Summary:

- The EV market is experiencing rapid growth, with Tesla being the only Western company maintaining a significant presence in China’s EV market.

- Tesla’s explosive sales growth is accompanied by an expansion of margins, outperforming competitors in terms of EBIT margins.

- There is still tremendous potential, as still less than 20% of cars sold are EVs.

Philipp Berezhnoy/iStock Editorial via Getty Images

Investment Thesis

Tesla (NASDAQ:TSLA) is showing one smart move after another and is, in my view, an extremely attractive buy & hold position in the long term. Unquestionably expensive, but the company is well-managed and currently captures high market shares in Europe. The Supercharger deal with GM and Ford should have a very positive long-term impact. Furthermore, Tesla is the only Western manufacturer playing a role in the Chinese EV market. China is the largest car sales market in the world, and the more EVs are sold, the lower the market share of GM, Toyota, Mercedes, etc.

Industry Overview

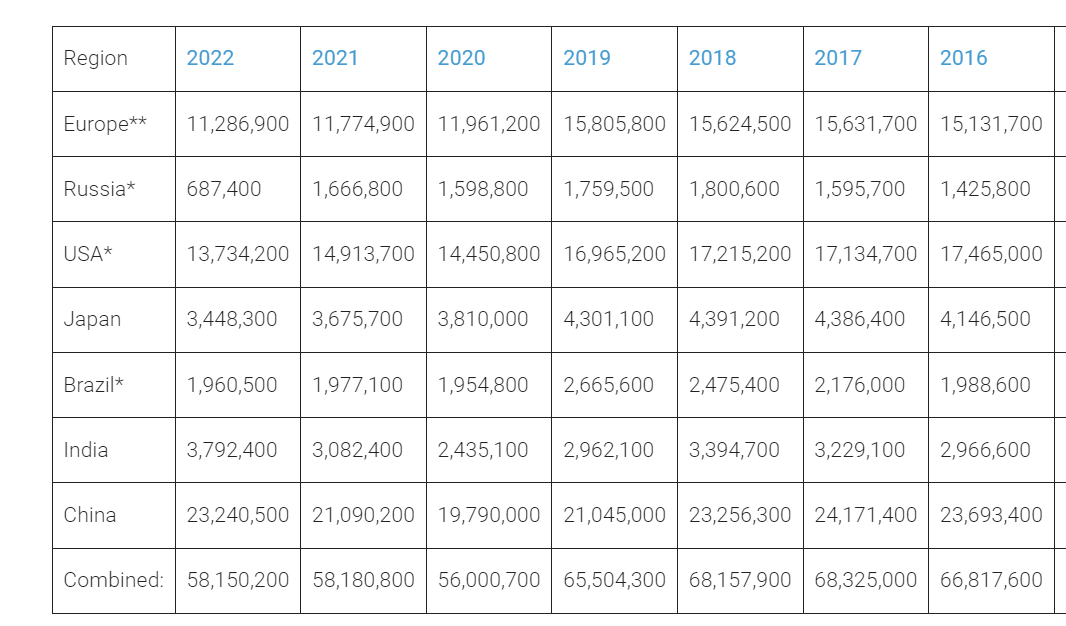

The EV sector is experiencing a dramatic expansion. In 2022, electric cars represented 14% of all new automobile sales, a significant increase from 9% in 2021 and just under 5% in 2020. Forecasts predict this surge to persist, with sales of electric vehicles projected to rise by 35% year on year by the close of 2023. This could mean that nearly one in every five cars sold in 2023 will be electric.

On a global scale, China is leading and accounts for approximately 60% of worldwide EV sales. In the United States, the EV market grew by 55% in 2022, capturing 8% of total car sales. Although they currently account for only a small portion of the global market, emerging economies such as India, Thailand, and Indonesia saw significant growth in their electric vehicle sectors in 2022 and could be key growth drivers in the future.

Tesla in China

I recently wrote a very detailed 4000-word article about the EV market in China, titled “Power Shift: China’s EV Market, Impact On Western Brands, And Some Trading Ideas”. The main message is that as China’s EV market adapts, Western companies are losing market share because they hardly play a role in EVs anymore; Tesla is the only exception. Only Chinese brands and two Teslas were among the ten most popular EV models in 2022.

