Summary:

- I think Apple’s currency risk has dissipated. In fact, the foreign exchange market will likely act in favor of Apple in 2023.

- Consumer confidence has hit a trough and changed its trajectory upward, likely supporting demand for Apple’s discretionary goods.

- With reasons for my bearish thesis on Apple disappearing, I now believe that Apple is a buy.

Nikada/iStock Unreleased via Getty Images

Introduction

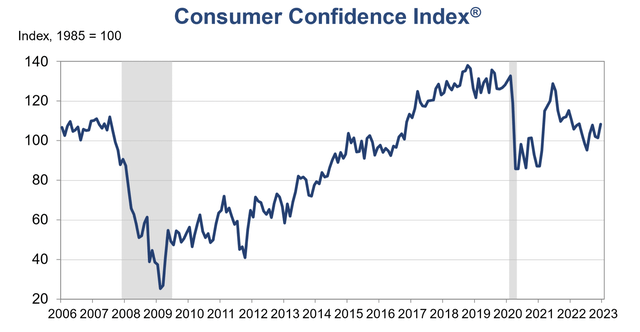

I was bearish on Apple (NASDAQ:AAPL) in my previous two articles. In October, I believed the rough macroeconomic conditions causing significant currency risks were a threat to Apple’s growth longevity in foreign markets. The absurdly strong dollar created iPhone price increases of double digits in key markets including Japan. Further, in July, given the nose-diving consumer sentiment and worsening macroeconomic expectations, I argued that iPhone 14 sales may not be stunning. However, today, given the current economic situation and consumers’ future expectations of improvement, I believe Apple, as a company, will see a strong rebound in the second half of 2023. Because stocks often move months before the actual event in anticipation, Apple may be a buy today.

Currency

Global currency risks have faded, likely permanently.

“In South Korea and Japan, iPhone prices grew by 15% and 21%, respectively while iPhone prices in the UK and Europe increased by 16% and 13%, respectively.”

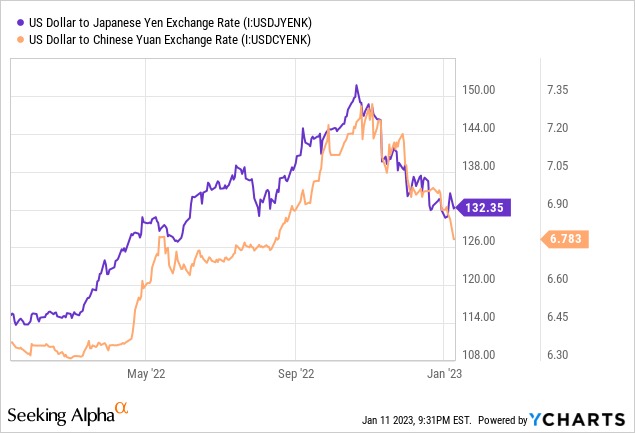

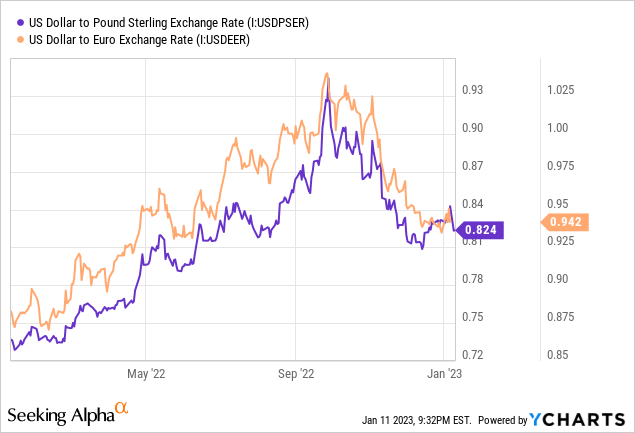

I said the above statement in my previous article to argue that the strong US dollar is making iPhone’s pricing less attractive in foreign markets. Today, in just a few short months, the US dollar’s strength has weakened significantly creating an immense positive catalyst.

As the charts above show, the US Dollar has seen a significant pullback from its October highs, which I believe is positive. First, since Apple has already raised prices for its products including iPhones in these markets, the favorable currency environment will inflate Apple’s financials when calculated in USD. For example, a theoretical iPhone sold for 100,000 Japanese Yen when USD to Japanese Yen exchange rate was 150 yen per dollar will equate to about 666 USD. On the other hand, when the same phone is sold today at 130 yen per dollar, it equates to about 769 USD. Further, if Apple sees that the high price has pressure on sales, the company will have more room for sales of iPhone 14 or a lower launch price of its new products that will be released in the future.

Throughout 2023 and beyond, I believe it is highly likely for the USD to weaken even further compared to foreign currencies. USD becomes favorable for investors in foreign markets when the US government increases interest rates, and if the foreign government cannot raise the interest rate faster than the US government, the strengthening of the dollar is usually a typical outcome.

This was the case in 2022. The US Federal Reserve raised interest rates more aggressively than its foreign counterparts causing the strengthening of the dollar. This creates massive risks for a foreign country as its access to a valuable dollar becomes limited. However, foreign governments like the Japanese government cannot typically intervene in the currency market to protect its currency despite the short-term instability because the US government, leveraging its dominant position of the dollar, attempts to limit foreign governments from intervening in the currency markets by designating either a monitoring status or a currency manipulator status each year in October.

