Summary:

- In this comparative analysis, I will compare Alphabet and Microsoft’s competitive advantages, their fundamental data, financial health and growth outlook.

- I will demonstrate why I believe that Alphabet is the superior choice in terms of Valuation and Growth, while Microsoft is superior in terms of Profitability.

- While Alphabet is still highly dependent on its Google Advertising business segment, the Microsoft stock has more downside risk, given its higher Valuation and lower growth metrics.

tupungato/iStock Editorial via Getty Images

Investment Thesis

Much has been written about the AI battle between Microsoft (MSFT) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) within the last few months, but in this comparative analysis on both companies, I will mainly analyze their competitive advantages, fundamental data, financial health and growth outlook to find out which is currently the superior choice for investors.

First of all, it can be highlighted that both companies have strong competitive advantages and are financially healthy, ensuring long-term stability for investors.

While there is no clear winner among the two, I would like to highlight that I see Alphabet as the superior choice when it comes to Valuation (Alphabet exhibits a P/E [FWD] Ratio of 23.12, which is below Microsoft’s P/E [FWD] Ratio of 35.05), and Growth (Alphabet exhibits an EPS Growth Rate Diluted [FWD] of 23.42% compared to Microsoft’s 11.32%). Given Alphabet’s attractive Valuation and Growth metrics, I see the company as having less downside risk when compared to Microsoft.

Even though Alphabet is much more dependent from a single business segment than Microsoft (in 2023, 77.38% of Alphabet’s revenue was generated from the Google Advertising segment), the Microsoft stock has a stronger downside risk, given its higher Valuation and lower growth metrics when compared to Alphabet.

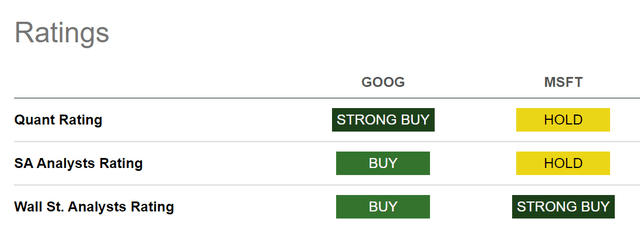

For these reasons, Microsoft receives my buy rating, while Alphabet gets my strong buy rating. In a long-term-oriented investment portfolio, I suggest overweighting both companies, but I recommend providing Alphabet with a slightly higher proportion of the overall portfolio in comparison to Microsoft.

Microsoft and Alphabet’s Performance within the past 5 years

Considering the past 5 years, it can be noted that Microsoft has shown a superior performance when compared to Alphabet. While Alphabet has shown a performance of +236.12%, Microsoft’s Total Return has been +260.94%.

However, it should be noted that Microsoft’s superior performance has also contributed to the company’s currently elevated Valuation when compared to Alphabet.

Alphabet vs. Microsoft: Competitive Advantages

Both Alphabet and Microsoft possess significant competitive advantages that position them strongly against competitors over the long term.

Among Microsoft’s competitive advantages are its broad product portfolio and ecosystem of products (including Microsoft Windows, Office Suite, Teams, Azure, Bing, LinkedIn, etc), loyal customer base, strong brand image (with a current Brand Value of $340,442M, Microsoft is presently the 2nd most valuable brand in the world as according to Brand Finance, behind Apple, with a brand value of $516,582M). It is further worth highlighting Microsoft’s financial health (reflected in its EBIT Margin [TTM] of 44.70%, which stands well above the Sector Median of 4.75%, and its Return on Common Equity of 38.49%, which is significantly higher than the Sector Median of 3.99%), strong positioning within the cloud computing market and global reach and scale.

Among Alphabet’s competitive advantages are its own ecosystem of products (such as Google Search, Google Maps, YouTube, Google Drive, Gmail, and the Google Cloud Platform, etc.), strong brand image (with a brand value of $333,441M, Google is ranked as the 3rd most valuable brand in the world as according to Brand Finance), financial health (EBIT Margin [TTM] of 30.49%, which stands significantly above the Sector Median of 8.80% as well as its Aa2 credit rating from Moody’s), and the dominant positions of Google Search, YouTube, and the Google Cloud Platform.

When comparing Microsoft and Alphabet’s competitive advantages, it can be highlighted that Microsoft has the broader economic moat, particularly due to its broader product portfolio.

Alphabet’s revenue still relies heavily on its Advertising segment: in 2023, the company generated 77.38% of its revenue from Google Advertising. However, it is worth noting that this represents a decrease in dependency when compared to the previous year, in which Alphabet derived 79.37% of its revenue from the Google Advertising segment.

It can be highlighted that Microsoft is less dependent on single business segments. In 2023, the company generated 32.69% from its Productivity and Business Processes segment, 41.48% from its Intelligent Cloud segment, and 25.83% from its More Personal Computing segment, indicating that Microsoft distributes its revenue share relatively equally among its segments.

Microsoft and Alphabet’s strong competitive advantages ensure long-term stability and help to build an economic moat against competitors.

