Summary:

- Netflix’s data-driven, non-IP-focused model allows for personalized content and lower production costs compared to traditional Hollywood studios.

- The rise of AI video generation and user-generated content poses a potential threat to Netflix’s business model in the long term.

- NFLX’s long-term success may depend on its ability to adapt to AI technology and compete with UGC platforms like YouTube and TikTok.

- A short-term threat is also posed by Netflix’s slower content spending and worse-than-anticipated ad sales.

BertrandB/iStock via Getty Images

Assessing Netflix’s Historical Triumphs

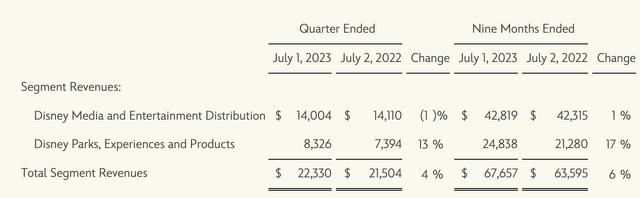

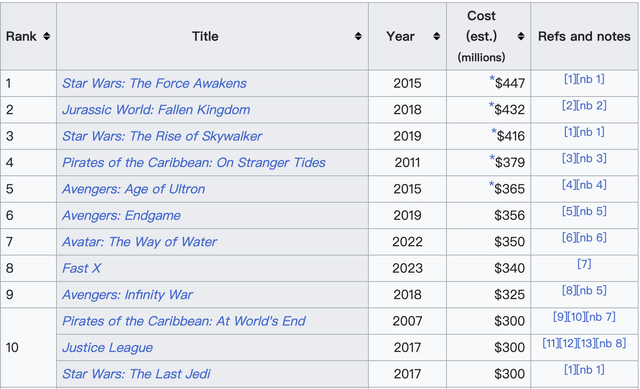

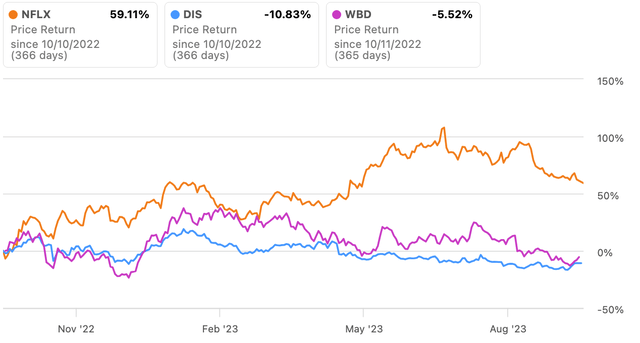

We wrote an article two months ago called “Disney Fiscal Q3: The Streaming Dinosaur” about why we think the Disney (NYSE:DIS) stock is not a buy.

Some investors may find the Disney versus Netflix comparison confusing given Disney’s more diversified business model across content, parks, and consumer products. However, the core of Disney’s business is built on monetizing its intellectual property (“IP”) through all those segments. Its parks and products derive value from and rely on Disney’s IP. Therefore, IP acts as Disney’s golden goose across its business lines, whereas Netflix eschews IP reliance to cater to underserved viewing niches it identifies through data.

Our thesis is that Disney’s intellectual property (“IP”) oriented strategy is outdated and is challenged by Netflix’s (NASDAQ:NFLX) data-driven, non-IP-focused model. There are two reasons for this:

1. Netflix’s approach provides more personalized content to serve a wider addressable market. By leveraging data and algorithms, Netflix can cater recommendations and new shows to niche audiences rather than just the mass market IP draws.

2. The non-IP focus solves the issue of paying exponentially more for talent/loyalty fees once an IP is proven successful – for example, Robert Downey Jr. was paid $500k for the first Iron Man movie and earned $10 million for Iron Man 2 and $70 million for the third movie.

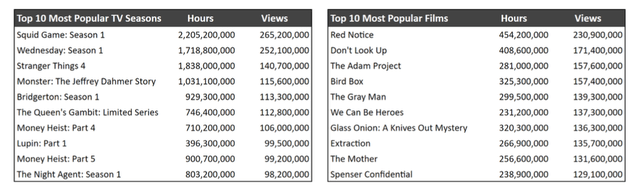

In contrast, according to this source, Netflix’s most expensive movie budget is around $200 million for The Gray Man while the top ten budgets range from $90-$200 million. For comparison, per Wikipedia, the production budgets for the top 10 traditional Hollywood movies range from $300-447 million.