China is by far the biggest car sales market, about as big as the US and Europe combined. EVs have a 25% market share of new Chinese sales, and, except for Tesla, Western manufacturers play almost no role here. This development is not yet reflected so much in the figures due to the remaining 75%, in which many sales can still be generated. But the more EVs are sold, the more market share Western companies will lose.

“Power Shift” Article

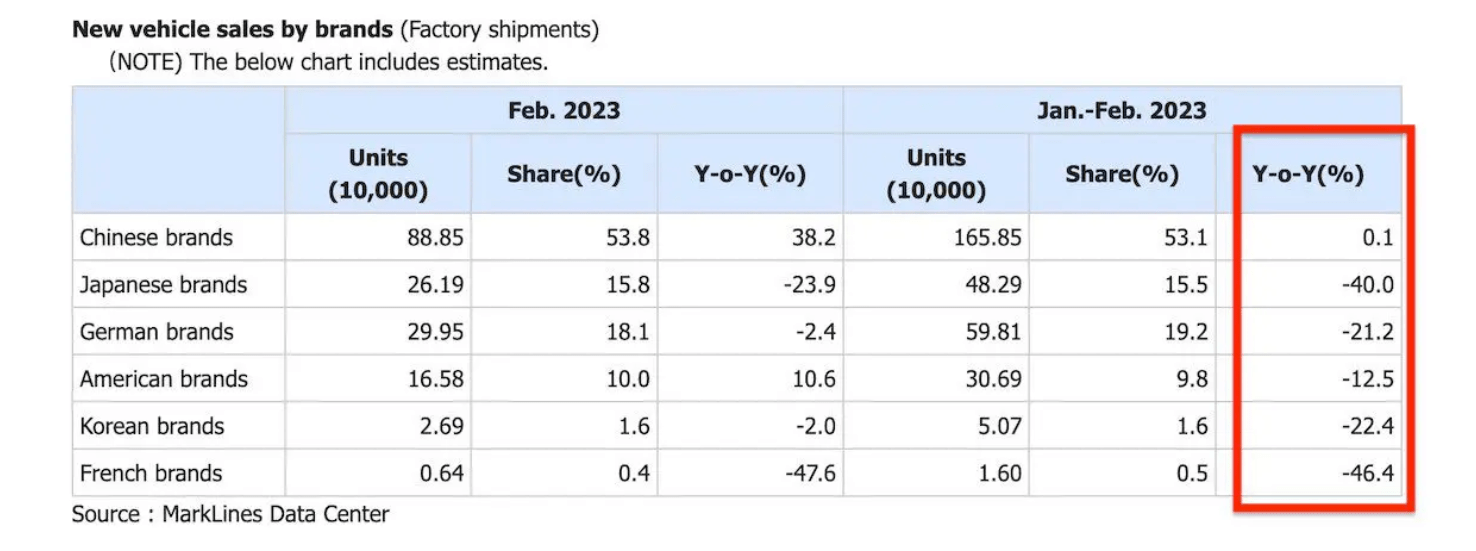

But in hindsight, I have to say this is already visible in numbers. All Western manufacturers that sell mainly combustion cars in China are experiencing declining sales. This is especially true for Japanese and European brands and General Motors. One of the few exceptions is Ford, but only because they sell almost nothing in China anyway.

thedriven.io

Financial Progress & Margin Trends

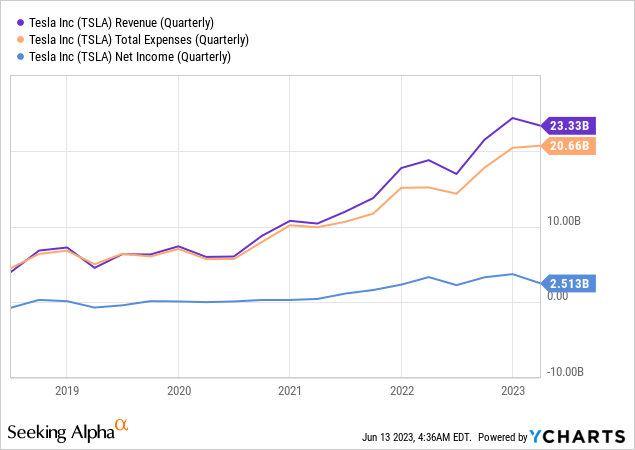

First, a short overview over a longer period for revenues, expenses, and net income.