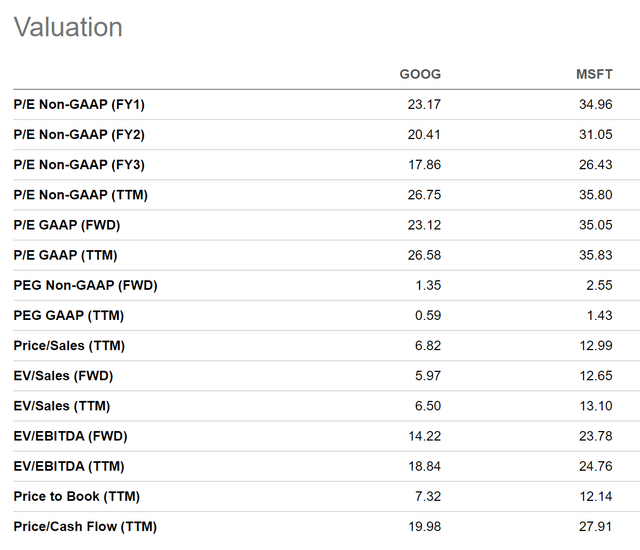

Alphabet vs. Microsoft: Valuation

In terms of Valuation, I believe that Alphabet is presently the superior pick when compared to Microsoft: with a P/E [FWD] Ratio of 23.12, Alphabet has the significantly lower Valuation when compared to Microsoft (which has a P/E [FWD] Ratio of 35.05).

I am convinced that Alphabet is still undervalued, especially when considering the company’s EPS Growth Rate Diluted [FWD] of 23.42%, which indicates strong potential to increase profits within the next years.

In addition to that, it can be highlighted that Alphabet’s Price/Sales [TTM] Ratio of 6.83 is significantly below the one of Microsoft (12.99), further underlying my theory that Alphabet is the more attractive pick in terms of Valuation when compared to Microsoft.

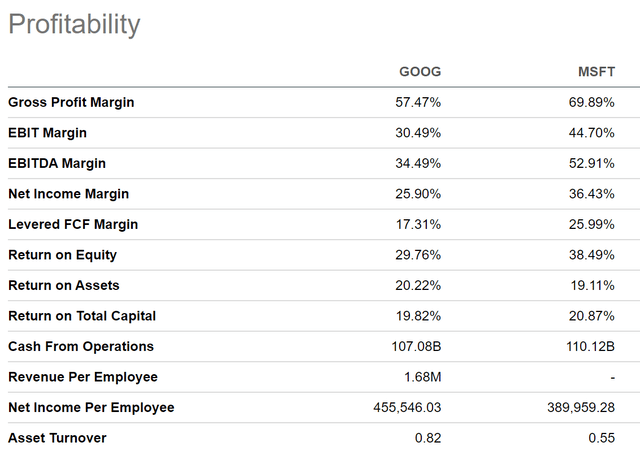

Alphabet vs. Microsoft: Profitability

In terms of Profitability, Microsoft appears to be the slightly more attractive pick. This is underlined by the company’s slightly higher EBIT Margin [TTM] of 44.70% when compared to Alphabet’s 30.49%.

The same is confirmed when having a look at Microsoft’s higher Return on Equity of 38.49% when compared to Alphabet’s 29.76%.

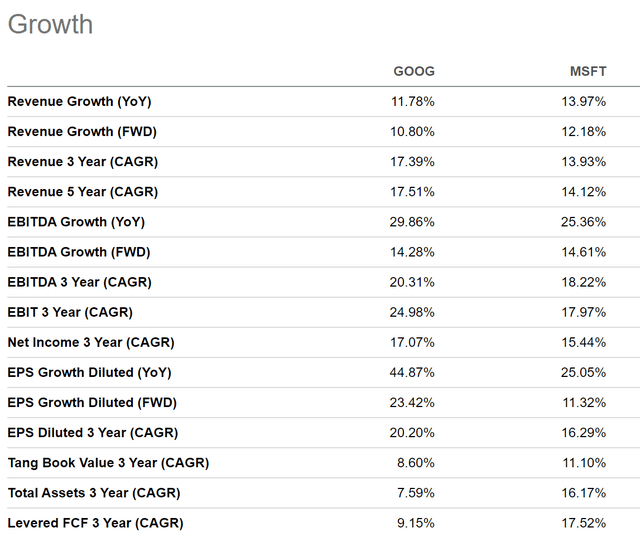

Alphabet vs. Microsoft: Growth Rates

Different growth metrics further underscore my investment thesis that Alphabet is presently the superior investment choice when compared to Microsoft: Alphabet exhibits an EPS Growth Rate Diluted [FWD] of 23.42% while Microsoft’s stands at 11.32%.

It can be further highlighted that Alphabet’s 3 Year EBIT Growth Rate [CAGR] of 24.98% stands above Microsoft’s (17.97%).

Moreover, Alphabet has shown superior results when it comes to Revenue Growth: while Alphabet’s 5 Year Revenue Growth Rate [CAGR] stands at 17.51%, Microsoft’s is 14.12%, further underscoring my investment thesis.

