Summary:

- XPeng has been experiencing a choppy period, with investors spooked by the recent duties imposed by the US and provisional duties proposed by the EU on Chinese Electric Vehicles.

- Looking underneath the hood, the company has been quietly chipping away at improving their margins and narrowing their losses.

- A major catalyst for XPeng in the coming quarters will be its continuing collaboration with VW, and the launch of new vehicles.

- The stock is now trading at a very low price-to-sales ratio of around 1.5 providing an opportunity for outsized gains.

- I issue a ‘buy’ rating on the stock with an expected price target of $15 with potential for further upside.

Editor’s note: Seeking Alpha is proud to welcome The Sol Seeker as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

teddyleung

XPeng (NYSE:XPEV) is one of the many rising Chinese EV start-ups in what is a fairly crowded market. Its recent stock performance has been torrid, with the price being down by almost 50% YTD. However, I don’t think the price reflects the underlying performance of the company, which has turned a corner over the last two quarters and is yet to enter its next growth cycle with the release of new vehicles. I have issued a ‘buy’ rating for the stock, where my analysis below considers the growth catalysts for the company and what that means for the stock price.

The Impact Of Tariffs

I’ll start by setting the context behind XPeng’s recent stock price movement. Chinese EV manufacturers exporting to the US will face tariffs of 100% and the EU has recently imposed provisional duties of 31%-48% on Chinese made EV imports depending on whether they cooperate with the EU’s investigation. This excludes BYD, SAIC and Geely which have their own individual duties. The EU tariffs are not a done deal, and there is still an opportunity to influence them before they apply from the 4th July.

XPeng has been expanding and opening new dealerships across several European countries, but its sales volumes are still very low and the tariffs won’t materially impact XPeng’s bottom line. In spite of that, investors are fearful of the company losing access to a huge potential addressable market, which is reflected in the recent stock price movement where the stock declined from $10 in late May following earnings to around $7. It should be noted, however, that the price of XPeng’s vehicles such as the G6 in Europe is a lot higher than in China (even after accounting for existing tariffs, shipping and marketing costs) which suggests there is some breathing room for maintaining existing prices by lowering its gross margins. It remains to be seen how XPeng prices its vehicles in Europe in the coming quarters.

Whilst continuing to expand in new markets is important, I would argue that XPeng’s fundamentals and performance in the domestic market remains key for the company and the stock price for the foreseeable future. This is what my analysis will focus on.

Revenue Growth Ramping

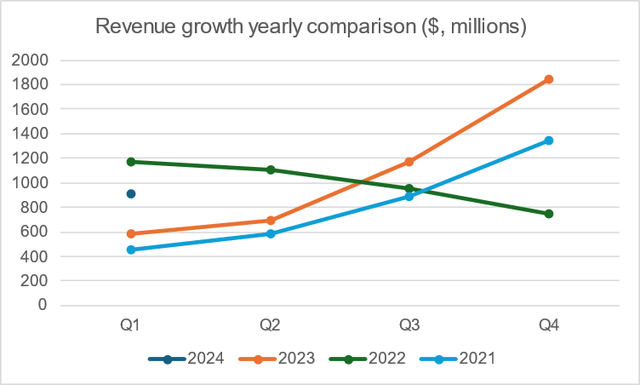

XPeng has turned a corner recently and sold a total of 60k vehicles in Q4 2023 and 22k in Q1 2024. It expanded its revenue growth at a rapid scale over the last two quarters, with growth rates of 54% YoY for the current quarter and 147% YoY in q4 2023. This was primarily driven by increased vehicle sales of its higher priced vehicles (the X9 and G9).

XPeng investor relations with graph created by author

Comparing revenue growth on a quarter over quarter basis doesn’t really make sense due to seasonal adjustments in sales in China, where Q1 is typically the slowest quarter owing to public holidays and Q4 is the highest. What we can see from the graph is that XPeng has started Q1 2024 positively and with forecasted Q2 vehicle deliveries of 29k at the low end of their estimates, they are on track to beat 2023 Q2 sales. I expect XPeng to follow the same growth trajectory in 2024 as 2023 and 2021, resulting from sales of their new vehicle line up.

The major catalyst for XPeng in the last two quarters of 2024 will be the launch of Mona in q3 and their B-class sedan in Q4. The Mona (Made of New AI) has been touted by XPeng as being designed using AI, which has reduced their development costs, although I don’t think that matters a lot in practice. What is notable though is that the CEO suggested the price in a presentation in the China EV100 Forum that it will be between ¥100,000 to ¥150,000 (roughly $13,800- $20700). The range is suggested as greater than 500km, which makes XPeng price competitive against the likes of the BYD Atto 3 and able to compete with the high range version of the BYD Dolphin. Why this is significant is because this segment is a highly addressable market for the average consumer in China, and at this range/price the competition appears to be thin.

