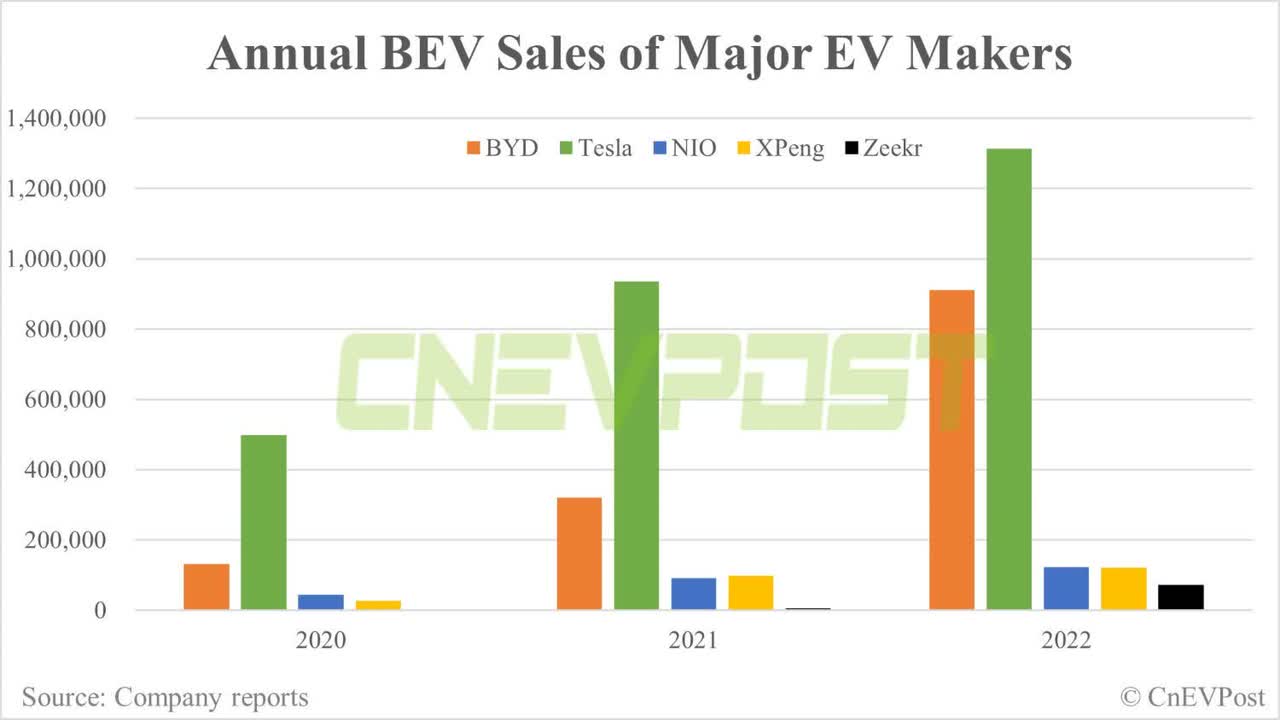

In 2023, NIO faced challenges in both China’s Electric Vehicle market and on the global scale as shown by the notable performances of their competitors. As previously stated, NIO attained the ninth position, securing a 2.1% market share, and recorded retail sales of 50,045 Battery Electric Vehicles (BEVs) in Q4 and an annual total of 160,038 units. However, their competition showcased robust growth with Tesla demonstrating an impressive 37.3% year-over-year increase, reaching 484,507 units sold in Q4 and a total of 1.81 million in 2023, just barely exceeding its 1.8 million target while securing the second position with a 12% market share. NIO’s larger and other Chinese-based competitor, BYD, surpassed both Tesla’s and NIO’s global sales in Q4, and claimed the top spot in December with 526,409 car retail sales, earning them a 31.8% share of the EV market. Additionally, the recently founded GAC Aion and Li Auto held the third and seventh positions, respectively, further intensifying the competitive dynamics. If NIO continues to be outperformed this could lead to not only potential shifts in consumer preferences, putting NIO at a competitive disadvantage, and impacting its market positioning, but also erosion of consumer loyalty, diminished investor confidence affecting stock performance, and limitations in influencing industry standards and innovations. To combat this, NIO must strategically address these challenges to secure its market position, foster investor confidence, and continue innovating within the dynamic EV industry.

CnEVpost

Impact of Politics

As we continue to analyze NIO’s potential as an investment, it’s imperative to consider the political situation within China and how its development will affect the global automobile market. Being a major one of the largest EV and battery producers in the market, the Chinese government has proven eager to have a domestic dominant force in the EV field, leading to large subsidies such as a $1 billion investment in October of 2023 when NIO was facing the previously mentioned loss of $35,000 per car produced. On the other hand, European and North American policies have continued to keep NIO afar in favor of other producers. This was most recently brought to light by NIO’s public statement addressing the fact that Tesla is allowed to freely compete in the Chinese car market while NIO faces high barriers to entry within US markets. The US’s decisions however can also be attributed to the economic situation surrounding NIO as American and European car dealers may simply not want to take risks associated with NIO’s already low sales volume and deliveries in Europe, combined with increasing concerns that the European Commission is considering imposing tariffs to protect EU producers against Chinese-manufactured EVs that it says are “benefiting from state subsidies.” Altogether, the increasing political tension between the Chinese government and Western powers has made its way to the car industry, essentially placing definite limits on NIO’s growth prospects and halting their ambitions.

