Summary:

- Tesla’s Q3-2024 automotive revenue reached $20.016 billion, showing resilience despite seasonal demand shifts and macroeconomic fluctuations.

- Energy revenue surged 174.4% over ten quarters, highlighting Tesla’s growing focus on diversified revenue beyond automotive sales.

- Services revenue, including maintenance and insurance, grew by 90.3% in Q3-2024, strengthening customer loyalty and lifetime value.

- Supercharger stations increased by 68.9% YoY, with 6,706 stations, supporting customer satisfaction and easing EV range anxiety.

- Cybertruck launched successfully with over 16,000 units sold in Q3-2024, positioning Tesla in the lucrative truck segment.

Just_Super

Investment Thesis

Tesla’s (NASDAQ:TSLA) latest results underscore its resilience and adaptability in a challenging market, solidifying its position as more than just an automaker. The company continues diversifying revenue streams, strengthening customer loyalty, and expanding into new, high-margin segments like the truck market while maintaining operational solid growth. These strategic moves reinforce Tesla’s long-term potential and innovation-driven edge, supporting our bullish investment thesis as Tesla evolves into a comprehensive clean energy and technology powerhouse.

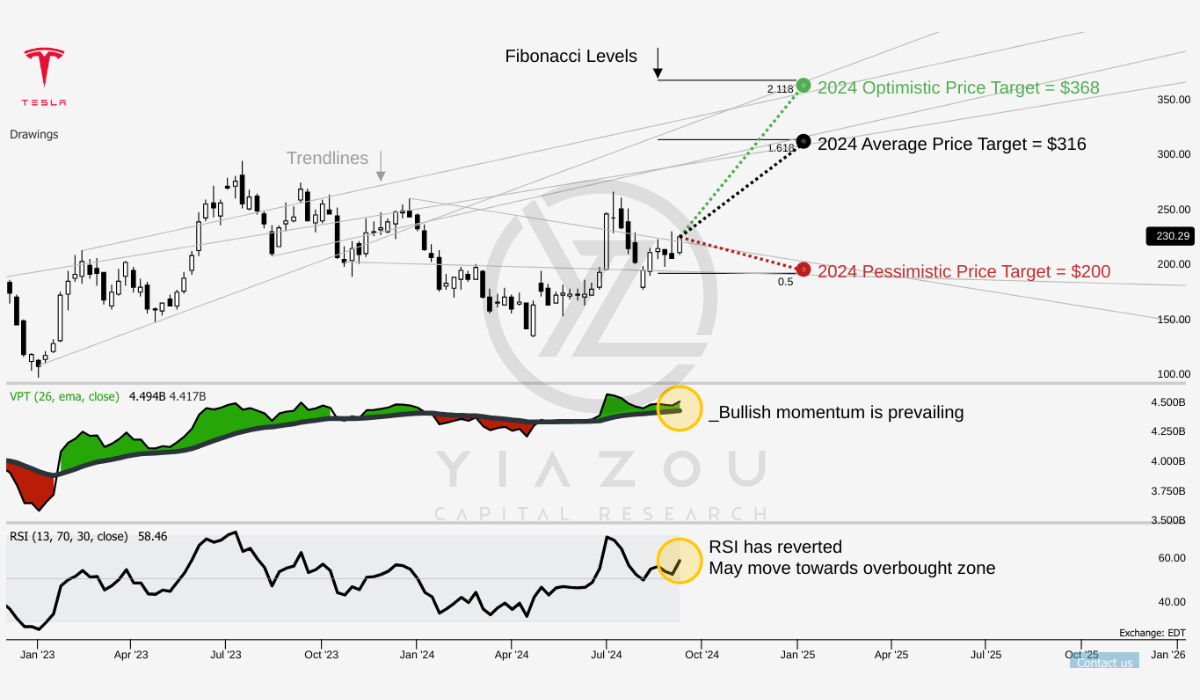

Technically, Tesla stock is following the expected bullish trajectory and moving towards attaining the average price target of $316. The stock can also hit $368 if the Santa Claus rally materializes. Thus, the technical outlook is unchanged from the previous coverage.

