Summary:

- Snap’s stock dropped significantly, creating a buying opportunity.

- Snap trades below three times its forward revenue projections, making it relatively cheap compared to competitors.

- Despite a minor sales miss, Snap provided strong earnings and guidance, showing growth potential and profitability prospects.

Luis Alvarez

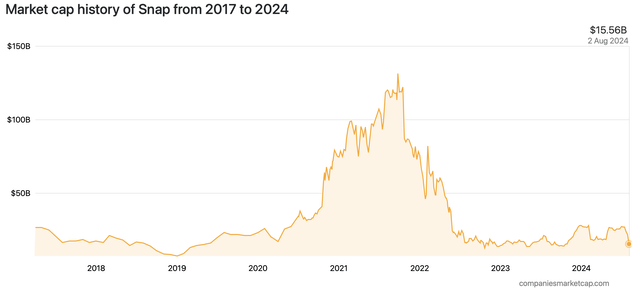

I discussed buying Snap Inc. (NYSE:SNAP) when its stock dropped to around the $10 range last time, and I think we should take a close look at Snap again. Its market cap has cratered around 25% during the latest selloff following Snap’s worse-than-expected Q2 earnings announcement.

Snap market cap (companiesmarketcap.com)

Snap’s 2025 consensus sales estimates are around $6.2B, and Snap trades below three times its forward revenue projections. This valuation is relatively cheap, especially compared to Meta Platform’s (META) 6-7 times forward sales valuation. Also, we should consider Snap’s considerable growth runway, future monetization, and increased profitability prospects, which make the stock appear exceptionally cheap here.

Moreover, Snap provided robust earnings and solid guidance. Despite the minor $10M miss in revenues, sales still came in at $1.24B, 15.9% higher than the same quarter last year. These results don’t warrant a 25% drop in Snap’s stock price, and the market appears to be overreacting.

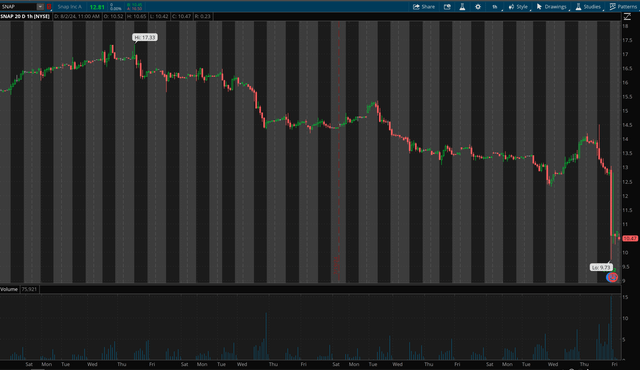

Snap 1-Hour Chart

SNAP 1-hour chart (thinkorswim)

Before reporting essentially inline results, Snap swung from a high of around $14.50 to just $9.73. This sharp reversal equates to a decline of roughly 33%, which is extreme considering Snap’s minor $10M sales miss. Considering Snap’s sales of around $1.24B, the sales miss is about 0.8% (less than 1%). Therefore, it’s not a very significant surprise in the grand scheme of things. Moreover, we know that Snap’s sales can be volatile. Yet, the stock is getting clobbered, creating a substantial intermediate and long-term buying opportunity.

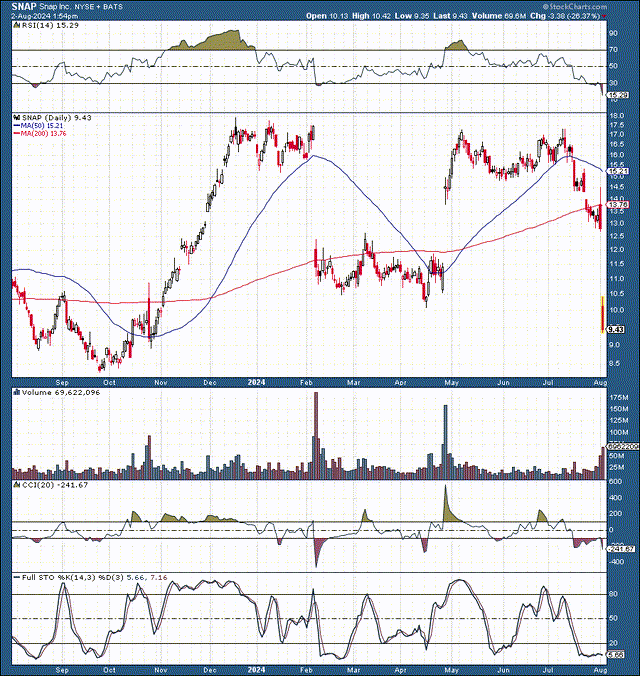

Snap 1-Year Chart

SNAP (stockcharts.com)

