Summary:

- Rivian Automotive, Inc. forged intraday gains of almost 10% on Tuesday on signs that consumer discretionary stocks are finding a bottom, before paring some of the gains mid-week on hawkish Fed sentiment.

- Rivian’s stock continues to reflect cautious investor optimism over Rivian’s prospects on ramping-up production sufficiently to drive gross profitability by next year.

- While Rivian stock is priced at a discount to peers on a multiple-based approach at current levels, a deeper dive into its terminal value might imply otherwise.

hapabapa

Rivian Automotive, Inc. (NASDAQ:RIVN) stock continues to hold onto some of its intraday gains of as much as 10% earlier this week (June 13) to outperform its EV peers, including industry leader and current market darling Tesla (TSLA). RIVN stock’s momentum this week has largely defied its muted performance since the short-lived rally that followed better-than-expected first quarter results in early May. The market’s optimism on Rivian’s reaffirmed full year production guidance – which suggests anticipation for continued improvements in production ramp-up and, inadvertently, profit margins to further narrow losses – has also largely faded, with looming recessionary pressure overshadowing the underlying business’ prospects.

Recall that much of the Rivian stock’s luster from earlier days has since diminished on the back of acute supply chain constraints over the past year, which roiled the broader auto industry and stifled the electric vehicle (“EV”) startup’s growth aspirations and ability to scale productions. And an ensuing monetary policy tightening campaign enforced by the Fed to temper inflation has only exacerbated the decline in value of Rivian’s prospects. Meanwhile, the deteriorating macroeconomic backdrop also continues to spur concerns over demand risks within the foreseeable future, with rising competition from better-funded incumbents levelling out Rivian’s prospects for a first-mover advantage in electrifying popular passenger vehicle segments in the U.S.

That said, the stock’s gains this week likely come on the heels of improved inflation data that points to potential for further moderation in long-end Treasury yield and, inadvertently, the appeal of Rivian’s valuation prospects, which are underpinned by its cash flows that will be realized further out in the future.

Policy-sensitive front-end Treasuries sold off Wednesday, while longer-date bonds rallied, after Fed officials indicated that they’re prepared to raise interest rates by another half-point this year following the first pause in the central bank’s 15-month hiking campaign. That sent the yield-curve inversion, as measured by the gap between two- and 10-year securities, to more than 90 basis points — a level last seen in March — and approaching this cycle’s 109 basis point extreme.

Source: Bloomberg News.

The stock’s ability to still hold some of its outsized gains earlier this week also implies market repricing of incremental value attributable to the favorable forward fundamental prospects outlined by Rivian, which had previously been overshadowed by uncertain market conditions. However, we remain incrementally cautious on the durability of the stock’s recent gains, given a lack of clarity on Rivian’s longer-term capital structure and trajectory to profitability still. This is expected to increase the stock’s vulnerability to volatility in tandem with broader market movements amid the uncertain macroeconomic climate.

Is Rivian’s Q1 2023 Outperformance Durable?

Rivian’s earnings beat during the first quarter, alongside a reaffirmed full year production target of 50,000 vehicles, were key highlights in its latest quarterly report.

Margin Expansion

Specifically, the company narrowed losses to $1.3 billion in the first quarter – or -$1.25 per share – which outperformed consensus estimates by more than 20%. Much of the margin improvement were driven by a reduction in stock-based compensation, while management alludes to continued “focus on driving cost-efficiencies” and ongoing production ramp-up of its existing EDV and R1 platform vehicles for an anticipated inflection to positive gross profit by the end of next year. In addition to cost optimization, Rivian’s roadmap for expanding its vehicle average selling price ahead will also be key to its longer-term margin expansion efforts.

