Summary:

- Broadcom Inc. has benefitted from a steady AI-driven rally, underpinned by consistently tangible fundamental outperformance.

- In addition to accelerating VMware revenue contributions and ensuing synergies, the company also benefits from a strong competitive advantage in custom AI accelerators and networking solutions critical in accelerated computing.

- The combination of tangible fundamental outperformance and robust market momentum will likely complement Broadcom’s upcoming 10-for-1 stock split, underpinning further appreciation prospects.

JHVEPhoto

Broadcom Inc. (NASDAQ:AVGO) has become a key beneficiary alongside Nvidia (NVDA) in the AI-driven rally within the broader semiconductor sector. The stock’s upsurge this year has been underpinned by tangible fundamental outperformance, thanks to Broadcom’s mission-critical role in supporting the development and deployment of AI-related infrastructure and applications.

Yet, the company has also been exposed to its fair share of both industry-wide and idiosyncratic risks, spanning incremental integration and debt servicing costs from its recent VMware acquisition, an extended cyclical downturn in non-AI segments, and stiffening competition. Meanwhile, the jury is still out on whether Broadcom’s upcoming stock split will be a nightmare or a dream, given the recent volatility observed in the Nvidia stock’s post-split performance.

But on a net basis, Broadcom continues to demonstrate a sustained revenue and earnings growth trajectory. This will continue to be a critical link in bolstering cash flows that underpin the stock’s premium at current levels.

VMware Integration

What we like:

Admittedly, VMware integration has been dilutive to the company’s profit margins. Specifically, Broadcom’s infrastructure software segment had consistently boasted gross margins of 90%+ before the integration of VMware. But the figure has dropped to 88% since the completion of Broadcom’s acquisition of VMware, considering the acquired firm’s previous gross margins in the mid-80% range. The infrastructure software segment’s operating margin has also dropped from the mid-70% range to about 64%, ex-transition costs, following the completion of the VMware acquisition, given incremental R&D investments.

Yet, the amalgamation, which was completed in F1Q, has been a complementary factor to Broadcom’s inherently high margin profile, nonetheless. The acquisition has effectively extended Broadcom’s consolidated reach into additional profitability and cash flows from cloud opportunities that are complementary to its existing business profile.

This is corroborated by accelerating revenue contributions from VMware observed through F1H24, which confirms the realization of anticipated growth synergies stemming from the acquired firm’s leverage of Broadcom’s existing relationship with enterprise and hyperscaler customers. Anticipated synergies were also reflected in Broadcom’s growing Annualized Booking Value (“ABV”) for its software portfolio, which accelerated by almost 60% sequentially to $1.9 billion in F2Q.

About 30% of Broadcom’s largest 10,000 customers have already adopted VMware as their preferred virtual private cloud on-premise since the acquisition, highlighting the value from its provision of end-to-end semiconductor and infrastructure software solutions. This accordingly improves visibility into VMware’s progress towards management’s target for a $4 billion quarterly revenue contribution run-rate next year as well, at which point the infrastructure software segment is expected to restore its pace of margin expansion.

Anticipated margin expansion is also supported by VMware’s transition to a more efficient go-to-market strategy. This is already evident through its recent consolidation of “over 8,000 disparate SKUs to four core product offerings,” and increased adoption of self-service through hyperscaler channel partners, which are cost-efficient and margin accretive at scale. The ensuing cost synergies realized to date have totaled about $700 million per quarter, reducing VMware’s quarterly spending run-rate from $2.3 billion pre-acquisition to $1.6 billion exiting F2Q.

The progress also bolsters confidence in management’s ambitions to reduce VMware’s cost structure further to a $1.3 billion quarterly run-rate exiting FY 2024 and $1.2 billion when integration completes. This accordingly reinforces management’s guidance for eventual margin convergence towards “classic Broadcom software” levels by FY 2025, with further expansion at scale over the longer-term to highlight the VMware acquisition’s margin accretive nature.

What we dislike:

However, VMware integration has also exhibited inherent risks that few have considered. Specifically, Broadcom has been pushing forward with “transitioning all VMware products to a subscription licensing model,” akin to that typically adopted by the SaaS sector. Under the subscription licensing model, customers are typically locked into multi-year contracts at a fixed, take-or-pay annual rate in exchange for consumption of VMware compute capacity.

However, the traditional subscription-based business model has exhibited its inherently elevated exposure to both cyclical and secular risks recently. This is evident through the extended curtailment of enterprise IT spending amid secular optimization trends and ongoing economic uncertainties, which has levied a direct impact on subscription-based volumes.

