Summary:

- I have been on the sidelines for far too long as I failed to appreciate the strength of the platform portfolio.

- Microsoft stands to benefit from its OpenAI partnership in ways far beyond its equity investment.

- The company continues to be a fast-growing cash cow.

- I am upgrading MSFT stock to buy as I expect market-beating returns over the long term.

Justin Sullivan

I have been neutral to bearish on Microsoft (NASDAQ:MSFT) for nearly a year, largely on the basis of valuation. I am now of the view that this stance was mistaken. It is always possible that my change of heart is a symptom of the continually rising tech sector, but I find it equally likely that I simply failed to adequately appreciate the long term sustainability of the company’s business model. While I still have reservations about the competitiveness of each individual business unit, it is clear that the company’s wide platform offerings offers it greater stability across economic cycles. Moreover, the company’s equity stake in OpenAI understates the company’s exposure to the growth of artificial intelligence, as it likely will be OpenAI’s exclusive cloud provider for years to come. I am upgrading MSFT stock to buy as I see a clear path to market-beating returns moving over the long term.

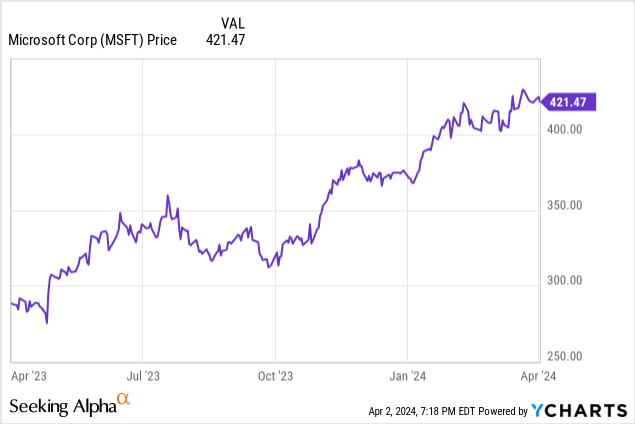

MSFT Stock Price

I last covered MSFT in January where I again recommended avoiding the stock due to valuation. In fact, I have written 3 reports on why I did not hold a favorable view on the stock, beginning with my report in June of last year. These reports proved incorrect, as MSFT has delivered strong, market-beating returns over this time period.

Even after the outperformance, it is still better late than never to rectify my mistakes.