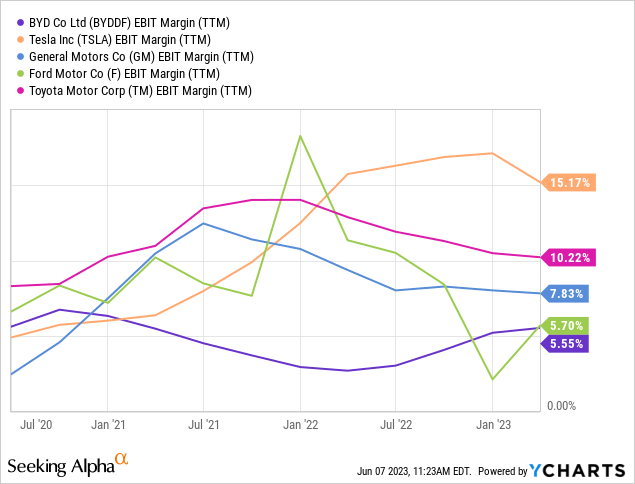

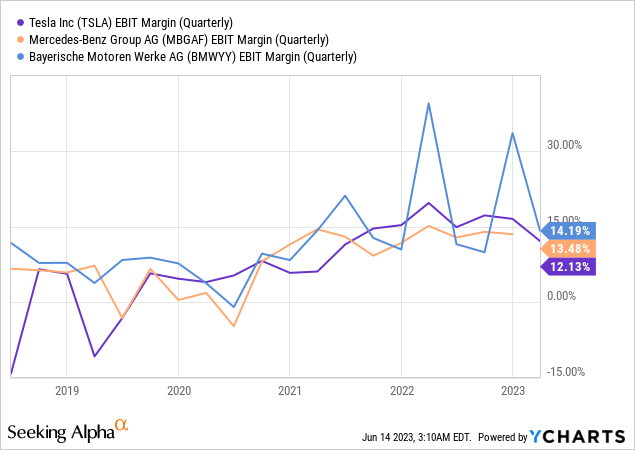

What is particularly remarkable and anything but self-evident is that an expansion of margins accompanies this explosive sales growth. Here is a comparison with the competition in terms of EBIT margins.

Seeking Alpha

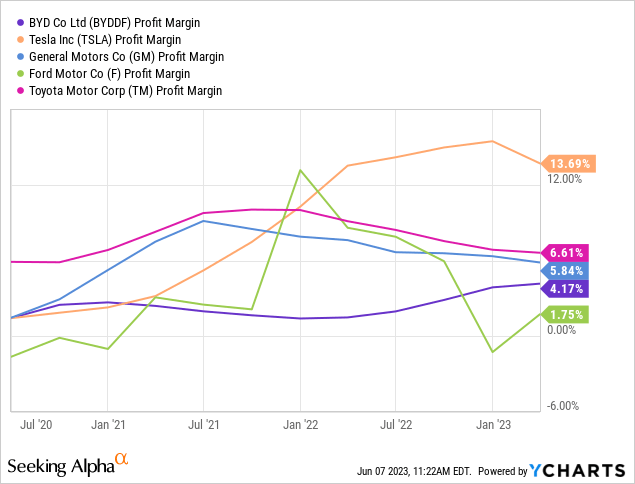

And below is the comparison of the profit margin. Of course, these comparisons are not entirely appropriate since all other manufacturers except BYD earn their money mainly with combustion cars, where competition and price pressure have prevailed for a much longer. By the way, BYD is growing even quicker and is significantly cheaper valued; see my analysis here.

Anyway, this doesn’t matter for the future: Tesla has already built up and optimized production capacities for EVs, which other manufacturers have to build up first. Therefore, Tesla can start lowering its prices earlier and thus make the electric car sales business a loss-making business for other manufacturers. If, simultaneously, the combustion business for these manufacturers is more and more shrinking, they are in a difficult position to remain competitive in the long run. In addition, manufacturers such as Volkswagen, Ford, and General Motors are already in enormous debt, while Tesla has no debt at all.

Seeking Alpha

Overall, there is a trend that I also mentioned in my recent article on BYD: Pure EV companies tend to have increasing margins, while traditional ICE manufacturers, who have to spend a lot of capital to expand their production to EVs, tend to have decreasing margins. If we were to see the margins of the EV division of Ford, GM, and other companies separately, they would probably be negative.

