Summary:

- XPeng’s CEO bought shares at $7.02, signaling confidence in the stock trading at the lows.

- The Chinese EV company launched the Mona brand, targeting Tesla’s Model 3 at half the price, with strong initial orders indicating potential success.

- The stock is trading below 1x sales targets, while growth rates remain strong and support a higher forward P/S multiple.

Sundry Photography/iStock Editorial via Getty Images

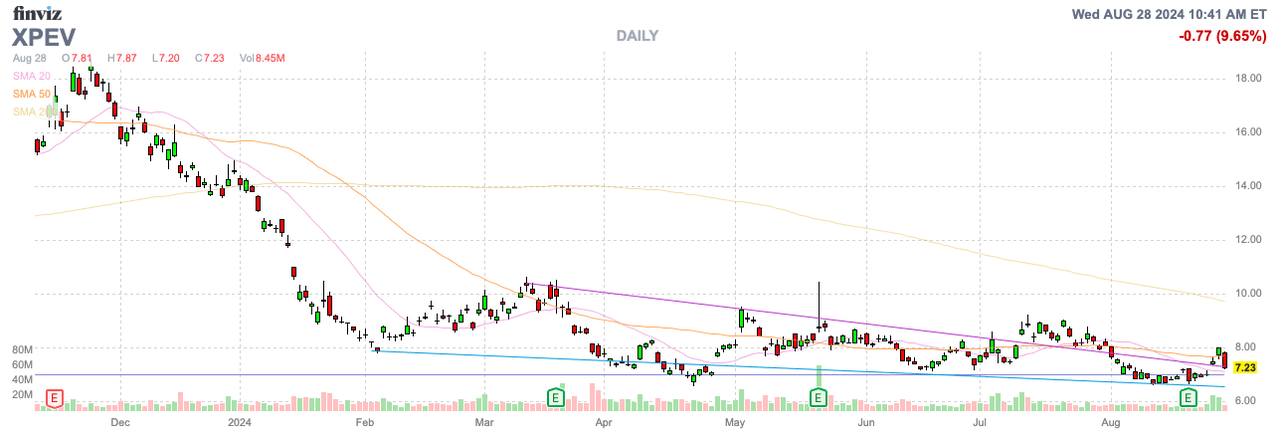

Chinese EV manufacturers have been some of the worst performing stocks over the last year, but XPeng, Inc. (NYSE:XPEV) shareholders recently got a strong signal of changed prospects with the CEO loading up on the cheap stock. The company plans to compete with Tesla EVs and is working on an EU manufacturing plan to work around European tariffs providing major catalysts for growth. My investment thesis remains Bullish on XPeng with the recent lows having a strong base over the last 6 months.

CEO Signal

CEO He Xiaopeng just bought ~$13.5 million worth of shares in XPeng at an average ADR price of $7.02. The shares quickly jumped to $8 on the positive sentiment in the stock, but XPeng has already rolled over.

The purchase was only days prior to the launch of a new mass-market car brand, Mona, with prices starting at $16,812. The brand is attempting to compete with brands like Tesla (TSLA), at half the price.

The company reported orders for the Mona M03 electric coupe exceeded 10,000 in the first 52 minutes. The M03 is targeted at competing directly with the Model 3 electric sedan from Tesla, a vehicle selling for over $30K in China.

NIO (NIO) recently launched multiple sub-brands in order to attract the lower income consumer in China. As with Nio, XPeng hopes to drastically boost volumes in order to push towards profits and increase vehicle delivery consistency.