MSFT Stock Key Metrics

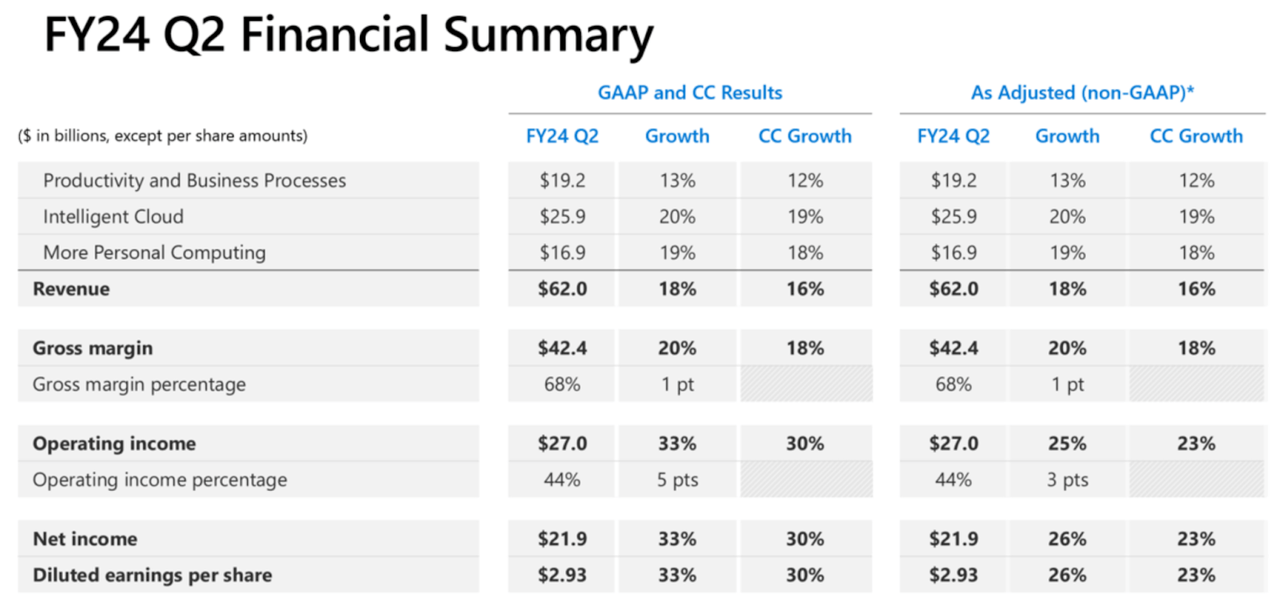

In its most recent quarter, MSFT delivered solid results all around, with revenues growing 16% YoY and operating income growing by 23% YoY (on a constant currency adjusted basis). It is impressive to see a company of this size continuing to deliver top-line growth strong enough to make smaller peers blush while also delivering mature market-leading profitability.

MSFT spent $5.6 billion on dividends and $2.8 billion in share repurchases, lower than the $9.9 billion spent on shareholder returns in the first quarter. This was primarily due to the company spending $11.5 billion on CapEx, mainly attributable to investments for generative AI.

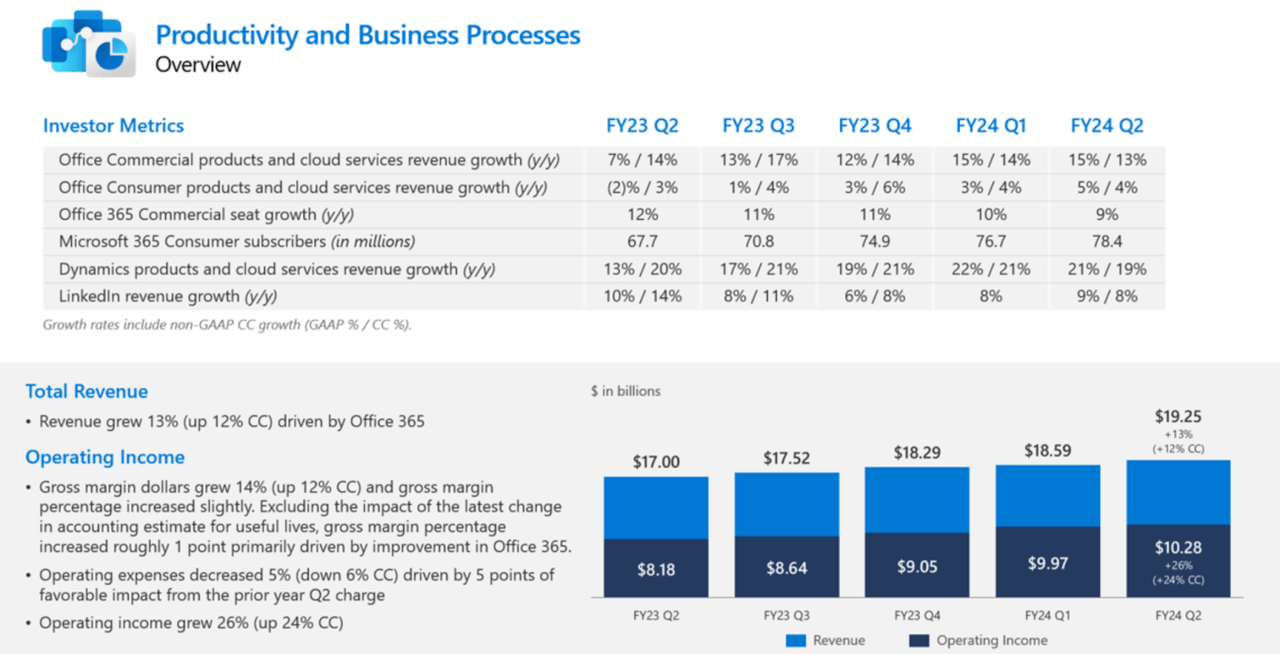

The company saw solid growth in its famous Office products, with Office Commercial growing 13% constant currency. The entire tech sector had in general seen growth rates slow due to the tough macro environment (specifically widespread headcount reductions), and the $19.25 billion in quarterly revenues for this segment would in itself make MSFT one of the larger tech companies among peers. Yet MSFT did not take any excuses in sustaining strong growth rates. I suspect that the company’s lead in integrating generative AI in its products may be having some boost here.

