Summary:

- XPeng has demonstrated its successful turnaround through growing profit margins along with the robust mass market model sales in September 2024.

- With a rich balance sheet, we believe that the automaker remains well positioned to grow its presence globally before the supposed break even point by the end of 2025.

- At the same time, readers must not forget XPEV’s well diversified capabilities across the XNGP ADAS platform and the flying car, boosting its long-term growth prospects.

- Even so, with the recent rally overly fast/furious and traders already taking their gains off the table, interested investors may want to wait for the pullback to be completed.

- Given the numerous risks arising from its global expansion, Chinese ADR status, and import tariffs, XPEV is also not for the faint-hearted.

alexsl

XPEV’s Mass Market Launch & Autonomous Capabilities Support The Management’s FY2025 Break Even Guidance

We previously covered XPeng (NYSE:XPEV) in April 2024, discussing why we had reiterated our Buy rating despite the stock’s continuous underperformance compared to its peers.

With the management opting to enter the mass market model with an extremely attractive pricing point, further aided by its expansion to the wider Asia and Southeast Asian countries, we had believed that the automaker was likely to achieve accelerating sales from H2’24 onwards, significantly aided by its low break-even price-point and compelling XNGP ADAS platform.

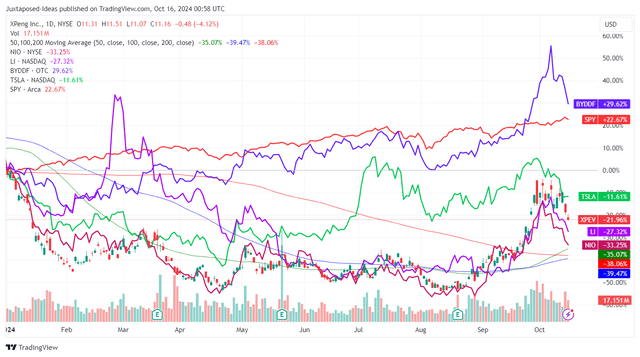

XPEV YTD Stock Price

Since then, XPEV has mostly traded sideways before the meteoric rise since the end of September 2024, attributed to the Chinese government’s stimulus measures “aimed at supporting the economy’s” recovery and boosting the domestic consumer spending.

This stimulus has already triggered the immense recovery observed in numerous Chinese ADRs, along with Chinese automotive stocks, thanks to the country’s supposed recovery “out of its deflationary funk.“

With regards to the automotive sector, the Chinese government has recently doubled their subsidies to 20K Yuan by August 2024, for consumers whom scrap old cars and buy new EVs capped below the price point of 300K Yuan.

This is on top of the “extended the purchase tax breaks for NEVs until 2027” at 30K yuan per passenger vehicle, allowing the typically more expensive EVs to be more affordable for Chinese customers.

As a result of the potential boost in their sales, it is unsurprising that the market has gotten exuberant surrounding the Chinese automakers’ intermediate term prospects, as evidenced by their robust September 2024 deliveries and MoM/QoQ growth acceleration.

If anything, XPEV’s launch of the entry-level EV, MONA M03 at between 119.8K Yuan to 155.8K Yuan by late August 2024 has been highly strategic as well, attributed to the exemplary first month delivery number at over 10K units by September 2024.

This is on top of the robust overall delivery numbers of 21.35K EVs in September 2024 (+52.1% QoQ/+39.4% YoY) and YTD deliveries of 95.86K EVs (+17.7% YoY) – with the QoQ acceleration likely attributed to the well-received mass market model.

Readers must note that EVs below the price range of 200K Yuan remains the most popular segment domestically, as opposed to XPEV’s previously premium product portfolio priced mostly above 200K Yuan – underscoring why BYD Company (OTCPK:BYDDF) has been able to dominate the EV market with its well diversified offerings priced between 72K Yuan for BYD Seagull to 1.68M Yuan for BYD Yangwang U9 (high-performance electric supercar).

These developments are material indeed, since the mass market model allows XPEV to drive profit margin improvements after the completion of its ongoing restructuring efforts, supply chain reforms, and the highly strategic partnership with Volkswagen (OTCPK:VWAGY).

If anything, the XPEV management already hints at “stable and maintained at mid to low-teens” overall gross margins moving forward, despite the new mass market model launch, with it building upon the 14% observed in FQ2’24 (+1.1 points QoQ/+17.9 YoY) and the vehicle margin of 6.4% (+0.9 points QoQ/+15 YoY).

While the Chinese automaker remains unprofitable on an adj net income basis at margins of -15% (+5.9 points QoQ/+40.3 YoY), the gap has been narrowing drastically, with the management’s guidance of breakeven sometime in 2025 seemingly plausible.

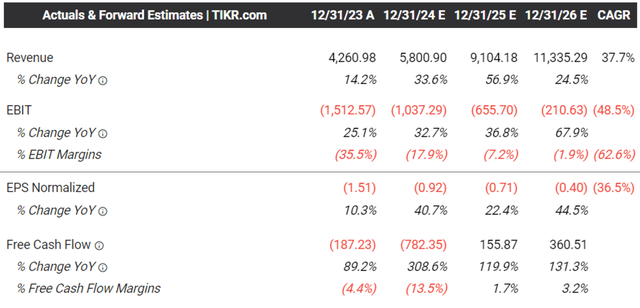

The Consensus Forward Estimates

This is also why we believe that the consensus forward estimates appear to be rather pessimistic, since we expect FY2024/FY2025 to be trough years with FY2026 to bring forth positive bottom-lines, albeit minimal.