Considering Netflix’s biggest budget movie The Gray Man was filmed in 2022 versus 2010-2020 for most major studio films, Netflix’s inflation-adjusted costs on a per-show basis are likely 50% or more lower than the traditional film production model.

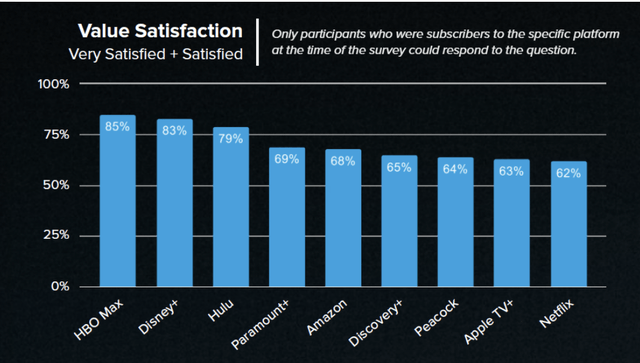

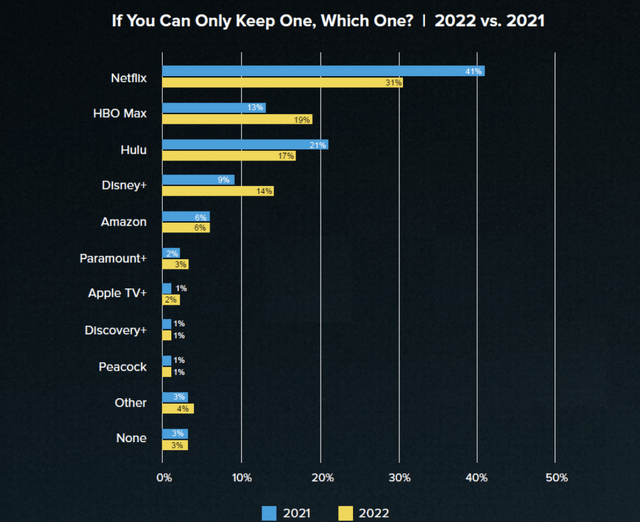

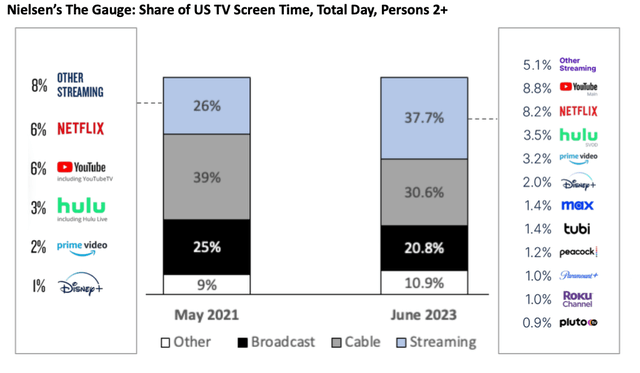

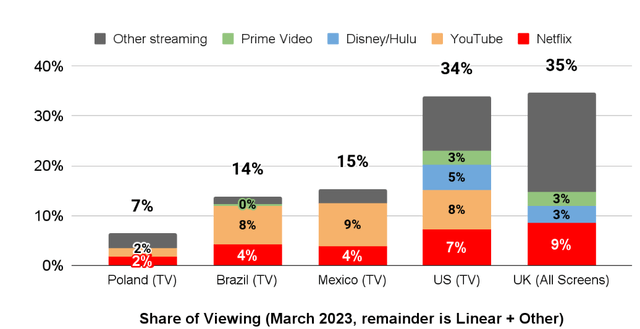

Although many consumers argue the video quality on Netflix is not the best compared to other streaming services, as shown in the chart below, Netflix still reigns as the top streaming platform globally. This is enabled by Netflix’s low production costs, which allow it to create content tailored to a diverse array of viewer interests and capture a wide addressable market.

The so-called disrupted companies are always the ones that come up with new low-cost production methods. For example, when Tesla introduced the Model 3 at Elon Musk’s hoped-for price of $35k, the market was excited even as the car sold for much higher. This is because Tesla’s simplified battery design with fewer parts required compared to traditional internal combustion engines reduces production and supplier costs at scale.

