Summary:

- Energy Transfer offers a compelling income play with a nearly 8% yield, driven by fee-based stability and strategic growth in U.S. energy infrastructure.

- ET’s diversified operations in crude oil, NGLs and natural gas, combined with strong cash flows, make it resilient to oil price volatility.

- Despite market underappreciation, ET’s valuation suggests 50% upside, supported by secular growth in North American energy supply and strategic acquisitions.

- Regulatory risks and MLP tax complexities exist, but ET’s mission-critical assets and consistent cash flows make it a top choice for income-focused investors.

malerapaso

Introduction

On July 7, 2020, Buffett bought the midstream assets of Dominion Energy (D), the struggling utility giant that has sold a number of key assets in recent years.

As I have written in a number of articles, 2020 marked the bottom for midstream assets. Before 2020, pipeline owners aggressively invested in new pipelines, often risking rising debt levels due to negative free cash flow.

Since then, the industry has enjoyed many tailwinds, including lower capital spending requirements, past investments turning profitable, and long-term growth in oil/gas supply and demand.

Even back in 2020, it was highlighted that more pipelines are needed to satisfy demand. Four years later, this is still true – and even worse in certain regions.

The deal’s timing might show that Mr. Buffett sees a silver lining in the regulatory headaches: More barriers for new pipeline build-outs could mean better value for existing ones. The pace of pipeline build-outs has long lagged behind the production of oil and gas; even with reduced production recently, pipelines will likely have plenty of business going forward. – The Wall Street Journal (2020)

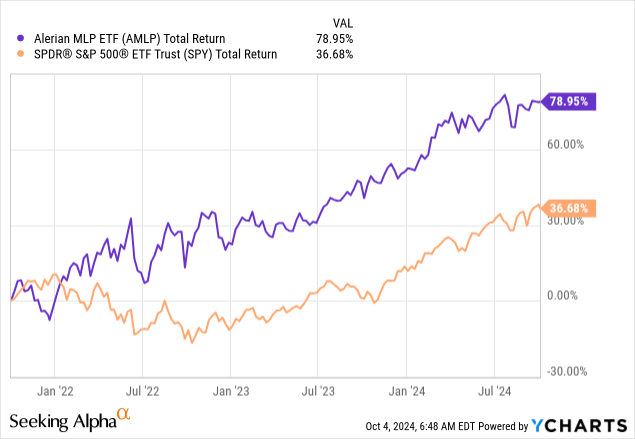

Betting on midstream turned out to be a genius bet. Over the past three years alone, the Alerian MLP ETF (AMLP) has returned close to 80% – including distributions (dividends).

As some of my readers may have noticed, I have become a huge fan of the industry in recent years. In addition to long-term demand and supply growth, increasing pricing power due to a lack of infrastructure, and subdued capex, there are other tailwinds, including this one:

- Rates are falling, which will push a lot of money from low-risk bonds into high-quality stocks. I have discussed this “cash trap” in many articles (like this one).

As the AMLP ETF still yields 7.7%, I believe the midstream industry will remain one of the best places to put money.

One of the companies that stands out here is Energy Transfer (NYSE:ET), a company I covered on June 27 in an article titled “Yielding Like A Gusher: 8% Makes Energy Transfer The MLP That Pays.”

Since then, ET has returned 4%, roughly in line with the market.

In this article, I’ll update my thesis and explain why I believe that ET, despite a lot of bullish coverage, is still not nearly as appreciated as it should be, as the mix of income, growth, and value is very hard to beat.

So, let’s get to it!

However, please be aware that ET is a Master Limited Partnership. This means its dividends (called “distributions”) are not taxed until shareholders (called “unitholders”) receive them. This also explains why I (as a non-American) cannot invest in ET without making my tax situation a nightmare.

A “Mission-Critical” Income Play

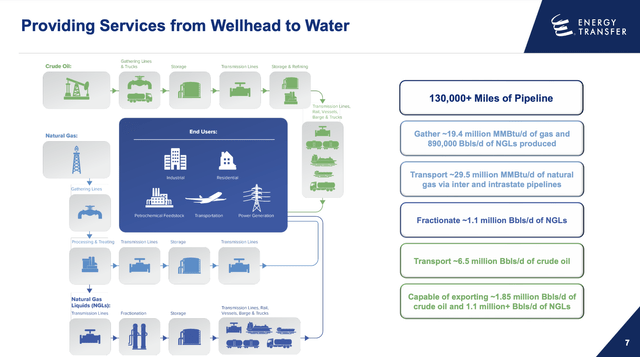

Energy Transfer does not produce energy. It transfers it.

