Summary:

- Investing in biotech and pharma stocks is certainly not for everyone, as these companies are vulnerable to various external risks.

- I turned bullish on Pfizer last January based on several reasons, including the expectations for a resumption in buybacks and the company’s strategy shift to focus on profitable growth.

- A couple of days ago, Vaxcyte, a clinical-stage biotech company, reported promising results in a Phase 1/2 trial for its pneumococcal vaccine, threatening Prevnar, Pfizer’s blockbuster drug.

- In this analysis, I look at the next steps for Vaxcyte to commercialize the vaccine and assess the threat it poses to Pfizer’s financial performance.

JHVEPhoto

Investing in stocks is not for the faint-hearted. Investing in biotech stocks is certainly not for everyone. There are a lot of external factors at play determining the profitability of a biotech company, and even the biggest players in this industry are not immune to regulatory and competitive threats. As a growth investor, though, it is imperative for me to be comfortable with the risks associated with biotech companies, which is why I have invested in a few interesting companies in this space.

Last January, I turned bullish on Pfizer Inc. (NYSE:PFE) as I found the company attractively valued with improving prospects for a resumption in buybacks. Changing priorities of Pfizer to focus on profitability improvements, CEO Bourla’s promises to embrace a more shareholder-friendly capital allocation framework, and the company’s strong pipeline which includes a few drugs with blockbuster potential are some of the other reasons behind my bullish stance for PFE. Pfizer stock is up a meager 1.25% since then, nothing to write home about.

On September 3, Vaxcyte, Inc. (PCVX), a clinical-stage biotech company focused on developing novel protein vaccines, published new data from its experimental VAX-31 vaccine in a clinical trial, showcasing impressive results that threaten market leader Prevnar 20, developed by Pfizer. Although PFE was unmoved in the face of this new development, I thought it’s best to dive deeper to understand the real threat posed by Vaxcyte.

Introduction

The pneumococcal vaccine market is a critical sector of preventive medicine focusing on pneumococcal disease, a prominent reason for pneumonia, meningitis, and sepsis. This market is currently dominated by a few drugs developed by two leading pharmaceutical companies.

- Prevnar 20 developed by Pfizer.

- Prevnar 13 developed by Pfizer.

- Vaxneuvance developed by Merck & Co., Inc. (MRK).

- Capvaxive developed by Merck.

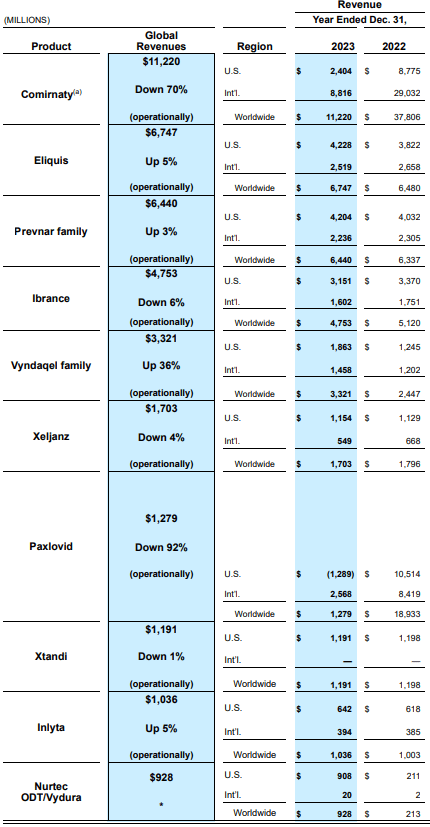

Prevnar, which recorded revenue of $6.4 billion in 2023, is the leading product in the pneumococcal treatment/prevention market today, followed by Vaxneuvance and Capvaxive which, together, brought in over $1.1 billion in revenue last year.

Vaxcyte’s VAX-31: A New Contender

Pneumococcal disease caused by Streptococcus pneumoniae is a vaccine-preventable disease that results in pneumonia in children aged five years and below and is a part of bacterial meningitis in the United States. Vaxcyte is working on a wider spectrum of vaccines to combat this disease. VAX-31, which is thought of as the most advanced pneumococcal conjugate vaccine (PCV) being developed, targets invasive pneumococcal disease (IPD) in infants and adults to cover greater than 95% of adult serotypes over the age of 50 years in the U.S.

Vaxcyte, with no approved product commercially on the market, was conducting one of its trials assessing the safety of the vaccine against IPD on 1,015 healthy people aged 50 years and above. In these Phase 1/2 trials, VAX-31 induced strong immune responses against all 31 serotypes at each dose used, with higher doses meeting or exceeding regulatory immunogenicity criteria.

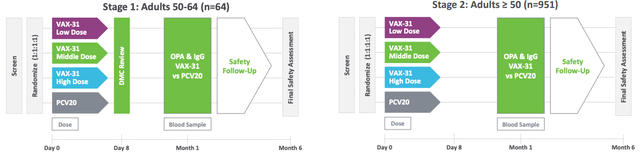

Exhibit 1: VAX-31 Phase 1/2 study design

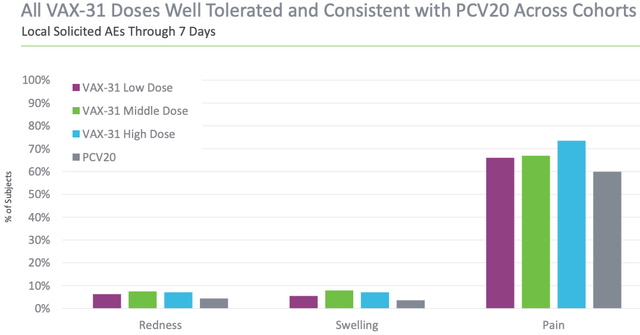

The vaccine also showed safety profile response approaches that are almost as good as the responses from Prevenar 20 by Pfizer, thereby positioning itself as a strong competitor to Pfizer in the future.