1. Cost Optimization

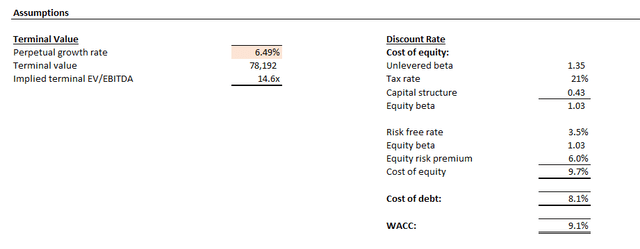

Rivian’s focus on optimizing costs amid tightening financial conditions was most prominent in the reduction of its SBC (stock-based compensation) spend during the first quarter.

Author, with data from Rivian SEC filings

Specifically, SBC as a percentage of revenue has decelerated to mid-double-digits from the prior year, and is expected to moderate further with recent job layoffs across operating functions spanning R&D and selling, general and administrative, sparing only those on the assembly line as Rivian continues to prioritize production ramp-up and improving visibility into its longer-term profitability roadmap.

To deliver over the long-term, we must focus our resources on ramp and our path to profitability while ensuring we have the right set of future products, services and technology.

Source: Rivian CEO RJ Scaringe from Bloomberg News.

Looking ahead, ramping up productions of its R1 and EDV platform vehicles remain the key focus at Rivian, and will be the critical link to further improving its cost structure towards positive gross margins next year. Specifically, management has highlighted “greater volume and utilization of [Rivian’s] installed capacity” as a driver for half of the cost reductions from now until 2024 when gross margins are expected to turn positive. Given its guided production output of 50,000 vehicles this year, Rivian is expected to double utilization at its current Normal manufacturing facility, effectively reducing the “fixed cost per vehicle” through economies of scale.

In addition to ramping up productions, the recent completion of retooling its production line to accommodate the Enduro motor platform and LFP battery packs will enable further cost savings, which combined with improving volumes would further bridge current losses to gross profitability by next year. As discussed in our previous coverage, the Enduro powertrain is developed in-house by Rivian and enables a substantial reduction to material costs.

The Enduro motor configuration is already being incorporated into the EDVs currently in production, alongside the lower cost LFP battery packs which will become a standard for Rivian’s commercial line-up. The Enduro-LFP powertrain has enabled Rivian to realize substantial cost savings through a 25% reduction in the bill of materials for EDV platform vehicles, which will likely have a more evident impact on the company’s consolidated margins as production volumes ramp-up for the commercial line-up.

The same combination will be incorporated across the R1 platform starting in the current quarter, which will effectively become the “dual-motor” option to complement the consumer vehicle line-up’s existing quad-motor configuration. In addition to BoM savings, the Enduro configuration will also help Rivian diversify its supplier base from Bosch, its electric motor vendor for the quad-motor R1 platform models, and mitigate the company’s exposure to persistent supply chain constraints.

2. Increasing ASP

Another key driver of continued margin expansion towards gross profitability by 2024 will be the gradual increase in vehicle ASP. Recall that Rivian has increased prices across its R1 platform vehicle line-up for pre-orders made after March 1, 2022. And Rivian is starting to “come off of those orders and into newer orders” made at the post-March MSRP, which will shift its ASP upwards going forward and contribute further to ongoing margin expansion efforts:

…the other element is the growth in post-March 1 orders or as [CFO Claire McDonough] noted, the pre-March first orders have a lower price and as we start to come off of those orders and into newer orders, that’s going to naturally start to shift pricing up, we’re already seeing that in Q1 of this year. So those two together give us a lot of confidence in ASP growing over time for the R1 platform.

Source: Rivian 1Q23 Earnings Call Transcript.

In addition to ramping up the start of delivery on higher priced pre-orders, Rivian is also preparing for the launch of R1 platform vehicle variants on the Max battery pack, which will come at a higher MSRP to further its growing ASP. Specifically, the R1 platform vehicles currently come with a Large pack option that offers up to 328 miles of range per charge for an additional $6,000 to the $73,000 and $78,000 starting MSRPs for the R1T pick-up truck and R1S SUV, respectively.

Meanwhile, the Max pack, which is expected to reach 400 miles of range per charge in the R1T and 390 miles in the R1S, will add at least $16,000 to the base vehicle MSRP. With the packs expected to enter start of production and vehicle integration later this year, the related margin contributions from the higher priced configuration are likely to become more prominent in 2024, in line with management’s expectations for gross profitability before the end of next year and further expansion of the figure to 25% over the longer-term.