Margin Outlook

After the publication of the Q1 results, there was a lot of discussion about the development of the margins, and some investors were displeased that the trend of increasing margins now seems to be over. In fact, Tesla currently no longer has the strongest margins in the industry.

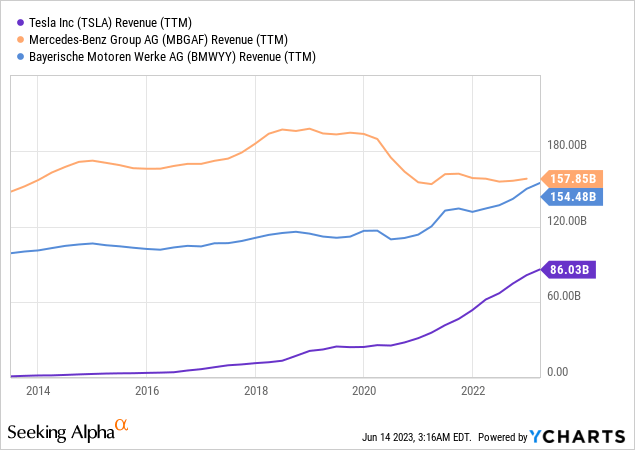

Mercedes has decided to focus more on the higher-priced luxury market of the automotive market, where high margins are achievable. There is nothing wrong with this strategy, but it has meant that revenue has not grown for years and that YoY car sales in 2022 vs 2021 have fallen by one percent.

Tesla has decided to take a different path. In the beginning, they benefited from their early mover advantage. There was much less competition, but it was clear that other manufacturers would also produce EVs sooner or later, and the competitive pressure would increase. So now Tesla was faced with a choice: keeping its prices high and establishing itself in the middle and higher price segments or trying to go for volume. The decision has been made, as Elon Musk clearly states in the Q1 earnings call.

And while we reduced prices considerably in early Q1, it’s worth noting that our operating margin remains among the best in the industry.

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy. This is an extremely important point.

Q1 2023 earnings call

Another comment from Zachary Kirkhorn on the margin outlook was this.

Just one other thing I wanted to mention on margin. While we’re not providing specific guidance there, I mean, just to set expectations of where we think this business will go in terms of margins, probably generally in the ballpark of what we’ve seen historically on the vehicle business. We generally look to mid-20% gross margins for any program that we launch. And so we’re not there yet on this business, but that’s what we’re working towards.

Q1 2023 earnings call

Based primarily on Elon Musk’s commentary, I think it’s fair to say that declining margins may be expected for several more quarters or even years. This is in exchange for more market share and higher sales. If you extrapolate the last chart of revenue growth compared to BMW and Mercedes, Tesla could possibly overtake Mercedes in revenue in 2024 or 2025. According to Elon Musk, the highest possible number of cars sold is the goal to then reap higher margins in the future.

Is this the right strategy? Certainly, this is a matter of opinion and not everyone will agree with it. I think higher volume has numerous advantages and opens up new opportunities

- Tesla focuses on the lifetime-revenue of customers. See this question and Musk´s answer in the Q1 call:” Rod Lache:

Just to elaborate on that point though, the revenue, the long-term lifetime revenue that you’re targeting from each vehicle is massive. So if you took that to the extreme, it would seem that you’d be comfortable with a relatively low initial margin. Am I misinterpreting that, or is that exactly right?

Elon Musk:

Correct. That’s exactly right.”

-

The Scale Game: An increase in production volume typically leads to economies of scale, streamlining costs, and enhancing efficiency.

-

Data Collection: Higher volume means more data for Tesla’s AI systems. This also means more data for Tesla’s Supercharger system to identify potential gaps. This increases customer satisfaction.

-

Additional revenue opportunities: Leasing autonomous driving systems to other brands, selling coffee and snacks at the Supercharger stations, etc. This is part of the lifetime value of a customer.

Valuation & Outlook

Given the better margins, Tesla can afford to lower prices more quickly. This is a smart strategy in the long run because it will lead to even lower production costs, and recurring revenues like the Superchargers will be even more valuable. In addition, this will give the company even more data, leading to better automated driving systems and smarter ways to set up Supercharger stations.