Specifically, subscription-based revenue models have historically been slow to recover when cyclical tailwinds return. This is because it takes time to restore functions underpinning subscription volumes (e.g., headcount, workloads, etc.), while some optimization-driven cost-saving considerations also become structural in the emergence from a cyclical downturn. And this headwind has already been increasingly prevalent in the performance of the broader SaaS sector in recent quarters, with increasing caution over “elongated deal cycles, deal compression and high levels of budget scrutiny.”

There has also been increasing preference from customers for a combined revenue model with consumption-based billing, as it offers increased flexibility on usage and payment. This would be reflective of the fully consumption-based revenue model typically embraced by hyperscalers, whereby customers initially “pay less upfront, but pays more over time” as usage scales up.

We believe there is opportunity for Broadcom to eventually pivot to a combined revenue model for VMware in the longer-term, especially as its customer base grows to facilitate market share gains and, inadvertently, expanded consumption volumes. This is similar to its hyperscaler peers’ increasing adoption of subscription-based business models, without sacrificing existing consumption-based billing.

Not only does the combined revenue model offer better value-for-money to customers by addressing increasing optimization demands, but it also preserves revenue visibility for service providers like VMware. Specifically, a combined revenue model would continue to complement VMware’s increasing revenue visibility under its current transition to subscription licensing, as most consumption-based customers also prefer long-term pre-commitment contracts to lock-in on lower unit pricing. This would be favorable to Broadcom in the longer-term, especially as increasingly complex AI/ML workloads dominate compute capacity, which would benefit the consumption-based revenue model as opposed to a single-pricing subscription licensing model.

AI Opportunities

What we like:

Burgeoning AI interest has been a boon for Broadcom’s core custom ASIC AI accelerator business. Recall that Broadcom is the market leader in custom ASICs, commanding 60% of related market share. This makes a key competitive advantage amid rising AI momentum, which we believe remains overlooked. It also offers differentiation for Broadcom amid intensifying competition in data center GPUs like those offered by Nvidia, AMD (AMD) and Intel (INTC).

Admittedly, the transition to accelerated computing supporting increasingly complex AI/ML and other compute-intensive workloads has fuelled relentless demand for data center GPUs. And this is evident in Nvidia’s eye-watering growth in recent quarters, underpinned by its best-selling data center GPUs that remain supply constrained.

Yet diversification needs by hyperscalers amid the AI boom have also unlocked new demand for custom AI accelerators. Specifically, hyperscalers have been keen on further diversifying instances to fit every performance and cost requirement from customers amid increasingly structural optimization demands and intensifying competition in the marketplace. This is evident in the increasing portfolio of internally developed silicon across major hyperscalers, such as Microsoft’s (MSFT) Azure Maia 100, Google’s (GOOG, GOOGL) Cloud TPUs, and Amazon’s (AMZN) Trainium and Inferentia used in powering AI-optimized instances.

And ensuing demand for custom AI accelerators is unlikely to stop here, which preserves sustainability to Broadcom’s growth trajectory. Recent industry forecasts predict renewed acceleration in demand for custom ASICs, with forward growth expected at a 20% CAGR to facilitate the AI-driven total addressable market (“TAM”) expansion from previous estimates of $25 billion to now $30+ billion.

In addition to custom AI accelerators, Broadcom also benefits from increasing industry needs for networking solutions to enable scalability of increasingly massive GPU clusters in accelerated data centers. For instance, Microsoft has disclosed “several hundred million dollars” in spending on “stringing together tens of thousands of Nvidia’s A100 graphics chips” alone during the early days of the generative AI sensation unleashed by OpenAI’s ChatGPT. And relevant demand for and spend on networking solutions has only grown since, with the size of AI clusters reaching as many as 100,000+ GPUs.

This is corroborated by acceleration in Broadcom’s networking solution sales in recent quarters. The company has also confirmed that “seven of the largest eight AI clusters in deployment today” have incorporated Broadcom Ethernet solutions, providing further validation to its technology advantage.

What we dislike:

Although Broadcom benefits from a competitive advantage in the custom ASICs and AI accelerators market, it remains exposed to intensifying competition in supporting networking solutions. Specifically, Nvidia’s CEO Jensen Huang has recently cited challenges in traditional Ethernet networking for AI. At Nvidia’s GTC 2024, Huang specified that “Ultra Ethernet” technology optimized for AI is not expected to materialize until at least three years out. Meanwhile, Nvidia has introduced “Spectrum-X”, its proprietary Ethernet enhancement solution optimized for handling AI workloads.