We continue to target positive gross profit in 2024…We see a clear path to our approximately 25% gross margin target, high teens EBITDA margin target and approximately 10% free cash flow margin target.

Source: Rivian 1Q23 Earnings Call Transcript.

Reaffirmed Production Guidance

In addition to Rivian’s roadmap to profitability, management has also reiterated the company’s full-year production target of 50,000 vehicles despite the slow start to the year. Specifically, Rivian had only produced 9,395 vehicles during the first quarter, down from 10,020 during the fourth quarter. The lower volumes were largely attributable to the complete shutdown of the EDV platform production line during the most part of the first quarter for implementation of the Enduro drive units and reconfiguration for the LFP battery packs, and was in line with management’s expectations. The reiterated full year production guidance implies significant ramp-up of output volumes through the remainder of the year, likely helped by improved production efficiencies from the Enduro drive units:

Our Enduro production line is our first use our internally developed plant software platform designed to aid in the rapid bring up of equipment and our robotics. This platform offers greater control over our equipment and visibility into thousands of data points across all parts of the manufacturing process.

Source: Rivian 1Q23 Earnings Call Transcript.

Looking ahead, Rivian remains more than 40,600 vehicles out from its reaffirmed full year production guidance of 50,000, which would imply an average weekly production run-rate of more than 1,040 vehicles, or a 35% improvement from the fourth quarter. We believe the 50,000-unit production target is achievable, considering a similar rate of production ramp-up efficiency observed over the past year at Rivian, which will likely improve further with the integration of easier to produce Enduro drive units across both the EDV and R1 platforms. The ensuing scale from continued production ramp-up towards 50,000 units by year-end will be key to improving utilization at Rivian’s Normal facility as discussed in the earlier section, which would be critical to driving further margin expansion and, in advertently, narrower losses.

Management’s confidence in the full year production target is also in line with broader observations of easing supply chain constraints across the auto industry, removing a significant overhang that has upended its production efforts last year. And consistent progress in ramping out output volumes will also be critical to driving leverage for Rivian in negotiating for both supply availability and pricing going forward, which will be critical to driving growth and further margin expansion.

…the vast majority of our bill of materials from when we started production, were negotiated in contracts in the 2018, 2019 time-frame. So that was a few years before we started production. Certainly, we didn’t have the negotiating leverage that we have today. And as we wind the clock forward through to today, the level of excitement and engagement that we have from suppliers is – it’s absolutely night and day. So there’s a tremendous amount of passion to drive towards – help us drive towards profitability.

Source: Rivian 1Q23 Earnings Call Transcript.

