Summary:

- Discounted cash flow models are used to determine the intrinsic value of a stock based on its future cash flows.

- Tesla stock is considered undervalued based on the net present value of its future cash flows.

- The company’s focus on generating free cash flow and its technological prowess make it an attractive investment option.

- The firm can be considered overvalued by other methods, but myopic concerns are margins shouldn’t concern long-term investors.

jetcityimage

Operations for profit should be based not on optimism but on arithmetic.

Benjamin Graham

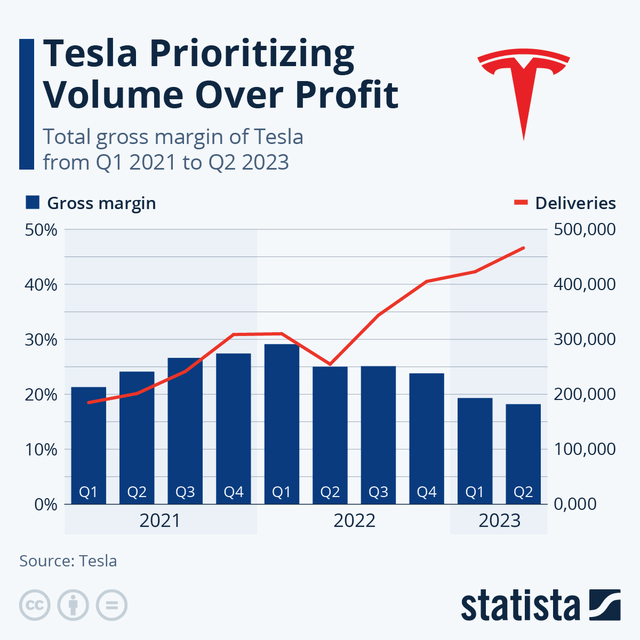

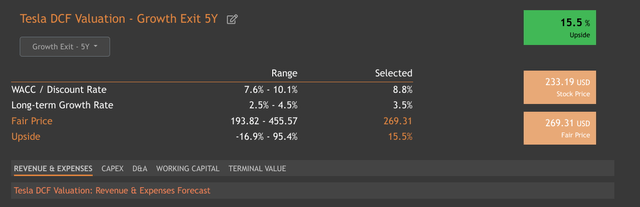

Discounted cash flow models are the anchor of equity valuation. When someone says an asset is fundamentally undervalued or intrinsically undervalued, they mean that the net present value of a stock’s cashflows suggests a higher fair price than the current stock price. Of course, any DCF model is only as good as its assumptions. But when a reasonable model suggests an upside on a large stock, it’s fair to assume some money will go toward that stock in the short or medium term.

Tesla (NASDAQ:TSLA) seems to have become a more controversial company over the past few years. Some may fret over CEO Elon Musk’s foray into social media when he bought Twitter; some may fret about a stale model line-up or the cyber truck delays. Many people will fret that Tesla is overvalued. Very rarely will you hear anyone say: Tesla is just too cheap right now based on the net present value of its future cash flows. But today, I am that guy.

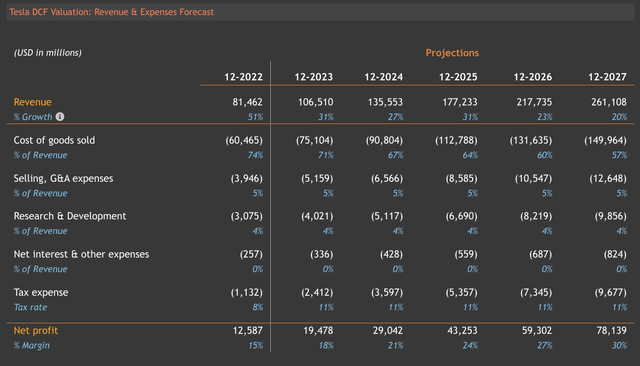

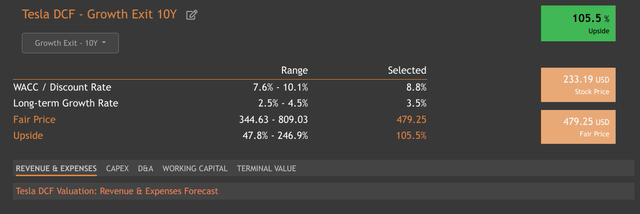

A 5-Year DCF model with very reasonable assumptions on long-term growth 3.5% suggests significant upside in Tesla (valueinvesting.io)

