Summary:

- Roku experienced significant growth during the pandemic, but saw revenue and profitability decline as the economy reopened, leading to a stock sell-off.

- The company has several strategies to rejuvenate revenue growth, including international expansion.

- It surprised analysts and investors with solid revenue growth and improving profitability in its second quarter earnings report.

- Despite recent struggles, Roku’s long-term potential suggests holding shares for three to five years as the economy and ad market recover.

JHVEPhoto/iStock Editorial via Getty Images

Roku (NASDAQ:ROKU), the popular streaming device and platform company, was a massive beneficiary of people staying home during the pandemic. It had a captive audience. Still, the boost it received was fleeting. As the economy reopened and people ventured outside of their houses more, revenue growth and profitability dropped; the market sold off the stock. My last article on Roku on November 17, 2023, ended with a hold recommendation at a stock price of $89.13. I concluded that article by stating:

Risk-averse investors would be better off if they avoided buying this stock at current prices. However, the company has enough long-term potential upside that if you already hold shares, it may be worth keeping them for the next three to five years as the economy and ad market fully rebound.

During 2023, management focused most of its efforts on making the company more efficient and reducing operating expenses (OpEx). When Roku reported its fourth quarter 2023 earnings on February 15, 2024, it announced it was back in growth mode. Chief Executive Officer (“CEO”) Anthony Wood said during the fourth quarter earnings call:

A large share of my management team’s attention in 2023 was spent on OpEx reduction and internal operational improvements. This year, we will be redirecting much of our attention to platform growth and innovation, where I see lots of opportunity. A core strategy for us is to take better advantage of our position as the programmer of the home screen for our 80 million active accounts globally. We use this to grow ad reach, which correlates to ad revenue, as well as to grow our streaming service distribution activities.

When the company reported second-quarter 2024 earnings on August 1, the market began to see the fruits of its recent growth initiatives. As of the September 27 market close, the stock has been up 34.50% since reporting the second quarter’s earnings. Some see the potential for Roku’s revenue growth to accelerate and the company to become profitable on the back of improving platform monetization. Additionally, the Federal Reserve cutting interest rates could rejuvenate consumer spending, and the company could have tailwinds at its back instead of the headwinds of the last several years.

This article will discuss Roku’s platform monetization plans and the company’s second-quarter fundamentals. It will also examine a few risks, its valuation, and why I am upgrading the stock to a buy.

Roku’s revenue growth drivers

Parks Associates estimates that 43% of homes in the U.S. with streaming media players use Roku devices. Amazon (AMZN) is in second place with 35% of the total. Alphabet (GOOGL) and Apple (AAPL) take up the remaining 22%; both companies plan to introduce new devices soon to try to take market share. The U.S. market may be close to saturation, and Roku’s ability to drive revenue by signing more subscribers in the U.S. may be closing in on its limit. Two of the company’s answers to slowing subscriber growth in the U.S. are growing international revenue and harvesting more revenue from its existing U.S. user base. One way to do that is by monetizing the platform’s home screen.

1. International growth

Roku’s plan in international markets is similar to the one it used in the U.S. market; It scales the business, increases engagement, and then monetizes the business. Roku started moving into international markets over a decade ago. It moved into the U.K., Ireland and Canada in 2012. The company later entered France, Australia, and Mexico in 2015. It entered the German market in 2021. Today, the company is in over 15 countries, with a solid footprint in South America, including Argentina, Brazil, Chile, Colombia, and Peru. The company’s 2023 10-K states:

We believe that the value our business delivers to viewers, content partners, and advertisers is as compelling in international markets as it is in the United States. Today Roku streaming devices are available in 15+ countries. We are the leading TV streaming platform in the United States and Mexico by hours streamed. Internationally, we continue to grow our footprint and deepen our presence in key markets…In international markets, we will continue to focus on building scale first, increasing engagement, and ultimately driving monetization.

