Summary:

- XPeng’s stock performance after Q2 earnings belies delivery trends, which are trending to significant underperformance in the current year.

- While retail investor activity in the stock is quite low, institutional conviction continues to be steady due to XPeng’s standing within China’s crowded car market.

- Institutional conviction has elements of similarity with that in NIO, in that XPeng is being positioned as a possible survivor of the long-running price war in China.

Robert Way

Since Chinese “pure play” EV carmaker XPeng Inc. (NYSE:XPEV) announced its Q2 earnings, the stock has been on a bit of a tear. The American Depositary Shares (ADS) closed 27.32% higher as of the 12th of September relative to that seen on the earnings release date, the 20th of August.

For all intents and purposes, this is at odds with trends seen in key line items. However, the underlying factors have a lot in common with those described in yesterday’s article about NIO Inc. (NIO) with the utilized framework being largely identical.

Trend Drilldown

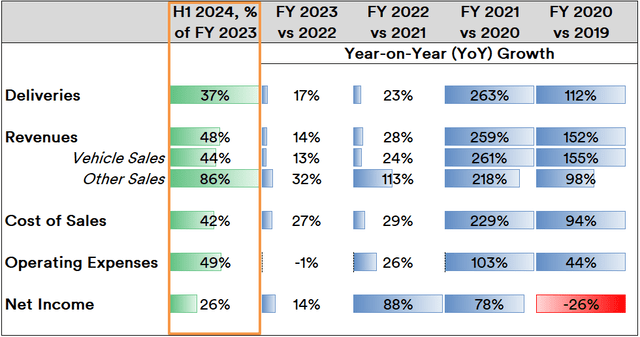

As of the first half (H1) of its current fiscal year (FY) 2024, the company is trending at a net deficit in deliveries relative to the past FY.

Created by Sandeep G. Rao using data from XPeng’s Financial Statements

If trends continue, deliveries will close the current FY a full 26% lower than that in the previous year. However, on balance, revenues seem relatively healthy and trending to close flat or down 4% relative to past FY. While Net Income might seem as closing a full 48% down from the previous FY, this is actually a plus: the company has never shown a positive income since it went public. Therefore, losses are narrowing.

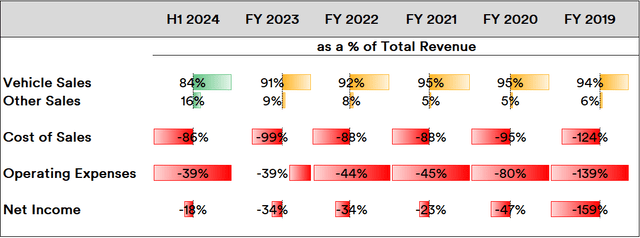

Overall, key line item trends relative to net revenue aren’t particularly interesting either:

Created by Sandeep G. Rao using data from XPeng’s Financial Statements

For the first time, after-sales services (spare parts, charging, et al.) are a strengthening double-digit percentage contributor to revenues while lower delivery volumes helped lower the cost of sales and lessen net losses in the year so far.

So, at first blush, there aren’t many positives for this stock. But, as in NIO’s case, the key drivers of investment activity in the stock have a more nuanced view on China and are likely moving with a set of considerations entirely different from that of most retail investors.

Market Players’ Outlook

Unlike NIO – which currently operates across the mid- and high-end segments – XPeng’s products run the entire gamut: its P5 sedan starts at around $22,000, the top-selling G6 crossover SUV starts at around $30,000 while the X9 van/MPV starts at around $50,000. The disparity between delivery trends and revenue/net income lends strength to the notion that, as far as XPeng is currently concerned, “the higher the price, the better the net income contribution.” While the company doesn’t explicitly detail which models exactly sold well, it can be assumed that volume trends were dominated by higher-priced models and variants.