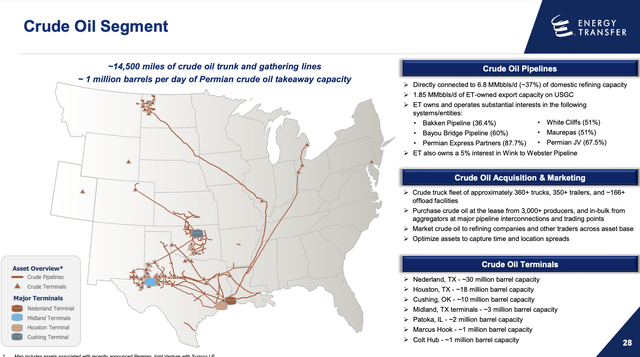

In its crude oil segment, for example, it has the capacity to ship close to seven million barrels per day, roughly 37% of the domestic refinery capacity. This includes assets in major basins, including the Bakken and the Permian. It also has a massive fleet of trucks that reach areas where pipelines are lacking.

On top of that, it has a network of crude oil terminals that allow the United States to ship its liquid gold to a wide number of international customers.

It also has a massive footprint in natural gas liquids (“NGL”), which are higher-margin products than natural gas. In this segment, it mainly owns fractionation assets, storage facilities, and pipelines for refined NGL products.

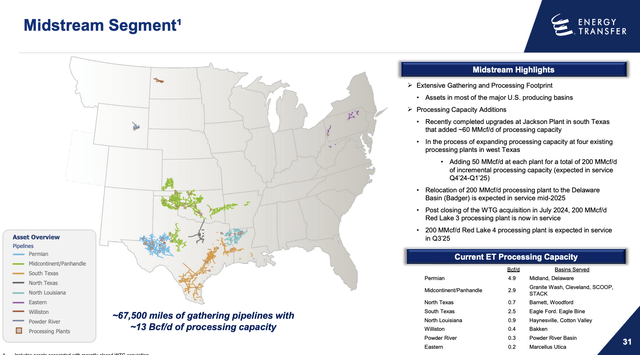

Then there’s the midstream segment, which includes a wide range of regional operations, including a massive gathering and processing footprint in most major production basins, including the Permian (Delaware and Midland), Eagle Ford, and Anadarko in Oklahoma.

On top of that, it owns more than 27,000 miles of interstate pipelines that are capable of shipping 32 billion cubic feet of natural gas per day from major production areas to high-demand areas.

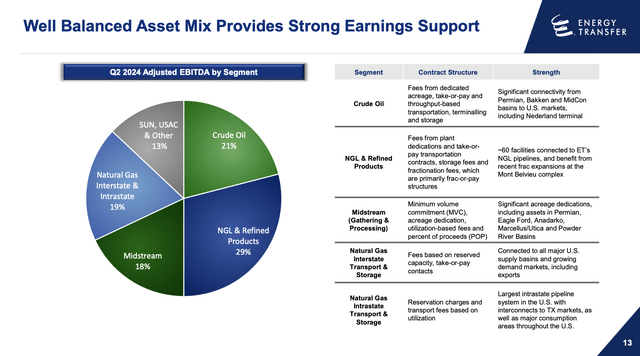

The result is a highly diversified business with a mission-critical footprint in crude oil, NGLs, midstream, and interstate natural gas.

Even better, as I already briefly mentioned, midstream companies are not directly dependent on the price of oil and gas. Unlike oil and gas producers, midstream companies are mainly dependent on throughput volumes. It’s like owning a toll road. It does not matter if a Rolls Royce uses your road or a Toyota – it’s all about volumes.

While midstream energy may not be the best choice for investors looking to capitalize on rising oil prices, it provides income-oriented investors with a more predictable and secure investment, shielded from the volatility of crude oil prices.

As we can see below, 90% of ET’s EBITDA is fee-based.

To reiterate:

- ET focuses on transporting energy, not producing it.

- The company handles crude oil, NGLs, and natural gas across major U.S. basins.

- ET provides safety through 90% fee-based EBITDA, driven by volume, not energy prices.

- The company is a mission-critical player, servicing America’s energy industry from wellhead to export facility.

The best part is that this business model comes with plenty of growth, both organically and acquired.

How Energy Transfer Keeps Growing

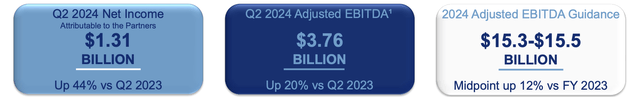

In 2Q24, the company reported $3.76 billion in adjusted EBITDA, 20% more compared to the second quarter of 2023. If it weren’t for $80 million in transaction expenses, the company would have broken the $3.8 billion mark.

Meanwhile, distributable cash flow attributable to partners was $2 billion, up from $1.6 billion in 2Q23.

The growth was mainly driven by record volumes in crude oil and NGL pipelines, supported by elevated NGL exports.

- Crude oil transportation was up 23% (a new record).

