Summary:

- XPeng’s Q2 vehicle margins improved marginally, but they still lag behind NIO and Li Auto, making it a less attractive investment choice.

- XPeng’s vehicle margin of 6.4% is significantly lower than Li Auto’s vehicle margin of 18.7% and NIO’s 12.2% margin, highlighting its profitability challenges.

- XPeng’s Q3 delivery outlook remains weak, with projected growth of only 2.5% to 12.5% year-over-year.

- XPeng’s higher price-to-revenue ratio compared to more profitable rivals like Li Auto makes it a riskier investment in the Chinese EV market.

Robert Way

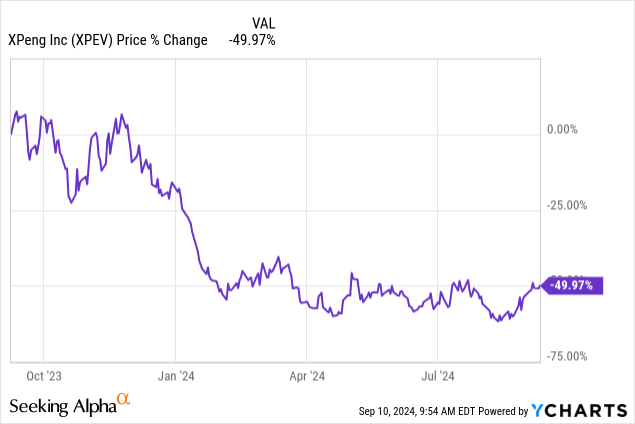

Shares of XPeng (NYSE:XPEV) have largely disappointed in the last year as the company worked through its own margin issues and suffered headwinds in the electric vehicle market in China. In the second quarter, XPeng managed to expand its vehicle margins, but not by much, and the company still trails EV rivals like NIO (NIO) and Li Auto (LI) by large margins. I believe both NIO and Li Auto are more attractive than XPeng from a vehicle margin and growth perspective, as well as from a valuation point of view. I give the EV maker credit for boosting its margin on a Q/Q basis, but don’t see a strong enough catalyst ahead for me to change my rating on XPeng’s shares!

Previous rating

I rated shares of XPeng a hold in May 2024 as the company failed to produce any material impulses for its business and exhibited overall a weak margin profile. In the second-quarter, XPeng saw an improvement in terms of vehicle margins, but the EV company is still fundamentally lagging its more successful electric vehicle rivals, namely Li Auto and NIO. XPeng announced the launch of a new low-cost EV alternative, which may weigh on the company’s margins as well.

Slightly improving margin profile, weaker delivery growth

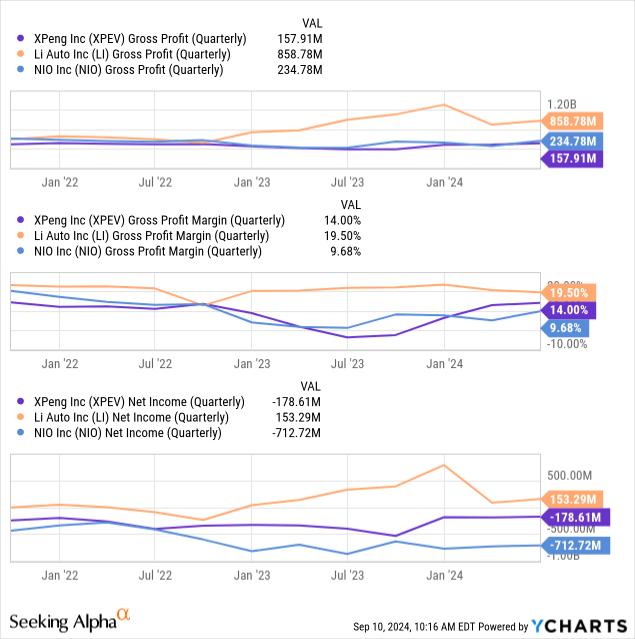

The main reason why I have a hold rating on XPeng, but strong buy ratings on both NIO and Li Auto, is that XPeng is not executing well on improving its margins. The electric vehicle maker had a vehicle margin of only 6.4% in the second-quarter which did show an improvement of 0.9 PP quarter-over-quarter, but its rivals have considerable higher margins and therefore either an accelerating profitability timeline (in the case of NIO) or higher current profitability (in the case of Li Auto).

Li Auto’s vehicle margins fell 0.6 PP quarter-over-quarter to 18.7% in Q2’24 — Strong EV Choice, Low Price — but they are still lightyears ahead of XPeng’s margins: Li Auto is making nearly three times as much profit per vehicle sold (in terms of vehicle margins) than XPeng. Even NIO, which has also struggled with its margins in the last year, had vehicle margins of 12.2%, almost double of what XPeng achieves right now. The reason for this is that Li Auto and NIO are selling more premium, higher-priced vehicles which obviously helps margins.