Xiaopeng also mentioned the $10,000 rule in the Q1 2024 earnings call, which suggests Mona could be a huge volume driver for the company:

“And we actually have a model and which is what we call the $10,000 rule and which means that every time the price goes down by $10,000, and you will see that the sales of that product will actually go up by one time will actually go up by two times. And this model has been validated in our old experience with our other vehicles of a price range above 200,000.”

What Xiaopeng is alluding to is that the price elasticity of vehicles becomes more elastic as you approach lower income segments, such that changes in price can result in significantly higher demand. This bodes well for XPeng who needs increased sales volume.

Expanding Gross Margins And Narrowing Losses

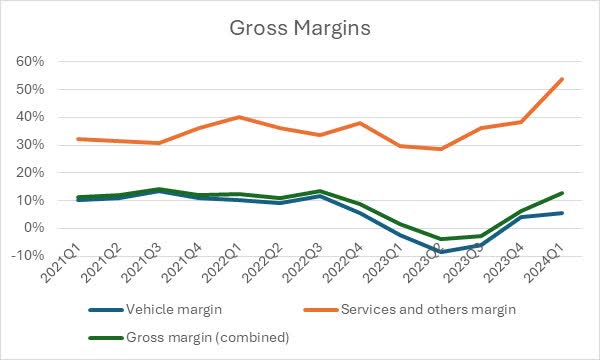

XPeng experienced huge reductions in their vehicle margins as a result of the EV price war in China, which resulted in negative gross margins in the first half of 2023.

XPeng investor relations with graph created by author

This has since inflected, and margins have really turned a corner. The main driver behind the reversal is the contributions of the X9 and G9 which are more cost-efficient vehicles with premium pricing that XPeng can sell for a higher margin. The services and others margin, which is a smaller segment of total revenue, is trending upwards, and consists of supercharging services, Xpilot (ADAS software), auto financing and supply of parts. But the recent uptick in margins to a whopping 54% in Q1 2024 comes from the technical collaboration with Volkswagen. XPeng shed light on jointly developing two B-class BEV models for sale in the Chinese market under the Volkswagen brand, and leveraging XPeng’s G9 platform, connectivity and ADAS software. This is recurring revenue for XPeng for the foreseeable future.

I believe the gross margins potential for XPeng hasn’t been fully realised, and we could see further surprises to the upside soon.

- Firstly, the Mona ramp will likely initially drag margins down, and it is unlikely XPeng will make much from selling a low-cost vehicle. However, greater volume of sales allows for greater cost efficiency from leveraging capacity and fixed costs such as XPeng’s powertrain, dyecasting, marketing and industrial robots for assembly. I think the latter will outweigh the former.

- XPeng mentioned the technical E/E architecture with VW will be realised in the 2nd half of 2024. This involves developing VW’s central computing and domain controller-based architecture to achieve a vertically integrated software stack. It’s not certain how much revenue this will generate, but this is a tailwind for margins in Q3 and Q4 2024.

- XPeng also mentioned in their most recent earnings call that they achieved a cost reduction of 25% in their next B class Sedan through technological advancements. This should feed into the bottom line. It’s not a coincidence they are making a B class vehicle, as some of the margin will come from the joint sourcing of materials for the B class vehicles being produced for VW. I think it’s a rather smart strategy.

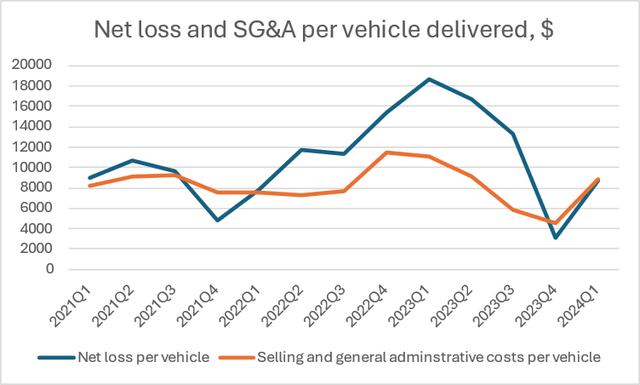

Now let’s turn to net losses and selling and general administrative expenses.

XPeng investor relations with calculations by author

Net loss by itself is not a meaningful metric, given that the vehicle sales in a quarter influences the total figure. Instead, I’ve calculated the net losses per vehicle delivered, which gives a better indication of the company’s efficiency and closeness to profitability. The graph shows that that net losses per vehicle have increased resulting from margins declining during the price war in early 2023 but have since come down significantly. Whilst increasing gross margins have helped, XPeng has become leaner and more disciplined in terms of expenses, especially on the SG&A line. This is a result of lower marketing costs, lower commissions to franchise stores and reductions in other expenses. This did tick up in q1 where vehicle sales were lower, but this just shows the importance of economies of scale and leveraging fixed costs across vehicles.