Broadcom, though, has argued otherwise in its latest earnings update. Broadcom CEO Hock Tan has confirmed that “all mega-scale GPU deployments” next year will be on Ethernet, nonetheless. And this will further buoy momentum in Broadcom’s networking sales, as corroborated by management’s raised growth guidance from 35% y/y previously to now 40% y/y for the vertical in FY 2024. Broadcom’s next-generation Ethernet solutions also aim at supplementing AI clusters composed of both off-the-shelf data center GPUs and custom AI accelerators, which, we believe, will extend its TAM and compensate for intensifying competition from Nvidia’s competitive alternative.

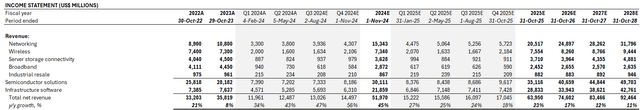

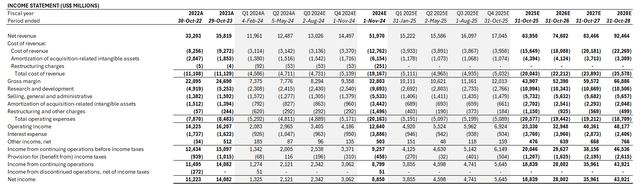

Fundamental Considerations

Based on the foregoing analysis on two of Broadcom’s two biggest fundamental drivers in the near-term, alongside consideration of its latest earnings performance and management’s guided outlook, we expect the company to grow revenue by 45% y/y in FY 2024 to $52.0 billion. We believe the forecast premium to management’s full-year revenue guidance at $51 billion is warranted, considering continued strength in the acceleration of both AI-driven and VMware revenue contributions. Specifically, management guides full-year AI revenue at $11 billion for FY 2024, which suggests flat growth from F1H24. We believe this is conservative, given the continued ramp of custom AI accelerator and networking solution sales amid a resilient demand environment. This will be further complemented by the anticipated recovery in non-AI revenue, which management expects to have bottomed in F2Q24.

Meanwhile, we expect VMware cost synergies, alongside operating leverage improvement from the continued scale of custom AI processor sales, to become more prevalent exiting FY 2024 and into FY 2025. This is consistent with management’s expectations for currently lower VMware margins to converge towards historical Broadcom software levels when revenue contributions reach a $4 billion quarterly run-rate in FY 2025. Continued discipline in VMware-related spend management will also continue to be a key accretive factor to Broadcom’s profit margins. This is reinforced by management’s expectations to reduce the unit’s spending from the $2.3 billion quarterly run-rate pre-acquisition to $1.3 billion exiting FY 2024, which would represent a 43% improvement.

And while custom AI processors are now more expensive to produce due to incremental on-chip memory capacity, management expects the business to become highly profitable at scale. Specifically, the products are expected to garner higher revenue, which will be accretive to margins as operating leverage improves over time at scale.

Valuation Considerations

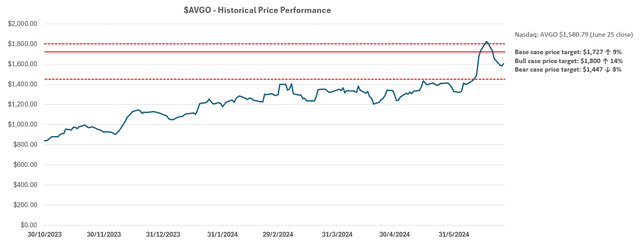

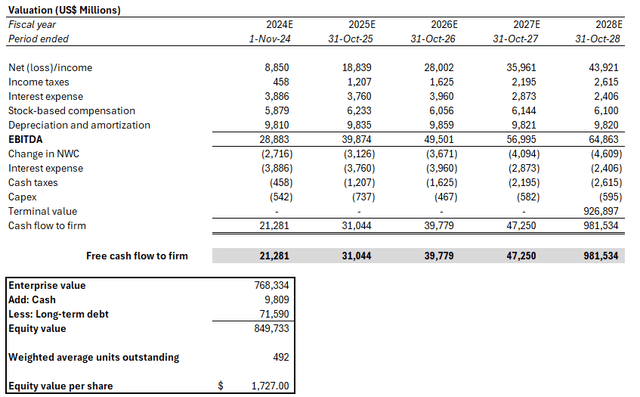

We are setting our base case price target for Broadcom at $1,727 apiece pre-stock split.

