Summary:

- Revenue growth and sustained gross margin despite the challenging macroeconomic situation.

- Acquisition of Figma could provide entry for Adobe into a fast-growing market, which could create significant value for its customers and shareholders.

- On the other hand, from a valuation perspective, the stock may not appear to be the most attractive candidate.

- Potential issues with regards to the Figma acquisition could also have significant impacts on the stock price in the near term.

- For these reasons, we rate ADBE’s stock as “buy”.

Santiaga

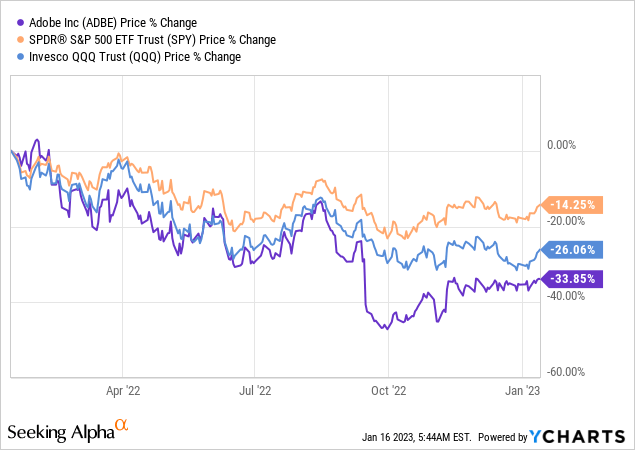

Adobe Inc. (NASDAQ:ADBE) operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. During the past year, Adobe stock price has declined by 34%, underperforming both the SPY and the QQQ.

One major trigger for the decline has been the announcement of the acquisition of Figma, a collaborative interface design tool, in the second half the year.

Despite significant loss in market value in 2022, we believe that Adobe’s stock may be an attractive one to own in 2023, especially as the Figma deal related risks may already be priced in. In today’s article, we are going to highlight the primary reasons for our statement.

Fiscal 2022 results

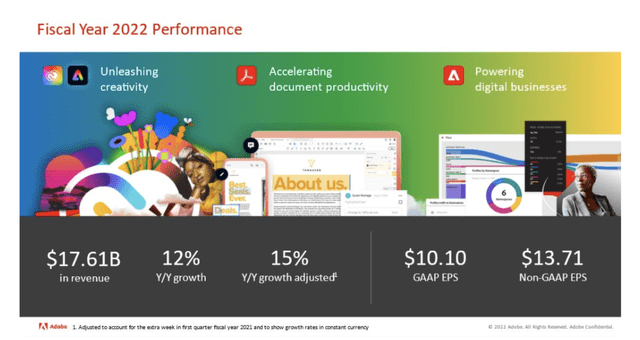

Despite the challenging macroeconomic environment, Adobe has achieved record revenue ($17.61 billion) and operating income ($6.10 billion GAAP) in fiscal 2022. For 2022, operating cashflow also came in at a record level of $7.84 billion. While Adobe does not pay dividends, the firm has purchased back about 15.7 million shares.

Fiscal 2022 performance (Adobe)

Revenue

All segments of Adobe have contributed meaningfully to the revenue growth.

Digital Media segment revenue has totalled in $12.84 billion, representing an 11 percent increase compared to the prior year or a 16 percent adjusted year-over-year growth.

Creative revenue has reached $10.46 billion, equivalent to a 10 percent year-over-year increase or 14 percent adjusted year-over-year growth.

Document Cloud revenue has been $2.38 billion, representing a 21 percent increase compared to the prior year or 24 percent adjusted year-over-year growth.

Digital Experience segment revenue has reached $4.42 billion, representing a growth of 14% YoY, or 17% on an adjusted basis.