This dominance isn’t entirely surprising and has some parallels with the U.S. auto market: as economic headwinds strengthen in China, the “creamy layer” of buyer segments will increasingly drive key trends while lower-income buyer segments either consider the used-car market or opt out of purchasing a vehicle altogether. What’s different in China is that the market is massively fragmented, with hundreds of companies with levels of state involvement (either through debt ownership, stock ownership or outright management) ranging from none to very high. For nearly two years now, China’s carmakers have been waging a damaging price war that seems to be underway with a goal to consolidate the market, regardless of economic headwinds.

Given the large number of players (currently), product build quality and engineering complexity are highly variable. While the price war is being waged across the spectrum, it is particularly harsh in the budget to mid-price ranges, which the bulk of China’s carmakers produce for. In here, the likes of XPeng and NIO are curious outliers in that overall build quality and engineering are generally considered to be running parallel to (or catching up with) that seen in the rest of the world among major globe-spanning carmakers.

Despite the ostensible downturn in budget segment sales, the company has done what NIO has done and announced a new marque – “Mona” – for the budget buyer. The first model for “Mona” is the M03, a compact coupe priced at around $16,000 with an upgrade to Tesla (TSLA)-styled autonomous driving being made available at around $21,000. Thus, regardless of conditions, the company is pressing on with a clear intention to remain in the market at all costs.

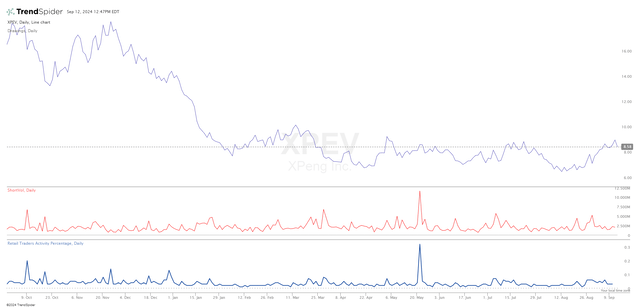

Regarding the company’s ADS, a point of interest is that retail investor activity in the stock has never exceeded 3% of total activity through most of the Year To Date (YTD):

The only period wherein retail investor activity spiked was following its Q1 earnings release, following which interest petered. In the immediate wake, a mild doubling to all of 5% of net activity is attributable to retail investors, which persisted for a short while before petering out. However, while activity dropped, volumes from institutions – growth funds, deep value funds, hedge funds, et al. – have maintained a steady level of interest through most of the year. They even drove up the price at various points after the Q2 earnings release.

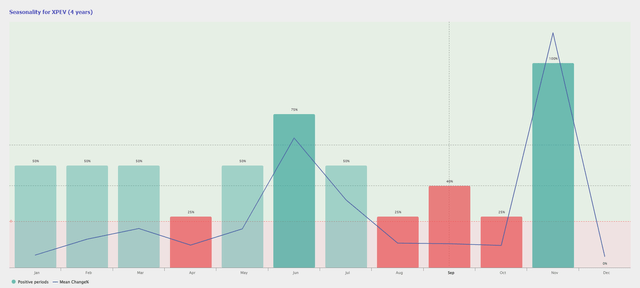

In NIO’s case, a “tactical” argument was made that “institutional” actors applying strategies such as event-driven techniques might be buying in, given that its stock generally does better in October and November. This argument is missing in XPeng’s case: September and October tend to be massive underperformers.

While September isn’t done yet, early trends seem to imply that it won’t be as massive an underperforming month for XPeng’s ADS.

In Conclusion

Just as with NIO, while retail investor attention has been low, institutions seem to be wagering that XPeng will be a long-term survivor. Perhaps they see the company as capable of garnering buyer attention and ultimately altering buyer preference to push automotive quality standards higher, which will inevitably force consolidation in China’s carmaker market.

However, given that the company continues to be deeply unprofitable without even the comfort of showing strong delivery trends (as in NIO’s case), XPeng Inc. isn’t a stock for most retail investors. As a long-term bet, however, it presents some interesting possibilities. Caveat emptor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.