Summary:

- YieldMax TSLA Option Income Strategy ETF uses a combination of call and put options to trade Tesla stock without actually owning the shares.

- The ETF uses a synthetic covered call approach, meaning it outperforms Tesla when the stock rises slowly but underperforms it when it rises quickly.

- The single biggest determinant of the Fund’s performance is still Tesla stock, and investors may lose significant principal if the stock declines significantly.

- Current near-parity in EV/gasoline prices may not last, as EV inventory has already normalized but gas cars have not yet.

- Lifetime savings calculations for EVs disregard certain additional costs which eat considerably into savings. I am avoiding Tesla and TSLY pending further clarity on cost savings.

Blue Planet Studio

With the recent Federal Reserve announcement that their dot plot is at least contemplating remaining higher for longer, we continue to see a certain amount of dislocation in the auto market, which is so influenced by those rates. As the auto market remains unsettled, various ideas about how to trade it and its increasingly central component, Tesla, Inc. (NASDAQ:TSLA), have emerged.

One of these is the YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) which is going to be my focus for today. As you might expect, however, we cannot really analyze TSLY without first analyzing the TSLA ticker it is built on.

YieldMax Fund Structure

I will assume if you are reading this that you already possess at least a basic knowledge of options trading itself, so I won’t lengthen an already long article by explaining that. Let’s turn immediately to exactly how YieldMax trades TSLA options to try to beat the broader market. You can see all the details of what I’m about to describe in their prospectus.

YieldMax’s ETF is an actively managed exchange-traded fund, or ETF, not a passive one which simply follows an index. It is basically a collection of Treasury Bonds – we’re already making progress, since those yield quite a bit more than they did 18 months ago – which are used as collateral for a put option on Tesla stock. Paired with that put option are two more call options, which are where the real magic happens.

Synthetic Long Exposure

YieldMax’s first two option trades are mirror images of one another; YieldMax buys a call option, i.e., the right to buy Tesla shares from a counterparty, at a strike price more or less equal to current price; and it sells a put option with the same strike price.

The practical effect of the combination of these two options contracts is that YieldMax is definitely going to end up with a share of Tesla stock when the period is over, because either the price will be over the call strike and it will elect to buy, or it will be below the put strike and YieldMax’s counterparts will force it to buy.

Thus, while YieldMax Tesla ETF doesn’t actually own Tesla shares, this fund’s outcome would be little different if it did.

Supplemental Call Option For Income

The far more significant part of YieldMax’s strategy than two options which basically cancel one another out is the third option, which is another call option. This call option is different from its fellow in two ways, however: first, YieldMax is selling it, not buying it; secondly, it has no corresponding put option on the other side of the trade.

YieldMax sells this option with a strike price somewhere between 5% and 15% higher than the going price on the day of the sale. Exactly how much higher depends on what the underlying stock is expected to do; YieldMax’s goal is to set a price just high enough that the option will expire unexercised and low enough to still yield a good premium price. This is where the “actively managed” part comes in.

At the end of the time period, options are exercised or expired, as the Tesla stock price dictates, and then any shares that have come into the fund are sold, profits paid out as dividends, and the whole process begins again.

Financial Implications of YieldMax

This more complicated approach to Tesla investing, as opposed to just owning Tesla stock, can create some confusion in terminology when discussing return on investment as well. The confusion arises when the speaker does not clarify what benchmark they are comparing returns to. Specifically, one can discuss “gains” and “losses” in relation to one’s original investment, or in relation to the gains and losses of a similarly situated straight owner of Tesla stock.

If someone invests $100 in YieldMax, and their cousin invests $100 in Tesla stock, if they have $105 in YieldMax after a month and their cousin has $110 in Tesla stock, have they gained or lost money. Well, they’ve gained money; but they’ve gained less than they would have if they’d just invested in Tesla stock straight up, which can be considered a “loss” of sorts.

Scenario Breakdowns

I want to make sure we avoid that confusion here.

TSLY return has two components. The first, as I said, is the shares of Tesla stock. Of course, it’s just going to sell those shares and get a new pair of options trades the next day. But the net effect of all that options trading and stock selling is that YieldMax’s Tesla fund will always have exposure to the movement of Tesla stock on a 1:1 ratio as one part of its total returns.