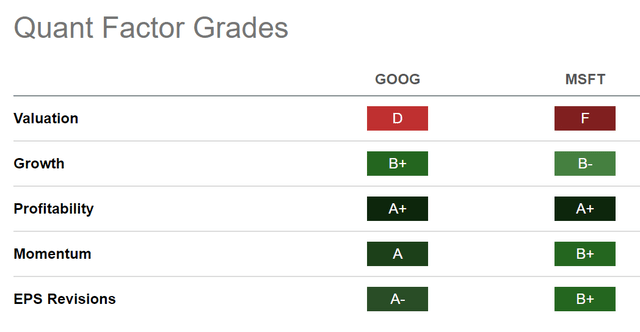

Alphabet vs. Microsoft According to the Seeking Alpha Quant Factor Grades

The Seeking Alpha Quant Factor Grades further confirm Alphabet as the superior choice between the two U.S. tech giants. For Valuation, Alphabet receives a D, while Microsoft gets an F. For Growth, Alphabet is rated with a B+ and Microsoft with a B-. For Momentum, Alphabet receives an A and Microsoft a B+, and for EPS Revisions, Alphabet receives an A- and Microsoft a B+. Both companies receive an A+ for Profitability.

Alphabet vs. Microsoft According to the Seeking Alpha Quant Rating, Analysts Rating and Wall Street Rating

While the Seeking Alpha Quant Rating rates Alphabet with a Strong Buy, Microsoft is rated with a hold rating. According to the Seeking Alpha Analyst Rating, Alphabet is a buy while Microsoft is a hold, further underscoring my investment thesis to prioritize Alphabet at this moment in time.

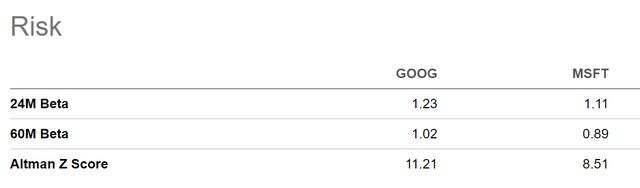

Risk Analysis

I believe that Alphabet comes attached to the slightly higher risk level when compared to Microsoft, which is underscored by the companies’ 24M and 60M Beta Factors. While Alphabet’s 24M and 60M Beta Factor stand at 1.23 and 1.02, Microsoft’s are 1.11 and 0.89, respectively, confirming my thesis that Alphabet has the higher volatility and slightly higher risk level.

However, it should be stated that Microsoft’s significantly higher Valuation (P/E [FWD] Ratio of 35.05) indicates that higher growth expectations are priced into the company’s stock price when compared to Alphabet (with a P/E [FWD] Ratio of 23.12), highlighting Microsoft’s higher downside risk.

Alphabet’s dependency on its Google Advertising segment, from which the company generated 77.38% of its revenue in 2023, represents an additional risk factor for the company. This supports my theory that Alphabet is the choice with the slightly higher risk level attached.

In addition, I believe that Microsoft has the significantly broader product portfolio, allowing the company’s management to mitigate risks to a significantly higher degree, once again underscoring my theory that Microsoft comes attached to a lower risk level in comparison to Alphabet.

Conclusion

I am convinced that both Microsoft and Alphabet are excellent investment choices for long-term investors. Both are among the largest positions of my personal investment portfolio and I see them as buy-and-hold investments.

I believe that Alphabet is the superior choice when it comes to both Valuation and Growth: Alphabet’s P/E [FWD] Ratio of 23.12 stands significantly below the one of Microsoft (which has a P/E [FWD] Ratio of 35.05), indicating Alphabet’s superiority in terms of Valuation.

In addition to that, Alphabet’s EPS Growth Rate Diluted [FWD] of 23.42% and its 3 Year EBIT Growth Rate [CAGR] of 24.98% also stand significantly above the one of Microsoft (which are 11.32% and 17.97%), underlying Alphabet’s superiority when it comes to Growth.

However, I believe that Microsoft is the superior choice when it comes to Profitability: the company showcases a higher EBIT Margin [TTM] of 44.70% when compared to Alphabet’s 30.49%, and a higher Return on Equity of 38.49% (compared to 29.76%), indicating Microsoft’s superiority in efficiency.

In addition to that, Alphabet comes attached to a slightly higher risk level, given its dependency from the Google Advertising segment. Microsoft, however, is less dependent on a single business segment with a broader product portfolio.

However, Microsoft’s stock price could decrease to a higher degree if growth expectations are not met (due to its higher Valuation). This indicates that the company has slightly more downside risk than the Alphabet stock.

Given Alphabet’s superiority in Valuation and Growth, which indicates a lower downside risk for the Alphabet stock, Alphabet receives my strong buy rating while Microsoft, with its strong profitability metrics and its broad product portfolio, receives my buy rating.

Due to Alphabet’s lower Valuation and higher growth metrics, I believe that Alphabet is the slightly superior choice when it comes to risk and reward when compared to Microsoft. Do you agree?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.