The international market’s monetization currently drags down Roku’s overall Average Revenue Per User (ARPU), which measures how well the company monetizes its users. Only a few countries outside the U.S. have started the monetization phase. CEO Wood said on the company’s first quarter 2024 earnings call, “We are starting to monetize in areas like Mexico and continue to monetize in areas like Canada, UK, and Germany.” Investors can expect Roku’s total ARPU to rise over the next several years as more international countries monetize. In some cases, higher ARPU leads to increased revenue growth. I view Roku’s move into international markets as more of a long-term revenue growth driver.

2. Monetizing the home screen

Roku First Quarter 2024 Shareholder Letter

Further monetizing the existing membership base in the U.S. is a more immediate way of increasing ARPU and revenue growth. One area ripe for monetizing U.S. viewers is the home screen, where users first interact with the platform after turning on the TV to find shows to watch. One of the issues that some of the company’s critics had with Roku over the years was that users could use an app that may not have ads. For instance, if a user primarily uses Netflix’s (NFLX) standard plan without ads, Roku’s ability to monetize that user could be limited. CEO Wood explained on the first quarter 2024 earnings call how the company could get around that issue:

Everyday households with 120 million people turn on their TV and they start their viewing experience, their streaming journey on the Roku Home Screen. And so that Home Screen is what a viewer sees before they select an app. And they use that Home Screen to find something to watch. During that process, they’re exposed to promotions. They’re exposed to advertising and they’ll see advertising on our Home Screen before they select an app and they might be selecting an app that doesn’t actually have ads in it. So we have the ability to reach everyone on the platform, not just the people, not just the viewers [that] select apps with advertising.

The home page has featured static ads until now. Management plans to add video ads to the home screen soon, but no one knows how Roku intends to implement those ads yet. Will the company go the way of Amazon’s Fire TV and Fire Stick, which immediately start annoying full-screen ads on start-up? People have accused Google TV of pulling the same stunt. It would be a feat if Roku could pull off advertising on the home screen without annoying users. Roku Media President Charlie Collier said the advertiser response has been great. He said on the second quarter 2024 earnings call:

Our new marquee video ad unit on the home screen is one example. We actually announced that at the upfront. We opened a limited invite-only beta for this new video ad unit, and it sold out in the first month. The participation was exactly what we hope to see from premier brands like Home Depot (HD) and Disney (DIS).

The company also recently placed a personalized content row on the top of the home screen, containing content recommendations from its Artificial Intelligence engine. Roku hopes that relevant content suggestions will improve user engagement and better monetize users by recommending a mixture of subscription and ad-supported content that users are likely to watch or subscribe to.

Lastly, in 2022, the company placed a destination named Roku Sports Experience on the home screen menu, which provides access to various sports content. Until recently, sports were one of the few areas more prevalent in traditional television broadcasting, cable, satellite, and over-the-air than on Connected TV (“CTV”). However, that is changing. Advertising software company MNTN stated in an article on its website:

In Connected TV news, it looks like fans of live sports are on their way to joining the world of streaming. In fact, by 2025, 118 million people in the US are expected to be streaming their favorite sports (a 71% increase compared to 2021), according to eMarketer. This will become especially true for football fans—this year Prime video and Twitch are set to become the exclusive streaming home of Thursday Night Football.

One problem is that as more sports move to streaming, the more fragmented it has become. PwC noted the following in an article:

The days when viewers tuned in to games exclusively on local or national sports networks may be numbered. Beyond the widespread migration to streaming platforms is the rise of short-form content on social media. Instead of tuning into full-game broadcasts, some fans may prefer to follow their teams via short-form videos from their favorite social media accounts and personalities. There’s a rise in fans who tend to follow their favorite players and teams on social media who also now consume more highlights than live sports. And game offerings like NFL Redzone and NBA League Pass are more popular than ever.

Since one of the primary purposes of Roku’s home screen is to help users discover content, it’s only natural that the company made it easier for users to find sports they want to watch by putting them in one central location on the home screen. CEO Wood briefly discussed Sports Experience on the first quarter 2024 earnings call:

The Sports Experience is a way for viewers to find sports across the platform, it’s a way for us to promote content, both AVOD and SVOD content. It’s also a way for us to integrate advertising into that experience.

