Summary:

- Thanks to the bottom line beat in the FQ1’24 earnings, Disney has outperformed expectations, with the stock rallying by +21.3% since the January 2024 bottom of $89.

- We can understand why sentiment surrounding the stock continues to recover, with the management also raising dividends and reinstating $3B in share repurchase program for FY2024.

- DIS’ growth is firing on all cylinders indeed, with all three of its segments likely to generate improved top/bottom lines, attributed to the robust demand for IP offerings.

- A moderate retracement may be necessary before adding, preferably at its previous trading range between $90s and $100s for an improved margin of safety.

- There have been tremendous improvements to DIS’ intermediate to long-term prospects, as long as the company remains profitable, reverts to a growth mode, and achieves its ambitious goals.

PeopleImages/iStock via Getty Images

We previously covered Walt Disney Company (NYSE:DIS) in November 2023, discussing multiple uncertainties surrounding its near-term prospects, attributed to the expensive Hulu acquisition, restart of its content productions from December 2023, and reinstatement of dividends.

Despite this, we had recommended the stock as a Buy due to its highly attractive discounted valuations, with the robust IP flywheel suitable for growth-oriented investors looking for undervalued contrarian plays.

In this article, we shall discuss how DIS has outperformed expectations, with the stock rallying by +21.3% since the January 2024 bottom of $89, thanks to the bottom line beat in the FQ1’24 earnings.

Combined with the raised dividends and reinstatement of $3B in share repurchases for FY2024, we can understand why sentiment surrounding the stock has recovered thus far.

We maintain our Buy rating on the DIS stock, preferably after a moderate pullback to its previous trading range of between $90s and $100s.

The DIS Investment Thesis Remains Robust After A Moderate Pullback

For now, we believe that DIS has reported an excellent FQ1’24 earnings call, with revenues of $23.54B (+10.8% QoQ/ +0.2% YoY) and adj EPS of $1.22 (+48.7% QoQ/ +23.2% YoY).

Much of its bottom line tailwinds are attributed to the improved gross margins of 33.8% (-1.6 points QoQ/ +3.5 YoY) and aggressive cost-cutting efforts, with the company reporting a moderate SG&A expense of $3.68B (-6.3% QoQ/ -1.6% YoY).

As a result, we are not surprised by DIS’ drastically improved operating income of $3.87B (+27.3% QoQ/ +30.3% YoY) and operating margins of 16.4% (+2.1 points QoQ/ +3.8 YoY) in the latest quarter.

The same has been observed in its expanded Free Cash Flow margins of 3.8% (-12.3 points QoQ/ +13 YoY), despite Q1s being the seasonally weaker quarter, compared to FQ1’23 margins of -9.2%, FQ1’22 of -5.4%, FQ1’21 of -4.2%, FQ1’20 of 1.3%, and FQ1’19 of 5.9%.

DIS has also committed to sustained cost efficiencies ahead, with the management already guiding for stellar FY2024 EPS of $4.60 (+22.3% YoY) and Free Cash Flow of $8B (+63.5% YoY), partly aided by the delayed production spending.

These developments naturally explain why the management felt comfortable to raise its semi-annual dividends from $0.30 to $0.45, further aided by the moderate improvements in its balance sheet YoY with a net debt situation of $34.41B (+23.2% QoQ/ -6.1% YoY/ +5.1% from FY2019 levels of $32.71B) in FQ1’24.

Despite the expected churn effect on DIS’ D2C segment from the price hike, with a declining domestic subscriber of 46.1M (-0.4M QoQ/ -0.5M YoY) and global subscriber of 65.2M (-0.9M QoQ/ +7.5M YoY), we are not overly concerned.

This is because the net effect remains positive, with a growing D2C revenue of $5.54B (+10% QoQ/ +14.9% YoY), mostly attributed to Hulu, and near break-even D2C profit margins of -1.8% (+6.2 points QoQ/ +19 YoY) by the latest quarter.

Assuming that the company is able to sustain its D2C outperformance, we may see the segment’s cash burn moderate from henceforth, well balancing the secular decline of its Linear Network segment at operating incomes of $2.8B (+250% QoQ/ -12.5% YoY) and operating margins of 42.8% (-12.1 points QoQ/ +2.2 YoY).

At the same time, DIS’s theme parks/ experiences remain a top/ bottom line driver, with $9.13B of revenues (+11.3% QoQ/ +6.9% YoY), $3.1B in operating income (+82.3% QoQ/ +8.3% YoY), and 33.9% in operating margins (+13.2 points QoQ/ +0.5 YoY).

These numbers further demonstrate why its robust IPs have contributed to the company’s top/ bottom line flywheel, with its loyal consumers continuing to spend top dollar for its media/ streaming and theme park/ cruise offerings, despite the uncertain macroeconomic outlook.