On the one-day chart, we also see the significant recent reversal, and the stock is trading around $9.40 now. So, Snap has closed the gap around $10-$11, which is constructive from a technical standpoint. Also, Snap’s RSI is around 15 here, illustrating highly oversold technical conditions.

Additionally, we see a pattern of Snap trading around the $18 resistance and $10 support areas. The $10 area is a solid base/support level, and there’s likely minimal downside risk ahead. On the other hand, Snap is highly likely to head back up to $18-$20 resistance and has the potential for a breakout if future earnings come in better than expected.

There Was Nothing Wrong With Snap’s Earnings

Snap reported inline EPS and sales that missed estimates by 0.8%. Snap’s sales of $1.24B, while $10M in light of estimates, represent YoY growth of 15.9%. Also, Snap’s guidance was roughly in line with the consensus estimates, pointing to 12-16% YoY sales growth and adjusted EBITDA of $70-100M for Q3.

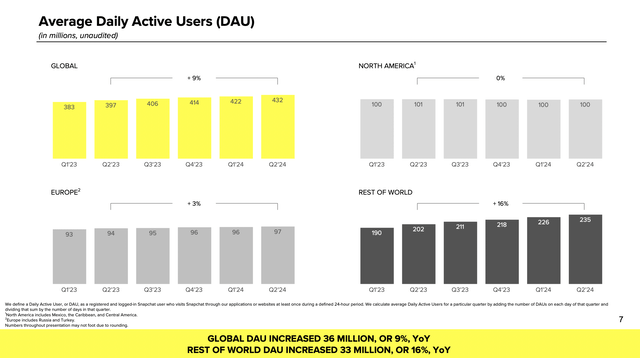

DAUs (Stock Market Analysis & Tools for Investors)

Global DAUs expanded to 432M, a YoY increase of 9%. While North American growth remains flat, Snap is making headwinds in other parts of the world (16% YoY growth excluding North America and Europe).

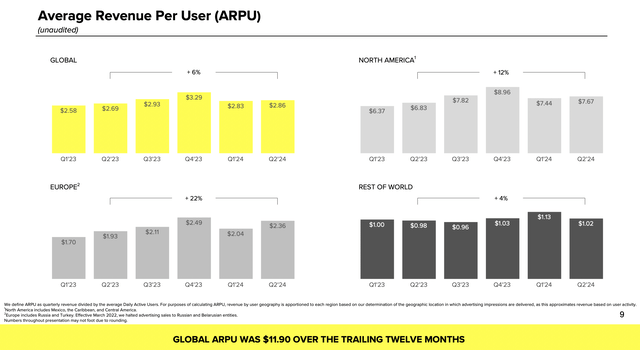

ARPUs (Stock Market Analysis & Tools for Investors)

Despite the 9% DAU growth, Snap’s ARPU increased by just 6%. Most of the ARPU growth comes from Europe and North America. The problem is that these areas need to show higher user growth metrics. While increasing users, the rest of the world had an ARPU growth of only 4% YoY.

Therefore, Snap needs to expand its sales-generating capabilities in emerging markets and improve growth in Europe and the U.S. while maintaining higher ARPUs in developed markets as we move forward. Lower interest rates and a more accessible monetary environment should increase Snap’s ad revenues, creating a favorable backdrop for future quarters.