I will likely undergo a gauntlet of criticism and verbal abuse for even uttering that Tesla is undervalued. Amazingly, I will likely get it from both sides. As I walk you through the details of the discounted cash flow methodology that shows Tesla is intrinsically undervalued, I’m sure the percentage of upside until the fair value is reached won’t be enough for Musk’s supporters, just as it will simultaneously infuriate the more value-oriented investors among you.

Let’s dive deeper into the assumptions above that show Tesla to be undervalued. The COGS declines 3-4% yearly over the 5-year forecast period. Net profit margin grows 3% annually over the forecast period, while revenue growth slows from 31% to 20%. Despite the deceleration in revenue growth, this prodigious level of significant revenue results in net profit approximately quadrupling over the five years covered by the DCF.

I think these assumptions are pretty reasonable, and I think the 5-year is a bit conservative for Tesla since the 3.5% growth rate kicks in in 2027. I don’t find this assumption realistic. And yes, I know some will grumble, but I think that the 10-year DCF is more appropriate for a firm of Tesla’s standing that deserves the benefit of the doubt on significant CAPEX efforts coming to fruition more than five years into the future.

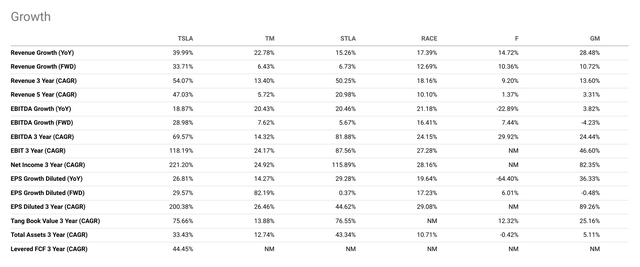

When you use this method to increase valuation, Tesla appears even more undervalued. Furthermore, when you look at fundamental differences between Tesla and its peers, the premium on Tesla, while perhaps excessive, is justified by the stock being fundamentally superior to major competitors along several vital planes. Tesla is a company that has long-term growth potential, and if you plan on holding for the period of this DCF, this valuation tool makes sense despite the necessarily inflated value of using ten years instead of five.

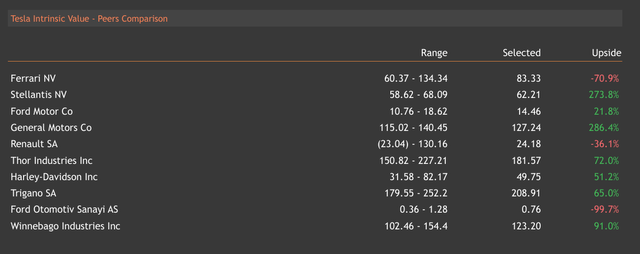

When you compare Tesla to peers, it can seem dramatically overvalued. Many peers have much more significant implied upside than Tesla. I enjoy using this hybrid valuation tool, which combines relative and intrinsic valuation. It also eradicates some problematic aspects of comparing by P/E ratio in the age of electric vehicles.