Lastly, DIS’ strategic choice to combine its existing sports offerings with Fox (FOX) and Warner Bros. Discovery (WBD) effectively creates a well-diversified sports-centered streaming powerhouse by Q3’24.

This naturally differentiates the legacy entertainment companies’ capabilities against the king of streaming, Netflix’s (NFLX) sports storytelling strategy.

The enhanced bundling will also allow the former to tap on a segment that continues to be well loved in the US, as observed in the growing excitement surrounding Super Bowl and sports betting, significantly aided by the availability of ESPN Bet.

Combined with the concert streaming deal with Taylor Swift, it appears that DIS is firing all of its growth cylinders indeed, with all three of its segments likely to generate improved top/ bottom lines ahead.

This trend is significantly aided by the robust labor market, strong discretionary spending, cooling inflation, and supposed Fed pivot from H1’24 onwards.

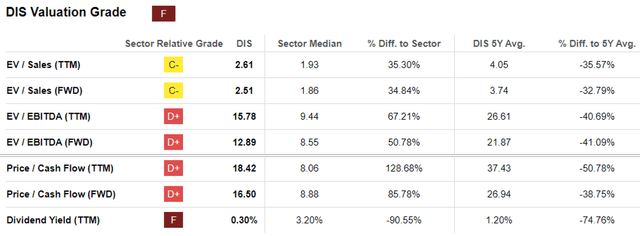

DIS Valuations

On the one hand, it appears that the market has upgraded DIS’ FWD valuations from the EV/ EBITDA of 10.95x and Price/ Cash Flow of 12.75x recorded in the October 2023 bottom, to 12.89x and 16.50x at the time of writing.

Readers must also note that the raised valuations remain a great distance away from its pre-pandemic means of 14.62x/ 28x and NFLX’s 25.30x/ 37.34x, thanks to the sustained cord cutting and the yet profitable D2C segment.

However, with the management already guiding for profitability in the D2C segment by the end of FY2024, we believe we may see DIS’ prospects eventually upgraded due to its inherent undervaluation and potential reversal moving forward.

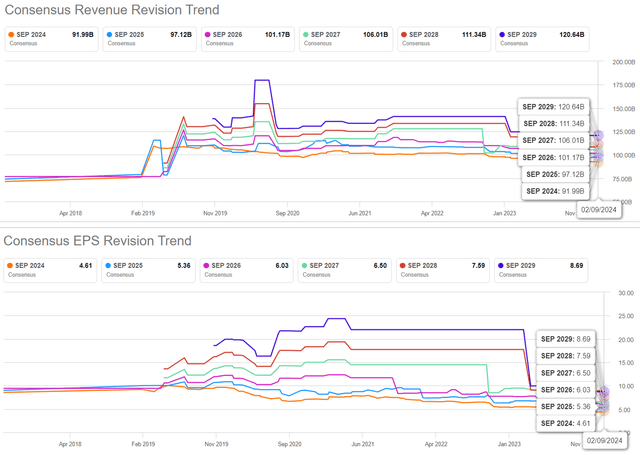

The Consensus Forward Estimates

On the other hand, it is apparent that the consensus have yet to raise their forward estimates, with DIS expected to generate top/ bottom line CAGR of +4.4%/ +17% through FY2026, despite the management’s stellar FY2024 guidance.

This is compared to the previous estimates of +7.3%/ +27.1%, though still improved than the historical growth of +6.9%/ -5.8% between FY2016 and FY2023, respectively.

Based on the FWD P/E valuation of 23.98x and DIS’ LTM adj EPS of $4.01, the stock appears to trading at a premium of +12.7% to our fair value estimate of $96.15.

However, based on the consensus FY2026 adj EPS estimates of $6.01, there appears to be an excellent upside potential of +32.9% to our long-term price target of $144.10.

Therefore, depending on an individual investor’s dollar cost averages and risk appetite, DIS still appears to offer a compelling growth and dividend investment thesis.

So, Is DIS Stock A Buy, Sell, or Hold?

DIS 2Y Stock Price

For now, DIS has rapidly broke out of its 50/ 100/ 200 day moving averages, with the stock also retesting its previous resistance levels around the $108s.

We are not certain if this sudden recovery may be sustainable, with the stock likely buoyed by the lifting market sentiments and the sports joint venture, as the market also enters extreme greed territory.

Nonetheless, we maintain our optimism surrounding its long-term prospects, with DIS only temporarily pulling forward part of its upside potential, thanks to the exemplary FQ1’24 earnings call and macro events.

We are maintaining our Buy rating, with the attractive long-term risk/ reward ratio offering interested investors upside potential over the next few years.

Otherwise, bottom fishing investors may consider waiting for a moderate retracement before adding, preferably at its previous trading range of between the $90s and the $100s for an improved margin of safety.

For now, we believe that DIS’ intermediate to long-term prospects have lifted tremendously, as so long it’s able to sustain its cost efficiencies, deliver growth, and deliver on its ambitious guidance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.