For example, if government A heavily intervened in its currency markets, the United States treasury might designate it as a manipulator or monitoring status to give a warning before potentially imposing sanctions. Thus, foreign governments typically attempt to avoid this status, which has limited their response to irregular currency market situations in 2022 causing a strengthening of the USD. However, in late October, Janet Yellen, Secretary of the Treasury, respected Japan’s decision to intervene in the markets signaling that other countries to follow suit given what I’d call irregular and illogical market conditions to stabilize the market. I believe this has caused the currency markets to cool down as investors betting on the strengthening USD against foreign currencies now also have to fight the local governments who likely do not wish their currencies to be devalued so quickly, in my opinion. Therefore, I think the USD will likely continue to decline to normal levels in 2023 benefiting Apple’s global operations.

Macroeconomic Forecast

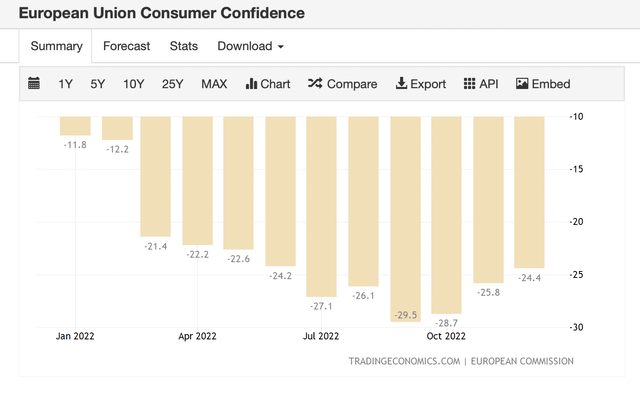

Macroeconomic conditions are expected to be gloomy in 2023. The ISM Manufacturing Index tracking manufacturing activity in the United States showed a contractionary environment for two consecutive months in November and December 2022 while the World Bank lowered the global economic growth expectations sharply in 2023 from 3% to 1.7% in just 6 months. However, looking at the consumer confidence data in the United States and the EU along with the inflation expectation data, I believe the economic downturn could be limited to 2023.

As the charts above show, both the EU and the US consumers saw a strong confidence boost toward the end of 2022. Given that recovering consumer confidence was followed by an economic recovery in the following year in the 2008 recession, I see this as a positive sign. Further, as consumers’ confidence is highly important for spending on discretionary items like the iPhone, the changing trajectory of consumers will likely benefit Apple as in times of hard economic hardships, discretionary goods are likely consumers’ lowest priority.

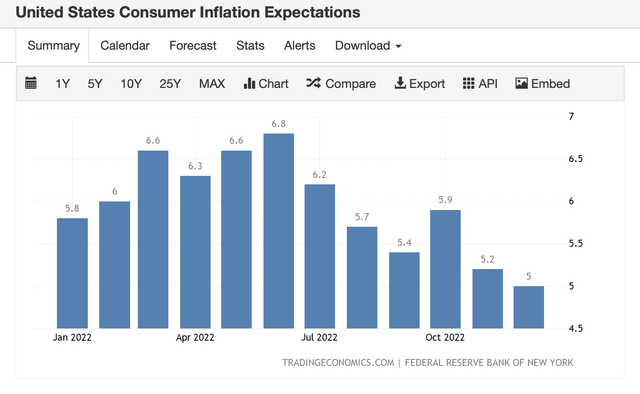

Future inflation expectations data further supports the argument that consumers are becoming more confident.

As the chart above shows, after peaking in June, US consumers are expecting inflation to swiftly come down, which has likely helped the strong rebound in consumer confidence.

I believe consumers’ willingness to spend will likely limit the magnitude and the duration of the recession acting as a strong support for Apple’s products as they are mostly discretionary items.

China

China poses both risks and opportunities for Apple. Starting with the risks, China’s strong stance on zero-Covid policy has prompted a massive production nightmare for Apple. Covid cases in its factory have hindered the company’s operation. However, although the earnings report for the fourth quarter has not been released yet with the details regarding this event, the repercussion from the event is likely priced into the company’s stock price. Further, given Beijing’s sharp turnaround in its Covid policy to allow normal activities, future production hindrances will be unlikely while economic growth from the policy will drive iPhone demand.

Valuation

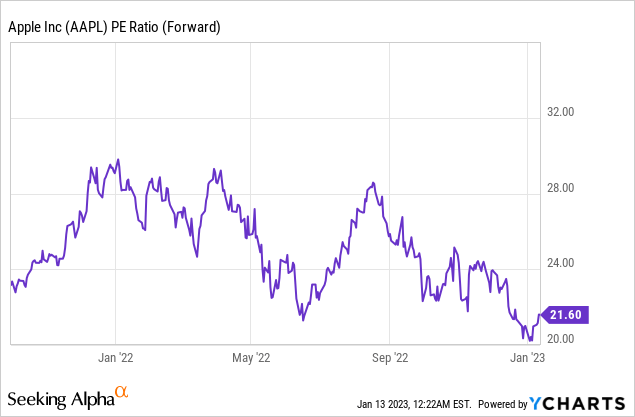

Considering that past headwinds have turned into a tailwind, I believe Apple’s valuation multiples could see a meaningful expansion in 2023. Valuation multiples of stock are inelastic, moving with the overall economy and the confidence of the investors. The chart below shows this phenomenon. When the market was confident in Apple and in the future of the economy, the valuation multiple of Apple shot up.

Thus, because the foreign exchange market and strong consumer sentiment could lead to margin and demand expansion, the investor’s confidence in Apple will likely return. Further, with strong confidence in consumers and declining inflation, I believe Apple’s valuation multiple today is cheap as it could expand its multiples to historic highs given favorable market conditions.

Summary

I was bearish on Apple in the second half of 2022 due to currency risks and macroeconomic conditions hurting consumer confidence. I thought the strong USD would eat away at demand and profit for Apple’s foreign markets while weak consumer sentiment would be detrimental to Apple’s discretionary products. However, given that both the currency risks and consumer sentiment risks have eased, I believe Apple is a buy again.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.