Summary:

- Home Depot has a wide moat to withstand macro challenges.

- We face normalising fundamentals as life resumes normal, leading to a slight decline in profitability was observed post-Covid.

- We expect Home Depot will have a revenue of $39.50B and EPS of $3.69 in Q3 of FY2024.

- Home Depot is a reasonably safe investment in a recession. However, its slight overvaluation halts our buying proposition.

KenWiedemann

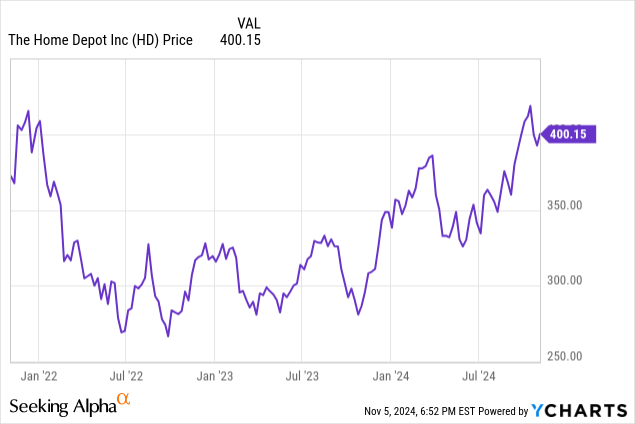

Home Depot (NYSE:HD) has long been one of the investors’ buy-and-hold-forever favourites.

Its uncontested position is strengthened by excellent return (over 300% return over the past decade) and uninterrupted dividend distribution (32 years of consecutive dividend payments).

Macro challenges for the home improvement retail sector have been around for over 2 years since the Fed commenced the latest rate hike cycle in March 2022.

Thanks to its wide moat, the home improvement retail giant performed decently amid a difficult macro environment.

Moat Analysis

The performance of Home Depot was protected by its moat in the home improvement retail market.

A moat protects a company from limited damage during an economic downturn, while a company without a moat is vulnerable to attack.

A recent example is LL Flooring, a specialised floor retailer without a moat. Due to a sluggish housing market, the company had suffered declining sales and significant losses. The company eventually filed for voluntary Chapter 11 reorganisation proceedings to pursue a going-concern sale of its business in August 2024.

Home Depot has a moat by its scale.

By 28 July 2024, the US-based company owned 2,019 stores in the US and 321 stores in Canada and Mexico. Its extensive scale of brick-and-mortar stores with the presence of e-commerce and omnichannel sales allow it to enjoy economy of scale and cost advantages.

Being in a highly fragmented market, with a total addressable market of approximately $1 trillion, Home Depot owned 17% share only. Even though Its revenue in fiscal year 2023 doubled, its major rival, Lowe’s (LOW).

Home Depot has a moat by its extensive product offering.

With over 100,000 square feet of space, Home Depot provides over 30,000 stock keeping units in store, not to mention its online presence. Compared with specialised retailers like Floor and Decor (FND), one of the market leaders in flooring retailing, has approximately 4,500 stock keeping units on average only. Home Depot’s diversity of product choices can be easily seen.

Consumers can save valuable time by visiting Home Depot, attracting them to return.

The wide variety of available products also attracts professionals. According to Morningstar, Home Depot’s pro mix incrementally shifted from 30% in 2013 to nearly half in 2023.

Home Depot has a moat by its excellent customer support.

Excellent customer support is the essence of building brand loyalty. The company provides a dedicated salesforce for the Pros, introduces Pro Xtra loyalty program, and develops an extensive delivery network for them.

The Pros are more likely to make frequent store visits and have a higher average price per transaction.

Despite all the boons, Home Depot faces intense competition in this fragmented sector, undermining its moat.

The home improvement retailers/distributors can be simply divided into four types:

1. Giant home improvement retailers [(HD), (LOW)]

2. Specialised retailers and distributors [(FND), BLDR, POOL, Ikea…]

3. General retail stores (AMZN, TGT, WMT, COST…)

4. Mom-and-pop stores

Home Depot’s major challenges originated from the first two types of companies. Companies that I mentioned are also great companies, consistently improving their profitability and engulfing market shares.

(We wrote a few articles about Floor and Decor and Pool Corporation. Please have a read if you are interested.)

Yet Home Depot has a diversified product mix that can withstand tests from an individual sector.

We opine that Home Depot has a wide moat, as the company’s dominant position is hardly replaceable in the foreseeable future based on the various reasons mentioned above.

