Summary:

- YouTube shows remarkable growth prospects within the video streaming and short-form content space.

- YouTube has quietly become one of the most popular entertainment mediums for consumers all around the world.

- Parent company Google’s valuation is attractive relative to peers; however, macroeconomic uncertainty and regulatory issues pose an existential threat to Google’s overall dominance.

5./15 WEST

Introduction

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is well known as one of the largest companies by market cap in the history of mankind. Additionally, they dominate the internet search industry, with a market share estimated to be over 90%.

While this business continues to be the most important segment for the tech giant, I have become increasingly fascinated by YouTube. This is the sleeping giant within the larger business of Google that, I believe, is poised to dominate the streaming and social media markets.

There are some potential risk factors that Google faces moving forward; however, the YouTube segment should continue to grow regardless. Additionally, the Shorts platform has grown increasingly popular over the past few years and should allow YouTube to grow ad revenue well into the future. Considering the growth potential of YouTube, I believe that Google is worthy of a BUY rating. With all that being said, let’s dive into an analysis of the competitive landscape and valuation of the YouTube business.

The Streaming Wars

Many news outlets have crowned Netflix (NFLX) the king of the so-called “streaming wars” after a monstrous recovery that sent shares up 47% over the past year alone. While Netflix is undoubtedly the most successful of the traditional paid streaming service providers, YouTube has consistently been left out of this conversation.

While YouTube is certainly an untraditional player in the entertainment industry, it is nonetheless a dominant force that has cemented itself in consumers’ daily viewing habits. Its vast array of content caters to every consumer demographic and this is clearly reflected in the data. As of May, of this year, YouTube ranked as the #1 platform with 10% of all viewership on TVs in the U.S. streaming YouTube content. Netflix came in second in this category at just 7.6% of total viewership.

Not only is YouTube objectively more popular than the other streaming options, but it is also significantly more profitable. Netflix’s operating margin in the TTM was 23.8% and Disney’s (DIS) Disney+ platform just reported their first-ever streaming operating profit of a measly $47mn on $6.38bn in revenue (0.73% EBIT margin).

Both of these streaming platforms have to either license content from creators or spend their cash flow to develop their own movies/shows. It is estimated that Disney spent over $10.5bn on original content in 2023 and Netflix was not too far behind at $7.2bn. The greatest advantage YouTube has is that they do not have to invest a dime in creating content, as users will do the heavy lifting for them!

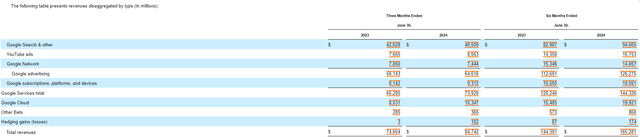

In the most recent quarter, Google’s services operating margin was 40.14%. This category is admittedly very broad, encompassing the Google Search business, YouTube ads, Google Network, and subscriptions/platforms/devices. While we do not have a direct EBIT margin figure for YouTube, we can assume that it is somewhere in the neighborhood of this 40% figure. The main cost of running a business like YouTube is building out and maintaining the network infrastructure to allow millions of users to post countless hours of footage every day. Unfortunately, Google does not disclose any information that will help us get a more exact figure, but it is safe to assume that YouTube is the most profitable of all the major video streaming services.

Disaggregated Revenue (GOOG)

Shorts

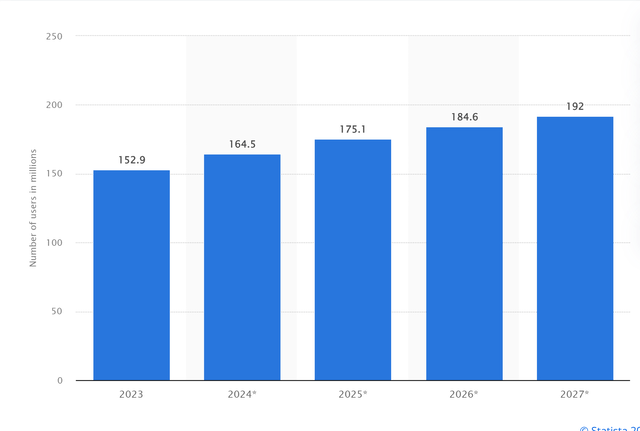

Short-form content is king nowadays, with 90% of all internet traffic projected to come from these types of videos in 2024. YouTube’s foray into this entertainment medium has proved to be incredibly successful, as the number of daily shorts views reach 70 billion in 2023. They are currently one of the three largest players in this market and have been growing steadily over the past few years. Additionally, the number of Shorts viewers is expected to grow from 152 million in 2023 to over 192 million by 2027.