Therefore, the recent Supercharger deals with Ford and GM are highly favorable to the company because of the revenue and allowing the company to build an even tighter network of stations which is free publicity.

Analyst Dan Ives and team believe Tesla is on track to hit its 1.8M unit delivery bogey for the year and should see margins ramp back up into FY24. The firm estimated the new EV battery charging deals with Ford and General Motors could add another $3B to services EV charging revenue for Tesla over the next few years in another accretive poker move by the Austin-based company.

Seeking Alpha News

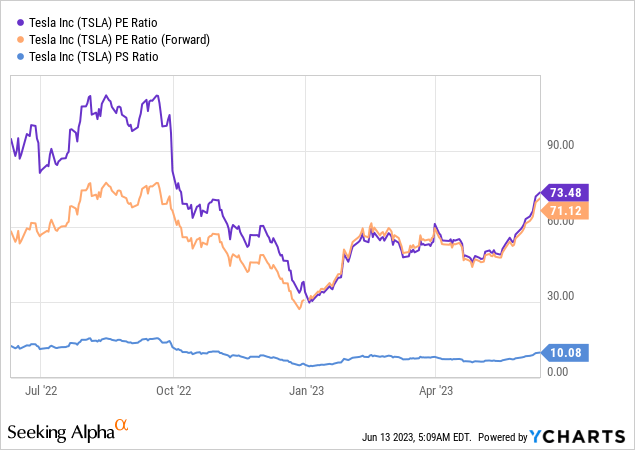

The company is currently valued at an enterprise value of $758.98B. The market cap is $774.63B and has more cash than debt. Obviously, it is not a cheap valuation, especially after the significant rise in the share price in recent weeks. However, the following chart shows that there have been excellent buying opportunities over a very long period this year. With all the positive developments, anything below a P/E ratio of 50 is a clear buy, in my view.

This assessment is mainly based on the general dynamics of the automotive market. Globally, fewer cars are being sold today than in 2016. However, pure EV manufacturers do not notice this but instead operate in a strongly growing segment. Tesla is now the best-selling brand in more and more countries.

best-selling-cars.com

Ranking second in terms of global EV sales share, Tesla crossed 1.3 million deliveries in 2022. Its sales rose over 31% YoY in Q4 2022. This number would have been more if fresh cases of COVID-19 hadn’t surfaced in China. Tesla’s Model Y became the best-selling model in Europe in November and December.