Yiazou (trendspider.com)

Tesla’s Revenue Machine: Stable Growth Across Auto, Energy, and Services

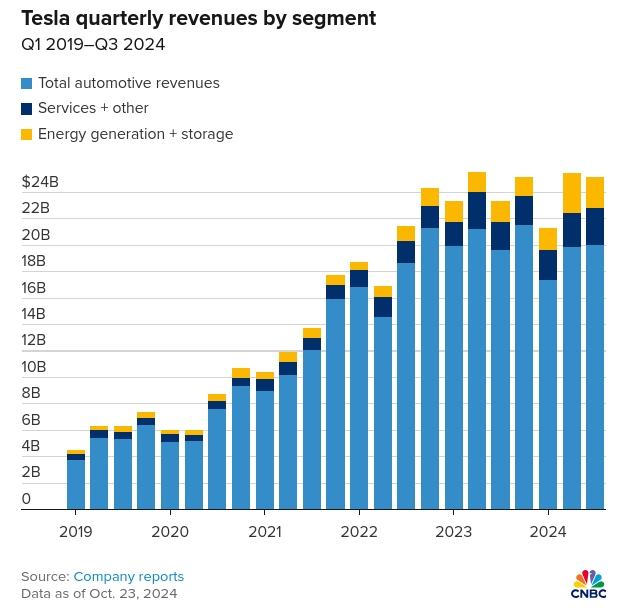

Tesla’s automotive revenue is its primary top-line source, hitting $20.016 billion in Q3-2024. This is down from the highest quarterly revenue of $21.563 billion in Q4-2023. However, this revenue fluctuation indicates Tesla’s seasonal demand dependency and macro (market) conditions (here, the last 10 quarters are considered to assess the top-line and business performance to minimize the effects of seasonal fluctuation).

Despite quarterly dips, Tesla’s year-over-year (YoY) growth in automotive revenue is at a considerable 45.7% in Q2-2023. Although YoY growth slowed afterward, Q3-2024 still hit positive growth at 2%. This growth indicates Tesla’s fundamental capability to shift with the market while maintaining stable YoY performance.

Moreover, Tesla’s energy revenue rose sharply to $2.376 billion in Q3-2024. Compared to Q2-2022, this marks a 174.4% rise over ten quarters. In energy revenue, YoY growth hit a high of 99.7% in Q2-2024 and 52.4% in Q3-2024. This trend reflects Tesla’s focus on diversifying revenue sources and sharp strategy to limit reliance on automotive revenue. Fundamentally, these growth rates indicate a growing demand for energy storage as Tesla expands its market for energy products.

Tesla’s stable rise in energy revenue reflects demand across consumer and industrial segments. Lastly, the Services and other revenue segments include maintenance, insurance, and merchandise business. This grew sharply to $2.790 billion in Q3-2024, with a 90.3% rise over ten quarters. For Services and other revenue, YoY growth peaked at 46.7% in Q2-2023, maintaining above 20% in later quarters. This revenue expansion indicates a stable capability to monetize additional products, improving customer lifetime value. Hence, Tesla’s ability to lead ancillary services and build a brand-aligned customer base enhances its ecosystem and top-line growth potential.

CNBC

Tesla Powers Ahead: Revenue, Deliveries, and Charging Network Soar

Tesla’s consolidated revenue was ~$25.2 billion in Q3-2024, with a 48.7% increase over ten quarters. Although Tesla saw a revenue dip with YoY growth at -8.7% in Q1-2024, the revenue bounced back to 7.8% YoY growth in Q3-2024. Tesla’s stable YoY revenue growth points to a capability to adapt across fluctuating quarters, benefiting from the diversified streams mentioned above.