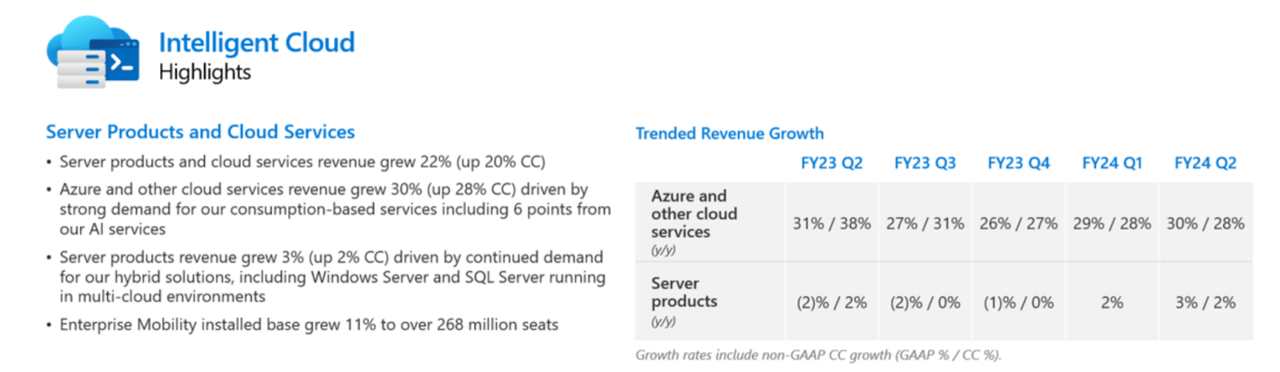

Nowadays, more investor attention is placed on the cloud division, highlighted by Azure which grew at a stunning 30% pace (28% constant currency). On the conference call, management noted that AI drove around “6 points” of that growth. My initial take in this and prior quarters was to note how growth ex-AI continued to remain pressured. However, I now view this prior take as being woefully incorrect. The macro environment will improve whenever it improves. MSFT should continue to benefit from AI-related growth in large part due to its partnership with OpenAI. There remains the possibility that Azure growth can accelerate further as the broader customer base recovers, but the lack of a recovery should hurt all cloud operators, not just MSFT. In such a scenario, MSFT would benefit greatly from having generative AI as being a key growth lever. If nothing else, the company’s partnership with OpenAI might help to give it a longer growth runway than other cloud titans.

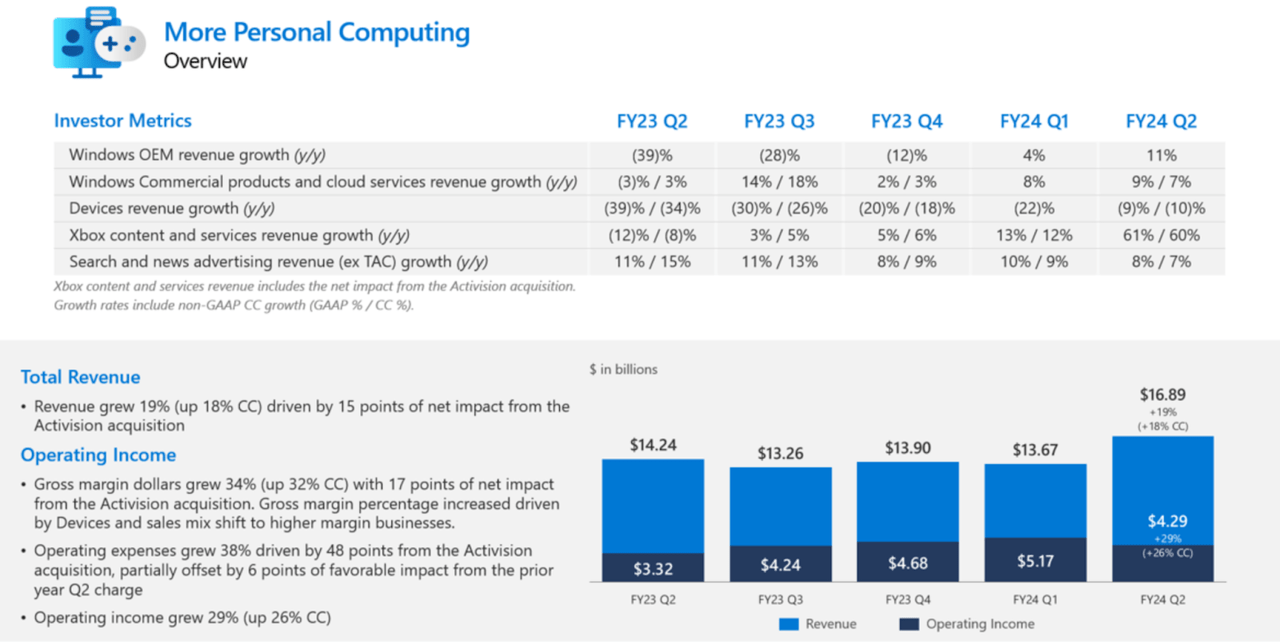

In its More Personal Computing segment, MSFT saw a cyclical recovery as revenues jumped 19% YoY. The company benefited from both improving market conditions as well as from lapping easy comparables.