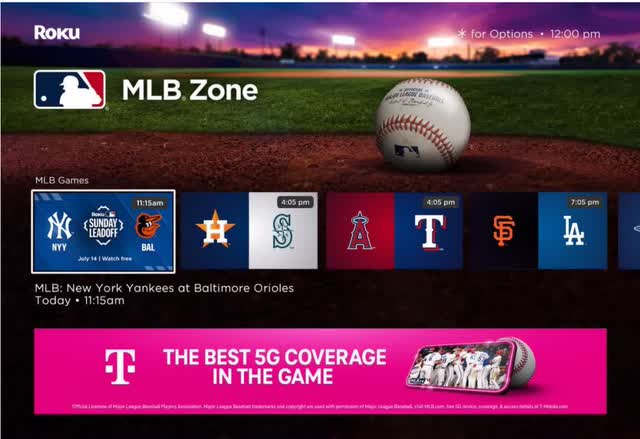

The Sports Experience further subdivides into individual sports. Roku’s first focus was pro football. CEO Wood also said on the same earnings call, “The NFL Zone was our first league-sponsored zone, and for this year’s Super Bowl, it was sponsored by TurboTax, delivering massive reach to the brand during a critical time of the year.” It established an NBA Zone for pro basketball content in April of this year. In its second quarter of 2024 shareholder letter, the company unveiled MLB Zone to discover Major League Baseball content across the platform.

Roku Second Quarter Shareholder Letter

The second-quarter shareholder letter said the following about MLB Zone (emphasis added):

One of our fastest growing features is the Roku Sports Experience. In addition to our NFL and NBA Zones, we recently launched the MLB Zone with T-Mobile as a sponsor. The MLB Zone aggregates and organizes live and upcoming games, nightly recaps, game highlights, a fully programmed MLB FAST channel, and more from across the Roku platform. Additionally, we secured the exclusive multi-year rights for MLB’s Sunday Leadoff live games, now available for free on The Roku Channel. Further, the zones elevate clips, scores, and related content that makes watching sports better on the Roku platform. In Q2, Streaming Hours originating from the Roku Sports Experience more than tripled YoY.

Investors should monitor news about Roku’s home screen moving forward, since it is one of the company’s best ways to monetize users through advertising. Just as Google monetizes Search through advertising, Roku does something similar by using its home screen as a search engine.

Company fundamentals

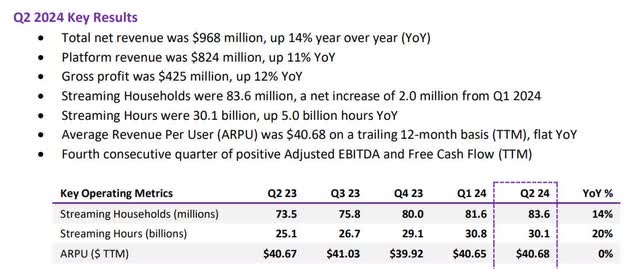

Roku Second Quarter Shareholder Letter

One of the big positives of its second-quarter report is that streaming households, similar to membership growth, continue to rise, up 14% year-over-year to 83.6 million. The more households streaming on Roku’s platform, the more viewers are available to monetize and the more attractive the platform becomes to advertisers. Equally important, streaming hours, an engagement metric, rose 20% year-over-year to 30.1 billion. The more hours users are on the platform, the greater the ability Roku has to reach viewers through advertising. As streaming hours rise, the platform becomes more attractive to advertisers.

Many investors watch ARPU closely as it is a factor that can contribute to revenue growth. ARPU was flat year-over-year and ended the second quarter of 2024 at $40.68. The U.S. market’s ARPU is growing. However, as I explained earlier in this article, Roku has not fully monetized its international markets and has a lower ARPU than U.S. markets. As a result, as Roku’s international streaming markets grow faster than its domestic ones, it puts downward pressure on ARPU overall. Investors may not see ARPU growth until the company increases its monetization of international markets.