Snap Looks Dirt Cheap

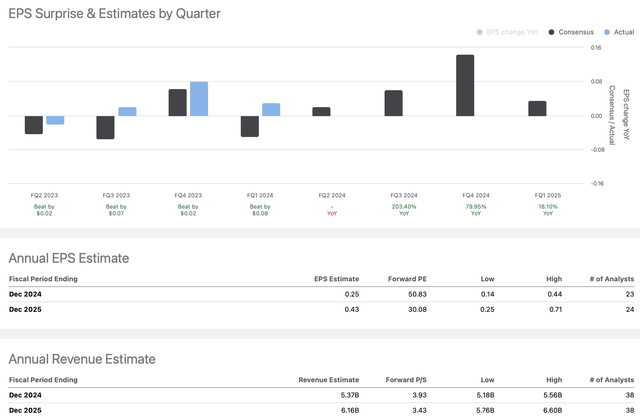

Estimates (Stock Market Analysis & Tools for Investors)

Snap’s minor revenue miss may not negatively impact Snap’s future forecast. Snap is projected to deliver about 25 cents in EPS this year and roughly 43 cents in 2025. However, Snap could report a considerably higher ESP due to its significant earnings growth potential and more robust sales growth prospects.

However, even using the lowballed consensus figures, Snap trades around three times forward sales estimates (or lower). Also, while Snap’s forward P/E ratio is about 50, it could be lower if Snap achieves higher-than-expected EPS. Snap’s forward EPS could be around $0.60-0.65 next year, implying its forward P/E ratio may be about 20-18 or lower after the recent declines.

Snap’s Growth Likely To Continue

Snap’s growth will likely continue, and it could deliver $9-10B in revenues around 2027-2028. This is relatively soon, and given Snap’s low valuation, it’s trading around or below two times forward sales projections.

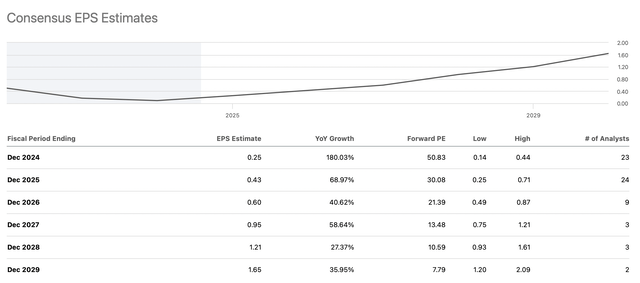

EPS Likely To Increase Substantially

EPS projections (Stock Market Analysis & Tools for Investors )

In addition to robust revenue growth, Snap’s EPS could increase considerably in future years. Snap should benefit from lower interest rates and a higher growth economic environment. Moreover, Snap could benefit from AI-related sales and AI-impacted efficiencies, leading to more substantial growth and higher-than-anticipated profitability. Therefore, Snap could earn $1 in EPS in just a few years, enabling its future estimates to increase and its earnings multiple to expand, leading to a much higher stock price in the future.

Where Snap’s stock could be in future years

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $5.4 | $6.4 | $7.3 | $8.1 | $9 | $9.9 | $11 |

| Revenue growth | 17% | 18% | 14% | 11% | 11% | 10% | 10% |

| EPS | $0.35 | $0.65 | $0.85 | $1.10 | $1.38 | $1.65 | $1.95 |

| EPS growth | 288% | 86% | 31% | 29% | 25% | 20% | 18% |

| Forward P/E | 25 | 27 | 29 | 32 | 31 | 30 | 28 |

| Stock price | $16 | $23 | $32 | $44 | $51 | $59 | $66 |

Source: The Financial Prophet

A modest 25 times forward P/E ratio enables us to reach a potential $16 for Snap this year and around $23 in 2025. Nonetheless, more robust earnings growth or multiple expansions could propel Snap’s stock price faster. Moreover, Snap’s solid revenue growth could increase profitability and trigger multiple expansions in future years. If Snap gets on a sustainable growth and profitability trajectory, its stock could appreciate considerably in the coming years.

Risks to Snap

Despite my bullish thesis, Snap faces risks. An economic slowdown and possible declines in ad spending could impact Snap’s stock negatively. Snap is especially vulnerable to decreases in ad spending due to a high-interest rate environment. Snap also faces substantial competition from Meta, TikTok, and other competing platforms. Snap has to maintain its user growth and expand ARPUs, especially in its secondary markets with growth potential. Investors should examine these and other risks before investing in Snap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!