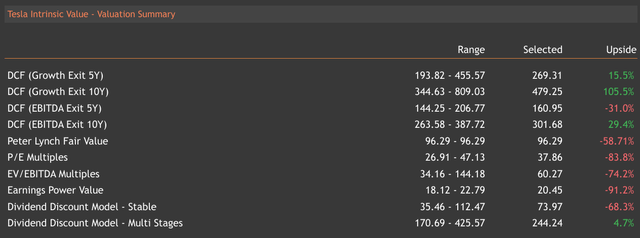

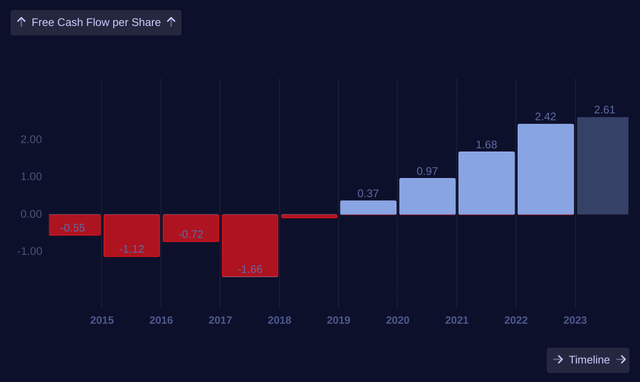

However, there are ways you can compare Tesla to peers where it becomes clear why the company is so overvalued. Remember that cash flow is of the utmost importance to valuation, and Tesla prioritizes generating free cash flow to an extent that has resulted in a significant advantage over peers. Indeed, Tesla’s prolific ability for free cash flow generation is a significant reason why it can still be intrinsically undervalued, even given its significant runup YTD.

Tesla FCF per Share (MacroAxis.Com)

As you can see, Tesla’s free cash flow generation is promising, and the company will continue prioritizing it. But there are many reasons to be bullish on Tesla and to think it could dramatically exceed expectations over the next decade. The firm has proven its ability to get shareholders a superior return on capital.

I am comfortable buying Tesla’s stock when there’s a margin of safety on key DCF models like the ones we have explored. The firm is consistently the most efficient of the auto firms. And yes, I fall into the camp of folks considering Tesla a Technology company.

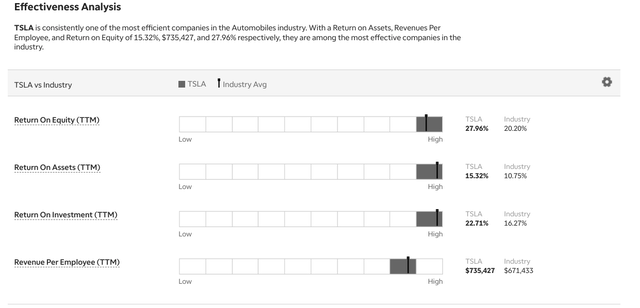

But even aside from this Wall Street debate (Tech vs. Auto), Tesla’s technological prowess, top talent, and exciting new models and technologies make me confident that it can continue delivering to shareholders the way it has in these past years. The firm’s decision to prioritize volume over profit has some myopic detractors, but I think it will prove highly successful.

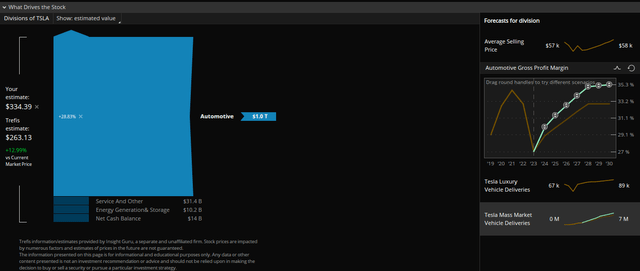

Despite its rough earnings report last quarter, I was surprised to see Tesla undervalued. So, I decided to double-check the output of the above model with another that I trust from Trefis (which is embedded into ThinkorSwim). I was even more surprised that the Trefis model confirmed that Tesla was undervalued, although with about four-fifths of the upside.

So, then, this confirmation got me excited. Tesla is a controversial stock for a lot of reasons, and there are significant risks that I will elaborate on. However, it is an excellent time to add for those with a long-term position. For those who want to start a position but feel they have missed out, it may be an excellent time to start building that position you wish you would have started earlier. All the risks aside, if you are thematically investing in Electric Vehicles, you must own Tesla, in my view.

