Summary:

- Initiating coverage on XPeng stock with a “Buy” rating and a 24-month horizon with the possibility of growth acceleration and narrowing of EBITDA level losses.

- XPeng’s low-priced MONA MO3 EV targets a significant market, supporting sales growth despite potential margin compression, with encouraging initial response.

- Aggressive international expansion, particularly in Europe, and strategic partnerships, such as with Volkswagen, are key growth catalysts for XPeng.

- XPeng’s financials show improving vehicle margins and a strong cash buffer, with potential for positive free cash flows and significant upside in 2025 and beyond.

3alexd

Initiating Coverage

I am initiating coverage on XPeng (NYSE:XPEV) stock with a “Buy” rating and an investment horizon of 24 months. I believe that there are challenges that the company needs to address. However, the business developments are in the right direction. It therefore makes sense to consider some exposure to XPEV stock. If the plans deliver the expected results, it’s likely that the stock will have a significant rally.

It’s worth noting that XPeng stock touched lows of $6.55 in August 2024. The stock has already surged by 85% from lows. I am inclined to believe that the uptrend is likely to sustain.

An important reason for XPeng surging in the recent past is expansionary monetary policies. Besides the significant monetary stimulus announced in China, the world is moving towards lower interest rates. This is likely to have a positive impact on consumer sentiment and hence consumption spending.

However, the impact of lower interest rates comes with a lag. Expansionary monetary policies are therefore likely to boost EV sales in the second half of 2025 or in 2026. Having said that, it’s not the only reason to be bullish on XPeng. This initiating coverage discusses the company specific factors that are likely to translate into positive price action.

Low-Price EV is a Potential Game Changer

On August 27, 2024, XPeng launched MONA MO3, an intelligent all-electric hatchback coupe. The EV is priced at $16,813 and will “compete with other EVs priced in the 100,000-150,000-yuan ($14,035-$21,052) range, which accounts for a third of total car sales in China.”

The addressable market is therefore significant and XPeng is targeting annual sale of at least 100,000 MONA cars. The company’s target is likely to be supported by the launch of MONA “Max” version that will be equipped with self-driving features with a starting price of $21,700.

It’s worth noting that MONA MO3 passed 10,000 orders within an hour of bookings going live. The initial response has been encouraging. However, the low-price model is likely to have an impact on vehicle margin. Once deliveries reach the company’s initial target, there will be clarity on the extent of margin compression.

Having said that, low-price models are likely to support sales growth and XPeng is moving in the right direction. It’s worth noting that Nio (NIO) has also launched its low-price car, L60 SUV, under the Onvo brand. Nio’s CEO Nio CEO William Li indicated that the brand will also be launched in Europe in 2025. Nio is targeting 20,000 vehicle deliveries a month next year for its L60 SUV.

An important point to mention here is that “buyers of electric vehicles face tighter financing terms compared to those who buy conventional, non-EV vehicles in Europe and in the U.S.”

The reason listed by experts at Wharton and the University of British Columbia in Canada is that “lenders price in the risks they perceive in obsolescence caused by rapid advances in EV technology.”

Tighter financing terms is a potential reason for lower-than-expected adoption of EVs in Europe and U.S. However, with interest rates trending lower and with the potential introduction of low-priced cars, there is visibility for accelerated adoption. I would not be surprised if XPeng launches its low-priced model in Europe and other international markets in 2025.

Ford CEO Jim Farley also believes that the U.S. auto industry needs to “pivot towards smaller, more affordable electric vehicles.” Jim believes that low-priced EVs are critical for future profitability.

Overall, China is also witnessing intense competition in the low-price EV segment. I see multiple players in U.S. and Europe focusing on smaller EVs with an attractive pricing. Chinese companies have an early-mover advantage. However, for now, the positive is mitigated by the tariffs on Chinese EVs by U.S. and Europe.

Aggressive International Expansion

I believe that one of the key growth catalysts for XPeng is international expansion with significant focus on Europe.

It’s worth noting that Europe has set an ambitious target of complete ban on new internal combustion engine vehicles by 2035. While EV growth has been sluggish, expansionary policies are likely to translate into GDP growth acceleration. Further, the introduction of lower-price EV can potentially support accelerated adoption.

I believe that XPeng’s plans for aggressive expansion in Europe is likely to yield results in the next few years. The company is already searching for a site with “relatively low labor risk.” Additionally, the company is looking at building a data center in Europe. This underscores the company’s long-term commitment to the European markets.

XPeng already has presence in multiple European countries that includes Norway, the Netherlands, Sweden, and Denmark. Recently, the company entered Spain and Portugal as it continues to expand in Southern Europe.

An important point to note is that XPeng partnered with Volkswagen in February 2024. The objective of the partnership is to fast-track the development of two smart e-cars. The joint development is expected to reduce the time to market by more than 30%. As a part of the deal, Volkswagen acquired 4.99% stake in XPeng.

As of Q2 2024, Volkswagen Group had a 6.7% global market share in battery-powered EVs. I believe as XPeng expands in Europe, the company’s partnership with Volkswagen can potentially deepen. The “Master Agreement on strategic technical collaboration” can be potentially extended to Europe.