Estimated Number of YouTube Shorts Viewers 2023-2027 (Statista)

One potential tailwind for the YouTube shorts platform is the proposed ban/forced sale of short-form video king, TikTok. According to industry experts, TikTok is projected to generate ~$10.5bn in advertising revenue in 2024. In the event that TikTok is banned in the U.S., these advertising dollars would likely begin to be spent on advertising via Instagram Reels and YouTube shorts, which could mean a massive boost to both the top and bottom line of the YouTube ads revenue segment.

This segment of the business was a topic of conversation on the Q2 earnings call, as CFO Ruth Porat mentioned that YouTube is “continu[ing] to close the monetization gap with Shorts.” This monetization gap stems from the fact that Shorts were not monetized during the initial rollout of the platform, and this was hurting YouTube’s overall advertising revenues. Shorts began to pick up steam during H1 2022, and the impact was clear as ad revenues fell 20.5% sequentially from Q4 ’21 to Q1 ’22.

YouTube began to monetize the Shorts platform in February 2023 and ad revenue picked up over the course of that year, reaching an all-time high in Q4 of that year at $9.2bn. This is across the entirety of YouTube, so it is not reflective of Shorts in and of itself, but it does show that the monetization efforts are leading to advertising sales growth in the segment.

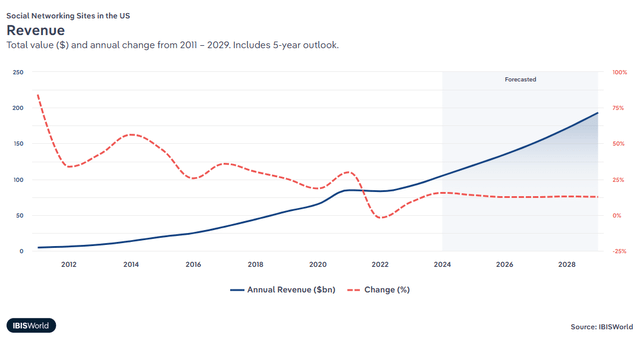

There are also secular tailwinds that will undoubtedly boost both user engagement as well as monetization success for YouTube in the near future. The social networking sites industry is expected to nearly double from 2024-2029, growing at a 10.69% CAGR.

IBIS World

YouTube Premium & YouTube TV

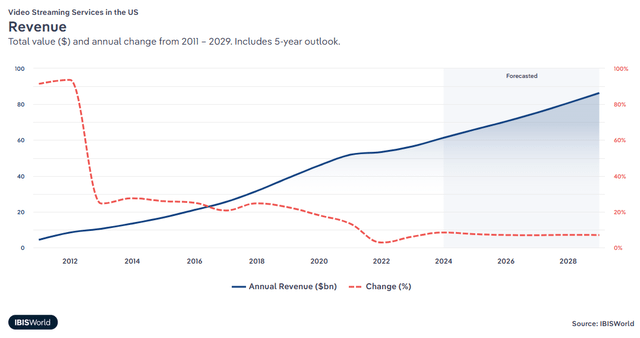

The video streaming services in the U.S. market is expected to grow substantially over the coming years, from ~$56.5bn in 2023 to $86.3bn in 2029 (6.24% CAGR). This is an obvious tailwind for YouTube, as it has become one of the largest players in this sub-sector of the market.

IBIS World

This is extremely bullish for YouTube, as there are estimated to be over 8 million YouTube TV subscribers as of April 2024. This was boosted in large part by the strategic acquisition of NFL Sunday Ticket back in 2022. These subscriptions likely contribute significantly to Google’s “subscriptions, platforms, and devices” segment since a membership costs consumers $73/month. That’s roughly $584mn a month in gross revenue from YouTube TV alone.

The YouTube premium memberships are even more popular, as they hit 100 million paid users earlier this year. A premium subscription only costs $13.99, but given the massive scale, this contributes $1.4bn a month to their subscription revenues. This means that on a quarterly basis, YouTube’s subscription offerings are bringing in $5.9bn for Google.

This figure may seem high, and admittedly, I am working with rather vague data which makes it hard to accurately assess YouTubes contributions to this revenue segment. However, if we go back to Q1 2020, the “subscriptions, platforms, and devices” category (then called “Google other”) was a mere $4.4bn. As of Q2 2024 this figure has more than doubled to $9.3bn, which makes me believe my estimates are realistic.