Risks

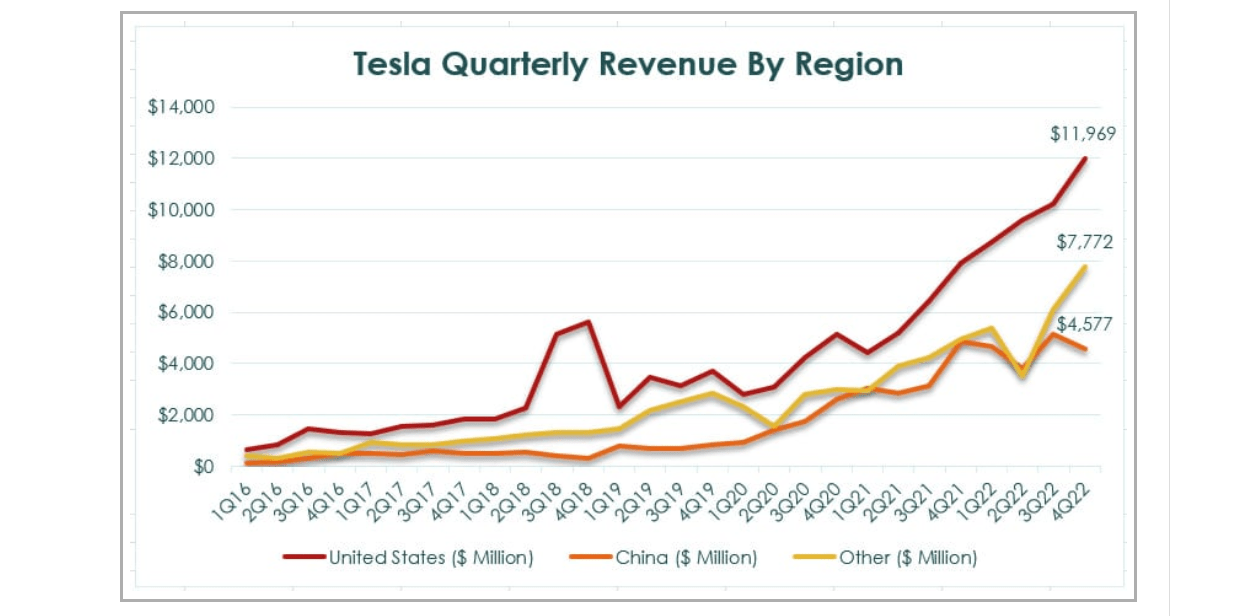

A risk that exists for Tesla is that they will also lose market share in China to domestic Chinese companies. So far, it doesn’t look like it, but that is a risk; currently, about 20% of the company’s sales still come from China, and as you can see below, it is growing slower than in other parts of the world.

stockdividendscreener

Not so much a risk for the company but for shareholders is if the strategy goes over to lowering the company’s margins even further, i.e., to make the vehicles cheaper and cheaper and, in this way, to keep the EPS more or less constant over several years. This could be the best strategy for the company, but for shareholders, it could mean that meager growth figures would result for several years. The market could lower its premium valuation for the company. Manufacturers like Mercedes or Volkswagen have a P/E ratio of less than five and a 7 or 8% dividend yield.

Furthermore, Tesla will sooner or later face a situation where its production capacity exceeds market demand. At this point, the market could also start to value the company at a lower average P/E.

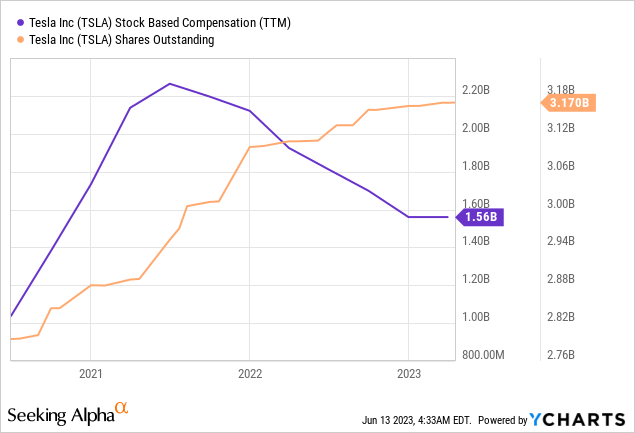

Share dilution, insider trades & SBCs

For me, these three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can put us, shareholders, at a disadvantage. In addition, insider trades sometimes contain valuable info about the confidence of management itself.

Overall, the SBCs are relatively low given the revenue and compared to many other, especially tech companies. However, there is quite a significant share dilution, but this seems to be slowing down.

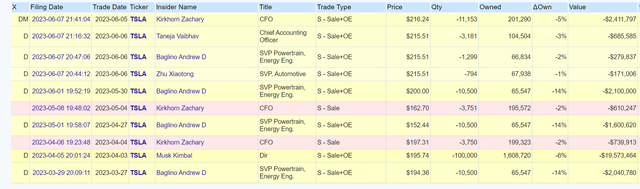

These are all insider trades from the last three months.

Conclusion

I would like to say that I have been skeptical about Tesla for a long time. The company is currently highly valued but no longer a hype stock; it is highly profitable and delivers one smart move after another: the company is well on its way to becoming a giant in the automotive industry.

Without question highly valued, but after many years in the market, we can say that Tesla plays the game extremely smart and, in its current state with the still existing potential, deserves a premium valuation. In the long term, I think Tesla stock is very attractive; I add shares whenever buying opportunities exist. It depends on one’s personal opinion up to which P/E ratio to buy. However, I think it is very unlikely that the share will fall below $200 again soon.

| Investor’s Checklist | Check | Description |

|---|---|---|

| Rising revenues? | Yes | Increasing over longer time periods |

| Improving margins? |

“Margin-To-Volume Shift” |

Possible competitive edge |

| PEG ratio below one? | No | PEG ratio below one may suggest undervaluation |

| Sufficient cash reserves? | Yes | Vital for the survival & growth especially of unprofitable companies |

| Rewards shareholders? | No | Returning capital to shareholders |

| Shareholder negatives? | Yes | Actions that disadvantage shareholders |

| Stock in uptrend? | Yes | Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.