Summary:

- Despite its strong AI accelerator technical performance, Advanced Micro Devices, Inc. struggles to compete effectively in terms of market share and absolute dollars.

- Its Data Center operating margins aren’t competitive internally, let alone against Nvidia.

- AMD requires significantly more R&D as a percent of revenue to be a distant second than Nvidia requires maintaining the lead.

- If you’re investing in AMD for its AI financial performance potential, you’re better off elsewhere in the AI investment landscape.

gorodenkoff/iStock via Getty Images

If you’re an Advanced Micro Devices, Inc. (NASDAQ:AMD) bull, this isn’t a “hate on AMD” article. I understand the bullish situation AMD is in and, more to the point, could be in — the potential. It does have an AI hardware product — a competitive one from a technical perspective — and has been selling billions of dollars’ worth over the last year. There’s no denying AMD has a formidable AI accelerator product. Yet, the market doesn’t seem to care about that when we look at 2024’s stock returns. The question is, why?

AMD’s AI Journey

To begin, let’s rewind to earlier in this AI market. You’ll recall in Q3 and Q4 of 2023, analysts were tossing out estimates of anything from $4B to $6B in AI revenue for AMD in 2024. The company then started guidance at $2B for it and has since slow walked it up to the latest $5B number from the earnings call the other week. So, while it hasn’t hit the top end of analysts’ year-ago estimates, it has finally arrived at the number everyone initially expected.

Yet, the stock is trading lower at the same level it found itself at in January — up a measly 0.68% year-to-date against the S&P 500’s (SP500, SPY) 25.6%, the Nasdaq’s (COMP:IND, QQQ) 28.2%, and Nvidia’s (NVDA) 198%.

The conclusion is that the market isn’t concerned about AMD’s AI revenue. If it did or thought it was meaningful in the sense of being competitive, it would overlook its struggles in Gaming and Embedded and reward it with the high-valuation goodness of AI gold. Instead, AMD has finally fallen back below Nvidia’s valuation as growth has not kept up with AMD’s shares.

The market expects accelerating growth in 2025, so it still has a forward P/E of around 29-30. This is not because AI revenue is going to somehow accelerate (granted, it was off a near-zero base) but rather because the Gaming segment and, more importantly, the high-margin Embedded segment should return to growth.

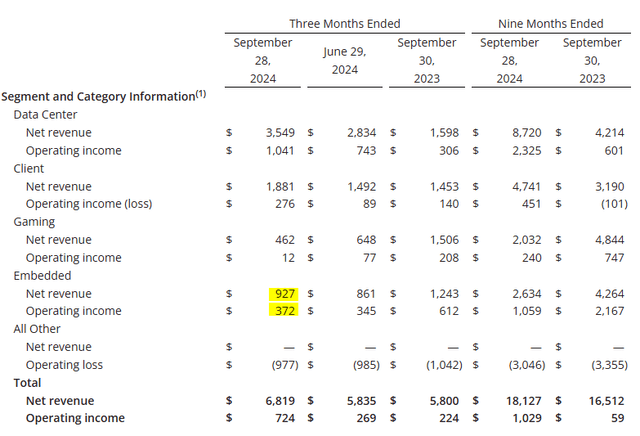

The Segment Comparisons Are Not Market Leading

I’ve detailed to Tech Cache subscribers in the past, its Embedded segment is its most profitable and what really drives its EPS growth. It has an over 40% operating margin for Embedded while Data Center has a mere 29% operating margin. That includes all that AI accelerator revenue. For comparison, Nvidia’s company-wide operating margin is above 62%, where Data Center makes up more than 87% of revenue.

The problem is the outlook for Embedded doesn’t sound all that encouraging and may be another slow roll, taking many quarters to play out.

Embedded demand continues recovering gradually, led by strength in test and emulation offset by ongoing softness in the industrial market.

…

Design win momentum is very strong across our portfolio, tracking to grow more than 20% year-over-year in 2024 and positioning us well to grow our embedded business faster than the overall market in the coming years.

– Lisa Su, CEO, AMD’s Q3 ’24 Earning Call.

The Sticking Points

Here’s the thing: there are multiple issues with AMD’s 2025. First, the Data Center isn’t at the margins it needs to be to carry the company. While it’s not the lowest operating margins at the company, Data Center should be the leader in margins. Instead, it turns out the margins are in the non-organic segment of Embedded (the Xilinx acquisition). This tells me AMD is not a leader in business execution. In other words, its organic businesses do not operate at the profitability level of its competitors and acquisitions.

Second, the Data Center is a full one step behind its competitor, Nvidia. AMD can only compare itself to the outgoing generation at Nvidia.

Looking ahead, we launched our next-gen MI325X GPU earlier this month that extends our memory capacity and bandwidth advantages and delivers up to 20% higher inferencing performance compared to H200 and competitive training performance. Customer and partner interest for MI325X is high. Production shipments are planned to start this quarter with widespread system availability from Dell, HP, Lenovo, Super Micro and others starting in the first quarter of 2025.

– Lisa Su, CEO, AMD’s Q3 ’24 Earning Call.