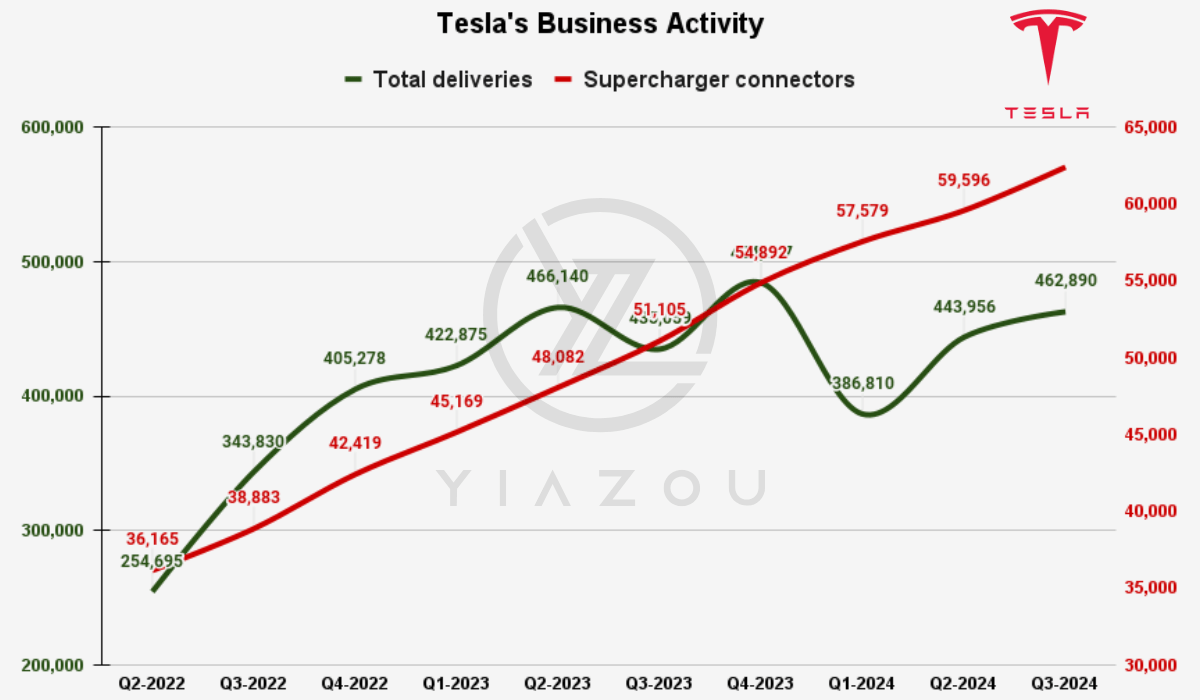

For the company, YoY top-line growth was 47.2% in Q2-2023, marking Tesla’s rapid expansion across quarters. The Q3 2024 YoY growth marks Tesla’s capacity to scale revenue, stabilize, and match market demand. For instance, Tesla’s delivery growth marks its market lead and production scale capability. Model S/X deliveries grew to 22,915 in Q3-2024, showing 41.8% growth over the last 10 quarters. Based on Tesla’s production boost, the YoY growth rate for Model S/X deliveries hit 43.4% in Q3-2024. Model 3/Y deliveries (the primary mass-market vehicles) rose 84.5% over ten quarters and now stand at 439,975 in Q3-2024 (+5% YoY).

As a result, consolidated deliveries expanded to 462,890 in Q3-2024, with 81.7% growth over the last 10 quarters. These rapid and stable delivery trends mark Tesla’s capability to match demand across vehicle lines, boosting its competitive stance. Beyond deliveries, Tesla’s supercharger network rose sharply to 6,706 stations in Q3-2024, a 68.9% increase over Q2-2022. YoY growth in supercharger stations has consistently stayed over 20% since Q4-2023.

Moreover, Supercharger connectors also grew, reaching 62,421 in Q3-2024 with a 72.6% increase over Q2-2022. This charging infrastructure expansion helps Tesla eliminate range anxiety among potential customers, boosting loyalty and satisfaction. Tesla’s focus on charging infrastructure helps derive its market lead, boosting EV adoption among consumers.

Yiazou

Finally, Cybertruck’s launch led Tesla to sell over 16K units in Q3-2024 with a positive gross margin, showing demand and manufacturing sharpness. The Cybertruck became the third highest-selling EV in the US, behind only the Model 3 and Model Y. Achieving positive gross margins quickly points to Tesla’s stable demand and sharp operational capability in new vehicle segments. Fundamentally, this positions Tesla to expand in the lucrative truck market segment.

Looking forward, beyond the current vehicle line-up, Tesla’s autonomy targets add considerable top-line growth potential. Musk’s projection of 20% to 30% vehicle growth next year and the production of 2 million Cybercabs per year (under volume production of 2026) reflects Tesla’s focus on expanding the autonomy market. Tesla has developed a ride-hailing app that allows select users to call rides in the Bay Area. Overall, the efforts to launch driverless vehicles by 2025 may lead to high business growth by reshaping its core operational model.

