Summary:

- Accenture’s stock has underperformed, down 18% YTD, but long-term prospects remain strong.

- Recent earnings results showed weakness, but the company’s past track record and generative AI business are promising.

- The valuation is attractive, with potential for double-digit total returns and a growing dividend.

HJBC

The market as a whole is enjoying a bull market move, as the S&P 500 Index has a total return of more than 25% over the last year, there remain many names that have underperformed.

One such name is professional services company Accenture plc (NYSE:ACN), which is down almost 18% year-to-date. Recent quarterly results left the market wanting, but there is still much to like about the stock long-term, including its past track record, generative AI business, and valuation.

This article will take a deeper dive into the stock to see why I believe Accenture could be an excellent investment.

Earnings Results Showed Areas of Weakness

Accenture reported earnings results for the second quarter of fiscal year 2024 on March 22nd, 2024. While results were last released three months ago, I believe in can be informative to examine the report to discern trends in the business.

For the quarter, revenue declined slightly year-over-year to $15.8 billion while missing estimates by a modest amount of $40 million. Despite this small decrease, adjusted earnings-per-share of $2.77 compared favorably to $2.39 in the prior year and was $0.11 cents above expectations.

By sales for geographic market, North America was flat at $7.4 billion, while EMEA was down 2%. Growth Markets, which accounted for $2.8 billion of sales, were up 6%.

By sales for customer type, Health & Public Services grew 10% to $3.3 billion, Resources improved 4% to $2.2 billion, and Products was flat at $4.8 billion. Communications, Media, & Technology fell 75% to $2.7 billion and Financial Services was lower by 6% to $2.8 billion.

Management also provided forward guidance that disappointed investors. Revenue growth is now projected to be 1% to 3%, down from 2% to 5% previously. Adjusted earnings-per-share are expected in a range of $11.97 to $12.20 compared to $11.97 to $12.32 previously.

Takeaways From Mixed Earnings Results

Looking at both geographic and customer type, we can see that results were very mixed for the company. This continued a trend from the first quarter of the fiscal year, in which Accenture had good numbers from Health & Public Services and Growth Markets and a double-digit decline in Communications, Media & Technology.

For the most recent quarter, consulting revenues totaled just over $8 billion, which represented a 3% decline from the prior year. New bookings were down 2% to $21.6 billion, though the book-to-bill ratio was 1.4 for the period.

While future business disappointed for the quarter, year-to-date new bookings were a record $40 billion. Looking beyond just the near-term results, we see that Accenture is still offering products and services that customers are looking for, given the company’s ability to generate new bookings.

Additionally, Accenture performed well last year. The company’s fiscal year 2023 demonstrated solid growth, as revenue was up 8% and adjusted earnings-per-share improved by 9%. As recently as the fourth quarter of fiscal year 2023, the company experienced growth in every region and area outside of Communications, Media, & Technology.

For comparison purposes, last year’s growth is nearly in-line with the company’s long-term performance. The company’s compound annual growth rate for the past decade was 7.2% for revenue and 9.9% for adjusted earnings-per-share. Operating at a high level has long been a trademark of Accenture.

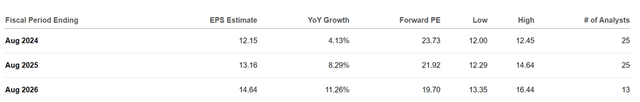

Analysts are expecting modest growth over the next few years, however, as demand among customer categories is expected to continue to be mixed.

The company’s guidance for earnings-per-share for this year is just about in-line with analysts’ estimates for the current fiscal year, but a stronger growth rate is expected over the next two fiscal years.

A return to growth after what is expected to be an atypical level of growth in fiscal 2024 is achievable. First, the company has been extremely active on the acquisition front as it has made a high number of bolt on acquisitions over the past few years. Accenture has purchased more than 140 companies over the past four fiscal years as it continues to augment its core businesses.

One of the latest acquisitions is the company’s purchase of Parisonate early last month. This acquisition will further boost Accenture’s Generate AI business, which has been exploding. Accenture had $600 million of new bookings during the second quarter, which comes on the heels of $500 million of new bookings in the preceding period.

The company had just $300 million of new bookings for generate AI in all fiscal year 2023, so this business is expanding at a high rate. AI should be a further tailwind to the company, as Accenture plans to invest a total of $3 billion in its AI services in order to meet its client’s needs. The company has also stated that it has plans to have an AI workforce of close to 80,000 by fiscal year 2026, which would be double what it currently employs. AI will be a significant portion of Accenture’s future business.

Valuation and Dividend Analysis

The plus side of a declining share price is that the valuation can be much more attractive. With the stock closing Friday at $289, Accenture is trading at 23.9 times the $12.09 midpoint of the company’s revised guidance.

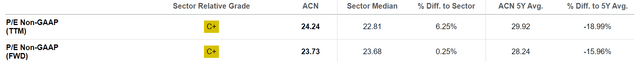

While this is still a premium valuation on the face of it, this is below the multiple that the market has recently assigned to the stock. In fact, shares of the company are trading at a 16% discount to the five-year average price-to-earnings ratio of 28. Accenture’s price-to-earnings ratio is also in-line with the average stock in its sector as well.

Given the company’s long-term earnings growth rate, acquisition strategy, and the importance of AI to future business, I believe that Accenture should trade within a price-to-earnings ratio of 26 to 28 times earnings estimates.

Using the midpoint for guidance for fiscal 2024, my price range target for the stock is $314 to $339, which would result in a return of 8.7% to 17.3% gain from today’s price.

This does not include Accenture’s dividend, either, which the company has increased for 13 consecutive years. Shares yield 1.8% is not the most generous yields, but it is among the highest that the stock has offered in more than five years.

The low yield is not for a lack of trying on Accenture’s part. The dividend has increased roughly at the same rate as earnings-per-share since 2014 at 9.2% annually.

The dividend is also likely to continue to grow, as the projected payout ratio for this fiscal year is just 43% and very close to the 10-year average payout ratio of 40%. The free cash flow payout ratio shows the dividend to be even safer, as Accenture has a three-year average payout ratio of just 29%. This leaves ample room for the dividend to continue to grow.

Inclusive of the dividend, investors could see at least double-digit total returns from Accenture’s current share price.

Risks to Investment Thesis

As with any investment, there are risks with owning shares of Accenture.

Even after the stock selloff, shares are still trading at a premium multiple. The multiple has been warranted due to the company’s long-term earnings growth rate, but if that continues to slow, then the market will likely rerate shares and cause the stock to decline further.

Second, Accenture’s acquisition spree has largely been successful as the company adds to its business, but buying the wrong competitor at the wrong price could be viewed as a negative by investors.

Lastly, while Accenture plans to be aggressive in its investment of generative AI, it could lag competitors, which would reduce the multiple the market is willing to pay for the stock.

Final Thoughts

Accenture has not been a great investment over the last year, but I believe that opens the door for the opportunistic investor to take advantage of a lower share price and valuation.

The company has much that is working in its favor, including a solid year-to-date book-to-bill ratio and a burgeoning generative AI business.

Even a small expansion of the price-to-earnings ratio to the low end of my valuation range coupled with the modest dividend yield could reward shareholders with a double-digit total return. Therefore, I believe that Accenture is a buy today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.