Risks

The primary risk to YouTube’s business model is that its parent company, Alphabet (Google), is under intense regulatory scrutiny from the District Attorney’s office and the DOJ. On Monday, a federal judge ruled that Google is operating an illegal monopoly in the search business, which is an understandable verdict given their competitive positioning within this industry. However, I doubt that this ruling has a severe or even material impact on Google’s business, let alone YouTube. The worst-case scenario is that regulators force a breakup of Google, which could lead to YouTube becoming neglected/sold off. I believe the likeliest scenario is that Google is forced to stop paying Apple (AAPL) for the privilege of being the default search engine on their mobile devices.

While this may have an impact on the search business, the odds that users select a different search provider seem relatively slim given the brand power Google has built up as the world’s de facto search engine over the past 20 years. Even if consumers are presented with the option to switch to an alternative (such as Microsoft’s Bing), they are likely to stick with Google given its familiarity.

Another risk is that the most recent jobs report was the start of a recession in the U.S. economy. As illustrated earlier, a large portion of the revenue generated by YouTube comes from subscriptions and if there is material weakness in the spending habits of consumers this could hurt their top line. Again, I highly doubt this is the case considering the strong Q2 GDP figure and the continued growth in earnings of U.S. companies, but this is a possibility that must be discussed when evaluating stocks that are sensitive to consumer spending habits.

Valuation

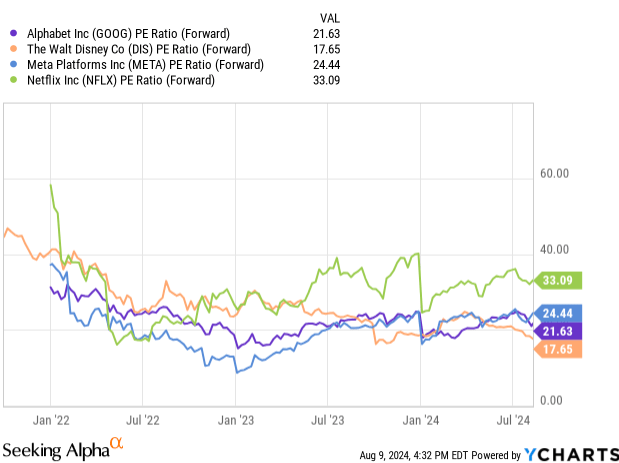

It is difficult to value YouTube as a standalone business, given the opacity of Google’s financial reporting practices. What I can do, however, is compare what the entire firm is trading at relative to some of its peers in both the streaming and social networking industries. I have chosen to compare GOOG to Meta (META), Netflix, and Disney. Again, it is not a perfect comparison, but it is merely a look at some other large players within these industries that YouTube (and by extension Google) operates within.

The forward price to earnings multiple comparison shows that Google is valued fairly attractively at only 21.63x. Compared to Meta at 24.44x and Netflix at over 33x, and you can see that Google is cheap relative to some of its competitors.

P/E Ratio (Forward) (YCharts)

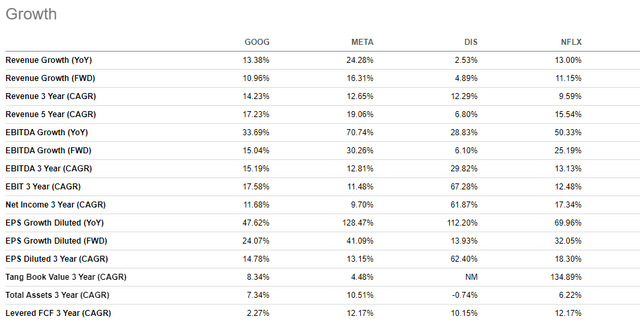

However, P/E ratios do not tell the full story of a company. To give additional color, I looked at forward revenue and EPS growth for all four of these companies. Meta came in on top in both categories. However, Google ranked second in forward revenue projections at 10.96%. Netflix came in second for EPS growth estimates at 32% compared to Google’s 24% expected growth. Both figures show Google is poised for solid growth, and considering they are trading at a significantly cheaper multiple than both Netflix and Meta, this presents an investment opportunity.

Seeking Alpha

Takeaways

YouTube is an extremely underappreciated segment of Google’s business that could be a Fortune 500 company by itself if spun off. The relative cheapness of Google shares presents a buying opportunity for investors willing to pay a slight premium to the overall market in order to invest in one of the highest quality companies trading today.

While there are some potential headwinds, specifically related to the larger search business and economic conditions, I believe that over the long run the YouTube business will continue to grow and dominate the streaming market. Consumers are only spending more time on social media, and YouTube is one of the largest beneficiaries of this trend. Considering all of the positive trends in the YouTube business model, I believe a rating of BUY on Google is fair and believe that investors looking for value in the mega-cap names should look no further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.