As an aside, it’s really difficult to tell which generation from AMD is the next one, at least on its face. AMD is using the 300-series for current and next-gen offerings — or so it refers to it — and it’s unclear what number in the 300-series is older or newer. I’m not sure if this is on purpose or if it continues just to be poor marketing, as has been the case over the last few decades. Because the 3 in the 300 number stands for the CDNA generation, it’s weird they would call 325 “next-gen” when it’s still the same generation of CDNA. It really isn’t “next generation” if it’s the same underlying architecture. Meanwhile, Nvidia is jumping architectures every year, and it’s apparent which product is which generation as they have distinct names (Ampere, Hopper, Blackwell, etc.).

Back to the point, the true next-gen won’t be until 2026 when it releases the MI400 with CDNA 4. This is why AMD must reference the now-old generation of Nvidia products, in this case, the H200. While the company releases its still truly current gen MI325X in 2025, Nvidia will be on its true next generation. Any comparison to H200 won’t be relevant as customers buy the “insane” demand of Blackwell. By 2026, Nvidia will meanwhile be onto its next generation beyond Blackwell (Rubin) before AMD even jumps one architecture.

So, not only is AMD perpetually behind Nvidia, but its margins prove it’s still playing second fiddle in all things GPU. AMD must work harder to maintain second than Nvidia does to maintain the lead from an operating perspective. And this is proven by R&D spend as a percent of revenue. AMD spent 26% of its revenue on R&D in the first three quarters of 2024, while Nvidia has spent 10.3% of revenue this fiscal year on R&D. Nvidia is doing more with less. This means any slip-up in AMD will forever make the lead unattainable. Currently, there’s still a possibility, though low as it is.

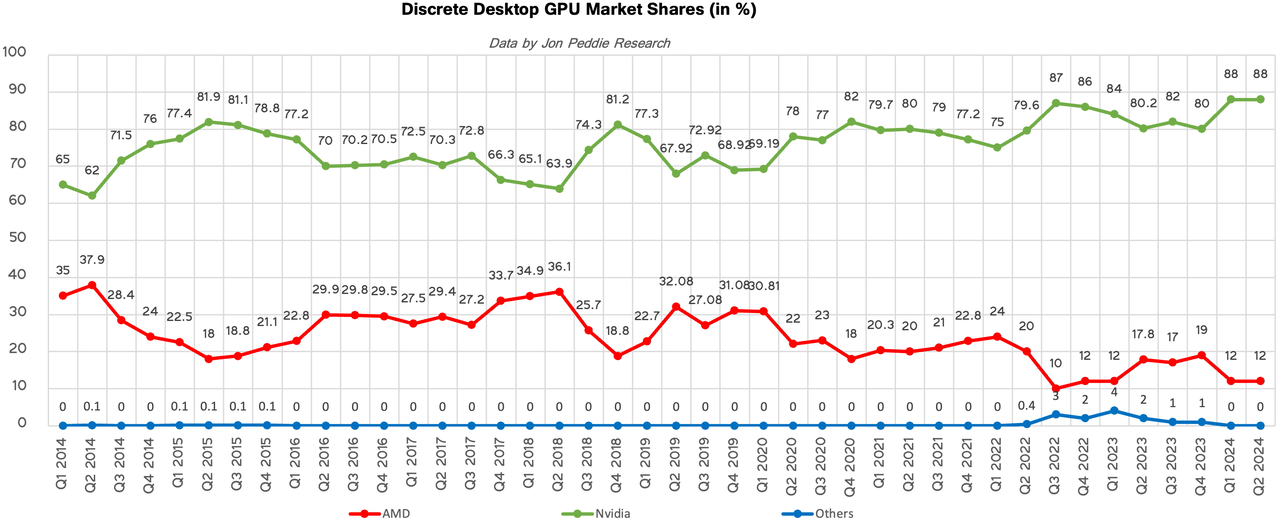

Thus, to answer the question of when the market will pay attention to AMD’s AI revenue, not until it can release same-gen products on par with Nvidia simultaneously or near simultaneously and with less effort. At that time, revenue won’t be paltry compared to the market Nvidia is blazing. However, to even attempt to eat away at Nvidia’s estimated $108B+ of Data Center revenue (my estimate for fiscal ’25), AMD must take more than 4.6% of the market. It’ll have to get to 12%-15% before it gets competitive and the market cares. It did it with Intel in the server sector, but Intel unwittingly (or unwillingly?) did AMD many favors to get there. The track record for AMD and GPUs hasn’t changed, though; it hasn’t been a leader for well over a decade and a half.

Tom’s Hardware

If the server (AI) GPU market is anything like the discrete desktop GPU market, AMD will slowly surrender whatever it gains over the next decade after it tops in the next year or so.

Market Isn’t Impressed

There’s a reason AMD has underperformed the market and its competitors in returns this year. Just any AI revenue isn’t enough to give the stock the jolt and valuation expansion many bulls have expected. Even $5B isn’t enough when the operating margins are below other segments and far below competitors. Add to it the expense of continuing R&D at higher rates than the market leader, and the conclusion is there’s no path to significant market share gain over the coming years.

If your reasons for investing in AMD are for its AI revenue potential, you’re better off elsewhere in the AI landscape.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, if you want more of this analysis plus the technical chart setup, step up to being a paid subscriber to my Investor Group Tech Cache with a two-week free trial and read more of this type of analysis on AMD and other tech stocks and assets.