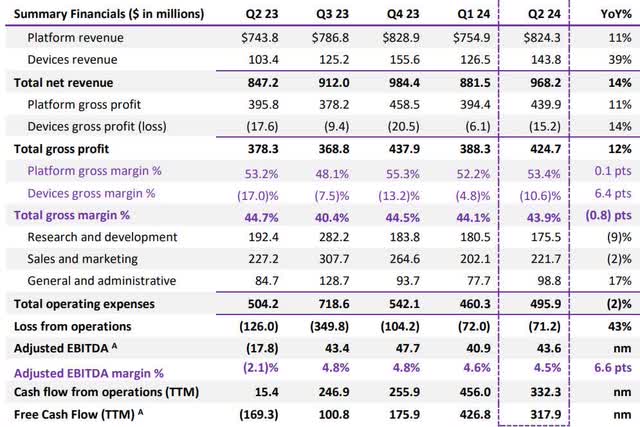

Roku Second Quarter Shareholder Letter

Platform revenue comprises digital advertising sales, media and entertainment (M&E) promotional spending, and streaming services distribution (including subscription and transaction revenue shares, premium subscription sales, and remote control branded app button sales). M&E spending essentially involves streaming companies like Disney, Prime Video, Netflix, and others promoting their channels or content in Roku ad slots.

Platform revenue rose 11% year over year to $824.3 million. Streaming services distribution and digital advertising did well. However, M&E slowed overall revenue growth. Management had stated earlier this year that M&E would have a rough 2024. Management also discussed on the earnings call that it is taking the ad inventory that used to always go to M&E providers and opening it up to other advertisers, thus diversifying away from M&E. Despite the diversification, the company remains in the M&E advertising business. Chief Financial Officer Dan Jedda said on the second quarter earnings call:

M&E is a significantly smaller percent of our overall platform business now versus the last several years. So while we’re in a good position to benefit from any M&E rebound and any new M&E entrants into the market, we’re not relying on the vertical for future growth.

Device revenue comes from sales of streaming sticks and players, Roku TVs, audio devices, smart home products, accessories, and licensing deals with service operators. In the second quarter, device revenue rose 39% year over year. The company uses device sales as a loss-leader to get viewers onto the Roku platform, so device gross margins are often negative. Second quarter device gross margins were -10.6%. Platform gross margin was 53.4%, flat over the previous year’s quarter.

Total revenue was $968.2 million, exceeding analysts’ expectations of $937.92 billion and management’s guidance of $935 million.

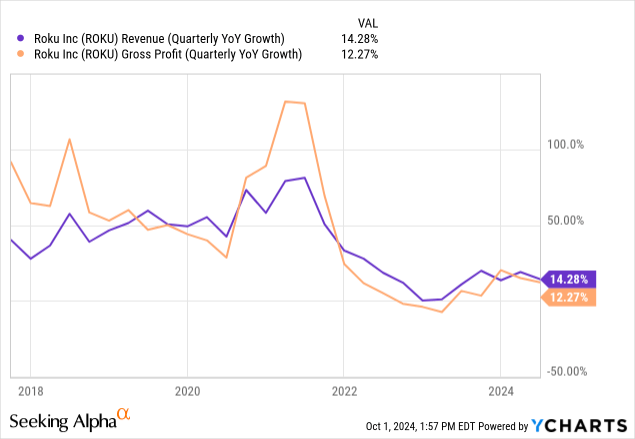

One thing that I sometimes like to compare is a company’s total revenue growth rate to its gross profit growth rate. When the gross profit grows faster than revenue, the gross margin rises; the opposite occurs when gross profit grows slower than revenue. Roku’s stock price rose steeply in 2021 because gross profit grew well above revenue growth, helping gross margins expand to a high of 56.9% in the first quarter of 2021. Roku’s second quarter 2024 gross margin was down approximately 80 basis points year-over-year to 43.9%.

Roku’s operating expenses were down 2% to $495.9. However, these expenses must decrease much further in relation to revenue to see positive operating profitability. Loss from operations decreased by 42% to $71.2 million.

