Summary:

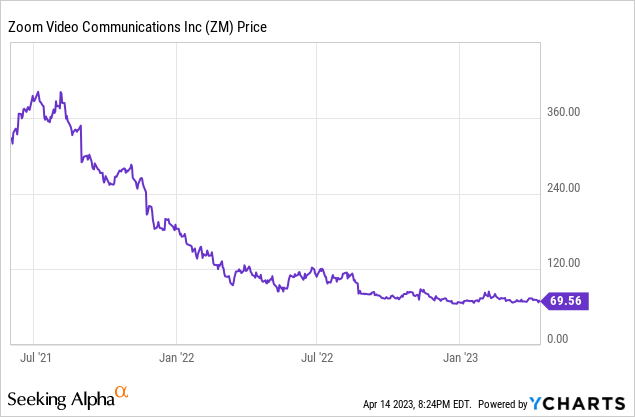

- Zoom’s stock price has been in a steady decline for close to two years due to slowing growth and contracting margins.

- The company had its flash-in-the-pan moment during the COVID-19 pandemic but is now firmly planted in decline.

- Microsoft has severely undercut Zoom’s pricing, providing an in-road into the video conferencing market that bolsters its already robust ecosystem.

- Even after the drop in stock price, ZM remains vulnerable and will continue to bleed while Microsoft thrives.

Sundry Photography

Zoom Video (NASDAQ:ZM) has had a rough couple of years on the back of increased competition, the slowing growth of the broader video conferencing market, and high investor expectations that the company has, quite spectacularly, failed to reach. However, despite this sharp decline, I still believe the stock has further to fall as businesses continue to mandate employees return to offices and as offerings from other companies, primarily Microsoft (NASDAQ:MSFT), continue to eat away at Zoom’s customer base. Mostly due to these factors, the company’s stock has plummeted more than 80% since its most recent peak in August 2021:

Rise and Fall

It’s a bit crazy to believe, perhaps only with the benefit of hindsight, that a simple video conferencing company like Zoom was once valued north of $150 billion in the midst of the COVID-19 pandemic. Even back then, the company’s competitive moat was thin, but investors appeared to believe that revenue growth and profit margins were sustainable. I wrote an article back in December 2021, after ZM had fallen to around $200 per share, saying that there would be more bleeding ahead for the stock due to Microsoft’s release of Teams Essentials, which is basically a lean, standalone version of Teams not tethered to Microsoft Office. I predicted that Zoom would either need to:

1. Cut prices to protect its market share, or

2. Cede market share to maintain its profit margins

That article can be read here.

In the time since that article was published, Zoom stock has fallen from $200 to its current price of ~$70, a drop of 65%, and I believe the following table illustrates why:

| Year | Revenue | Net Income (non-GAAP) | Profit Margin (Non-GAAP) |

| FY2021 | $2,651 million | $996 million | 37.6% |

|

FY2022 |

$4,100 million | $1,375 million | 33.5% |

| FY2023 | $4,393 million | $1,329 million | 30.2% |

As we can see from the progressively declining profit margin YoY, of the two choices I presented above, it appears Zoom has chosen to sacrifice profit margin for the sake of retaining market share. This is really the only logical choice when the product in question is something as un-sticky as video conferencing. However, even these actions haven’t closed nearly enough of the gap to indicate that this margin erosion will slow down any time soon. Here’s a table from my previous piece showing a feature breakdown of Teams Essentials versus Zoom’s low and mid-tier offerings:

| Product | Group Meetings | Participant Max | Cloud Storage | Meeting Transcripts | Price (user/month) |

| Teams Essentials | Unlimited, up to 30 hours | 300 | 10GB | N | $4 |

| Zoom Pro | Unlimited, up to 30 hours | 100 | 1GB | N | $15 |

| Zoom Business | Unlimited, up to 30 hours | 300 | 1GB | Y | $20 |

The importance of the first four columns can be debated, but the sheer price discrepancy is undeniably significant. By comparing the contents of this table to both companies’ current offerings, we can get an interesting look at how the release of Teams Essentials has affected the market.

Outside of price, the only real difference in the comparison today is that Zoom Pro and Zoom Business offer 5GB of cloud storage instead of 1GB, which is good I guess, but still below the 10GB still offered by Teams Essentials.

As far as the price per user per month, Teams Essentials has remained at $4 while Zoom Pro costs $12.50 and Zoom Business costs $16.67, decreases of 17% and 16.6%, respectively, since the launch of Teams Essentials. In other words, Zoom’s offerings are still remarkably more expensive while still providing no tangible feature benefits to compensate. And of course there will be those who claim, as they have been for the last couple of years, that Zoom has a superior UI and UX, but I would counter that if user preference is the only thing standing between your company and a multi-trillion dollar behemoth like Microsoft, that is extreme cause for concern.

What Zoom offers is not sticky enough on its own for customers to continue shelling out orders of magnitude more money per year when easily accessible and cheaper alternatives are available. In a market like video conferencing, which currently has no clear product feature differentiation in my opinion, the market price will eventually converge to the lowest denominator. Right now that is well below what Zoom is charging and Microsoft is showing no signs of raising the floor.

To bring it all into further perspective if the point has not yet been sufficiently driven home, Microsoft has an offering called Microsoft 365 Business Standard that comes with access to Teams as well as the company’s full suite of business productivity apps (e.g. Excel, Word, etc) plus 1TB of cloud storage per user for the exact same price as Zoom’s cheapest offering (which maxes out at 9 licenses by the way): $12.50 per user per month.

This is not sustainable.

Investor Takeaway

Zoom has been under siege since Microsoft started making a concerted effort to target its niche and since companies began bringing employees back into offices. The company has managed to keep revenue above water by slashing prices and accepting lower profit margins, but even current prices are significantly higher than what is sustainable in this market in my opinion. Microsoft has blasted holes into Zoom’s hull and the boat is sinking.

Is there a price where ZM would be attractive even with these headwinds? I think there is, but we’re not at the bottom quite yet. The company’s revenue growth has become anemic, margins are currently in freefall, competition and pricing pressure will only continue to increase, broader market headwinds from return-to-office initiatives will likely continue, and the stock is still trading at growth multiples. Taking all this into account, I believe ZM remains a sell.

On the other hand, Microsoft is making apparent progress at further breaking into the video conferencing market and, more importantly, integrating it into the company’s software ecosystem. Teams Essentials is a profit-generating product on its own but also allows for upselling Microsoft Office offerings. In addition, the success and adoption of Teams increases the stickiness of Microsoft’s other products, contributing to the company’s long-term strategic goals. I continue to rate MSFT a buy due to the company’s wide-ranging suite of complementary products and the consistently sound execution demonstrated by this and other initiatives.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.