The Rise of AIGC (Artificial Intelligence Generated Content)

However, while investors are celebrating Netflix’s success and Reed Hastings enjoys framing streaming video as replacing traditional broadcast/cable, the market is undergoing a dramatic change that is quiet for now. The question of whether AI tools will replace humans is the mainstream focus. We see that AI tools will change the dynamics of the current industry more quickly than they will replace humans.

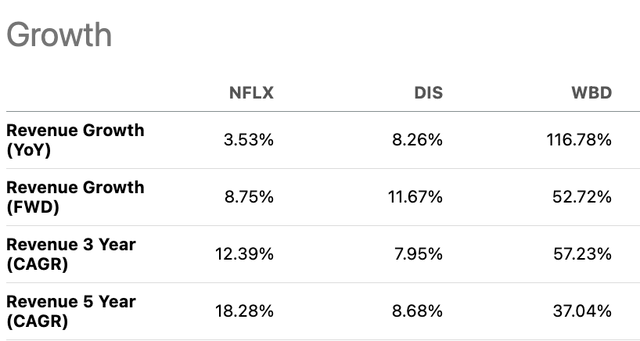

According to the stats, Gen Z (42% positive) and millennials (51% positive) in the US are more favorable toward animated films and television programs produced by AI.

Attitudes towards the impact of AI-produced and animated films or TV shows on the film industry in the United States as of April 2023, by generation (Statista)

According to 11Press, the AI animation market is likely to experience 35% over the next 10 years.

In 2022, the Global Generative AI in Animation Market was estimated to be valued at USD 0.9 billion. Over 2023-2032, this market is projected to experience a compound annual growth rate of 35.7% and be worth an estimated total of USD 17.7 billion by 2032.

According to Grand View Research, UGC video will grow at 29% CAGR from 2023-2030 versus a projected 21% CAGR for online video streaming for the same period.

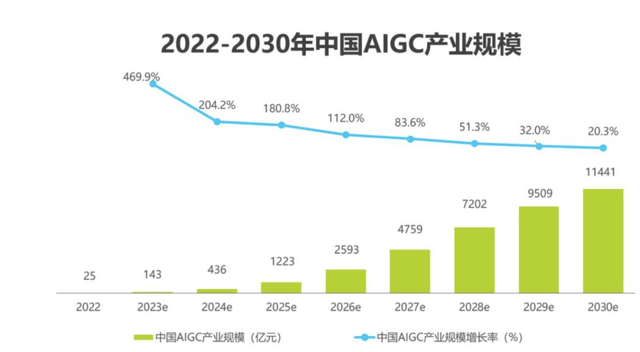

AIGC development is more robust in China. iResearch forecasts that the scale of China’s AIGC industry will grow at a rate of 470% to reach 143 billion yuan in 2023. By 2030, the scale of China’s AIGC industry is expected to exceed 1 trillion yuan, reaching 11,441 billion yuan.

Animations: AIGC’s Success Showcase

Currently, people associate UGC with influencer content on Instagram, YouTube, and TikTok. This doesn’t seem an existential threat to Netflix given the production quality gap.

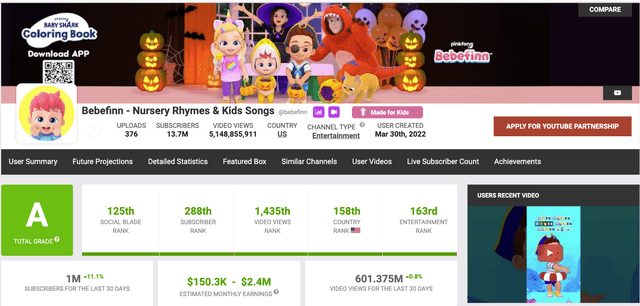

However, advances in AI video generation technology could change this. Animation is poised to be the inaugural entertainment sector influenced by AIGC, given the escalating consumer acceptance. For example, the “Bebefinn” kids channel on YouTube founded in March 2022 used AI to create characters and environments. It has the top YouTube kids rankings ranked by SocialBlade.

Remember, disruption is not about how popular is the product/service but lower production costs. With subscription services like Adobe Express ($9.99/month), Canva Pro ($14.99/month), or AIGC Koreado AI Pro (RMB599/quarter), creators can now produce animation videos within days. The “Bebefinn” example shows that AI-generated content can get 5.1 billion views in 18 months. This can translated to a $30*18/5.1 billion=$0.00000011 per view.

Compared to Netflix’s Red Notice at 230 million views for a $200 million budget, or ~$1 per view. Though the exact Bebefinn operating costs aren’t public, it’s reasonable to assume they are a fraction of a Netflix-produced movie.

