Summary:

- XPeng is facing financial distress and declining profitability, despite obtaining approval for its eVTOL and AI project.

- Plummeting sales and profitability, along with low cash reserves, indicate the company’s struggle in the EV market.

- XPeng plans to focus on product innovation and launch over 30 new models in the next 3 years, including an AI car.

Robert Way/iStock Editorial via Getty Images

XPeng (NYSE:XPEV) has recently announced that its “Land Aircraft Carrier” has obtained the approval from the Civil Aviation Administration of China (CAAC) and will be available for pre-order in Q4 2024 and be delivered in Q4 2025. And while investors of the company are cheering for the achievement, the company is slightly improving in terms of financial loss and declining profitability as suggested in its latest earnings, after a number of years’ bleeding.

However, the EV competition in China market remains extremely intense, with emerging players like HiPhi and Hozon Auto facing difficulties in operations. Little do investors know that XPeng, who was once considered the top three new EV makers in China, is also showing signs of financial distress and, worst of all, is trying to save the company with a risky bet on eVTOL and AI which expect a long payback period.

Therefore, in my opinion, the company is a Sell. More analyses will be provided in the following sections.

Revenue and profitability are showing slight signs of improvement

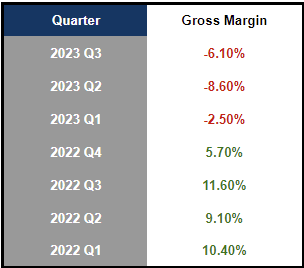

On May 21st, the company released its financial results for the first quarter of 2024. The company has reported a 62% YoY revenue increase to RMB 6.55 billion and a narrowed net loss of RMB 1.4 billion. The gross margin has been improved to 13% in 2023 compared to low double-digit in previous years.

Looking closely:

- Revenue: EV sales revenue was RMB 6 billion mainly attributable to the sales increase of G6 and G9, the discounted model of the company in the face of price competition in China. Hence, the average selling price per vehicle for dropped from RMB 205,700 in 2022 to RMB 198,000. Although the revenue has seemingly increased substantially based on the YoY comparison, it is actually a more than 40% decline than the number in Q4 2023.

- Profitability: Gross margin has gone back up to double digit in previous years, at 13%. The worrying decline, according to the management, was mainly due to the increased sales promotions, the expiration of subsidies for EV in China, and losses related to inventory provisions. However, this year’s gain is mainly attributed to the company’s efforts in efficiency and partially due to its new smart products.

Image created by the author with data from the company

- Cash flow: On the expenses side, the annual R&D for the company has increased due to the company’s continuous innovation and development of new products, including eVTOL. R&D expenses account for more than 15% of the company’s total expenses, less than the sales and administration expenses at 20%. While R&D and sales are expected to continue to increase given the fierce competition, cash reserve of the company is merely at RMB 41.4 billion, which is lower than its peers.

All these metrics show that the company, although slightly improving, struggles to establish a foothold in the EV market. This will become even more difficult, be it strategically or financially, for the company to compete against its peers in China. Even worse, it appears the company may not have sufficient financial reserves to maintain operations until the delivery of its eVTOL, assuming the product is able to turn around the company.

Product innovation may be the way out…

In my own local experiences and knowledge in China, the development of consumer technology products tend to follow similar paths. In my opinion, the EV industry is walking the same journey as the smart phone industry. Apple entered into China in 2009, and Xiaomi was founded in 2010 to offer cheap products alongside many other competitors like Oppo and Vivo. But in the next 10 years after engaging in the price war, the industry has shifted from price competitions to diversification to attract consumers with better, smarter and more engaging features, like Xiaomi’s Leica phone and the selfie specialist Meitu.

I predict that EV in China will follow the same path. Companies will not engage in indefinite price war, but will gradually shift the battle in product innovation, which XPeng is doing.

More than 30 products in the next 3 years, including an AI car

The company plans to launch more than 10 new models in the next 3 years with different global variety and upgrades, bringing the total new products to about 30 types. XPeng also aims to revolutionize the new types of vehicle, by creating the first AI smart driving car for young people, called MONA. The company plans to enter the global car market with this new product, which will be in the RMB 100,000 to 150,000 price range, while further bringing down the current product price to below RMB 100,000.

The MONA brand was officially launched at the Beijing Auto Show in April, which is expected to be delivered in Q3 this year. MONA is actually an AI EV project acquired from Didi by the company, through a joint strategic cooperation announced last year. The company will invest and leverage its assets and R&D capabilities to bring the MONA project to life.