This is especially since the XPEV management continues to reiterate the “iPhone 4 moment for autonomous driving” by latest 2026, with the automaker already aiming to release its “AI-powered XNGP-equipped mass-production smart EVs provide a driving experience equal to that of world-class Robotics by the second half of 2025″ across 95% of China’s roads.

This also builds upon Tesla’s (TSLA) guidance of starting “unsupervised autonomous driving in Texas and California in 2025 for the firm’s Model 3 and Model Y,” as the autonomous driving capability is increasingly rolled out and accepted globally.

As a result of the growing revenues from services and others (including software) at $0.18B (+28.5% QoQ/+102.5% YoY), we believe that the consensus forward estimates are likely to upgraded in the intermediate term, once XPEV continues to execute the positive gross profit margins and narrowing net margin losses over the next few quarters.

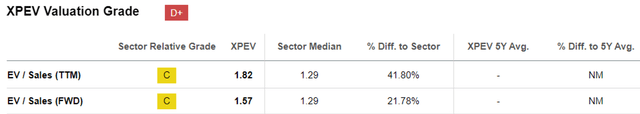

XPEV Valuations

While XPEV may appear to be trading at a premium FWD EV/Sales valuations of 1.57x, compared to the previous article at 0.50x and the sector median of 1.29x, we beg to differ.

Assuming that the automaker is able to generate the FY2025 revenues of $9.1B, it appears that the resultant EV/Sales valuations of 0.94x remain reasonable enough for long-sighted investors.

This is compared to its Chinese automaker peers, including BYD at FWD EV/Sales valuations of 1.12x, Li Auto (LI) at 0.77x, and NIO (NIO) at 1.33x, with it apparent that XPEV remains a compelling Buy after a moderate retracement.

At the same time, with FY2026 likely to bring forth positive profit margins, we believe that XPEV remains well capitalized to weather the near-term cash burn, based on the $5.14B of cash on balance sheet as of FQ2’24 (-10.2% QoQ/+10.5% YoY) – significantly aided by the strategic partnership with VWAGY.

Lastly, readers must not forget the potential boost from its rather speculative launch of its modular flying car, XPeng Aeroht in 2026, with the market likely closely watching the upcoming showcase in November 2024.

So, Is XPEV Stock A Buy, Sell, or Hold?

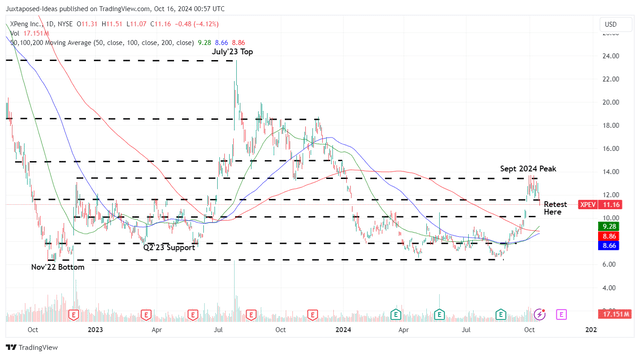

XPEV 2Y Stock Price

For now, as discussed in our BYD article here, it is apparent that the recent rally has been overly done with most Chinese ADRs already returning part of their recent gains, XPEV included.

With the stock now retesting the historical support levels of $11 after failing to break out of the $13s resistance levels, we believe that further moderation is likely as traders unlock most of their gains at these inflated levels.

Despite so, we believe that the ongoing retracement is a gift indeed, since a further pullback to its next support levels of $9s and $10s is likely to trigger a far more attractive entry point, based on the estimated FY2025 EV/Sales valuations of 0.62x – with it bringing the stock nearer to its historical valuations and its peers.

As a result of its high-growth prospects along with the intermediate term tailwinds from the automotive subsidies, we are maintaining our Buy rating for the XPEV stock once the pullback is complete.

Risk Warning

It goes without saying that XPEV is only suitable for those with a long investing trajectory, since the automaker is only expected to record break even by FY2025 and minimal profitability in FY2026.

At the same time, readers may to monitor its upcoming execution, since the management has bet its long-term growth strategy on overseas markets – with it expected to play a “more significant role in driving both sales and profit growth,” building upon the fact that overseas sales accounted for more than 10% of its total sales by the latest quarter.

The aggressive global expansion may potentially trigger moderate bottom-line headwinds, with XPEV expecting to enter UK, Australia, and Southeast Asia in H2’24, building upon its growing presence in the EU, Middle East, and LatAm – attributed to the projected doubling in its international sales stores (and likely operating expenses) over the next two quarters.

At the same time, readers must not forget that numerous countries are planning, or have imposed import tariffs for Chinese made EVs – with it potentially triggering demand headwinds and top/bottom-lines misses.

Combined with its Chinese ADR status and the potential volatility arising from the ongoing US elections through November 2024, it goes without saying that XPEV is only suitable for those with moderate geopolitical risk appetite.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.