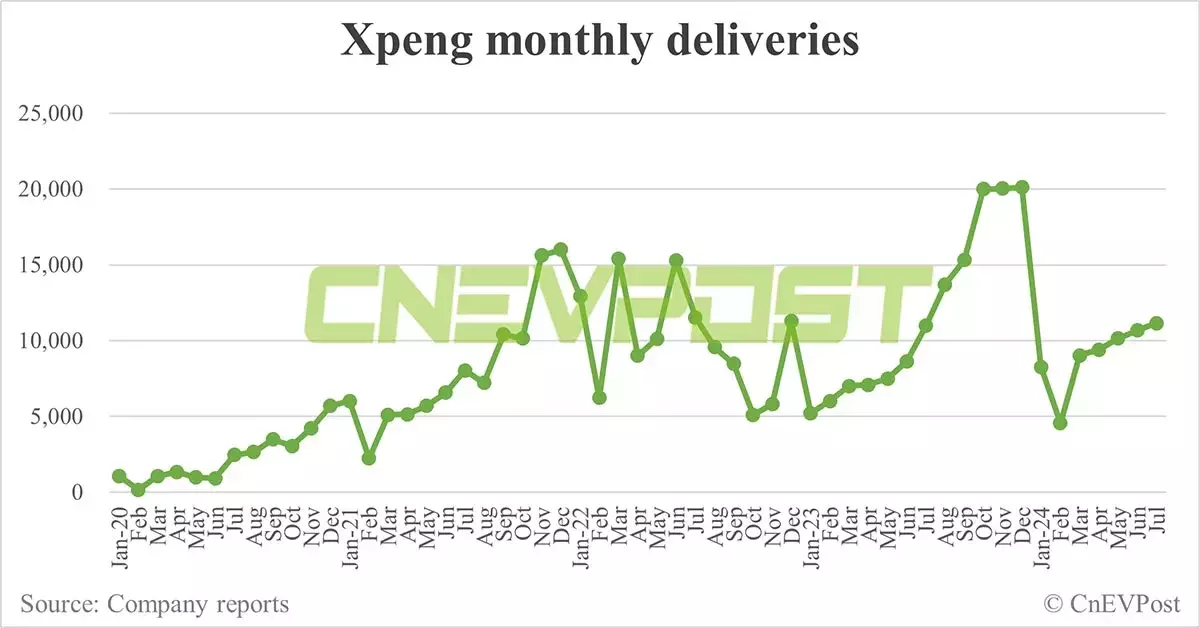

As a prime example, XPeng only had 11,145 deliveries for July, mostly flat with prior periods. The Chinese EV company actually had 3 consecutive months topping 20K in deliveries, but XPeng has failed miserably to maintain and consistently grow volumes.

Source: CnEVPost

The first hour orders for the Mona brand already match or top the month deliveries for each month of 2024 so far. XPeng doesn’t appear to have provided any monthly targets for the new sub-brand, but the company did forecast returning to 20K monthly units in September with the launch of the Mona band at the end of August with immediate production sales.

As the company moves into 2025, XPeng plans to offer advanced ADAS equivalent to Level 3+ on vehicle models costing $20,000. If the Chinese EV manufacturer can actually achieve this goal of bringing premium technology to high-end EVs, the company could have a home run product.

In addition, XPeng has successfully reached 10% of vehicle sales in international markets. The company plans to work towards producing vehicles in Europe to avoid tariffs, but XPeng also has opportunities in Israel, the Middle East and Southeast Asia.

Need More Than Promises

Only a week ago, XPeng reported mixed to disappointing Q2’24 earnings with revenue missing targets as follows:

XPeng is producing $1.1 billion in quarterly sales despite the limited and volatile vehicle deliveries. At the base price of the M03, the Chinese EV company will only produce $168 million in revenues from each 10K vehicles sold, which appears to be the current target for September volumes based on the overall guidance for delivering 41K to 45K vehicles in Q3.

The volumes will no doubt rise, but XPeng needs to produce 2 to 3 vehicles of the Mona brand to match the revenues from 1 vehicle sold under the XPeng brand. The stock should benefit from some short-term momentum starting in Q3 when the Mona vehicle deliveries start showing up in the monthly deliveries and pushing the company towards record volumes.

After the initial excitement from higher vehicle numbers, XPeng will have to quickly shift towards producing profits and cash flows. The Chinese EV company still reported a loss during Q2 and the launch of multiple brands has to scale to profits, or the company will need to return to the drawing board to convince investors that the investment thesis still makes sense.

At the 10th anniversary gala, XPeng again discussed work on a flying car with pre-sales in Q4 and a second generation humanoid robot to be unveiled in October. Investors will want to see a shift towards a focus on positive cash flows to fund these investments.

XPeng improved margins with a 14.0% gross margin in Q2 due to revenues from the technical collaboration with Volkswagen (OTCPK:VWAGY) and a vehicle margin of 6.4%. XPeng only had a minimal Q2 loss of around $200 million, though even this amount will add up over the course of a year.

The Chinese EV company has $5 billion in cash to fund further investments. With the stock at only $7, the clear signal is for management to outline a path to profits and reduce dilution in the future.

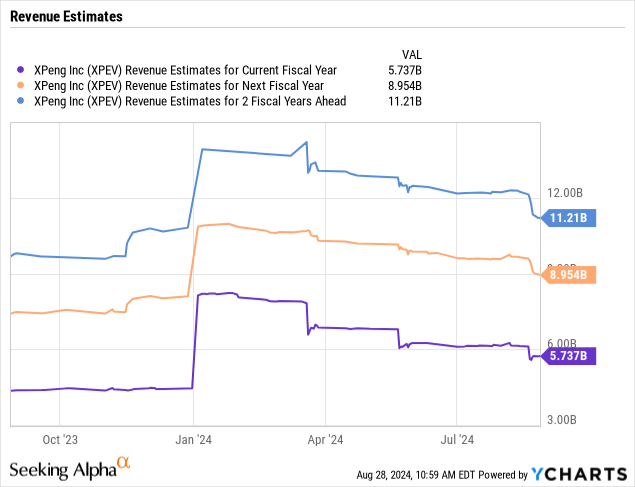

The stock has a market cap of $7 billion based on ~944 million ADS outstanding. The company has seen revenue estimates slip for future years, but the consensus estimates still have XPeng reaching $9 billion in 2025 and over $11 billion in sales for 2026.

The stock is definitely appealing back at $7 where the CEO just bought a bunch of shares. The Chinese EV market is highly competitive, and no guarantees exist for the new Mona brand to be successful, and the international sales push could run into more tariff restrictions, while XPeng could quickly run into the cash to invest in manufacturing facilities around the world.

Takeaway

The key investor takeaway is that XPeng is appealing here with the positive signal from the CEO and the launch of a sub-brand targeting the Model 3. The competition is fierce, so success isn’t guaranteed, but undercutting Tesla prices with similar technology could provide a huge boost to sales, as indicated by the initial order volumes.

Investors should use the recent weakness to load up on XPeng.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.