Fundamental Analysis Update

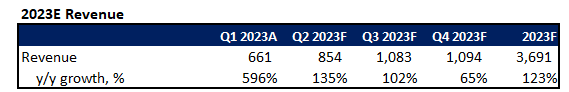

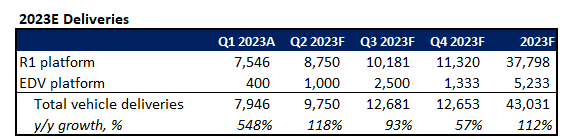

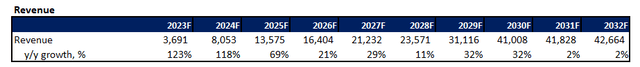

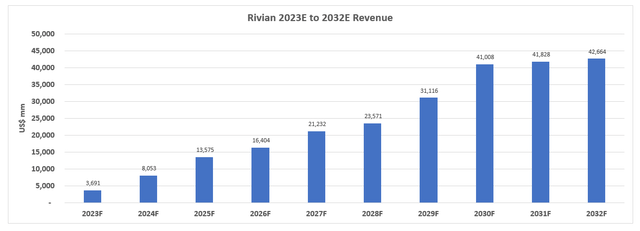

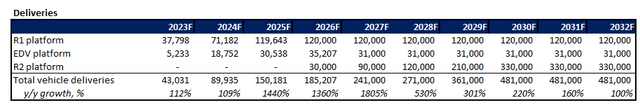

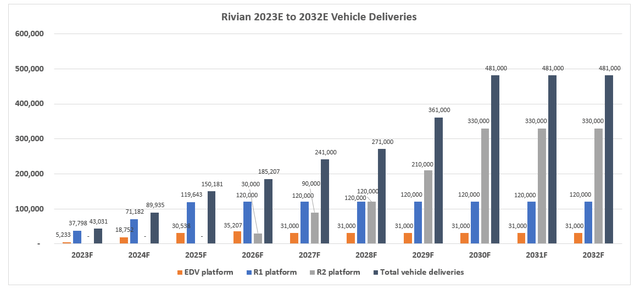

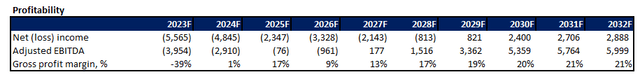

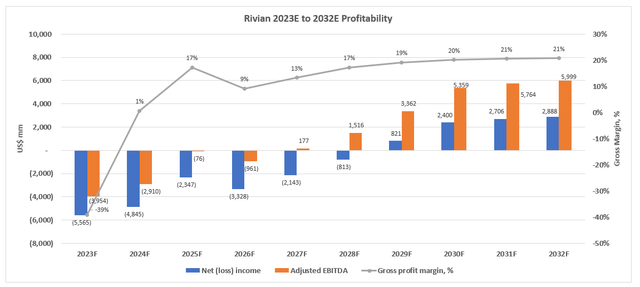

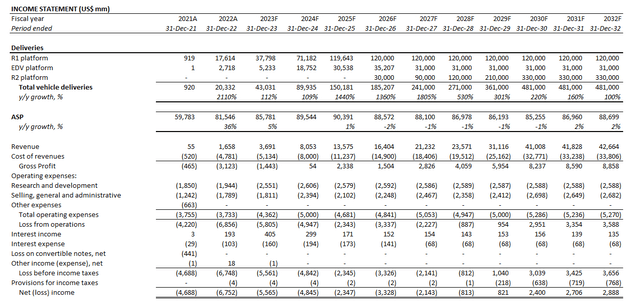

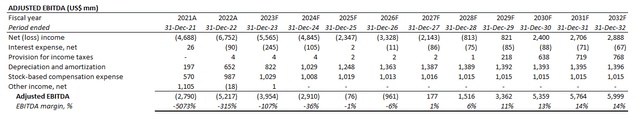

Adjusting our fundamental forecast for Rivian’s actual first quarter results, with additional consideration for its recent developments – including the integration of Enduro drive units and LFP battery packs, alongside the anticipated SOP of the higher-priced Max pack R1 variants – and the company’s forward profitability roadmap, we expect revenues to reach $3.7 billion by the end of the year on deliveries of close to 37,800 R1 platform vehicles and 5,200 EDV platform vans.

The growth assumption takes into consideration Rivian’s disclosure of $72 million in revenues from Amazon (AMZN), its exclusive buyer of EDVs, during the first quarter, which represents about 11% of the period’s consolidated sales, and $343 million for full year 2022, or about 20% of the period’s consolidated sales. Applying the related ASP on EDVs, we expect the commercial line-up’s sales to represent about 20% of estimated full year 2023 revenues, in line with historical observations. We also expect greater improvements to the ASP of R1 platform vehicles through the remainder of the year as deliveries come off of the pre-March 2022 pre-orders and move on the higher MSRP post-March 2022 pre-orders, which would contribute to full year 2023 revenue growth.

Looking to the longer term, Rivian is expected to near 500,000 vehicles in annual deliveries, which would represent a 10-year CAGR of 27%, driven by average annual growth in the teens range for the R1 and EDV platform vehicles, and expectations for greater take-rates on the upcoming R2 platform vehicles that will enter SOP in 2026. Specifically the R2 platform vehicles will likely be a lower cost, and lower priced model to better attract prospective buyers and differentiate Rivian from the anticipated rise in EV competition over the longer term.