- Crude oil export volumes were up 11%.

- Total NGL exports rose by 3% (a new record).

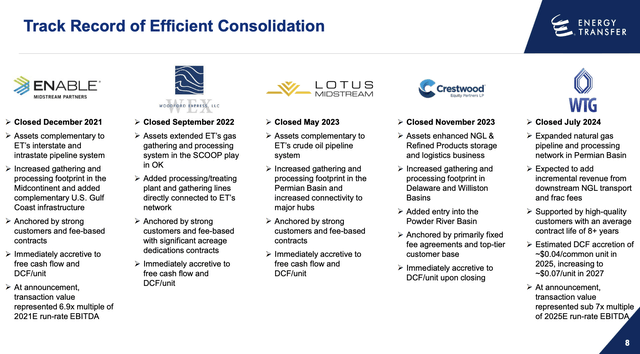

Moreover, the company’s acquisition of Lotus Midstream and Crestwood Equity Partners in 2023 contributed to this strength.

As we can see below, these two deals were part of five major deals since 2021.

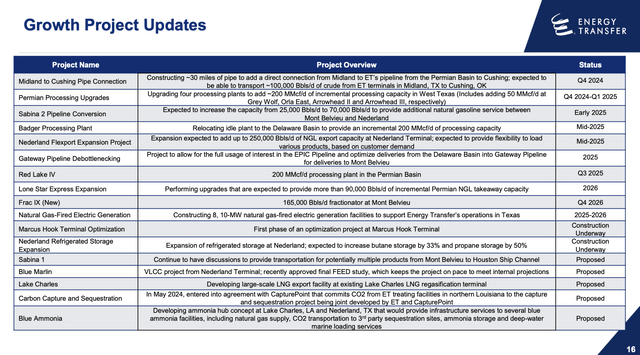

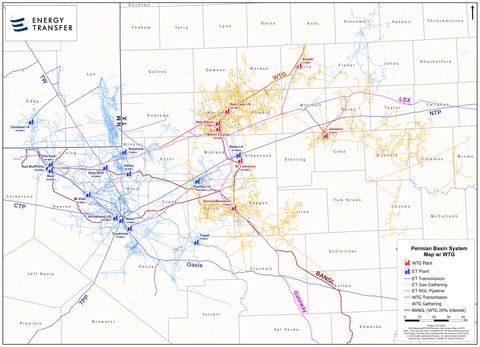

In July (part of 3Q24), the company acquired WTG. This deal improves its natural gas and NGL footprint in the Permian Basin and complements its existing downstream business.

So far, the company is happy with the integration as it placed a new 200 million cubic foot per day processing plant in service.

Permian Basin System Map of WTG

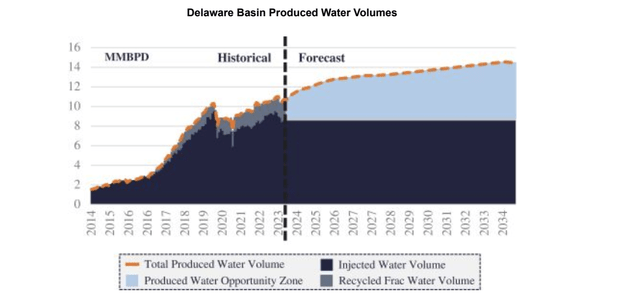

On top of that, the company formed a joint venture with Sunoco (SUN) to combine crude oil and “produced water” gathering assets in the Permian. This is a smart move as the Permian is increasingly dealing with a water problem. As I wrote in a prior article, in some areas, each barrel of produced oil comes with four barrels of produced water.

It’s also expanding NGL export capacities at its Nederland and Marcus Hook terminals, with the first phase of the expansion at Nederland coming online in mid 2025.

Energy Transfer also approved the construction of a ninth fractionator at Mont Belvieu. This asset has a capacity of 165,000 barrels per day and is scheduled to be completed by 4Q26, increasing the total fractionation capacity at Mont Belvieu to over 1.3 million barrels per day.

Energy Transfer (Mont Belvieu)

The company is also boosting its processing facilities in the Permian and building eight 10-megawatt gas-fired generation facilities in Texas to improve system reliability and its internal operations. These are expected to be in service by 2025 and 2026.

For those keeping track at home, here’s a full overview of ET’s projects:

So, what does this mean for shareholders?