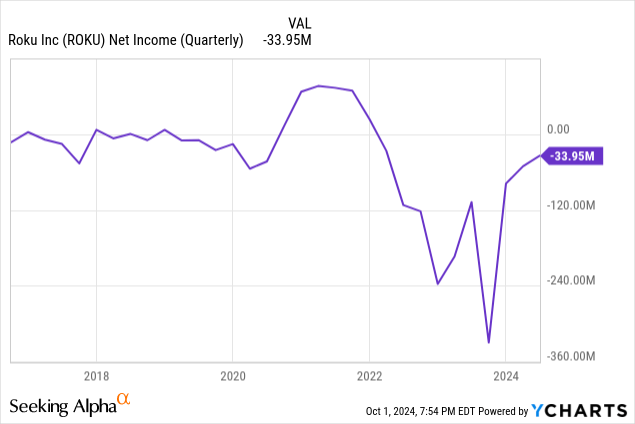

The net loss was $33.95 million, and the diluted loss per share was $0.24, which was above analysts’ expectations for a loss of $0.42. Although the company still produced a loss, analysts expected far worse and were pleasantly surprised by the results.

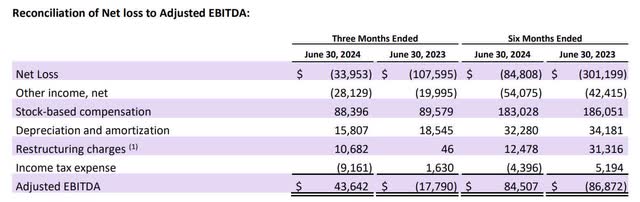

The following table shows Roku’s reconciliation from net income to adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Roku Second Quarter 2024 Shareholder Letter.

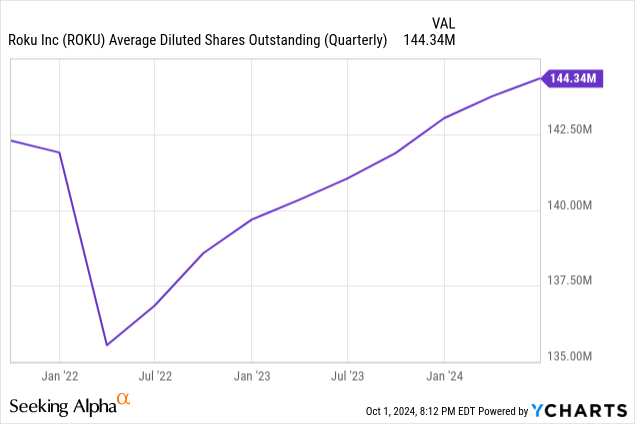

The company’s stock-based compensation is 10.4% of revenue. Although that number is not excessively high, diluted shares outstanding rose from 3.31 million to 144.34 million year over year.

Over the last year, the company’s adjusted EBITDA flipped from a loss of $17.8 million in the second quarter of 2023 to a positive $43.6 million in this year’s second quarter. EBITDA margin was up 660 basis points to 4.5%.

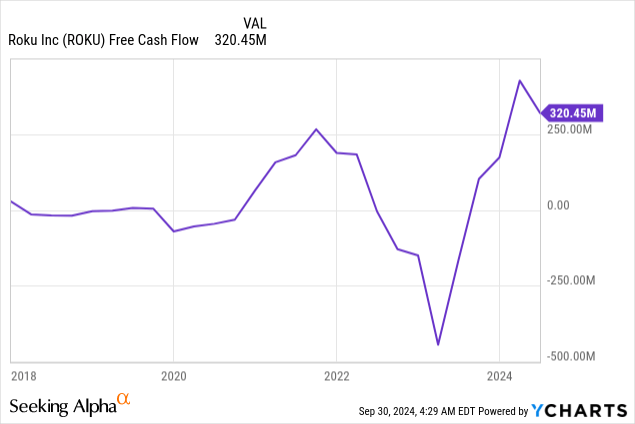

Using standard calculations, Roku’s free cash flow (“FCF”) was $320.45 million. However, the company’s second-quarter 2024 shareholder letter lists its FCF at $317.9 million because its calculation deducts $2.54 million, which is the exchange rate effect on cash, cash equivalents, and restricted cash.

