Summary:

- Tesla, Inc. faces increasing competition from legacy carmakers offering a wide variety propositions in both U.S. and China. China data – both sales and exports – are down in YoY terms.

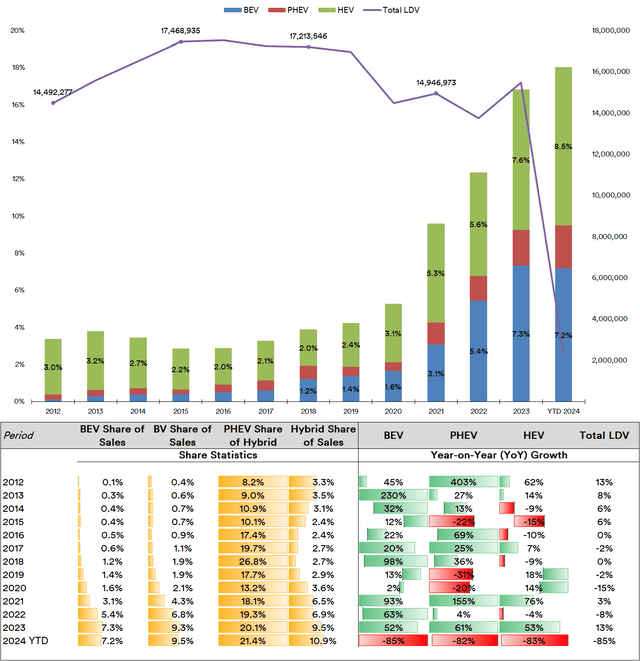

- BEV market growth pales in comparison to sale of PHEVs and hybrids, both areas that Tesla is non-existent in.

- With sales trending down despite overall sales of NEVs trending up, the company is at a strategic crossroads.

greenbutterfly

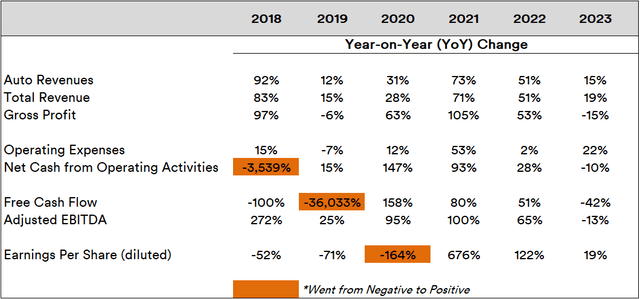

In the Year To Date (YTD), Tesla, Inc. (NASDAQ:TSLA) is the worst-performing stock in the Nasdaq 100-Index (NDX in index form and QQQ in ETF form). The company’s line item performance in first-order (i.e., Year-on-Year) terms indicates that 2023 wasn’t quite as explosive as they were in the past two years.

Source: Created by Sandeep G. Rao using data from Tesla’s Financial Statements

An increase in automobile revenues – and earnings per share (EPS) – was accompanied by a nearly equivalent drop in gross profits and adjusted EBITDA. Free Cash Flow also saw a decline along with an increase in operating expenses. All things considered, the company missed analysts’ consensus by a small margin and the company’s stock is currently flashing at “Hold” in many stock pickers’ lists.

A large factor behind the revisions towards a “Hold” is in the automotive market dynamics

Car Markets: Here and There

Over in China, where the company has its largest factory with a capacity of 950,000 vehicles, Tesla has reportedly slashed the number of working days by 23% (down to 5 days a week), with some production lines such as the battery workshop subjected to even longer suspensions. Tesla’s sales in China (where its Model 3 and Model Y start at a little over $35,000) have been slowing on a Year-on-Year (YoY) basis in YTD: sales were down 24.42% and 11.15% in January and February. Exports from the China plant were down 22.46% for the first two months combined on a YoY basis. This isn’t necessarily a market-wide issue: overall sales of Battery Electric Vehicles (BEVs) in China were up 18.06% for the same period.