Macro Challenges

The performance of Home Depot is highly correlated with the housing market, albeit its leading position partially shields itself from damage.

High-interest rate environment caused underwhelming consumer sentiment and the slowing down of housing activities, undermining HD’s profitability.

As the CEO of Home Depot stated, large-scale remodel projects, which require financing, have plummeted and negatively impacted the business.

Below tabulated the financials of HD from FY2020 to FY2024(TTM):

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024(TTM) | |

| Revenue | $132.1B | $151.2B | $157.4B | $152.7B | $152.1B |

| Earnings per Share | $11.94 | $15.53 | $16.69 | $15.11 | $14.86 |

| Comparable sales (% change) | 19.7% | 11.4% | 3.1% | -3.2% | -3.3% (Q2 result) |

(Data abstracted from Seeking Alpha and HD annual report, consolidated by Value Voyager)

There are two takeaways from the data above:

1. Home Depot benefited from the WFH trend and government stimulus during the pandemic.

2. A slight decline in profitability was observed post-Covid.

Categories like vinyl flooring, paint, and outdoor power equipment are pulled forward during the pandemic, as people spent a lot of time at home. But things started to normalise as life resumed normal.

In fact, all three major product lines of Home Depot (building materials, decor and hardlines) recorded a decline in sales from the prior year.

We expect the struggle to continue as the focus gradually shifts from intensified inflation to unemployment. The unemployment rate has slowly climbed from 3.4% in January 2023 to 4.1% in October 2024, while the latest nonfarm payroll unexpectedly plummeted to twelve-thousand jobs.

Indicators such as manufacturing payrolls and capacity utilisation also declined, reflecting a slowdown in manufacturing activities.

We expect this trend to persist, and the underwhelming consumer sentiment will sustain in 2025.

However, this will be partially offset by the declining 30-year mortgage rates, which has retreated from the high of 7.79% in October 2023 to 6.72%. The moderating mortgage rates stimulate housing activities, mortgage applications and mortgage refi applications. As 30-year mortgage rates rebounded recently, a drop in mortgage applications was immediately seen.

With that said, Home Depot provided a guidance of a 3% to 4% decline in comparable sales for FY2024.

Approaching Q3 Earnings Release

Ahead of its earnings release on 12 Nov, Home Depot has an EPS consensus of $3.65 (-4.1% YoY) and revenue consensus of $39.14B (3.8% YoY).

The company has beaten all EPS consensus in the prior 2 years, while missing out 3 out of 8 revenue estimates.

The housing market was still sluggish in general terms.

With the recent resurgence of 30-year mortgage rates in October, existing home sales hovered around at last year’s underwhelming level at the reporting period (i.e. Aug to Oct). The Leading Indicator of Remodelling Activity also reaffirmed that home improvement and repair spending to owner-occupied homes were still on a declining trend.

We expect Home Depot will have a revenue of $39.50B and EPS of $3.69 in Q3 of FY2024.

Valuation of Home Depot

In the prior financial quarter, inclusive of the SRS acquisition, Home Depot provided guidance of total sales growth between 2.5% and 3.5%, and diluted earnings per share percent decline between -2% and -4% for FY2024.

The stock is now trading above its 5-year average PE ratio (22.07) by around 20%.

With Donald Trump winning the presidential election, we expect he will impose tariffs to China imports, which shall exert bottom-line pressure to Home Depot.

Here are my optimistic and pessimistic cases for Home Depot for the upcoming twelve months, which shows its slight overvaluation at current level.

| Optimistic Case |

(2023 EPS*1-2%)*(22.27*1.15) (15.11*0.98)*22.27*1.15 =$379.23 |

| Pessimistic Case |

(2023 EPS*1-4%*1-4%)*(22.27) (15.11*0.96*0.96)*22.27 =$310.12 |

Is Home Depot a Buy?

Home Depot is a reasonably safe investment in a recession. However, its slight overvaluation halts our buying proposition.

We anticipate the stock don’t have a meaningful upside, nor have underperformance in the next 12 months.

Therefore, Home Depot is rated as a “Hold”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FND, POOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Value Voyager is not a professional investment advisor. No information in this publication is intended as investment advice to buy or sell any stock, bonds, derivatives, and any other financial instruments. Value Voyager may utilise past market performance to deduce future performance, but it is not guaranteed that the actual result will meet expectation. Readers should conduct their own research and due diligence before making any investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.