XPeng’s net losses in q1 2024 and q4 2024 were $18.9m and $19.0m, respectively. They reported that they have cash and cash equivalents of $5.52 billion, which means there is no danger of running out of cash for a very long time, especially as XPeng will likely become free cash flow positive soon.

Valuation

I am issuing a ‘buy’ rating on XPeng based on its improving outlook for revenue and because there will be less risk for the stock as the company narrows its losses. My one year expected price target for the stock is $15 with further upside in the bull case of $26.

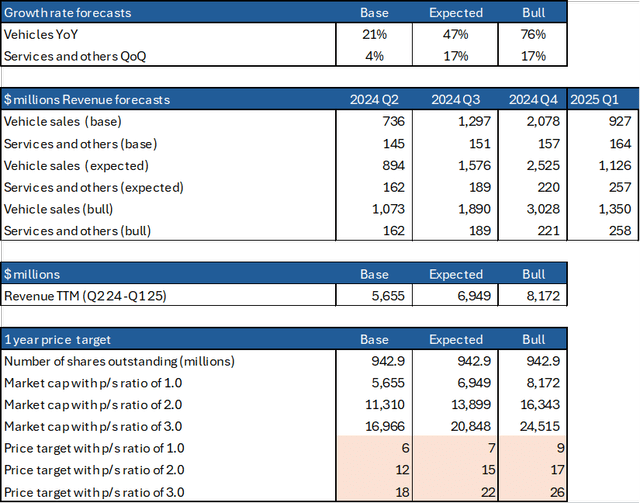

Because XPeng is not profitable and is not yet optimised in terms of free cash flow and gross margins, the metric I will focus on is the price to sales multiple based on expected revenue. My analysis forecasts the expected revenue for XPeng using trailing growth rates to predict future revenue. I think this method is conservative given all the growth catalysts I’ve mentioned above that could see revenues potentially increase further than my bull case.

For my analysis, I’ve split out ‘vehicle sales’ and ‘services and others’ as these segments have different levels of growth.

For vehicle sales, I’ve used YoY growth rates and adjusted last year’s revenue from Q2 23 – Q1 24 to forecast Q2 24 – Q4 25 revenue. My bear case uses revenue growth for Q1 23-Q4 23 which includes a period of sales decline, the expected case uses the growth rate of the last 4 quarters and the bull case uses the growth rate of the last 3 quarters where XPeng has really turned around sales.

For services and others, I’ve used QoQ growth rates as it is recurring revenue and more predictable given that it isn’t heavily impacted by seasonality. For the bear case, I’ve used the time period when sales were falling and before the technical collaboration with VW from Q4 22 – Q4 23, whereas for the expected and bull case, I’ve used the same periods as I did for vehicle sales.

Analysis by author using information from XPeng investor relations

By estimating the forecasted revenue trailing 12 months, I calculated the market cap with different price to sales multiples. I haven’t made any adjustments for dilution, although that shouldn’t materially impact the stock price over one year. My expected price target of $15 assumes a price to sales multiple of 2. The reason I think the multiple will change is because of the consistently higher revenue growth, particularly from its software segment, which should improve margins.

Headwinds And Tailwinds

Besides what I’ve already covered, there are some further tailwinds for XPeng as well as risks.

I don’t currently value the tailwinds in my investment thesis, as I don’t have confidence of whether they will materialise. XPeng is taking the Tesla approach to solving FSD using vision led ADAS technology rather than using LIDAR. They have nowhere near the processing power that Tesla acquired through spending hundreds of $millions on H100s, but if XPeng are able to improve their ADAS and increase subscription take-up, the recurring revenue from software will go to their bottom line. XPeng are also working on a flying car called AeroHT with sales expected in late 2025. I’m on the fence on whether this will work or has an addressable market, but it may have potential upside. Lastly, XPeng is also working on robotics, although I haven’t seen anything compelling in this space, but it shows that the company has potential in other spaces beyond their primary market.

As for headwinds, the macro environment, further price wars and the political environment could worsen and impact XPeng sales. XPeng must also execute well in terms of selling its Mona vehicles and the new B class sedan. In the short term, a potential trade war between Europe and China may also result in negative stock price movement.

Conclusion

In conclusion, I believe XPeng stock is priced for outsized gains for investors who can stomach the short-term volatility. The moat is stable, and I would argue it is expanding from entering the lower cost vehicle segment.

Much depends on the sales of its new vehicle line-ups, and collaboration with VW in the near term, but if XPeng executes well with selling more vehicles, increasing its margins and becoming free cash flow positive. I think my price target of $15 is achievable, which represents roughly a 2x in the stock price from where it is today. The 52-wk high of $23 is also not out of the question if the revenue growth carries on in the same way as the last two quarters.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.