XPeng

New technology updates

The company also announced several new technology updates to enhance its technical edge amidst fierce competition:

- Optimize the space of the car occupied by its battery pack via integrating the battery pack into the base layer of the car

- Through the Smart Electric Platform Architecture, the company shortens R&D cycle by 20% and significantly optimizing R&D efficiency

- Continue to develop its auto-pilot technology

…But pivoting into eVTOL is a leap too far

It is notable that the company, against the backdrop of financial distress and declining profitability, has chosen to invest in flying cars (eVTOL) which is a cutting-edge technology but requires a long period of investment and cash burn. The company aims to open up new growth engine amidst fierce competition, but this looks more like a unrealistic plan to cover its short-term difficulties.

At the 2024 CES exhibition, XPeng showcased its flying car which attracted the market attention. At the same time, the co-founder of the company announced that another “land aircraft carrier” detachable flying car will be available for pre-orders in Q4 this year and deliver a year later.

eVTOL is an opportunity to the company. But it brings more challenges. First of all, as discussed in my analysis on EHang (EH), getting the regulatory approval for a commercialized flight is extremely difficult, and would require time and money – two of the things that XPeng desperately needs. Therefore, this is simply a risky bet for the company in my opinion.

Valuation

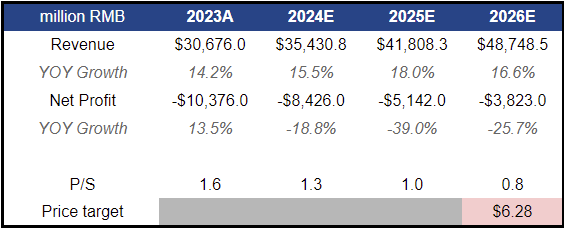

Image created by the author with data from the company and author’s forecast

It is expected that the company’s sales will grow at a similar pace as this year’s, reflecting the company’s slow growth and the intensified market competition. Therefore, the revenue of the company in 2026 will be about RMB 48,750 million.

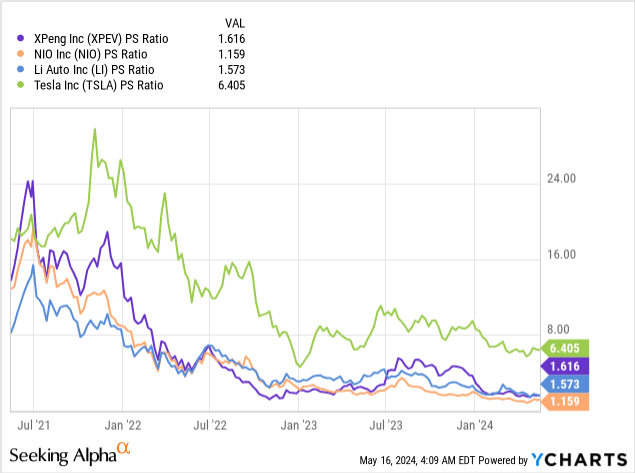

Taking into account the sales number, we expect that the valuation premium for XPEV and other Chinese EV players will continue to be suppressed, reaching below or around 1x. This is because the EV market and the general economy are both under immense pressure. Applying the 0.8x P/S ratio to our financial forecast, the target price is around $6.2 to $6.3.

Investment risks

- Financial instability risks: XPeng’s financial losses are widening, while its cash reserve is likely not sufficient to sustain the operations until next year when the new products are public. Therefore, long investors should be cautious about the financial health of the company and the possibility of subsequent financing

- Market risks: The EV industry, especially in China, is highly competitive. Other than Tesla (TSLA) who is the leader in EV and has gotten the regulatory endorsement recently in China, there are many other local players like Nio (NIO) and Li Auto (LI) that are becoming more competitive. XPeng’s inability to meet its delivery target and the failure to compete in market shares indicate that the company is facing substantial risks in market competition

- Regulatory risks: The expiration of EV subsidy in China has already impacted XPeng’s gross profit margin. Future changes in government policies, such as the recent import tariff of EV to the US will further impact the company’s business

Conclusion

Using a long-term risky plan in an attempt to solve short-term urgent problems is the summary of my view on the company. The competition in the EV industry in China has never been more difficult, and XPeng is apparently declining. However, I still have not seen any correct remedy to the situation, but some long-term bet on AI and eVTOL. Hence, a Sell rating to me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.