However, the trend in the EV market is towards lower-priced models for budget-conscious consumers. Therefore, XPeng, at the end of August, launched the Mona 03 EV model, an all-electric hatchback coupe, that costs just 120,000 Chinese Yuan which calculates to less than $17k. Other companies in the Chinese EV start-up market have announced similar measures such as NIO which is starting its own low-price EV brand, dubbed Onvo, while Tesla (TSLA) planned to release its own low-cost EV option to come to the market in FY 2025. Tesla has since backpedaled and focuses on self-driving taxis instead.

The trend towards lower priced electric vehicles comes at a time of heightened margin pressures and growing competition that has resulted in an unfavorable earnings profile for Chinese start-ups. Only Li Auto is currently profitable in terms of net income and both NIO and XPeng continue to lose a ton of money on their EV operations. XPeng’s net loss, just in the second-quarter, was 1.3B Chinese Yuan ($179M).

Moderate delivery outlook for Q3

XPeng has guided for 41,000 and 45,000 electric vehicle deliveries in the third-quarter which implies a year-over-year growth rate of between 2.5% to 12.5%. NIO expects up to 14% year-over-year growth and a total delivery volume of 61,000-63,000 electric vehicle deliveries in Q3’24 while Li Auto is still leading the segment with its projections of up to 48% Y/Y delivery growth (and estimated EV delivery volume of 145,000 and 155,000 vehicles).

XPeng’s valuation

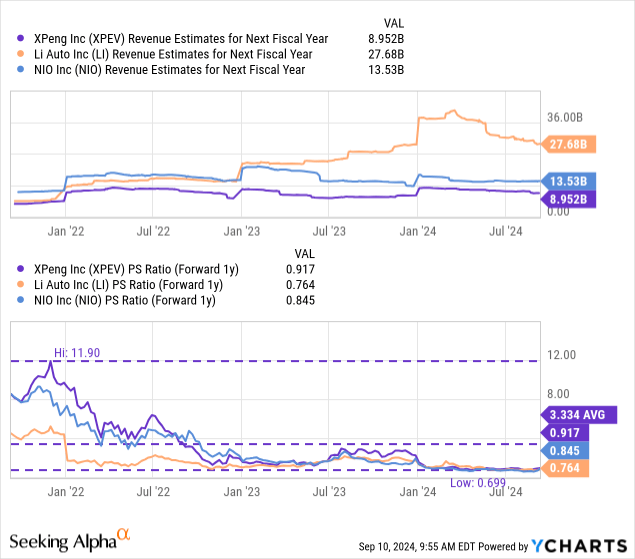

XPeng, ironically, is trading at a higher price-to-revenue ratio than either Li Auto or NIO which doesn’t make much sense to me. The discrepancy with regard to Li Auto is especially striking since the EV maker has stronger delivery growth and has much higher vehicle margins in a direct comparison.

Shares of XPeng are currently valued at a price-to-earnings ratio of 0.92X while NIO has a forward P/S ratio – based off of FY 2025 earnings — of 0.76X and Li Auto, despite already being profitable, is priced at the lowest price-to-revenue ratio of 0.76X. Because Li Auto is so much better executing its EV strategy in terms of delivery ramp and margins, I see the company as the best value for investors that look to invest in the Chinese EV start-up market. I also recommended NIO as the EV maker posted the highest Q/Q vehicle margin gain in Q2’24: Strike While The Iron Is Hot.

In my last work on XPeng I stated that I saw a fair value for the EV company of $9.50 per-share, based off of the average industry group P/S ratio of 0.8X. If there was a company that deserved to trade at a premium to the industry group average price-to-revenue ratio it would be Li Auto… simply because the company is already profitable and executing so much better than its start-up rivals. I don’t see many catalysts for XPeng at the moment, however, and given that the company only slightly improved its vehicle margins in Q2’24, I believe XPeng deserves a hold rating.

Risks with XPeng

XPeng, to me, is one of the riskier choices in the Chinese EV start-up market given the muted delivery outlook for Q3 and the margin profile. In my opinion, XPeng is also especially vulnerable to lower vehicle margins due to the trend towards lower-priced (low-margin) electric vehicles. Therefore, new models such as the Mona 03 EV could help spur delivery growth for XPeng in the short term, but this could come at the cost of a deterioration in the margin picture in the longer term.

Final thoughts

I have seen nothing in XPeng’s second-quarter results that would indicate to me that the value proposition has materially improved in the last quarter. While XPeng did see a sequential vehicle margin expansion, the increase was relatively small (+0.6 PP Q/Q) and it didn’t change the fact that XPeng is lagging far behind NIO and Li Auto in terms of vehicle margins. The outlook for Q3 deliveries also wasn’t great, with an estimated Y/Y growth rate of only up to 12.5%. What I also find a bit hard to understand is that despite weaker margins and slower growth, XPeng trades at the highest price-to-revenue ratio. In my opinion, Li Auto would be the much bigger bet in the EV market and the EV company also has much lower risks given that it already is profitable.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO, LI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.