…the updates we’re making to our network architecture really laid the groundwork for what we’re doing with R2. And one of the benefits of developing the – all the electronics in the vehicle and of course, the software stack in the vehicles. As we’ve now reached a level of maturity, we’re consolidating a number of those [electronic control units] and removing not only a lot of these [units] from the vehicle while maintaining feature set, but also along with that, massively simplifying the vehicle harness. And all that work flows very naturally into R2, so we not only pay costs out of R1, but we de-risk the launch of R2…we hope to carry [the excitement in R1 platform vehicles] into much lower price point with the R2 platform. And the R2 platform, [we’ll] have a number of other players that are offering products that are in that price range of $40,000 to $50,000.

Source: Rivian 1Q23 Earnings Call Transcript.

Related revenues are expected to expand at a 10-year CAGR of about 28%, with growth to decelerate near the end of the decade as delivered on the lower MSRP R2 platform vehicles are expected to ramp up and dominate the sales mix.

In considering Rivian’s longer-term deliveries and sales growth, we have also taken into consideration the risks facing the company’s go-to-market positioning within the increasingly competitive EV industry. While the U.S. EV TAM (total addressable market) is rapidly expanding, with emissions free vehicles expected to represent 50% of total new car sales by the end of the decade, the upcoming entry of better-funded incumbents in Rivian’s target pick-up truck and SUV segments – namely Ford (F), GM (GM), Stellantis (STLA) – alongside similar offerings by pureplay rivals like Tesla’s Cybertruck, Lucid’s Gravity SUV (LCID) and Fisker’s Ocean SUV (FSR), is likely to overtake the company’s prospects of gaining a first-mover advantage in electrifying some of the U.S.’ most popular vehicle types. As such, we expect greater competitive headwinds ahead for the company’s go-to-market roadmap, which Rivian acknowledges and seeks to differentiate over the longer-term with proprietary offerings and technologies, such as the Rivian Adventure Network charging stations as well as bolstering its full software stack.

On the profitability front, we expect management’s aspirations for positive gross profit margins before the end of next year to be achievable. As mentioned in the earlier section, ramping up production volumes remain a priority for Rivian, as related efforts will contribute to as much as half of the cost reductions needed to bridge current losses per vehicle to breakeven by the fourth quarter of 2024. Meanwhile, the combination of higher ASPs through the shift to deliveries on the higher priced pre-orders and upcoming launch of the Max pack R1 variants, as well as lower material costs through the ramp-up of Enduro drive units will drive the other half of reductions needed to reach gross profitability next year.

With all the key pieces to narrowing current gross losses – spanning delivery on higher priced pre-orders, SOP on Enduro drive units, and ongoing production ramp-up – already in motion, with the upcoming Max pack already in final stages of validation testing and an anticipated SOP timeline as early as later this year, Rivian is positioned on a reasonable timeline to gross profitability before the end of next year. And this is further corroborated by the drastic y/y reduction in gross losses observed in the first quarter, despite stalled EDV productions, which highlights incremental room for improvements going forward.

Rivian_-_Forecasted_Financial_Information.pdf

Valuation Analysis

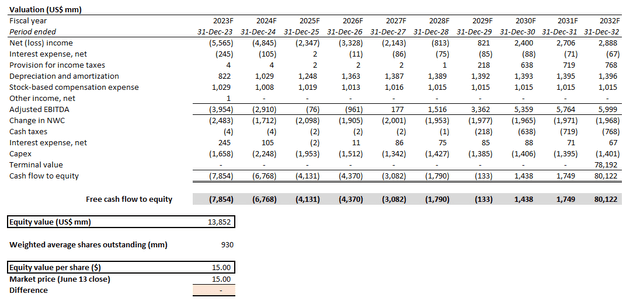

Based on the discounted cash flow (“DCF”) analysis on projected cash flows taken in conjunction with our fundamental forecast for Rivian, with the application of a 9.1% WACC in line with the company’s capital structure and risk profile, the stock’s current price at about $15 apiece implies a 6.5% perpetual growth rate. This prices in future growth that exceeds the pace of economic growth across Rivian’s core US. market, representing a significant premium attributed to its prospects. However, that figure remains proportionately below industry leader Tesla’s estimated 8%, underscoring market’s optimism for the broader EV sector’s prospects still despite transient macroeconomic challenges.