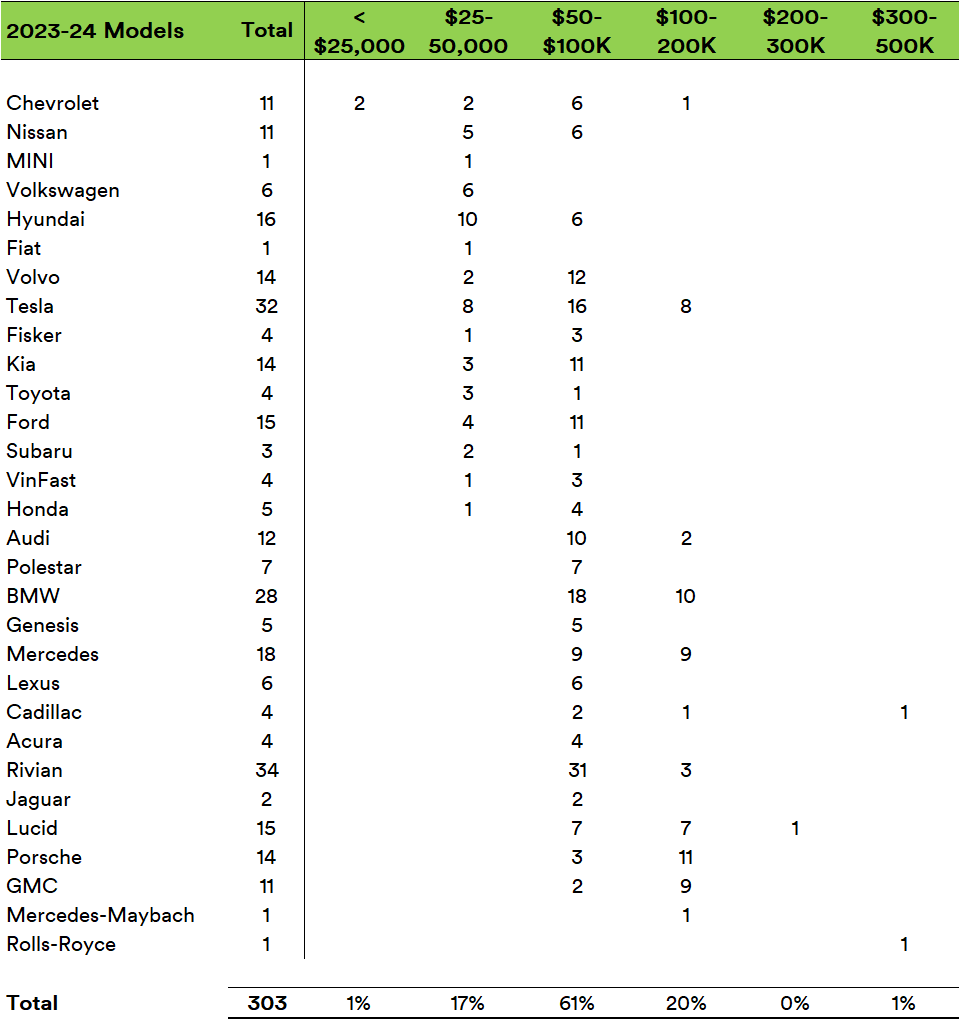

When differentiated by model year, brand, model name, version (battery or drive type) and wheel size in inches, Tesla finds its home turf (the United States) replete with competition: a little over 10% of all models slated in 2023/2024 are from the company.

Source: Created by Sandeep G. Rao using data from InsideEVs

The heaviest level of competition – nearly 98% of all releases – are squarely aimed at all three price ranges that Tesla retails its American offerings at. Almost every single major legacy carmaker is in the fray with a steadily rising and consistent sales on a YoY basis that is eating up Tesla’s once-commanding market share, which is now hovering around the 50% mark.

Be it in the U.S. or China, a median-performance BEV typically isn’t cheap. A Hybrid Electric Vehicle (HEV) – which switches between an internal combustion engine (ICE) with an electric-powered motor and charges its battery autonomously through energy from the former – are often significantly cheaper. Next up in the list and typically below the BEV is the Plug-In Hybrid Electric Vehicle (PHEV), wherein the battery are replenished via a charger (like BEVs) and propulsion switches to an ICE when the battery is depleted.

The pricing matrix for HEVs and PHEV is largely patterned on fuel efficiency. For instance, an ICE-powered Toyota RAV 4 delivers a fuel economy of 27 miles per gallon (mpg), the HEV version does 41mpg, while the PHEV version delivers 94MPGe*.

*MPGe is “miles per gallon equivalent” which isn’t quite the same as “mpg.” As per the Environment Protection Agency, it represents the number of miles the vehicle can go using a quantity of fuel with the same energy content as a gallon of gasoline.