MSFT ended the quarter with $81 billion of cash versus $74.2 billion of debt, representing a steep sequential decline from the $72.4 billion in net cash shown in the first quarter. That decline reflects the $69 billion spent on the Activision acquisition. Management has not indicated if they intend to rebuild the net cash balance or maintain the neutral leverage position (though I’d expect these two to be the most likely results, at least for now).

Management touted productivity gains from integrating generative AI in its products, noting that “early Copilot for Microsoft 365 users were 29% faster in a series of tasks like searching, writing, and summarizing.”

Looking ahead, management has guided for Productivity and Business Processes to see growth decelerate sequentially to between 10% and 12%. Management expects Azure growth to “remain stable” to this past quarter’s results. Management expects Activision to be “accretive to operating income” for the full year. Consensus estimates call for the company to generate 15% YoY revenue growth to $60.84 billion and 15% YoY earnings growth to $2.82 per share. I wouldn’t be surprised if MSFT ended up being slightly on the top-line (I am guessing around 16% growth) and heavily on the bottom-line due to the ongoing operating leverage shown in the business.

Is MSFT Stock A Buy, Sell, or Hold?

I’d wager that nearly every investor is familiar with MSFT and its products, but it bears reminding ourselves of their reach due to its bearing on the investment thesis. MSFT is an enterprise and consumer tech company with a wide breadth of offerings ranging from productivity to cybersecurity to cloud operations.

The last two years have presented tech companies with a tough macro environment, highlighted by higher interest rates, difficult post-pandemic comparables, and headcount reductions across all industries (especially the tech sector). Names like MSFT have shown that having a wide platform of products is especially valuable in such times due to it helping to sustain top-line growth from upselling existing customers. During tough macro conditions, it becomes more difficult to win new customers. I had previously put too much emphasis on the potential that competing products offered superior results – such as in endpoint protection versus SentinelOne (S) or video conferencing versus Zoom (ZM) – but I failed to appreciate two important realities. First, customers might not know or care to optimize for the very best solution. Second, customers might feel inclined to work with MSFT for additional products due to the convenience of having so many products under one platform. I also might have failed to appreciate how generative AI (and the company’s swift execution in integrating generative AI in its products) might have directly addressed any such concerns.

This creates high switching costs and thus justifies higher valuations. On a side note, this might help to explain why Salesforce (CRM) had been so aggressive in M&A activity heading into the pandemic. With these points in mind, we can better understand how to interpret the 36x earnings valuation.

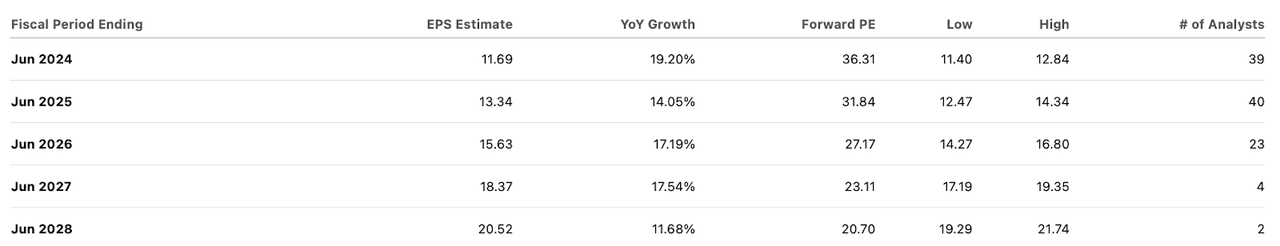

I previously might have assumed that this valuation was too aggressive, even against consensus estimates for double-digit top-line growth over the long term.