Roku has $2.058 billion in cash and short-term investments. And no long-term debt.

Roku Second Quarter 2024 Shareholder Letter.

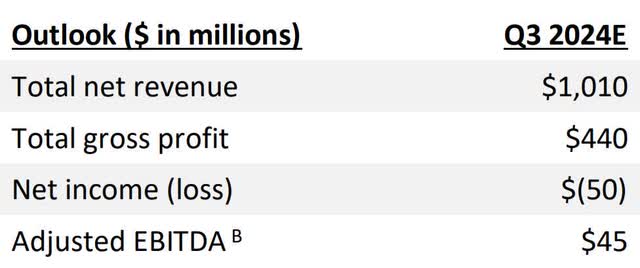

If Roku hits management’s revenue projections of $1.01 billion, it will produce revenue growth of 11% year over year and will be the company’s first billion-dollar quarter. If it hits its third-quarter adjusted EBITDA forecast, it will show a 3.7% rise over the previous year. So, investors should not expect a big profit jump when it reports third-quarter results.

Risks

The company gains many of its platform subscribers by selling its streaming devices. However, eventually, every TV sold will be a smart TV, eliminating the streaming stick and box market. Roku faces intense competition in the smart TV operating system (“OS”) market, with Google, Samsung’s Tizen, LG’s webOS, Amazon’s Fire TV, and the newer Whale TV providing stiff competition for providing an OS for Sony, Hisense, TCL and other branded TVs. There is no guarantee that Roku will maintain its leadership position in the smart TV OS market.

The top three streaming channels are Netflix, Amazon Prime Video, and Disney+. Roku’s 10-K states, “In the fiscal year ended December 31, 2023, the top three streaming services represented almost 50% of all hours streamed in the period.” If any of the big three streamers leave Roku for any reason, its membership and engagement numbers could drop, making the service less attractive to advertisers.

Valuation

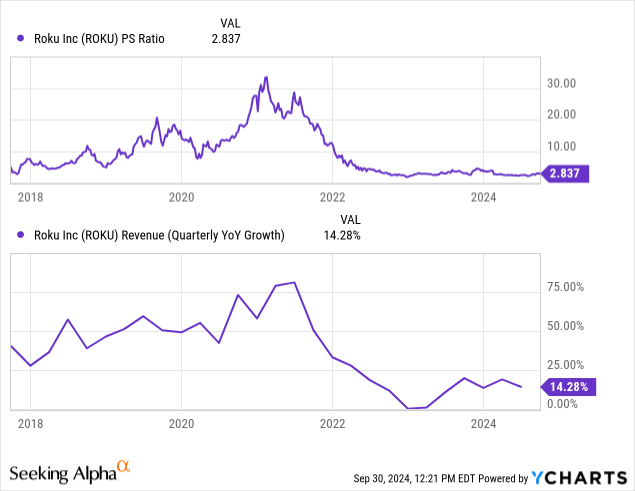

Since Roku rarely achieved TTM EPS profitability before the pandemic and only achieved it briefly in late 2021 to early 2022 post-pandemic, the price-to-sales (P/S) ratio is one of the best ways to value the company. Its P/S ratio is 2.845, and its P/S median since its September 2017 IPO (Initial Public Offering) is 4.92. The following chart shows that the valuation soared in the immediate aftermath of the pandemic, as the service became popular when people stayed home. The stock’s P/S ratio peaked in early 2021 and dropped off a cliff in late 2021 into 2022 as people started venturing outdoors again. As inflation rose across 2022, investors abandoned it. If it sold at its P/S median since its IPO of 4.92, the stock price would be $129, a 73% rise above its September 27 closing price of $74.41. Still, investors should not expect the company to return to quarterly revenue year-over-year growth rates of between 25% and 80%, which it sold at up until 2021. The company will likely never return to double-digit P/S ratios and may have difficulties returning to a 4.92 P/S ratio.