The only real question is what happens to option number three. That option is what causes YieldMax’s returns to depart from the underlying security.

Scenario #1: Only First Call Exercised

YieldMax’s return is maximized if Tesla stock rises slowly and steadily. This allows it to generate extra income via the premiums it charges for the third call option that it sells, as well as the interest on the Treasury bonds it holds as collateral, while still cashing in on most or ideally all of the underlying stock’s price appreciation by not actually having the third option exercised. In that circumstance, both Tesla shareholders and YieldMax investors will accrue a profit, but YieldMax’s Tesla ETF will substantially outperform Tesla stock itself.

Scenario #2: Both Calls Exercised

If Tesla stock shoots higher very fast, the second call option counterparty will exercise and YieldMax will still reap gains, but only up to the strike price of the second call option. Past that, the gains will accrue to the contracting counterparty. In this circumstance, YieldMax will underperform Tesla stock, but it will yield a profit on the transactions. (Though its principal balance may be adversely affected on the subsequent rollover.)

So for example, if Tesla bought and sold a pair of options at $300 with offsetting premiums, and sold a call at $330 for a $10 premium, and Tesla stock rose over the $330 mark; then YieldMax’s return would be $40, regardless of whether Tesla stock rose to $350 or $500. The second call option caps its upside. Conversely, if Tesla stock only rose to $320, YieldMax would make $30 total on premiums and gains, and Tesla shareholders would only make $20.

Scenario #3: Put Option Exercised

The worst outcome for YieldMax and Tesla investors is if Tesla falls in price. Because it sold that put option, YieldMax has exposure to price falls in the underlying Tesla stock, just as it would if it actually owned the stock. In that circumstance, however, YieldMax will still perform better than Tesla stock itself, because it will have the premiums from the put option and the second, higher call option to offset at least some of the losses.

To carry on from our previous example, if Tesla stock fell to $270, then YieldMax would lose $30 on its put option – it will be forced to buy at $300 – but would retain the $10 premium for the unexercised second call option, so its net loss would only be $20 – $10 less than someone actually owning Tesla stock, who just lost the $30. Unlike the price rise scenarios, there is no downward cap on that loss; if Tesla shareholders lost $100, YieldMax would lose $90, etc.

Potential Tesla Downside Risks

It is this last scenario which concerns me, because Tesla stock is priced at a level that represents considerable risk to investors buying in at current prices.

Current Financial Ratios

The first risk is simply current financial ratios – Tesla is now trading at a P/E of nearly 80, suggesting that it would need to quadruple its profit to justify current levels, let alone any appreciable gain. That is no small order for a company already at $25 billion in annual revenue, facing increased competition.

Shrinking Margins

I am concerned, however, that even that is to understate the hill Tesla must climb. So far, most of Tesla’s profit comes from selling into the luxury car market, where its Model S and other higher-priced vehicles can return considerably higher profit per vehicle. But as Tesla and other EV manufacturers like Rivian (RIVN) and Lucid (LCID) try to take EV buying mainstream – followed by traditional automakers like Ford (F) and General Motors (GM) when their workers aren’t on strike – it will have to compete in the mass non-luxury market, where margins tend to be quite a bit smaller.

The price gap between luxury and non-luxury is considerable. In the United States last month, the average luxury car sold for $63,500 as compared to $44,700 for non-luxury. Tesla’s top seller, Model Y, isn’t priced at luxury levels at $50,000, but nor has it truly reached the average price of mass market cars.

Neither Tesla nor any other automaker breaks out their profit levels by segment or model – it would be impractical to do so in any event, since so many of the R&D costs that go into producing a whole fleet of vehicles are shared between all models at each manufacturer.

But assuming that there is some considerable difference between luxury models profit margins and non-luxury, Tesla would need to increase sales by quite a bit more than 4x to quadruple profits.

Potential Price Gap Reopening

I also wonder if the gap between Electric Vehicles and gasoline cars in upfront prices has closed quite as much as we think it has, over the long-term. It is true EV prices have come down by quite a bit over the course of 2023, but that has been accompanied – actually, was slightly preceded by – a tremendous increase in inventory levels for Electric Vehicles, which now sit at over 100 days of supply. So much in fact that some dealers are now refusing to take delivery of EVs By contrast, gasoline supply remains at barely half that.