Margins

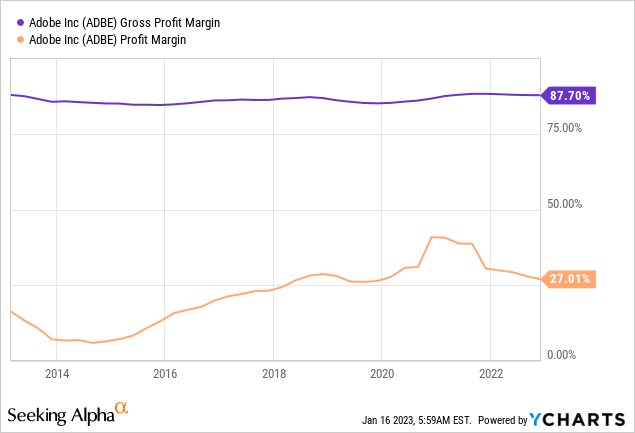

Over the course of the past years, ADBE has managed to maintain its gross profit margin at very high level of about 88%, consistently.

From 2015 onwards, the firm’s profit margin has been gradually increasing until reaching its peak in 2021. While profit margin has been declining over the past quarters, it still remains at pre-pandemic levels.

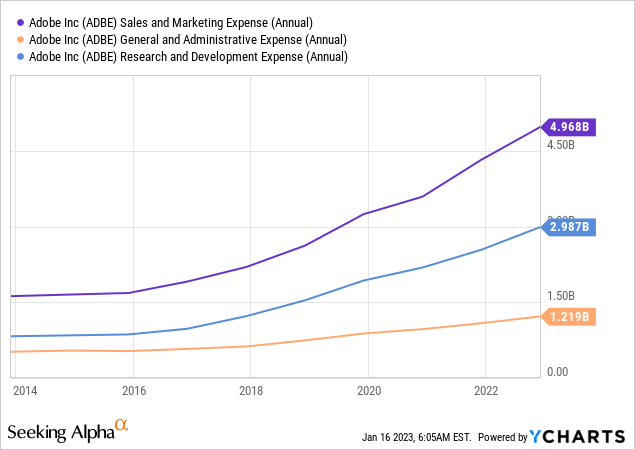

SG&A- and R&D expense increases have been both contributing to the contraction of the profit margin in the past quarters.

In our opinion, both the revenue growth and the margin performance in this challenging market environment show that the demand for Adobe’s products and services can remain high even in a slowing economy. In 2023 we expect the macroeconomic environment to remain challenging, however we may already see some improvement in the second half of the year. We believe that the improvement is likely to be fuelled by:

- Slowing inflation and slowing rate hikes by the Fed.

- This in turn could lead to an improvement in consumer sentiment, which may have a positive impact on the discretional spending of the customer.

- The increase in wages may also start to slow, positively impacting the margins of the firm.

Adobe is also relative optimistic about the near term:

For Q1 FY23 the company is targeting:

- Total Adobe revenue of $4.60 to $4.64 billion;

- Digital Media net new ARR of approximately $375 million;

- Digital Media segment revenue of $3.35 to $3.375 billion;

- Digital Experience segment revenue of $1.16 to $1.18 billion;

- Digital Experience subscription revenue of $1.025 to $1.045 billion;

- Tax rate of approximately 22 percent on a GAAP basis and 18.5 percent on a non-GAAP basis; GAAP earnings per share of $2.60 to $2.65; and

- Non-GAAP earnings per share of $3.65 to $3.70.

For the 2023 estimations, Adobe has not yet been taking into account the potential benefits of the Figma acquisition. With a potentially successful acquisition, these figures could turn out to be even better than expected.

Acquisition of Figma

Many have been criticising Adobe for the acquisition of Figma, a leading web-first collaborative design platform, at a price of $20 billion, which is to be paid in cash and stock.

The primary strength of Figma is that it allows people who design interactive mobile and web applications to collaborate through multi-player workflows. This strength is likely to provide opportunity for Adobe to expand its user base and to enter a fast-growing market, which could create significant value for its customers and shareholders.

What are exactly the advantage for Adobe? Adobe has summarised the main areas, where synergies are expected. We are highlighting some of those here:

- Figma’s web-based, multi-player capabilities will accelerate the delivery of Adobe’s Creative Cloud technologies on the web, making the creative process more productive and accessible to more people.

- Adobe and Figma will benefit all stakeholders in the product design process, from designers to product managers to developers, by bringing powerful capabilities from Adobe’s imaging, photography, illustration, video, 3D and font technology into the Figma platform.