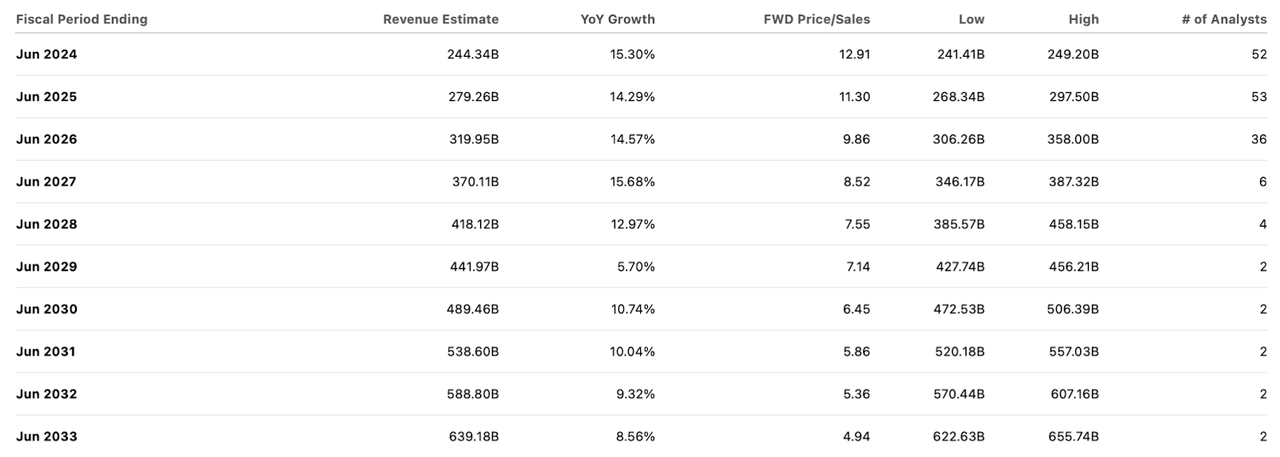

There’s clear reasons to believe in consensus estimates. I’ve already mentioned how the wide platform offerings help to power growth due to upselling opportunities. MSFT may also benefit from pricing power due to the high switching costs, and it has recently rolled out global price hikes. Finally, I previously underestimated the company’s exposure to OpenAI. The company has invested around $11 billion in OpenAI which is peanuts relative to its $3.2 trillion market cap. I note that this investment is still peanuts even accounting for the capital appreciation from the recent $80 billion valuation implied from a tender offer. But that is missing the point. The real value from its partnership with OpenAI may be the associated boost to Azure revenues, which as previously noted has already benefited the company for several quarters. OpenAI is unlikely to work with competitor Google Cloud (GOOGL) for obvious reasons and it appears that it may continue to work with MSFT due to their partnership (and equity ownership). MSFT thus has far more exposure to ongoing OpenAI growth than its equity investment might imply. While the AI boost to cloud growth will likely slow as the company laps tough comparables, I can still see it offering several hundred basis points of contribution, helping the company to sustain double-digit revenue growth on a consolidated basis over the long term.

In my prior fair valuation estimates, I used a 10x sales (25x earnings at 40% long term net margin) assumption which I called aggressive. Now, I expect the company to trade at around 12x sales (30x earnings at 40% long term net margins). It is hard to find direct comps to justify that valuation given that MSFT itself is often used as a valuation bellwether. Just one potential example – MSFT’s revenues are arguably as ironclad as industrial real estate investment trust (‘REIT’) Prologis (PLD), which trades at 23x earnings, yet MSFT should be able to sustain materially faster growth rates while maintaining less leverage on the balance sheet. Assuming a 12x sales valuation in 2033, MSFT stock appears priced for 10.2% annual return potential over the next 9 years (or around 13% to 15% inclusive of the earnings yield). This kind of return potential would comfortably beat the market by a significant margin, which is an attractive reward proposition given the low risk profile of the business.

What are the key risks? MSFT does not look cheap. The investment thesis clearly centers around its ability to maintain a high quality perception. If MSFT were to see elevated churn (perhaps my past concerns on competition might come to fruition) then Wall Street might call the business model quality into question. There is always the lingering risk that growth will decelerate faster than expected – perhaps slowing revenue growth in productivity and business processes more than offsets strength in Azure. I expect pricing power to be an important long term catalyst, but headcount growth will likely be needed to get to a double-digit overall growth rate. I view the company’s acquisition of Activision Blizzard as a potential risk factor given the expensive price tag – it is possible that the company becomes so big that management eventually seeks “creative” ways to create shareholder value. I call that the “General Electric (GE)” risk.

Conclusion

I have been on the sidelines with MSFT for quite some time and I greatly regret it. I now have a greater appreciation for the company’s product portfolio which may both help sustain strong top-line growth over the long term as well as justify premium valuation multiples. I am upgrading my rating of the stock to “buy” as I can see the stock delivering market-beating returns over long time horizons.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL, CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!