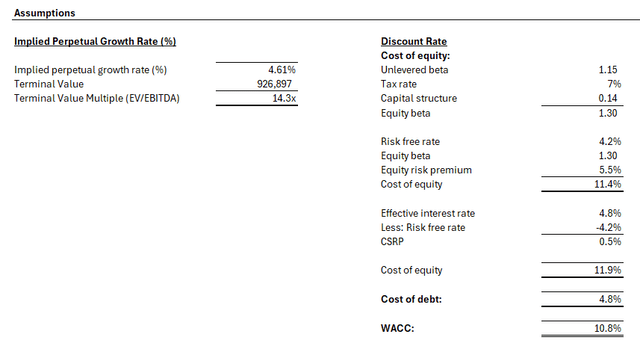

The price is derived under the discounted cash flow approach, which considers cash flow projections taken with the fundamental analysis discussed in the earlier section. A WACC of 10.8% in line with Broadcom’s capital structure and risk profile is applied to the analysis. An estimated perpetual growth rate of 4.6% is applied to FY 2028E EBITDA to determine Broadcom’s terminal value.

We believe the implied perpetual growth assumption, which is a premium to the anticipated pace of economic expansion across Broadcom’s core operating regions, is warranted, given the company’s competitive advantage in custom AI processors and networking solutions critical in the transition to accelerated computing. VMware integration also broadens Broadcom’s reach into incremental opportunities in private cloud deployments on-premise, which further supplements its exposure to AI-driven cloud TAM expansion. The perpetual growth rate of 4.6% applied in our discounted cash flow analysis for Broadcom yields a terminal value equivalent to the application of a 1.5% perpetual growth rate on FY 2033E EBITDA when the company’s growth profile is expected to normalize towards steady-state, in line with the long-term pace of estimated economic expansion across its core operating regions.

Looking ahead, Broadcom’s upcoming 10-for-1 stock split will likely drive increased volatility to the stock’s performance in the near-term. Admittedly, stock splits have no fundamental impact on the company’s financial performance. Yet, they have typically been accompanied by an upsurge in the stock’s performance during a bull market, especially if the underlying business shows tangible fundamental outperformance, which is the case for Broadcom.

This is consistent with the recent upsurge observed in the Nvidia stock during the period between its 10-for-1 stock split announcement and execution. The stock appreciated by almost 30% during the period, which is in line with historical post-split strength observed during a risk-on market. Meanwhile, stock splits have done little to boost share prices during risk-off market sentiment – cue Google’s latest stock split in 2022 after the Fed kicked off one of the most aggressive monetary policy tightening cycles in history to curb runaway inflation.

Specifically, the Nvidia stock appreciated close to 30% during the period between its last 4-for-1 stock-split announcement in May 2021 through effectiveness in July 2021. Meanwhile, its mega cap peers Apple (AAPL) and Tesla (TSLA) also appreciated by similar levels during their respective stock splits in 2020. The post-split upsurge observed historically was likely thanks to incremental demand from individual investors that previously did not have access to fractional or whole shares of the highly priced stocks, which complemented a risk-on buying market.

We expect a similar post-split upsurge for Broadcom, given its strong underlying fundamental performance amid secular AI tailwinds. By applying a 30% premium to Broadcom’s price of $1,495 apiece at the time of its 10-for-1 stock split announcement, the stock has potential to exceed $1,900 apiece (or $190 apiece post-split) when the split takes effect on July 12.

We believe the anticipated post-split upsurge remains reasonable, especially given the company’s robust fundamental outlook. Under upside scenario cash flows, which considers a stronger-than-expected ramp of custom AI accelerator and networking solution deployment, alongside faster acceleration in VMware revenue contributions, the stock has potential to exceed $1,800 apiece pre-split.

Conclusion

Taken together, we believe Broadcom is entering a net positive set-up heading into F2H24. Specifically, the company is well-positioned for a strong ramp-up in AI-related sales, with ensuing economies of scale improvements likely to drive incremental ROI expansion. Meanwhile, the gradual recovery of non-AI opportunities will likely ensure durability to the company’s sustained long-term growth trajectory. The anticipated acceleration in VMware revenue contributions will also be complementary to Broadcom’s pace of consolidated margin expansion and cash flow growth.

Admittedly, the stock is not cheap at current levels. Trading at 13.5x estimated sales and 29.4x estimated earnings, Broadcom is priced at a premium to its semiconductor peers that exhibit a similar growth and earnings profile. However, the company remains well-positioned for incremental outperformance ahead, which should provide an uplift to its valuation at current levels. We believe this will also be complementary to upside appreciation prospects stemming from Broadcom’s upcoming stock split, which should not be overlooked.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.