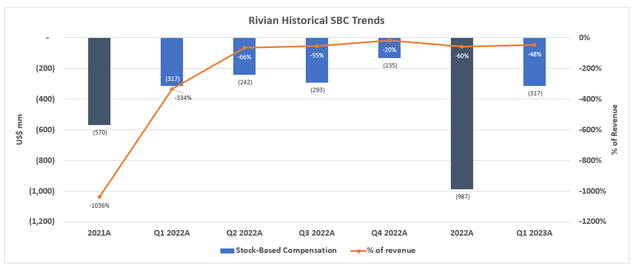

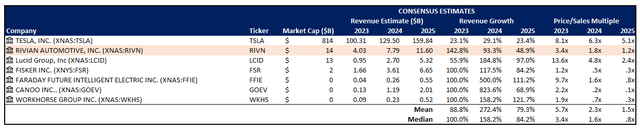

Meanwhile, considering the multiple-based valuation approach, Rivian’s forward growth and profitability outlook remains underpriced relative to its EV pureplay peers and the broader high-growth tech sector.

Author, with data from Seeking Alpha

This is likely a reflection of ongoing multiple compression risks facing the cohort’s largely unprofitable, yet capital intensive nature, amid a backdrop of rising borrowing costs and deteriorating consumer sentiment. The Rivian stock’s relative discount to peers is also likely a reflection of investors’ cautious optimism on its near-term production and profitability goals, given potential execution risks in bridging current quarterly output volumes in the sub-10,000 range to its annual target of 50,000 units, and closing the gap from current gross losses at -81% of revenue to breakeven by 2024.

Concerns over execution risks ahead are further corroborated by the lack of clarity on Rivian’s longer-term growth prospects, which are important in its roadmap to profitability as it relies on the realization of higher ASP sales. Specifically, management has stopped disclosing the size and pace of growth on Rivian’s pre-orders, other than it being extended “well into 2024.” Considering potential near-term macroeconomic challenges to auto demand, as well as rising competition, there remain reasonable risks to Rivian’s ability in realizing the higher ASP deliveries needed to transition from current gross losses to profitability next year.

The Bottom Line

While Rivian Automotive, Inc. stock appears adequately valued at current levels considering its relative valuation to peers as well as its fundamental prospects, execution risks ahead may subject the stock to further downside within the foreseeable future in tandem with ongoing volatility across broader markets. This is consistent with gains across key market benchmarks that have been largely buoyed by large-cap tech stocks, while smaller caps – especially unprofitable names – remain in decline.

Gains were as usual concentrated in tech megacaps most closely tied to the AI theme, squeezing the S&P 500 higher on a day when almost 60% of its constituents fell…Beyond [the] AI hype, there are other things behind the tech revival. These are companies — with their pristine balance sheets and big cash hoards — that can act as havens in the event of any downturn.

Source: Bloomberg News.

In addition to the lack of investors’ preference for unprofitability names amid the risk-off market climate, Rivian’s removal from the Nasdaq 100-Index (NDX) this month could lead to further volatility in the stock as institutional investors such as funds matching the gauge’s performance reshuffle their respective portfolios. The tech-heavy index typically removes constituents “weighted at less than 0.1% [of the gauge] for two straight months,” a threshold Rivian has failed to meet in April and May.

While Rivian’s potential to accelerate the pace of output and reach gross profitability over the course of the next two years could be key catalysts to unlocking greater pent-up value in the stock, the immediate risk considerations spanning execution uncertainties and the lack of clarity over its longer-term capital structure amid tightening macroeconomic conditions may drive further volatility ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!