This tight supply means that gasoline vehicles prices may not yet reflect their full ability to compete with EVs when demand normalizes between the two segments. Back in August of 2022, EVs were priced at over $66,000 and gasoline prices were not that different than they are now. If gasoline sees similar price cuts when demand normalizes, then the gap could once again open to five figures.

Lifetime Savings Analysis

And, finally, assuming some significant gap does remain, I wonder about the ability of the lifetime savings to close it. I don’t deny that EVs are considerably cheaper to operate once they are sold to consumers…but assuming they remain or will soon be again considerably more expensive to buy in the first place, closing that gap is no small order.

Initial Financials Table

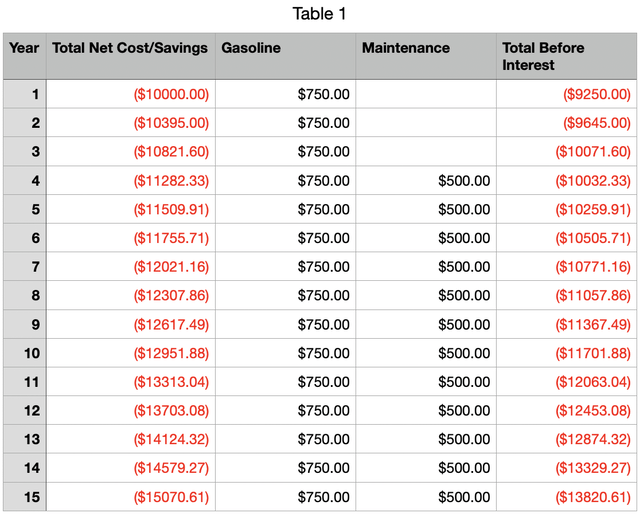

Assuming a $10,000 gap in upfront price between an EV and its gasoline equivalent, with a fifteen-year lifetime, and assuming $750 per year in fuel savings and $6,000 lifetime savings in maintenance savings, accrued on a straight-line basis beginning in year four, we get the following, with an 8% discount rate.

Initial Financial Table (Author Calculations)

The real killer in this first table is the discount rate, which basically eats up most of the year-to-year savings in interest and never really let’s things get going.

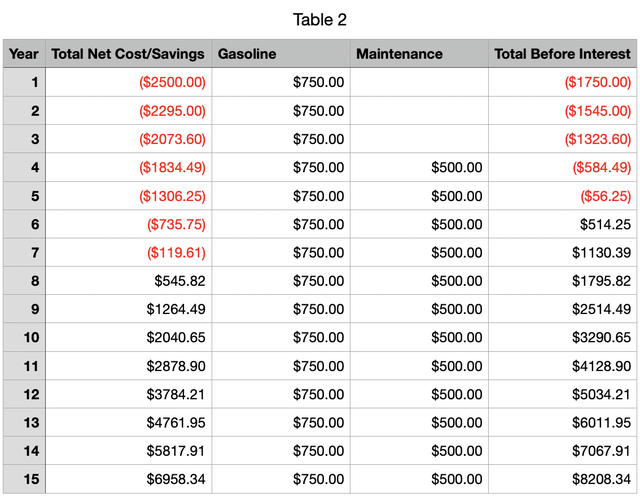

Tax Credit Adjusted Table

It’s not really this grim, though, even a bear like me will admit.

Perhaps the single best thing Tesla has going for it right now is that the government has reinstated the EV tax credit for all manufacturers. That is a huge plus for Tesla, because it takes a huge bite out of the upfront cost, assuming its buyer is rich enough to use the whole tax credit but not so rich that they run afoul of the new income limits on the credit. If we reduce the upfront difference by the full $7,500 of the tax credit, we get this.

Tax Credit Included Table (Author Calculations)

Well, that’s much better. A considerable lifetime savings with room to spare.