While Disney or Netflix films bring strong brand recognition, their actual utility in terms of quality family bonding and amusing children is not necessarily higher than alternative options. A parody video from an animated channel like Bebefinn could fill the same desires for togetherness and amusement between parents and children as a Pixar movie. According to Bureau of Labor Statistics survey data, the top reasons people watch television with others are for socialization and entertainment. As Netflix has normalized watching films at home rather than in theaters, parents have become more adaptable to different at-home viewing options for quality time with kids. As at-home streaming further permeates family routines, the premium status of studio animations may diminish if UGC creators utilize AI to close any artistic quality gap.

In addition to animation, more AIGC films are being produced. For example, The Crow, which won Best Short Film at the 2022 Cannes Short Film Festival, was created by AI artist Glenn Marshall using OpenAI’s CLIP. CLIP is a neural network that can effectively learn visual concepts from natural language supervision. The Cannes Award demonstrates AI’s growing capacity to generate quality cinematic content.

UGC Platforms as Potential Competitors

AI now empowers small creators to make content unimaginable before.

An interesting question arises – can Netflix adopt AI to defend against competition from small-budget content creators? Our assessment is that doing so would not provide a sustainable competitive advantage. This is because the marginal cost of leveraging AI to produce each additional piece of video content approaches zero. As AI technology progresses, the gap in production quality between Netflix-created shows and UGC will progressively narrow. Once AI-enabled UGC content becomes nearly indistinguishable from traditionally produced shows, Netflix loses its edge. With AI providing a commodity capability available to anyone, competitive differentiation would shift almost entirely to whoever possesses the most creative users and can engage them at scale. On that front, UGC platforms such as YouTube and TikTok boast inherent strengths from their massive existing creator bases. So even if Netflix utilized AI in its productions, other platforms like YouTube and TikTok with stronger creator communities could do the same while maintaining a cost advantage. YouTube’s addition of movies to its channel signifies a potential move toward category expansion.

For Netflix to combat this, they would need to pivot their business model to better incentivize user content contribution. But this conflicts with their current premium subscription approach. Even if Netflix pivots to a mostly ad-based model, its variable content costs will remain higher. Further, Netflix may face margin compression in this scenario.

Netflix’s Data advantage is not Huge

Netflix has traditionally leveraged its vast subscriber data to gain valuable insights for content production and licensing, which individual creators could not match. With over 200 million global subscribers, Netflix can analyze overall viewing habits, genre preferences, and other trends to guide its content decisions. This gives Netflix an advantage in using data to produce and acquire shows and movies that will appeal to its audience.

However, creators can leverage these UGC platforms’ algorithms to connect with the right audiences. The platforms’ recommendation engines analyze individual users’ interests based on their engagement and automatically suggest new content and accounts that align with those interests. Creators who produce content that resonates with a specific user community can benefit from algorithms surfacing their content to other users with similar tastes. While Netflix still holds some data advantages from its subscriber base, individual creators are now able to tap into data-driven insights of their own to better understand and reach their audiences through UGC platforms.

Financial review and outlook

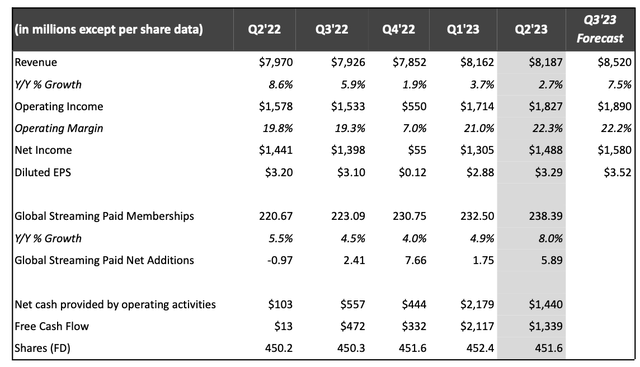

Netflix is set to report third-quarter earnings on October 18th. Below we preview Netflix’s upcoming results and outlook:

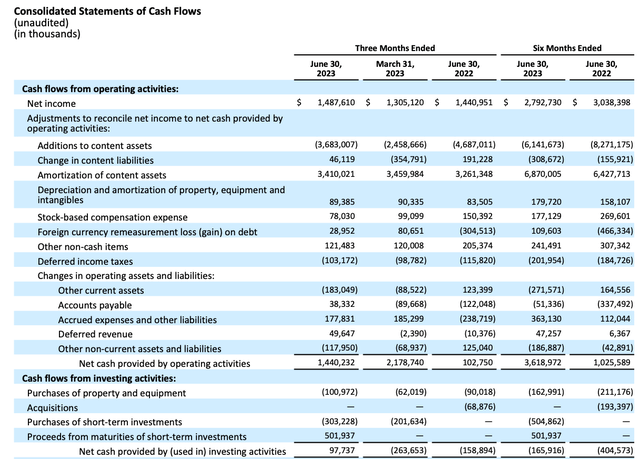

- Netflix revenue and subscriber growth slowed to single digits in recent quarters. However, membership reacceleration in Q2 helped by the new password-sharing policy may lift Q3 revenue growth.

- Early signs of weaker-than-expected ad business performance are evident in the departure of the advertising chief on October 10th. This implies fierce competition in the freemium streaming market.

- Netflix expanded its global market share from 6% in 2021 to 8.2% in Q2 2023 and improved sequentially from 7% in Q1. Its penetration story remains intact. However, YouTube still dominates in the US with an 8.8% market share.

- A concerning trend is lower content spending by Netflix in both Q2 and the first half of 2023 compared to last year. This could be the fallout from the consumer sector slowdown. Less investment in content creation may negatively impact future user growth.

We will be watching Q3 results closely for signs of how these underlying dynamics shape Netflix’s growth and competitive positioning in streaming.

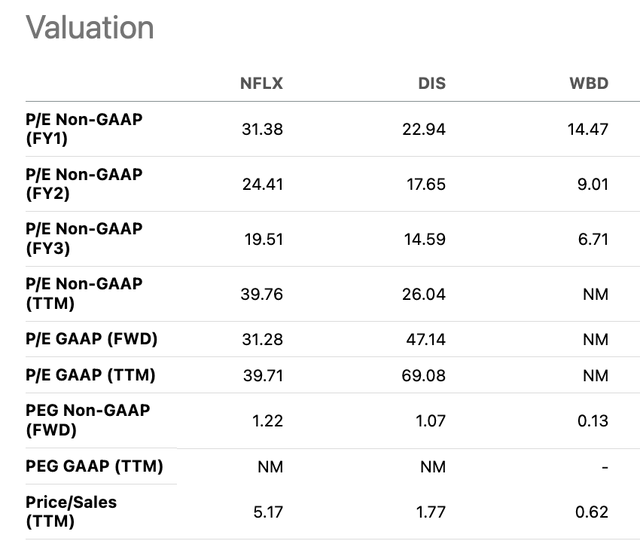

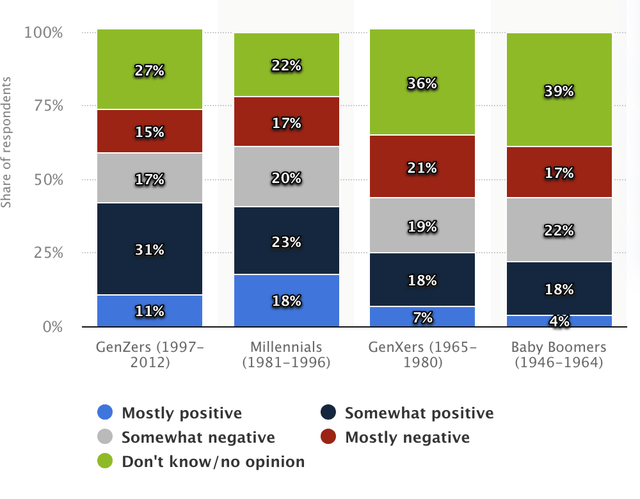

Valuation

Despite the potential AI impact, Netflix trades at a premium – P/E of 30x based on 2023 EPS estimates. This seems expensive given slowing growth on a current, forward, and historical basis.

For now, Netflix retains dominance in the streaming space, leaving room for continued growth by capturing market share from broadcast and cable TV. The threat posed by AI technology remains fluid in the short term. As a long-term investor however, we would like to see Netflix’s management team start evaluating and articulating a long-term strategy to address the potential industry disruption AI could spark within the next 3-5 years.

We prefer sector leaders but avoid them if core threats loom and the strategy to address competition is unclear. In addition, it is prudent to take a wait-and-see approach with Netflix until investors gain more clarity on its ability to reaccelerate growth. Hence, we are neutral on Netflix for the time being.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.