Batteries typically make up around 40% of a BEV’s cost. PHEVs tend to have smaller batteries, which typically make them cheaper than their nearest BEV equivalent. HEVs’ batteries tend to be even smaller, which tend to make them even cheaper.

In the U.S., among all New Energy Vehicles (NEVs), HEVs have always ruled the roost.

Source: Created by Sandeep G. Rao using data from Argonne National Laboratory

Light-Duty Vehicles (“LDVs”, which include cars and light trucks) have been meandering with a bearish trend since 2015 (with passenger cars showing downtrends while sales of SUVs, pickup trucks and vans remaining somewhat buoyant). Within these bearish trends, however, NEV sales have been resilient and bullish. Within NEVs, BEVs have just begun to show a downtrend in 2023 while “Hybrids” (be it HEV or PHEV) have been growing very steadily.

Within “Hybrids”, the share of PHEVs have been on the rise since 2019 and helping lift the sales of all BVs (“Battery Vehicles”, i.e., BEVs and PHEVs). During years of all-round positive YoY growth in NEVs, PHEVs have begun to display outsized YoY growth relative to BEVs and HEVs.

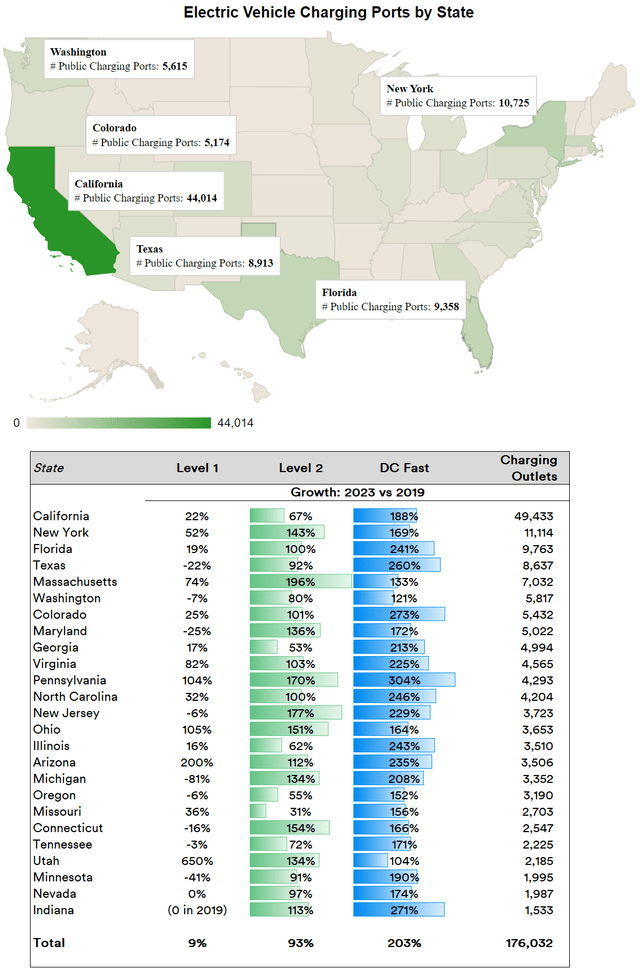

The distribution of charging networks in the U.S. is heavily skewed in favor of a select number of states.

Source: Created by Sandeep G. Rao using data from the Alternative Fuels Data Center, U.S. Department of Energy

Relative to 2019, 47 states have registered a triple-digit percentage increase in DC Fast Charging outlets available to the public while 30 states have shown similar levels of increase in Level 2 outlet availability. Despite these trends, it is a fact that comprehensive coverage of charge infrastructure heavily disfavors almost all of Middle America. This is a problem: with lower availability of charging infrastructure, there is a greater disincentive towards buying BEVs. When choosing between NEV types, HEVs and PHEVs have a substantially greater advantage.