Valuation

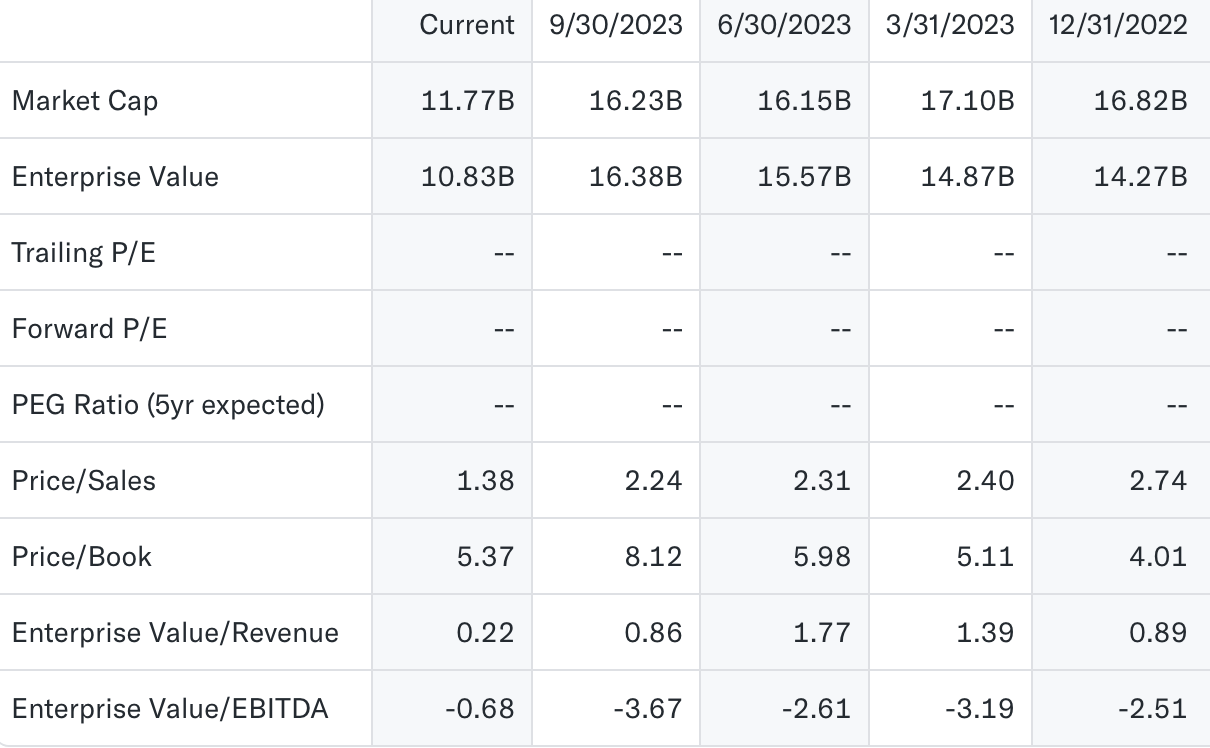

At a current stock price of $4.30 and a price-to-earnings (P/E) ratio of -2.37, NIO faces significant challenges in achieving profitability. Its enterprise value has significantly decreased from approximately $16.5 billion in Q3 to nearly $8.22 billion recently, largely due to a stock drop and $4.53 billion in debt. This decline has increased pressure from investors to deliver on other valuation metrics, an expectation NIO has not yet fulfilled due to limited cash flows. NIO’s price-to-book (P/B) ratio has fallen to 5.37, a 34% decrease from Q2. In comparison, Chinese competitors Xpeng (NYSE: XPEV) and Li Auto (NASDAQ: LI) boast P/B ratios of 1.91 and 3.76, respectively. This indicates that NIO is valued higher relative to its assets compared to these competitors, but its higher P/B ratio suggests skepticism regarding its ability to thrive in competitive pricing environments and expand aggressively through building a European dealer network as initially hoped. NIO’s significant year-on-year revenue growth of 26.61%, well above the sector median, indicates its potential, but achieving sustained profitability and expanding market share are crucial to justify its current valuation. Innovative solutions like battery-swapping stations could differentiate NIO, but investors should closely monitor its ability to scale operations and manage competitive pressures.

Yahoo Finance

Yahoo Finance

The Bottom Line

In summary, NIO’s recent financial performance, while exhibiting commendable revenue growth and strategic measures to enhance efficiency, raises concerns among investors due to the sheer intense competitiveness within the EV market.

The company’s Q3 net loss of 4.6 billion yuan and a workforce reduction of 10%, underscore the challenges it faces in maintaining a robust financial position. Investors should exercise caution given these developments. Furthermore, the highly dynamic nature of the EV sector, coupled with NIO’s recent strategic adjustments, will require a thorough assessment of its financial stability and competitive positioning. While the company has demonstrated resilience, the bearish outlook indicates an emphasis on potential hurdles in a disproportionately blossoming, fiercely contested market.

In light of these considerations, potential investors should adopt a watchful stance. A delayed investment into NIO until late 2025 or early 2026 allows for a more comprehensive evaluation of the company’s response to external challenges, cash flow sustainability, and its ability to navigate the competitive landscape. This careful approach aligns with the inherent volatility of the EV industry (NIO’s beta value is 2.01, two times the S&P’s standard 1.0), providing investors with a strategic advantage in making well-informed investment decisions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.