Great News For Unitholders

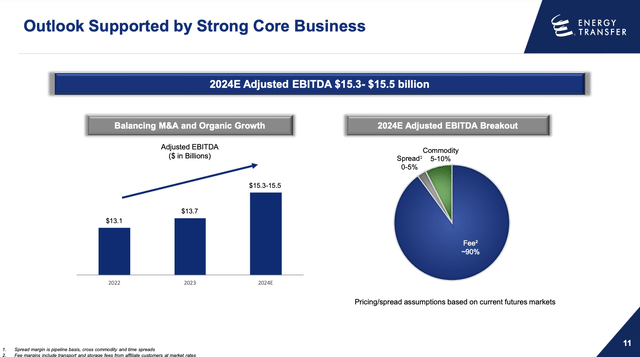

Thanks to strong tailwinds and growth plans, the company raised its full-year guidance, expecting no less than $15.3 billion in adjusted EBITDA. That’s $300 million more compared to its initial expectations.

The midpoint of its guidance is 12% above its 2023 result.

Moreover, thanks to its progress, Moody’s upgraded the company’s senior unsecured credit rating to Baa2. Baa2 is the equivalent of S&P’s BBB rating. It’s an investment grade rating, two steps below the A range.

This adds another layer of safety to its distribution.

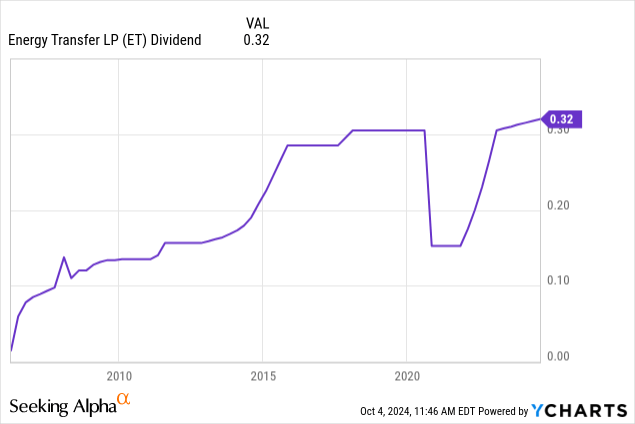

Currently, ET units pay $0.32 per quarter. This translates to a yield of 7.8%. What’s impressive is that even after taking care of capital spending, the company is expected to generate $6.0 billion in free cash flow this year, 11% of its market cap.

This implies a cash payout ratio of 73% and bodes very well for future income growth.

This also applies to its valuation.

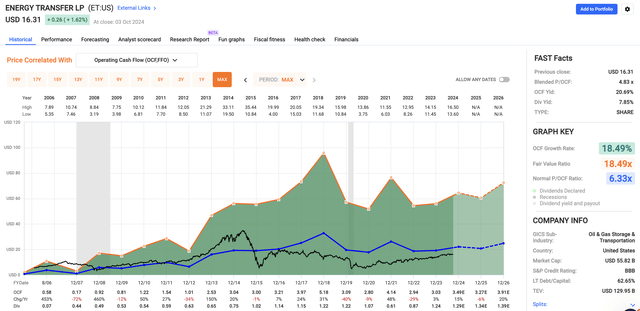

Using the FactSet data from the chart below, ET is expected to grow its cumulative per-share operating cash flow (“OCF”) by 30% through 2026.

If we apply a subdued OCF multiple of 6.3x, we get a fair price target of $25 per unit, more than 50% above the current price.

This is the result of both organic and inorganic growth, secular growth in North American energy supply, strong global energy demand, and the fact that ET has the right assets for the right job.

Even better, if rates continue to decline, I expect ET to get a much higher multiple than 6.3x, unlocking far more value down the road.

If I could own MLPs, I would have a very large position in this company.

Takeaway

My takeaway is simple: Energy Transfer is a compelling income play that combines growth, stability, and value.

Its mission-critical energy infrastructure and consistent cash flows make it one of the best opportunities in the midstream space.

Meanwhile, its yield of 7.8% is highly attractive, especially as falling rates could push more investors toward high-quality stocks.

Even with conservative estimates, the stock appears undervalued by at least 50%.

While I can’t invest in MLPs personally, I believe ET deserves serious consideration from income-focused investors looking for long-term exposure to U.S. energy infrastructure.

Pros and Cons

Pros:

- Attractive Yield: With a yield of almost 8%, ET provides steady income that’s hard to match, especially as interest rates come down.

- Fee-Based Stability: 90% of EBITDA is fee-based, making ET less vulnerable to oil and gas price fluctuations and more reliant on throughput volumes.

- Growth Potential: Strategic acquisitions and expansion projects are driving strong volume growth and boosting cash flows.

- Valuation: ET trades below an already subdued long-term average OCF multiple.

Cons:

- MLP Tax Complexity: As a non-American, I can’t invest in ET due to tax complications, making it less accessible for some investors. However, some investors prefer buying MLPs.

- Energy Regulation Risks: The midstream sector faces ongoing regulatory headwinds that could impact future growth and operations.

- Energy Price Implosion: A very steep recession could cause investors to believe that midstream volumes are in a cyclical decline. That could hurt the ET unit price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.