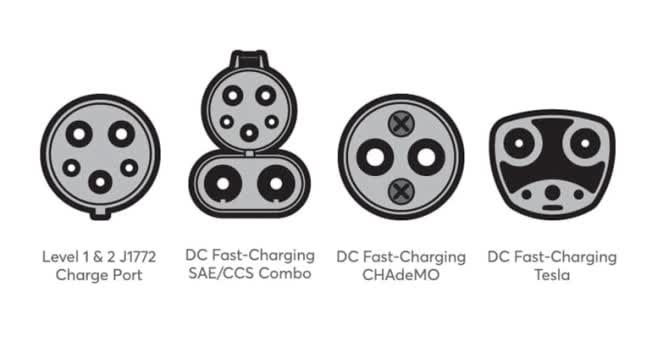

Unlike in China, which has a mandated common charging standard, the U.S. doesn’t. At least 4 different standards exist, including Tesla’s “Supercharging” standard.

Source: Chris Philpot

On top of that, recent surveys indicate that nearly 1 in 5 EV owners reported an inability to finding a charging port to replenish batteries “on-the-go,” which is up from 1 in 7 in 2020. The reasons for this vary from weather conditions knocking out the device to vandalism and theft for the copper wires within.

Among fast-charging stations, Tesla’s Superchargers account for slightly more than one-quarter of all fast-charging stations and one-third of all outlets in the United States. While Tesla had earlier stated that its fast-charging infrastructure is exclusively for Tesla owners, they now have been offered an incentive to open up this non-Tesla owners, courtesy of the 2021 Bipartisan Infrastructure Law which allocates $5 billion to the buildout of a charging network along major roads and $2.5 billion to charging within communities.

To qualify for a piece of the $7.5 billion action, it was announced on February 15 that Tesla will open up 7,500 chargers from its Supercharger and Destination Charger network to non-Tesla vehicles by the end of 2024. The “Tesla charging standard” is now the “North American Charging Standard” (NACS, pending for certification as SAE J3400). BMW, Mini, Rolls-Royce, Mercedes-Benz, Volkswagen, Hyundai, Honda, Kia, Mazda, Nissan, Geely, Volvo and Stellantis have all announced that NACS will be available as a default starting from 2025.

Source: Mercedes-Benz Press Release

Tesla isn’t the only carmaker with an exclusive edge in the ownership of charging infrastructure. Ionna — an alliance between BMW, General Motors, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis — will be deploying 30,000 high-powered charge points across the U.S. and Canada that will be open to all car makes.

In Conclusion

Across the U.S., given the overall paucity of charging infrastructure and the cost of a BEV, it stands to reason that PHEVs offer the next best option for the vast majority of buyers. The driving factor why BEVs are so heavily highlighted is the ticket price: about 80% of all 2023/2024 models and variants announced in the U.S. are in the $50,000 – $200,000 range. The higher the price, the better the margin. Also, customers able to afford the ticket are more inured to the vagaries of the affordability crisis roiling America, thus making them more likely to be persistent buyers.

For all others, including those who want more flexibility in sustained usage, PHEVs are the way forward, which U.S. buying trends confirm over the past decade. Incidentally, China shows similar trends: while BEVs registered a 18.06% increase in sales in the first two months of this year, PHEVs registered a 74.93% increase in the same period. More than 70% of China’s public charging network are in 10 of the most economically developed provinces and municipalities, with only 30% of all charging points open to all car makes.

Much like the “never” regarding the public’s access to its Supercharging network, another “never” has been any attention to other segments of the NEV space. Given the growth of PHEVs and the inherent market potential to access additional markets, one wonders why the company won’t take the plunge into PHEVs or even HEVs. Competition in both these segments is already fierce.

Next, as Ferrari’s earnings portrayed so elegantly, going higher in price bracket via a premium/luxury offering can pay off regardless of economic cycle. The company doesn’t quite indicate any inclination in this at present.

As it stands, Tesla, Inc.’s BEV market share is near-constantly being eroded due to a variety of carmakers offering a variety of value propositions, a more extensive dealer/service network and a longer operational history of success to the very same consumer segments. This a significant gap in the company’s strategy at present.

Overall sales trends and market competitors being able to offer a wider variety of interesting options in both of its primary markets are major factors in the consideration of the stock’s valuation. Barring a brief rally in February, the stock’s Price-to-Earnings (P/E) Ratio is down 28% from that registered at the start of the year. Given that the industry average is 15-18 versus the stock’s current P/E Ratio of 54.5, there is significant potential for this ratio to be corrected downwards another 20-45%.

All in all, the majority stock pickers’ opinion seems entirely valid unless Tesla, Inc. takes some powerful strategic announcements soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.