Loss of Market Share, CapEx, And FCF Fluctuation

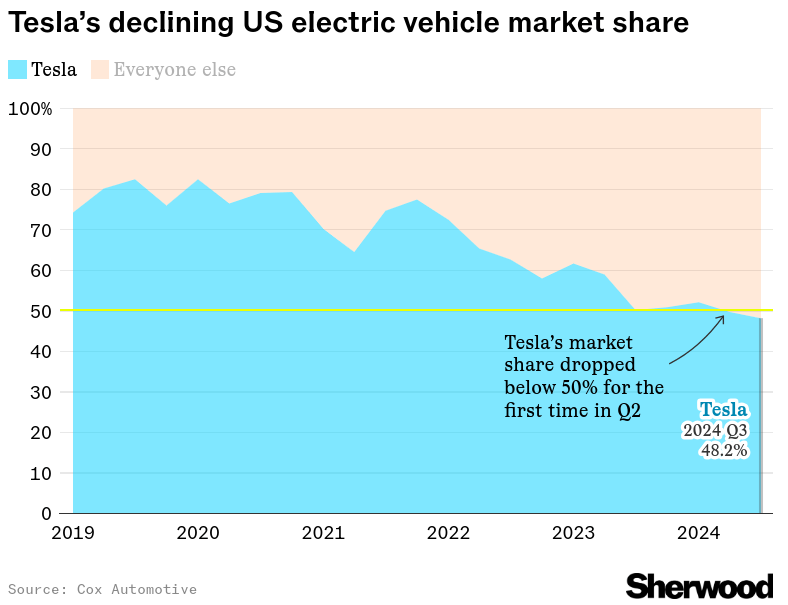

On the downside, Tesla’s EV market share in the US has declined sequentially. This market share fell from 66.1% in Q2-2022 to 48.2% in Q3-2024, signaling growing competitive pressures. The decline reflects intensified competition with local and international (Chinese and German) manufacturers.

Tesla’s market share loss points to challenges in retaining its dominance, and such sustained market erosion may impact revenue growth projections, mainly if sales volume does not rise elsewhere. To counter this drop, Tesla is boosting competitive strategies (pricing) and increasing production innovation (vehicle cost). Any failure in these areas may sharply limit revenue generation in the near term.

sherwood.news

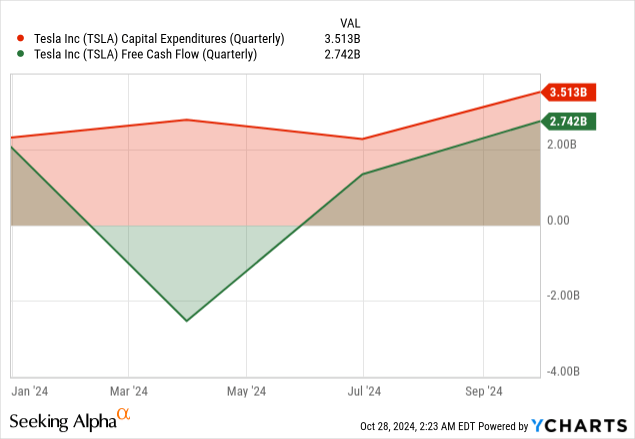

Moreover, Tesla’s CapEx has surged considerably in recent quarters. CapEx rose from $1.730 billion in Q2-2022 to $3,513 billion in Q3-2024, hitting a consolidated increase of 103.06%. This rise reflects an investment focus on expanding facilities and advancing technology. However, constant growth in CapEx suggests inefficiencies in scaling operations potentially related to delays, rising materials costs, and shifts in priorities. Rising CapEx impacts free cash flow (FCF) and reduces profit margins.

In short, FCF has fluctuated significantly, marking liquidity and cash management concerns. FCF hit a high of $3.297 billion in Q3-2022, followed by a notable drop to -$2.531 billion in Q1-2024, and now in Q3-2024 at $2.742 billion. Such extreme FCF shifts point to irregular liquidity supply, reflecting challenges in sustaining cash flow while undergoing high CapEx outlays. Negative cash flow quarters limit Tesla’s cash capability to reinvest in growth areas, making it susceptible to cash shortages. Therefore, the FCF fluctuations underline a high reliance on revenue inflows, adding risk if revenue fails to offset market share losses.

Takeaway

Tesla’s latest results highlight its adaptability and strategic growth, solidifying its evolution beyond automaking into a diverse clean energy and technology leader. Despite competitive and operational challenges, Tesla’s expanding revenue streams and innovation-driven approach support a bullish outlook, promising long-term potential in high-margin segments and autonomous solutions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.