This can support the launch of technologically advanced EVs in the region. XPeng has already mentioned that its objective was not “to sell its cars in Europe in order to provide a cheap alternative but to bring its technology.”

MONA “Max” seems to be a combination of low-price and an advanced technology. I wanted to quickly mention XPeng’s low-price model here because of the following observation from the Bank of America.

One of the key reasons for the sluggish growth of battery electric vehicles in Europe is the higher total cost of ownership compared to internal combustion engine vehicles… Battery electric-vehicle prices need to come down in order to trigger a sales boom regardless of regulation.

I therefore believe that XPeng’s expansion into Europe through a combination of a technological edge and low-price will yield positive results. Further, a potential partnership with Volkswagen for the European markets can boost penetration in relatively quick time.

Besides Europe, XPeng is also exploring other attractive markets. In June 2024, the company announced a dealer partnership in Thailand. It’s likely that the company will enter other Southeast Asian markets in the next 12 to 24 months. In September 2024, XPeng added Qatar to its export list. The company is targeting consumer demand for its premium electric cars in the Middle-East nation.

Therefore, expansion in multiple countries is likely to have a positive impact on growth. Having said that, overseas sales accounted for just 10% of the company’s total sales as of Q2 2024. While the company is spreading its wings from a geographic perspective, I believe that it will take 24 to 36 months for this expansion to significantly reflect in the financials.

Improvement in Financial Metrics

From a financial perspective, there are several positives to note from the company’s Q2 2024 results. For the quarter, XPeng reported vehicle margin of 6.4%. On a year-on-year basis, vehicle margin expanded by 1,500 basis points.

Further, on a quarter-on-quarter basis, there was a 90-basis points margin expansion. A key factor driving margin expansion was cost reduction through technical improvement that was supported by the strategic partnership with Volkswagen.

It’s worth noting that for Q2 2024, Nio and Li Auto (NASDAQ:LI) reported vehicle margin of 12.2% and 18.7% respectively. XPeng’s vehicle margin is therefore inferior to peers.

However, XPeng is entering a “strong product cycle” with large number of new models and facelift versions to be launched in the next 3 years. This is likely to support revenue growth acceleration coupled with improvement in key margins. Further, with economy of scale, “operating efficiency and cash flow will significantly improve.” As EBITDA level losses potentially narrow in the coming quarters, I expect XPeng stock to trend higher.

As of Q2 2024, XPeng reported cash and equivalents of $5.14 billion. With a strong bash buffer, I don’t see the need for any immediate equity dilution. However, considering the company’s global expansion plans (including a European manufacturing plant), I expect fund raising over the next 18 to 24 months. With interest rates likely to trend lower, debt financing is a likely option. I therefore don’t see significant financial challenges under the assumption that Xpeng continues to report improved growth and margin metrics.

Risk Factors

XPeng is positive on its low-price car having an impact on growth. However, China’s low-price EV segment is intensely competitive with BYD Company (OTCPK:BYDDF) having a leading market share. It remains to be seen if XPeng can penetrate the markets and the segment is profitable after scaling-up of production and sales.

As I mentioned before, international markets contributed to just 10% of the total sales in Q2 2024. Aggressive expansion plan might imply higher cost from the perspective of marketing and initial brand building in new markets. Therefore, there is a possibility of margins remaining relatively depressed.

As of June 2024, XPeng reported total debt of $1.6 billion. I don’t see this as an immediate concern. Credit metrics will improve significantly once EBITDA break-even is achieved. However, if XPeng leverages for aggressive expansion and new markets don’t yield the desired results, high-debt can significantly elevate the financial risk.

Considering these factors, I would remain cautiously optimistic. If the company’s low-price model gains growth traction and international expansion yields results, the positives will overshadow the risks.

Concluding Views

From a valuation perspective, XPeng trades at a forward price-to-book ratio of 2.7 as compared to 11.55 and 3.01 for Nio and Li Auto respectively. On the forward price-to-sales front, XPeng trades at a premium to the same set of peers.

However, these valuation metrics do not provide a conclusive view. According to analyst estimates, XPeng is likely to deliver positive free cash flows in 2025 and beyond. If this holds true and cash flow accelerate, the upside potential is significant.

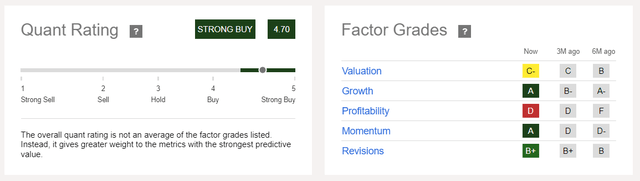

This broad view on the valuations is underscored by Seeking Alpha’s Quant Rating of a “Strong Buy” for XPeng stock. A key factor determining the rating is the impending growth potential.

Seeking Alpha

Based on these factors, some exposure to XPeng stock can be considered. A expect the stock to consolidate after a significant rally in the recent past. This is likely to provide a good entry opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.