The consensus revenue estimates for Roku are in the low teens. However, the Trefis team posted an article on Forbes that stated, “[Revenue] growth could accelerate to around 25% between 2024 and 2027, touching $7 billion levels.” If that assessment turns out to be valid and the company continues on its path to profitability, the stock could go well above a 4.92 P/S ratio. In that Forbes article, the author predicts the stock price will eventually rise to $200. So, the valuation assumptions in this article are conservative.

Roku’s price-to-FCF is 33.08, compared to its seven-year median of 171.58. Apple’s price-to-FCF is 34.44, and Alphabet’s is 34.80. Suppose the company sold at a price-to-FCF of Apple or Alphabet; its stock price would range from $77.49 to $78.30, within 5% of its closing price on September 27. Some might call the stock fairly valued based on its comparison to mature companies such as Apple and Alphabet.

The following is Roku’s reverse discounted cash flow (“DCF”), which I am using to determine what the September 27 closing price implies about the stock’s cash flow growth rate over the next ten years. This DCF uses a terminal growth rate of 2.5% because the company should grow cash flow slightly above the GDP (Gross Domestic Product) long-term growth average once it exceeds the forecast period. I use a discount rate of 10%, which is the opportunity cost of investing in Roku, reflecting a moderate risk level. This reverse DCF uses a levered FCF for the following analysis.

Roku Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$321 |

| Terminal growth rate | 2.5% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 14.8% |

| Current Stock Price (September 27, 2024 closing price) | $74.41 |

| Terminal FCF value | $1.304 billion |

| Total Present Value of Cash Flows | $6.704 billion |

| FCF margin | 8.5% |

Roku should conservatively grow its FCF margin to at least Alphabet’s current FCF margin of around 16% (Alphabet’s FCF margin ten-year median is 21.87%). Since Roku primarily generates revenue from advertising while also having a hardware-based platform, it compares favorably to Alphabet’s main Search business. Suppose Roku can maintain an FCF margin of 16% over the next ten years; it would only need to grow its revenue by 6.3% over the next ten years to justify its September 27 closing price — something it should achieve.

Data Intelo estimated the global TV ad-spending market at $212 billion in 2023, growing at a compound annual growth rate (“CAGR”) of 5% to reach a $324 billion market by 2032. Roku’s annual revenue was $3.485 billion at the end of 2023, with 14% coming from device sales and 86% from platform sales, primarily CTV advertising. Multiplying $3.485 billion by 0.86 equals approximately $3 billion, or 1.4% of the global TV ad-spending market.

Although Roku may not be able to squeeze much more juice out of the U.S. market because it is likely close to membership saturation and will generate revenue growth in the U.S. primarily by increasing its monetization of existing users, the company still has a sizeable membership and revenue growth opportunity internationally. Assuming that the market grows at a 4.5% CAGR from 2023 to 2034, the market will reach $344 billion in 2034. Assuming Roku can continue growing its market share globally and grow revenue at a conservative 7% over the next ten years, its estimated intrinsic value would be $78.28, with a 2.3% global TV ad market share. At an annual 8% revenue growth rate, its estimated intrinsic value would be $84.25. At a 9% yearly revenue growth rate, its estimated intrinsic value would be $90.68, and it would capture a 2.6% market share.

Remember, these are very rough ballpark figures. For instance, I used Roku’s platform revenue as a proxy for advertising revenue. However, platform revenue has other revenue sources outside of advertising, including subscription and transaction revenue shares, Premium subscription sales, and branded channel buttons on Roku remote control. The main takeaway from this analysis is that investors can justify today’s stock price assuming that Roku can maintain at least a 6% revenue CAGR and average an FCF margin of 16% over the next ten years. FCF margin is crucial to this analysis. As long as investors see Roku’s FCF margin rising towards 16% and above, sentiment around the stock should be positive. If the FCF margin declines and FCF growth stalls, the sentiment around the stock will likely be poor.

Roku is a buy

With consumer sentiment improving and CTV ad spending forecast to continue rising at double-digit rates over the next several years, Roku has tailwinds behind it. The company should continue growing revenue in the low teens over the next several years and achieve GAAP profitability by 2027. If you are an investor looking for a stock that should produce solid returns over the next several years, consider buying Roku. I am upgrading Roku to a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.