Risks and Where I Could Be Wrong

Tesla has always had a lot of detractors. Yet, so far, it has also continued to earn its reputation as a commercial Goliath that, more often than not, proves its detractors wrong. Nonetheless, there is a mounting list of concerns for the stock that investors should take seriously:

- Increasingly strange behavior from CEO Elon Musk (cage fight) and the continued concern of investors that his valuable attention may be too consumed with his high-profile social media acquisition.

- Valuation risk is still a significant concern for Tesla, despite having some solid methods suggesting a bargain. Many valuation methods suggest Tesla is significantly overvalued.

- Increasing safety concerns around Tesla’s autonomous driving could vex the prolific electric automaker.

- Margin pressure, which drew the ire of Wall Street last quarter, could take more of a toll on earnings power in the coming quarters than analysts expect.

- Tesla’s long-term viability could be threatened if the current focus on electric vehicles fades in favor of hybrids or a new technology that achieves a breakthrough.

- Increasingly competent competitors in the electric space could significantly eat into Tesla’s market-share dominance and lead to lower-than-expected growth.

- Stale model line-ups and product delays could result in fickle consumers rejecting the brand or not responding well to new models.

- Recent high-profile employee departures and increasing evidence that Mr. Musk allegedly runs a corporate autocracy could prove problematic.

Despite these considerable and diverse risks across this prodigious auto manufacturer, I believe in the seemingly simple plan this automaker laid out early in its inception. Back then, it was controversial for a different reason for receiving a government loan.

Mitt Romney famously compared Tesla to the failed solar company Solyndra as an example of foolhardy government investment. Now, as then, I am confident Tesla can prove detractors wrong and continue to set the course for the future of mobility.

Conclusion

Tesla is undoubtedly maturing as a company, and nobody has ever pretended that it picked an easy business. Recently, many have been concerned about the firm’s declining margins, but I see this as a short-term issue. Auto manufacturing isn’t easy at all, and it’s tough to manage costs. However, Tesla continues to differentiate itself from peers by taking innovative approaches to efficiency that will eventually correct any short-term setbacks in margins.

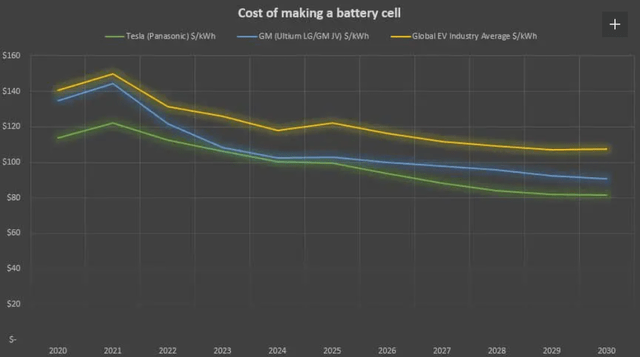

Tesla’s lead in batteries is already considerable, but recent investments that should increase vertical integration create the potential for this lead to grow even further. This is a crucial area where margins could be expanded, particularly since the underlying technology may have additional potential for further monetization.

Furthermore, as you can see, when I make minor adjustments in assumptions, it can have a very outsized impact on the implied intrinsic value of Tesla. For example, above, I increased the assumption for delivery of mass market vehicles by 1 million cars. I also increased the assumption for the Auto segment’s margin over the same period from around 33% to around 35%. Given Tesla’s record, these are not wildly optimistic assumptions, yet they resulted in an implied price of $334.39 compared to the Trefis model output of $263.12.

This means that simple incremental outperformance over the forecast period that seems well within Tesla’s grasp results in the implied upside going from 12.99% to 43.4%. When looking at the stock with several models using reasonable assumptions, Tesla is intrinsically undervalued. Suppose you believe in better-than-expected results from economies of scale and regulatory credits over the forecast period. In that case, it is easy to see why discerning investors could consider Tesla a bargain at current price levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.