What’s Next For Vaxcyte?

Jefferies analyst Roger Song noted the results were “straightforwardly impressive.” Immediately after the announcement, Vaxcyte stock rose nearly 35%, increasing the company’s market value by more than $4 billion. Many analysts are turning positive about VAX-31, including David Risinger of Leerink Partners, who believes this vaccine will be a “category killer” for pneumococcal vaccines with a possibility of taking a dominant share of the market.

Vaxcyte intends to begin a core, non-inferiority Phase 3 study with top-line results for safety, tolerability, and immunogenicity expected by 2026. A Phase 2 trial of VAX-31 for infants will start in Q1, 2025, subject to the favorable review of the Investigational New Drug application. Should these studies be successful, they will set the stage for a biologics license application where VAX-31 is likely to provide better protection against IPD for adults over 50 years than available standard-of-care vaccines.

How Big Of A Threat Is VAX-31 To Pfizer?

The pneumococcal vaccine market has so far been dominated by two large pharmaceutical companies; Pfizer and Merck. The Prevnar brand by Pfizer is home to Prevnar 13 and Prevnar 20. Pfizer received FDA approval for Prevnar 20 in 2023 which has been a significant revenue driver for the company since then. In 2023 alone, Prevnar generated $6.4 billion in revenue for the company.

Given that VAX-31 designed by Vaxcyte has a comparable safety profile and wider serotype profile relative to Pfizer’s offering, the new vaccine is likely to emerge as a major threat to Prevnar if it is commercialized (which is a few years away at least).

Exhibit 2: VAX-31 and Prevnar 20 tolerance across cohorts

If VAX-31’s performance remains steady and stable in the demanding Phase 3 trials scheduled for 2025 with first data readouts expected in 2026, investor sentiment toward Pfizer is likely to take a major hit given Prevnar’s important contribution to company revenue. As illustrated below, the Prevnar product family was the third-largest contributor to Pfizer’s revenue in 2023, behind Comirnaty (Covid vaccines) and Eliquis.

Exhibit 3: Pfizer revenue by product

10-K

Prevnar 13 is patent-protected in the U.S. through 2026, but more importantly, recently approved Prevnar 20 is patent-protected through 2033, leaving ample time for Pfizer to enjoy returns from its research expenses for Prevnar. However, the emergence of a formidable candidate may hinder the growth expectations of the company in the coming years.

The Growing Pneumococcal Vaccine Market

The U.S. market for pneumococcal vaccination is set to grow at an approximate CAGR of 3.9% through 2030 while the global market is projected to grow at a CAGR of 6.2%. The market is about $8 billion in annual sales. Analysts expect the opportunity to surpass $10 billion in sales in the coming years. With a 93.1% share, the pneumococcal conjugate vaccine (PCV) segment is expected to show robust growth. This expected growth will stem from government campaigns and conducive regulation, with new vaccines such as Prevnar 20 making inroads and innovative developments such as VAX-31 driving more awareness.

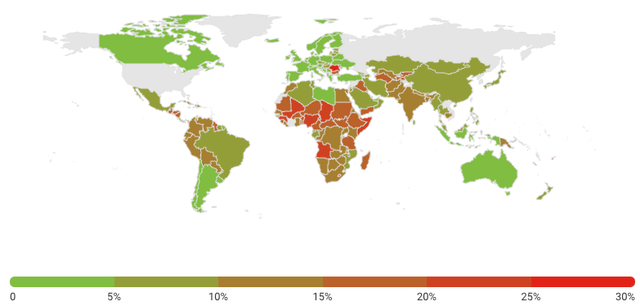

According to UNICEF data, pneumonia kills more children under 5 years than any other infectious disease – more than 2,000 deaths per day. The good thing is that these deaths could be avoided through proper vaccination. As illustrated below, a higher percentage of pneumonia-related deaths occur outside of the U.S. and other developed markets, as developed markets are light years ahead when it comes to vaccinating children.

Exhibit 4: Percentage of deaths caused by pneumonia in children under 5 years of age (2021)

The high prevalence of pneumonia among children is likely to trigger a major growth in the vaccination market, as government initiatives across the world have resulted in more awareness of preventing this infectious disease through proper vaccination. Given the long runway for growth in this market, maintaining a dominant position is likely to result in handsome financial rewards, which is why Pfizer investors should monitor the threat posed by VAX-31.

Takeaway

Vaxcyte’s VAX-31 has the potential to become a game changer as it sets out to change the landscape of the pneumococcal vaccine market and, for the first time, challenge Pfizer’s supremacy. Although there is no immediate threat to Pfizer, as a Pfizer bull, I am monitoring VAX-31’s progress very closely to determine whether I should revise my expectations for Pfizer’s long-term revenue growth under a scenario where VAX-31 takes market share from Pfizer before the latter enjoys the commercialization of a new blockbuster drug.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.