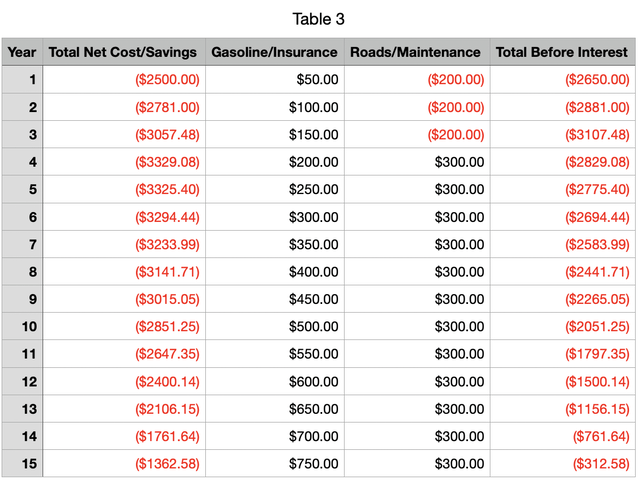

Additional EV Costs Table

This analysis, however, may be too generous, even accounting for the generous tax credit. It assumes that all of an EVs savings post-sale are completely unencumbered by any corresponding special costs pertaining to EVs. We’ve already offset the cost of electricity and maintenance by using only the difference between gasoline and regular car maintenance and the EV equivalents in our calculations, so we’re good there. But is that all there is to the story?

We are increasingly learning that one of the ways Tesla has made these EVs cheaper to produce is by making them more expensive to repair. Insurance companies have sometimes taken to writing off even mildly damaged EVs rather than fix them and put them back on the road. The Model Y, Tesla’s top selling model, is beginning to develop a particularly bad reputation in this regard.

Insurance companies have to find that extra money somewhere, and they are beginning to do it by charging more to cover EVs. The most recent data has average gasoline car insurance at $2,014 per year and the Model Y at $2,800. The Model Y sells for 10% more off the lot than the average car, so I will discount that gap by $80 and I will also assume that it falls off on a straight-line basis over the life of the car, with the extra insurance cost disappearing completely in year 15.

Another cost is roads. Yes, I’m aware that both EVs and gasoline cars use roads, but under the current tax system, gasoline cars pay for road construction through the gas tax and EVs do not. Inevitably that will have to change if EVs are ever to become a mainstay of the car fleet, and we are beginning to see what kind of cost that might impose. As of this month, Texas has begun charging $200 annually to Electric Vehicle registration renewals, to plug the revenue gap.

If I integrate these costs into our table, it now looks like this

Table With Credit And Costs (Author Calculations)

As you can see, there are still enough savings to recoup some of the upfront cost, but not all of it. And these are not the only additional costs we could conceivably integrate into our calculations.

Financials Conclusion

It is certainly not impossible to envision scenarios where EVs reach lifetime parity with gasoline vehicles. But it is at least as easy to envision scenarios where they do not.

Investment Summary

The short and sweet takeaway of this is that YieldMax does have an interesting strategy which could theoretically allow it to report higher gains from an increase in Tesla stock price – interesting because its multiplier comes from something other than just a straight levering up of its position via debt and extra share purchases. However, YieldMax’s returns will still be substantially correlated with the returns of Tesla’s own stock. A YieldMax Tesla investor has little less invested in the success of Tesla than a straight share owner would.

Most importantly, a YieldMax investment is not, in any significant sense, protected from a pronounced decline Tesla share price. Theoretically YieldMax could avoid taking a loss on a massive decline in Tesla if the decline happened slowly over many years and each quarter YieldMax was able to offset losses with unexercised option premiums but in practice that is very unlikely. Tesla is somewhat of an all or nothing bet on Elon Musk’s vision of battery powered, self-driving cars. If the market ever loses faith in that vision, the reaction is likely to be swift and violent.

Far more likely, if the Musk engine should lose steam, is that YieldMax investors will lose tremendously from a sudden decline in Tesla stock, and their only consolation will be that they lost slightly less than they would have if they’d owned stock.

Truth be told I probably would buy YieldMax Tesla ETF before I bought the underlying security, but that is coming from someone who is not currently inclined to buy either one. I still don’t exactly understand this market; how exactly is Tesla going to quadruple its profits as it moves from being practically the sole seller of EVs in a luxury market to a competitive mass market? For that matter, are Electric Vehicles themselves even over the hump yet?

Conclusion

I am avoiding Tesla stock in all its incarnations and trading strategies right now. I know this runs the risk of missing out on gains from one of the top performing stocks in the market over the last decade. But I remain concerned about how exactly Tesla is going to justify all this share appreciation, which has run well ahead of current fundamentals at this point. At the same time, I’m not quite confident enough to actually take out a short, so for now, I am simply Avoid on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.