- The combination of Adobe’s and Figma’s communities will bring designers and developers closer together to unlock the future of collaborative design.

We also have to mention that there are also potential risks associated with an investment in ADBE in the near future. In 2023, as investors, we will be definitely looking out for news and signs of how the acquisition is progressing and we also expect that these pieces of news can result in the volatility of the stock price in the near term.

Risks

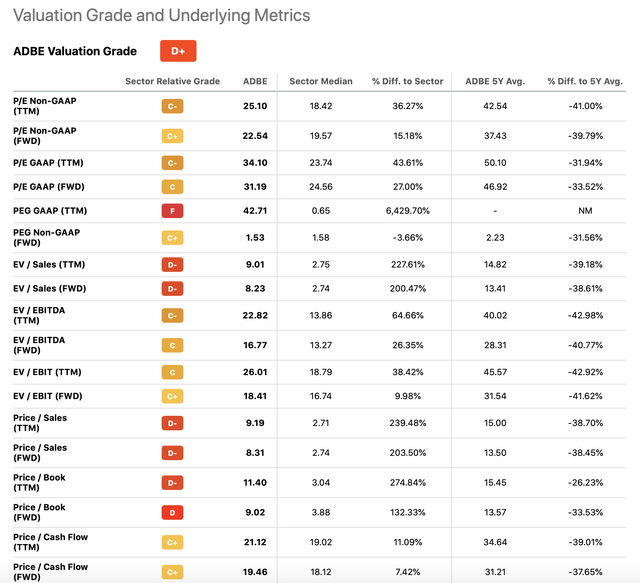

To assess the risks, we will be primarily looking at a set of valuation metrics. The valuation of the firm appears to be relatively high. Adobe’s stock compared to the information technology sector median is trading at a substantial premium, even after the sharp market cap decline in 2022.

Valuation metrics (Seeking Alpha)

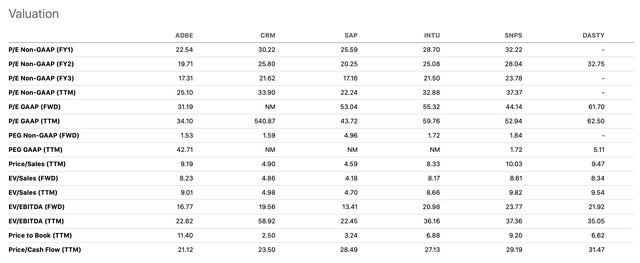

When we narrow this comparison to some Adobe’s peers, the picture looks somewhat better. Compared to some of its direct peers, ADBE’s stock even appears to be attractively priced.

Valuation comparison (Seeking Alpha)

Further, compared to its own 5Y averages, ADBE’s valuation appears to be more attractive, according to all the metrics presented in the valuation metrics table.

While the price ratios indeed appear to be high compared to the rest of the market, in our opinion, the premium is justified as the firm has kept demonstrating strong growth even in the recent quarters.

On the other hand, we have to keep in mind that there is a chance that the Figma acquisition does not turn out as good as expected by Adobe. In this case, the synergies are likely to be less and the expected revenue and profit growth may not be achieved. If so, the concern of many investors considering the $20 billion for the acquisition may be validated. The potential issues related to the acquisition have been also acknowledged by analysts, stating that the “ongoing regulatory review process will likely serve as an overhang [on the stock] for a while”. As mentioned earlier, this may cause a volatility in the stock price in the near term.

Our final take

Adobe’s share price has substantially declined over the past 12-months, while the firm kept growing, despite the challenging macroeconomic environment. The announcement of the Figma deal created further downward pressure for the stock. Although ADBE’s stock is selling at a premium compared to the IT sector median, we believe that most of the risks associated with the Figma deal are already priced in. As we expect the macroeconomic environment to start improving in 2023, we believe that the demand for Adobe’s services will also likely follow. In our opinion, this positive development is likely to be reflected in the stock price over the course of the year. For this reason, we are bullish on Adobe at the current price levels.

Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.